- Bitcoin’s dominance was around 55% at press time.

- The market remained in Bitcoin season despite a drop in its dominance.

As a seasoned analyst with over two decades of experience in the financial markets, I’ve seen my fair share of market fluctuations and trends. In this case, Bitcoin’s [BTC] recent decline has certainly turned heads, but it’s not exactly surprising to see such volatility in the cryptocurrency world.

As a market analyst, I’ve noticed a substantial dip in Bitcoin’s [BTC] price lately, which has fallen beneath the $60,000 threshold.

The dip in Bitcoin’s value not only affected its control over the cryptocurrency market but also caused a decline, paving the way for a minor surge in the popularity of alternative cryptocurrencies.

Bitcoin suffers price drops

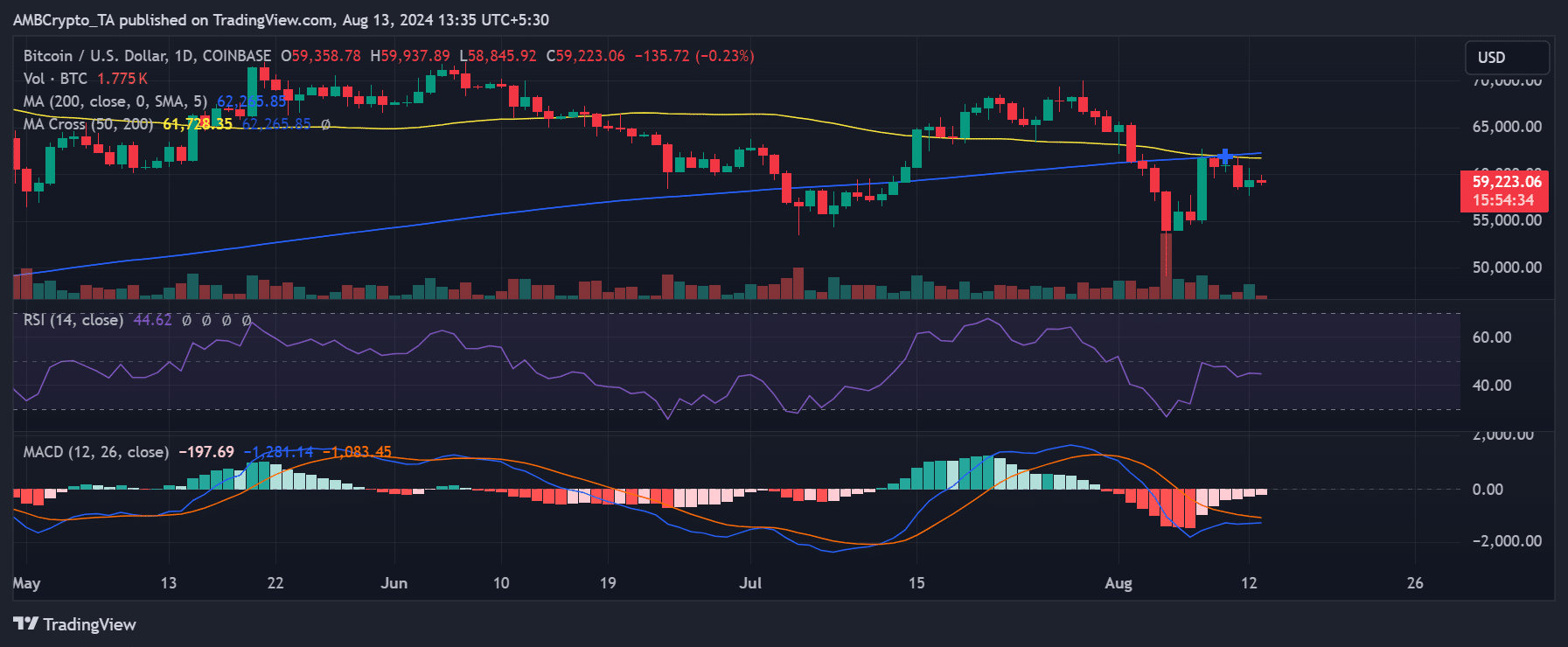

According to AMBCrypto’s examination of the daily Bitcoin chart, the beginning of August appears to be tough for Bitcoin investors. The graph demonstrates that Bitcoin endured successive drops in value, causing its price to slip beneath the crucial $60,000 threshold.

Also, the chart showed a low cost of around $49,000, which impacted the Bitcoin dominance.

Despite a significant rise that brought Bitcoin’s price back to around $60,000, it has dipped once more. In the last trading session, BTC experienced a minimal growth of about 1.08%, closing at roughly $59,358.

At the moment of reporting, it maintained its position close to $59,000, experiencing a minimal drop of nearly 1%.

Additionally, the Relative Strength Index (RSI) continued to stay beneath the non-biased level, implying it was deeply rooted in a downward trend, suggesting bearish conditions persisted.

