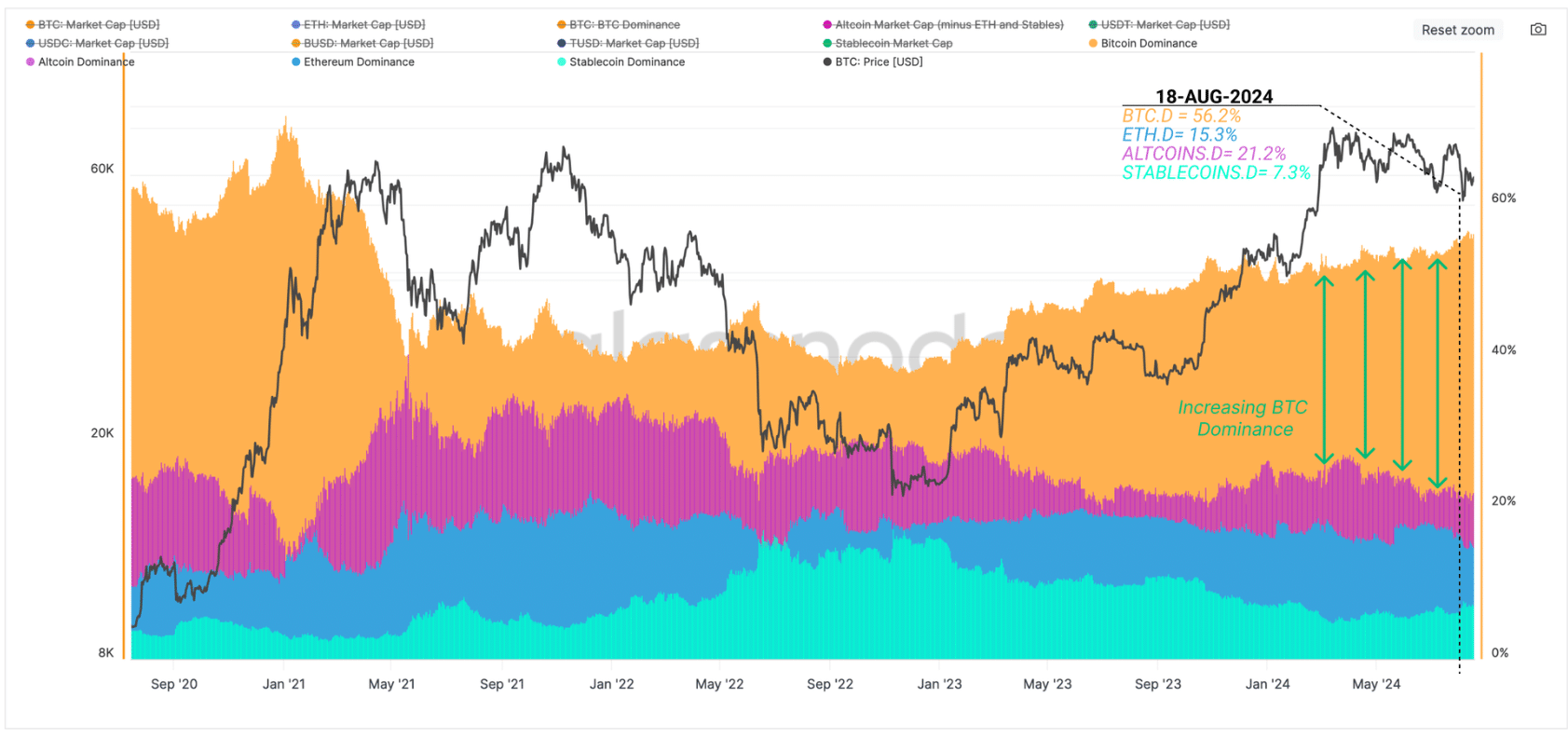

- Bitcoin dominance has increased from 38% in 2022 to 56%, largely attributed to long-term holder accumulation.

