- Bitcoin dominance approaches 60% amid rising volatility, suggesting a near-term bullish outlook.

- What does this mean for altcoins?

As a seasoned researcher who has witnessed the ebb and flow of the crypto market since its inception, I can’t help but feel a sense of déjà vu when analyzing the current state of Bitcoin [BTC] dominance and altcoins. The surge in BTC dominance to nearly 60% amid rising volatility has been a familiar sight, suggesting a bullish outlook for Bitcoin in the short term. However, this trend could also indicate a market top, especially if the price consolidation continues.

Within a span of approximately two weeks, the influence of Bitcoin (BTC) in the cryptocurrency market has grown significantly, rising from approximately 57% to almost 60%. This expansion has allowed it to maintain its leading position amidst tough competition from other potential assets.

Nevertheless, even though Bitcoin surpassed $68,000, its value has been holding steady for a full week below that figure. If this pattern continues, the high prevalence might suggest a market peak, making the current price a significant psychological barrier to further growth.

Conversely, major economic conditions play a crucial role in molding the general market mood. Upcoming election outcomes might lead to changes in monetary policies, which could cause Bitcoin’s price fluctuations during the coming week. Nevertheless, this scenario highlights a bigger problem:

Investors are increasingly becoming risk-averse

The world of digital currencies is undergoing a significant shift. As Bitcoin consistently reaches unprecedented peaks, other cryptocurrencies seem to be falling short in comparison.

In the past 90 days, only 14 out of the top 50 alternative cryptocurrencies (altcoins) have surpassed Bitcoin’s performance, making up only 29% of Bitcoin’s overall dominance in the market. Simultaneously, Ethereum‘s market share has declined by approximately 7% within a span of 30 days, currently holding a 13% share at the time this statement was written.

From my perspective as a crypto investor, it’s widely believed that Bitcoin acts as a refuge in times of market turmoil. With regulatory ambiguities on the horizon, there could be an increased influx of capital towards BTC, possibly dealing another setback to high-cap altcoins.