How price decline affected the Bitcoin Dominance

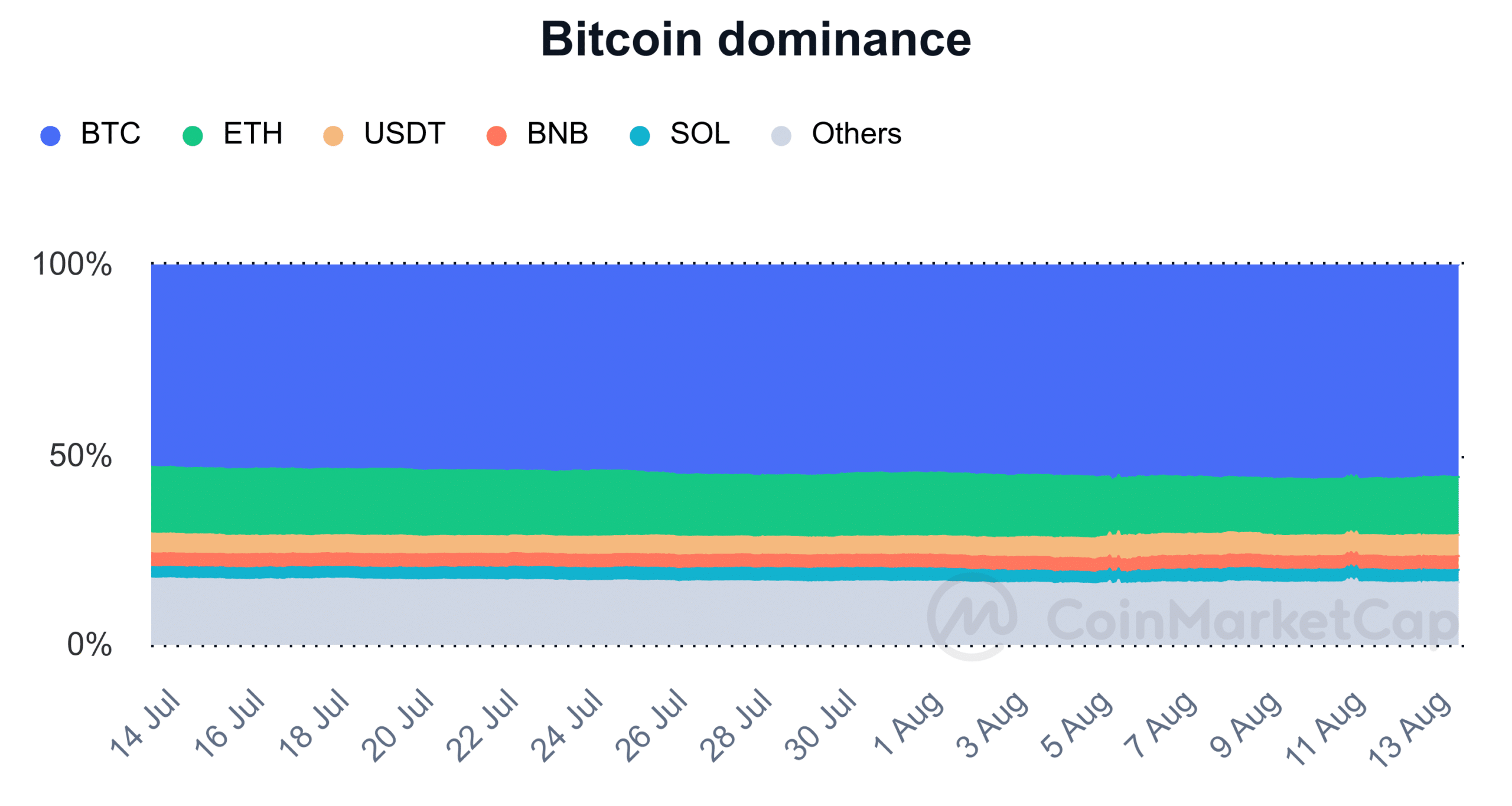

The preeminence of Bitcoin within the digital currency sector showed a substantial drop in August, mirroring a fall in its value. This decline in its price was reflected by its dominance.

The data shows that Bitcoin’s control over the crypto market dropped to about 53%, with its peak this month reaching around 56.5%.

Currently, Bitcoin’s influence over the crypto market stood at approximately 55%. This modest rebound can be credited to a small increase in Bitcoin’s value and decreases observed in other digital currencies.

The market cap trend indicated that Bitcoin accounted for over 55% of the total crypto market capitalization, totaling around $2.09 trillion.

As a proud crypto investor, I can’t help but feel a sense of awe as I witness Bitcoin’s dominance in the market. Its staggering market cap soaring past the $1.1 trillion mark is a testament to its powerful impact on our digital financial landscape.

Bitcoin dominance vs. altcoin season

According to AMBCrypto’s examination, Bitcoin’s influence has slightly decreased, but this has given a small boost to the period of increased activity for alternative cryptocurrencies (altcoins).

Based on data from the Blockchain Center, there’s been a noticeable increase in the use of alternative cryptocurrencies lately.

Nevertheless, even though other cryptocurrencies were present, Bitcoin continued to dominate the market, as altcoins had not yet shown consistent superiority over Bitcoin.

Read Bitcoin’s [BTC] Price Prediction 2024-25

To announce an official ‘altcoin season’, it’s required that at least 75% of the leading 50 cryptocurrencies show superior performance compared to Bitcoin during the past 3 months (approximately 90 days).

The available data indicates that the threshold has not been reached so far, since a significant number of these assets have similarly suffered losses, much like Bitcoin’s dip.

Read More

- WCT PREDICTION. WCT cryptocurrency

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

- LPT PREDICTION. LPT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- PI PREDICTION. PI cryptocurrency

- SOL PREDICTION. SOL cryptocurrency

- PGA Tour 2K25 – Everything You Need to Know

- New Mickey 17 Trailer Highlights Robert Pattinson in the Sci-Fi “Masterpiece”

- Cynthia Erivo’s Grammys Ring: Engagement or Just Accessory?

2024-08-14 02:16