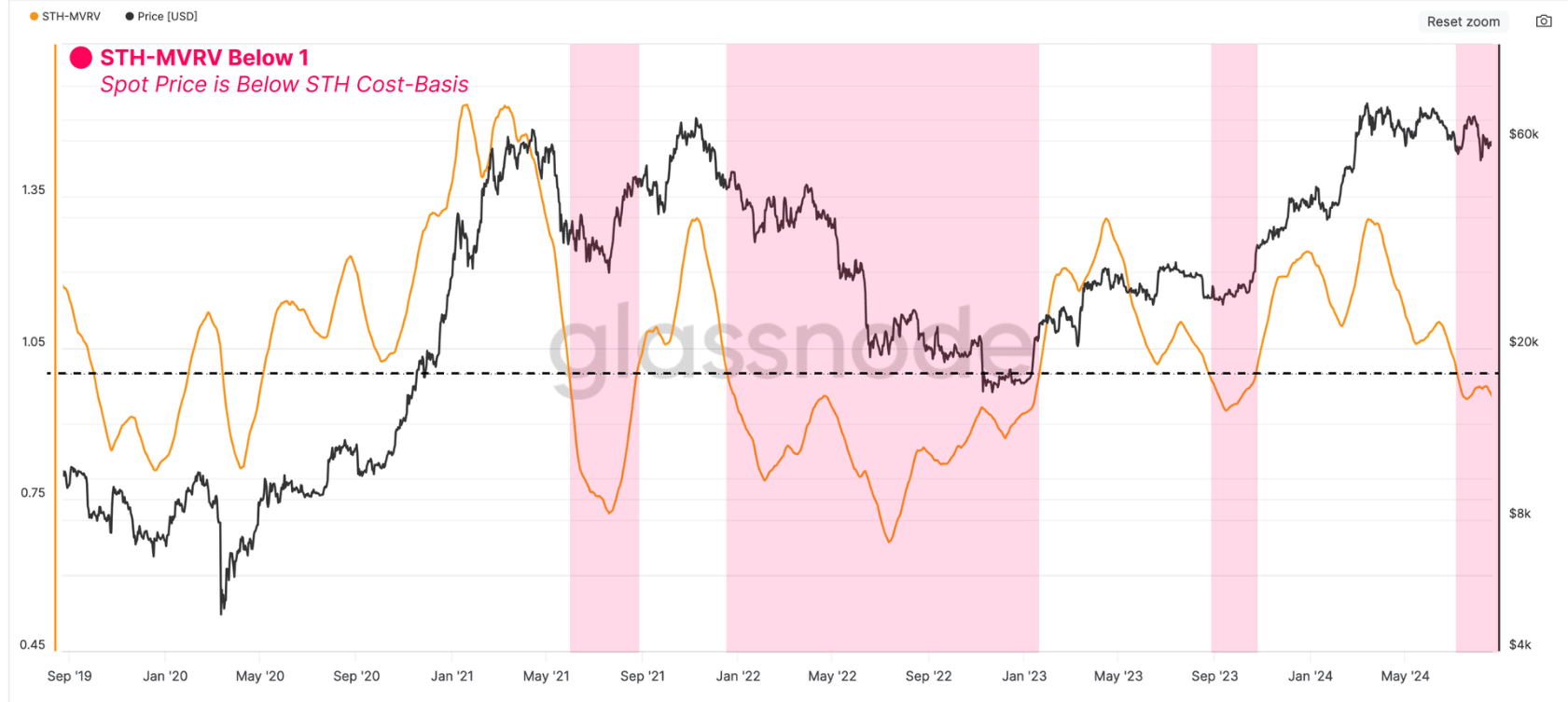

- Short-term holders are sitting on unrealized losses, with an overreaction bound to cause further dips.

As a seasoned crypto investor with a decade of experience navigating the digital asset market, I find myself intrigued by the current state of Bitcoin dominance. The growth from 38% to 56% in just a year is indeed impressive and can be attributed to the resilience of long-term holders. Their unwavering commitment to HODL and strategic accumulation has undeniably played a significant role in this surge.

In simple terms, Bitcoin (BTC) remains the leading player within the overall cryptocurrency sector, making up over half – or approximately $1.15 trillion – of the total $2.1 trillion value in the global crypto market capitalization.

As per the data from on-chain analysis tool, Glassnode, Bitcoin’s dominance in the cryptocurrency market has increased significantly since it reached its lowest point in November 2022. Starting at 38%, Bitcoin’s share of the total crypto market value has now grown to 56%.

However, over the past two years, Ethereum‘s [ETH] dominance has shown little change compared to other cryptocurrencies, as they collectively have seen a decline of around 6.5% in their market share.

Long-term holders drive Bitcoin dominance

According to Glassnode, Bitcoin’s expansion is happening due to a rise in investments flowing into the asset, with long-term holders demonstrating strong resolve and holding onto their assets like diamonds.

Among these traders, there’s been a substantial boost in Bitcoin availability. Remarkably, it was observed that most of them transformed into long-term investors following their purchases of BTC around the peak prices seen in March.

Despite the turbulent and unpredictable fluctuations in pricing, long-term investors are steadfast in their commitment, showing a strong inclination towards holding onto their assets (‘HODL’) and buying more coins, as suggested by data from Glassnode.

As a researcher studying this context, I find that these assets generate approximately $138 million in daily profits. This escalates the potential risks for selling, yet it seems that the fervor for profit-making has noticeably subsided.