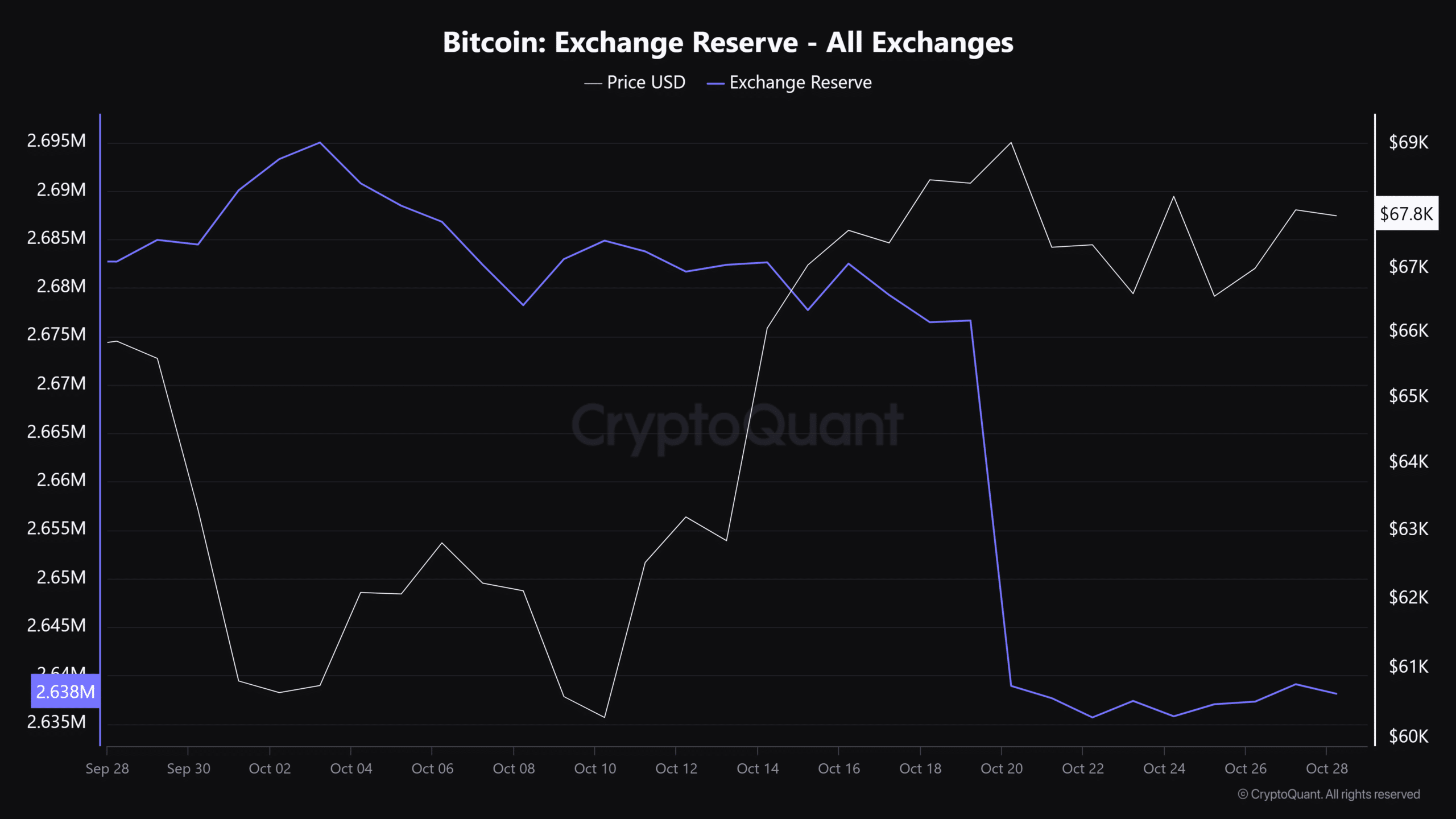

Source : CryptoQuant

The amount of Bitcoin stored on exchanges has reached a new record low, which often indicates the end of a downturn in bullish markets and suggests a possible change in investor attitudes.

As the election excitement starts to wind down, it’s possible that more investors might be drawn towards Bitcoin – that is, until there’s greater clarity on the regulatory front.

In this case, it seems that Bitcoin’s near-future perspective remains balanced, given the search among traders for a stable environment amidst prevailing uncertainties.

Altcoins poised for short-term gains

As Bitcoin stands to benefit from the current volatility, altcoins may also see some movement. However, an altcoin season remains out of reach.

As an analyst, I find that while there might be factors driving some altcoins towards a potential minor uptick, their overall trajectory remains closely tied to Bitcoin’s movement. In other words, the direction and strength of altcoin prices are significantly influenced by Bitcoin’s performance in the market.

Therefore, AMBCrypto doesn’t believe that a strong altcoin period will occur unless the atmosphere after the election becomes more favorable towards altcoins or the dominance of Bitcoin reaches around 70%. This could indicate a heated market and potentially a peak.

Read Bitcoin’s [BTC] Price Prediction 2024–2025

Right now, the data from blockchain transactions suggests that $67,000 serves as a notable bottom for Bitcoin. As we move into the upcoming week, which is expected to bring increased market turbulence, Bitcoin seems ready to test its previous resistance at $69,000 and potentially set a new all-time high.

Consequently, various altcoins are exhibiting a favorable short-term perspective, aiming to capitalize on Bitcoin’s upward trend. Yet, the much anticipated “altseason” – where altcoins outperform Bitcoin – continues to evade us for now.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- SOL PREDICTION. SOL cryptocurrency

- FANTASY LIFE i: The Girl Who Steals Time digital pre-orders now available for PS5, PS4, Xbox Series, and PC

- Playmates’ Power Rangers Toyline Teaser Reveals First Lineup of Figures

- Solo Leveling Arise Tawata Kanae Guide

2024-10-28 16:08