-

Analysts claimed that the Alt season could lag amidst a possible BTC dominance surge.

But other observers expected the alt season to be trigged by the US spot ETH ETF launch.

As a seasoned cryptocurrency analyst with over five years of experience in the industry, I have witnessed numerous market cycles and trends. Based on my analysis of historical data and current market conditions, I believe that the altcoin season could be delayed amidst a potential surge in Bitcoin dominance.

Having closely followed the cryptocurrency market for several years now, I strongly believe that we could witness a significant turning point for altcoins this week. With the much-anticipated US spot Ethereum [ETH] Exchange Traded Funds (ETFs) set to begin trading, Ethereum’s performance as the largest altcoin could very well dictate the trend for the entire sector. This is an exciting time for crypto enthusiasts and investors alike, as we wait with bated breath to see how this development unfolds.

According to well-known cryptocurrency expert Benjamin Cowen, the altcoin rally may be delayed due to a possible increase in Bitcoin‘s market dominance before the anticipated Federal Reserve interest rate reduction in September.

Based on Cowen’s analysis, the present-day Bitcoin supremacy echoes the 2019 scenario, with Bitcoin leading the pack two months prior to the Federal Reserve’s interest rate reduction, during which altcoins struggled to keep pace.

Back then, Bitcoin (BTC) experienced a remarkable surge, while Altcoins struggled to keep pace. The current price action of BTC resembles that old pattern, possibly indicating a wait of approximately two months until the first interest rate reduction.

Will Ethereum ETF trigger Alt season?

For those hoping for a respite in the altcoin sector of the cryptocurrency market, which experienced significant declines in June, this might bring unwelcome news.

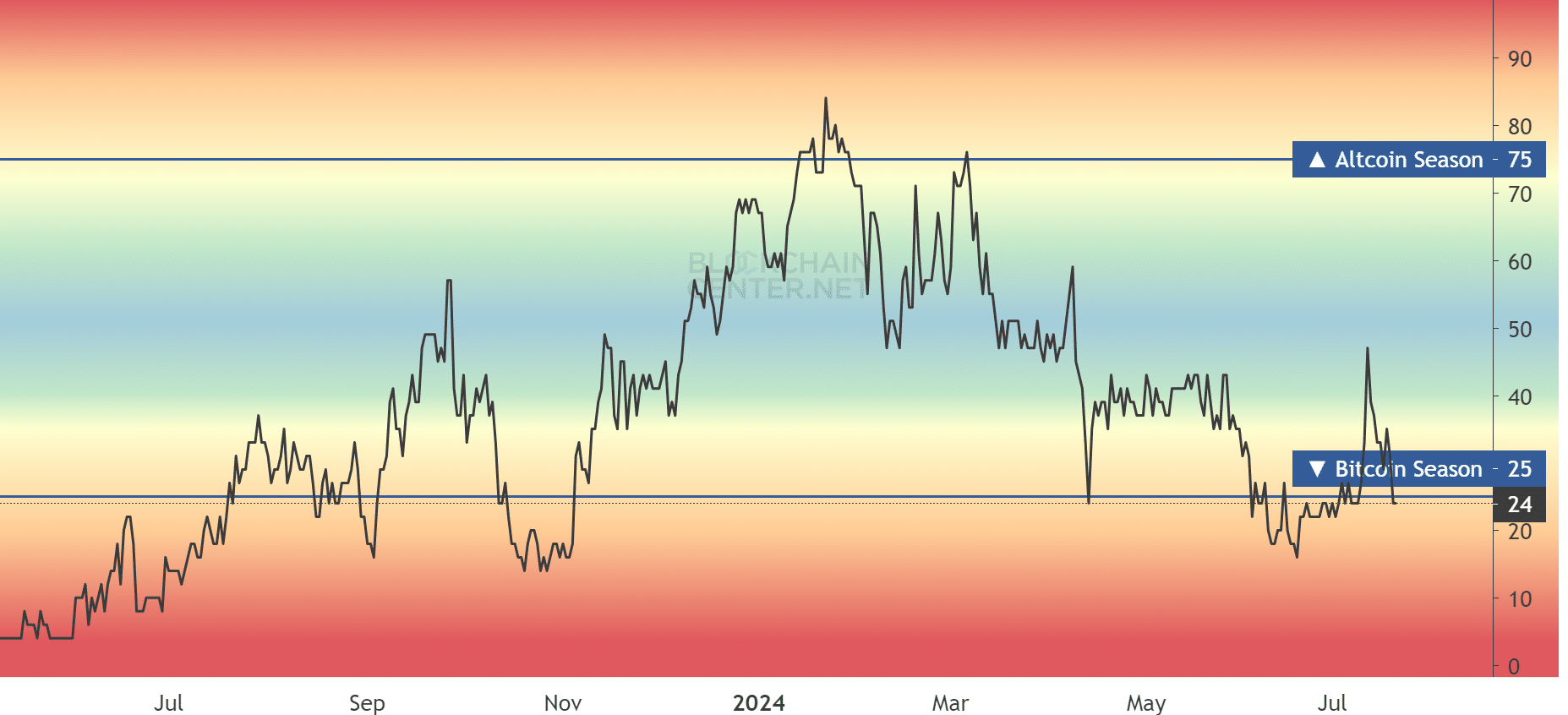

The Altcoin Season Index hinted, at the current moment, that an altcoin rally had not fully commenced according to its reading.

Based on the data from the indicator, the first six months of 2024 have seen a surge in Bitcoin activity. If Cowen’s predictions hold true, this trend may persist.