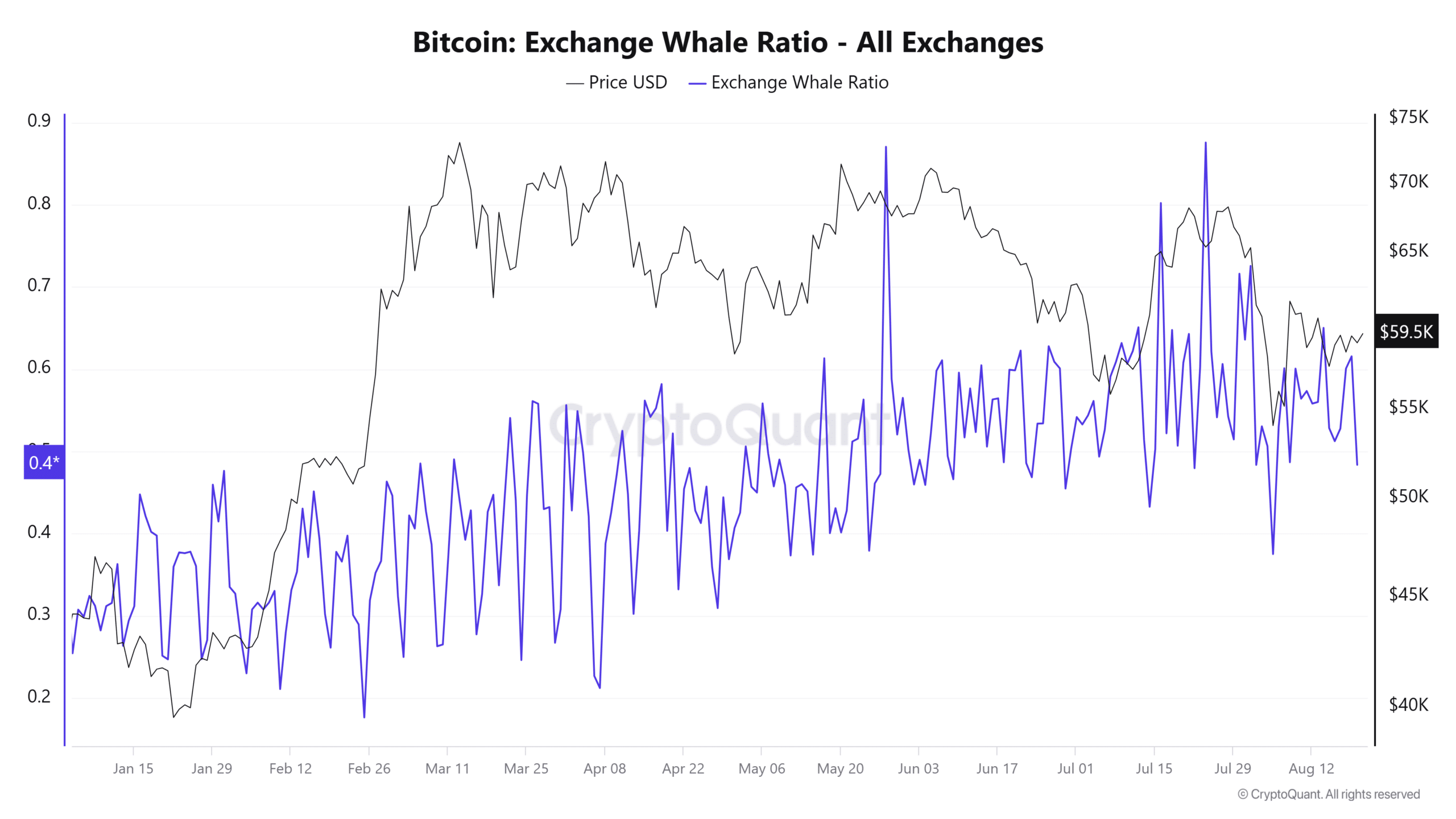

The evidence supporting this notion becomes even stronger when considering data from CryptoQuant, which indicates a decline in the Exchange Whale Ratio following significant whale-led profit-taking events in May and July.

Additionally, it seems that buyers are taking up the previously sold Bitcoins, which might be the reason for the cryptocurrency’s recent price stability within a range following its decline from its All-Time High (ATH).

Short-term holders caused $50K dip

According to Glassnode, the rapid sell-off by short-term investors might have caused Bitcoin’s dip below $50,000 earlier this month.

1. Investors with short-term holdings currently have a lower Market Value to Realized Value (MVRV) ratio than 1, indicating they’re currently experiencing unrealized losses. Over the past 30 days, this ratio has been below its equilibrium point.

Instead of holding Bitcoin for extended periods, short-term investors tend to be more responsive to price fluctuations. They often react near local peaks or troughs, as observed by Glassnode. For instance, on August 5th, a significant drop in Bitcoin’s value occurred, reaching a multi-month low of $49,000.

Read Bitcoin’s [BTC] Price Prediction 2024-25

If investors continue to experience losses under $59,000 for prolonged durations, experts predict that this could significantly boost the chances of market anxiety and strong downward trends.

As a crypto investor, I’ve noticed a subtle lean towards the bullish side when considering leveraged trading. My analysis of the long/short ratio on Coinglass indicates a steady rise in long positions since August 18th, hinting at growing optimism among investors.

Read More

- Gold Rate Forecast

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

2024-08-21 21:12