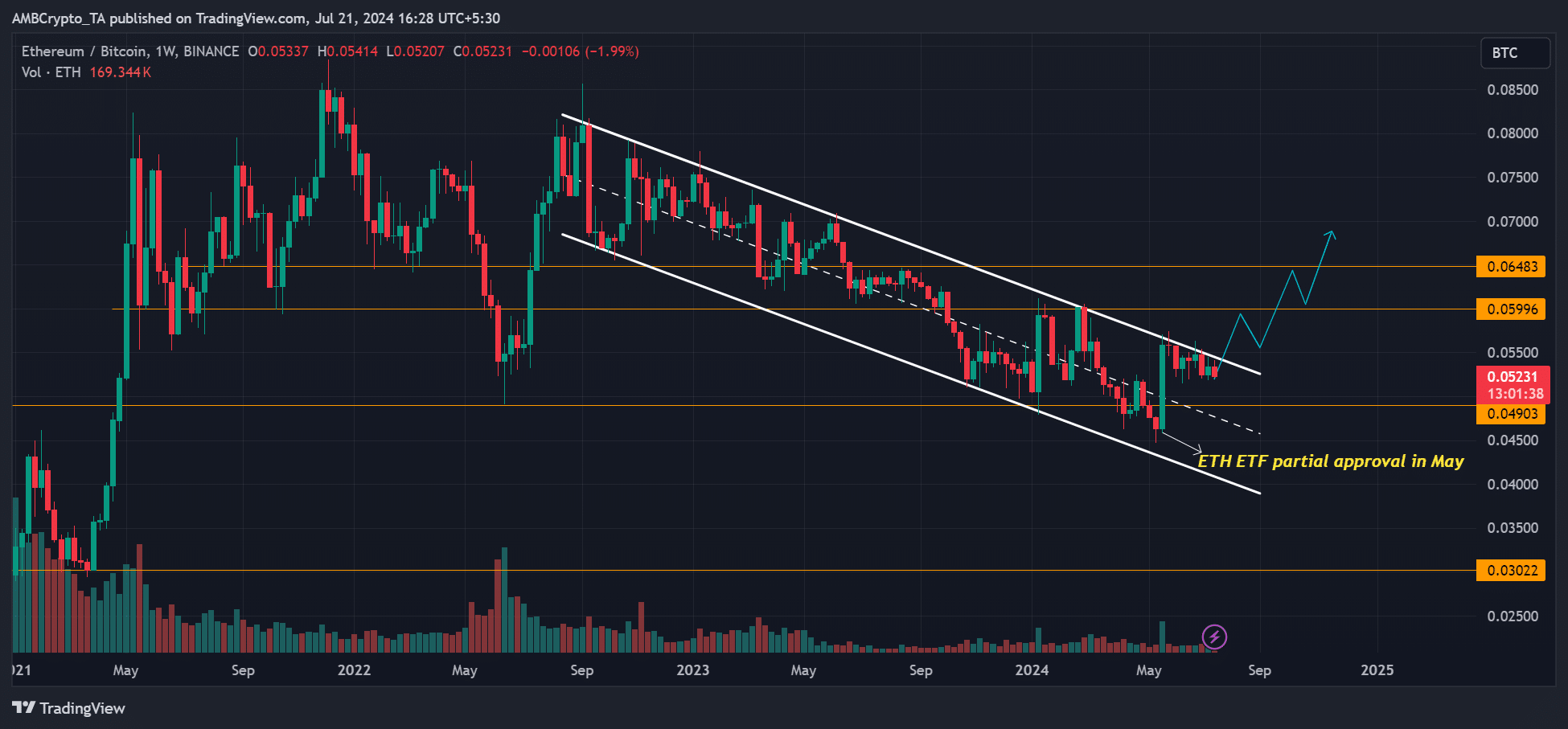

As a crypto investor, I’ve come to realize that while Bitcoin Dominance is an essential metric to monitor, it’s not the only indicator of an altcoin season. Some analysts, such as those at Glassnode, argue that the Ethereum-to-Bitcoin ratio is another valuable way to gauge the market. By keeping an eye on this ratio, we can better understand the relative strength of Ethereum compared to Bitcoin and potentially identify shifts in the crypto market landscape.

The relationship between the price of Ethereum (ETH) and Bitcoin (BTC) is displayed through the ETH/BTC market. As per Glassnode’s founders, who use the username Negentropic on certain platforms, a significant event such as the launch of a US spot Ethereum Exchange-Traded Fund (ETF) could potentially cause a surge in altcoins if it occurs.

The products are set to launch and start trading this week.

The analysis conducted by AMBCrypto revealed that the ETH/BTC ratio experienced a significant increase following the partial approval of the ETH ETF in May. Nevertheless, this upward trend had not succeeded in disrupting the existing downward trend, as indicated by the evident descending channel (white).

The future response of Ethereum (ETH) in relation to Bitcoin (BTC) is uncertain, and it may influence the potential onset of an altcoin market surge. Keeping a close eye on Bitcoin’s dominance and the ETH/BTC ratio is essential for evaluating any probable repercussions for other cryptocurrencies.

Read More

- WCT PREDICTION. WCT cryptocurrency

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- New Mickey 17 Trailer Highlights Robert Pattinson in the Sci-Fi “Masterpiece”

- The Elder Scrolls IV: Oblivion Remastered – How to Complete Canvas the Castle Quest

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- AMD’s RDNA 4 GPUs Reinvigorate the Mid-Range Market

- Royal Baby Alert: Princess Beatrice Welcomes Second Child!

- Studio Ghibli Creates Live-Action Anime Adaptation For Theme Park’s Anniversary: Watch

- SOL PREDICTION. SOL cryptocurrency

2024-07-22 03:03