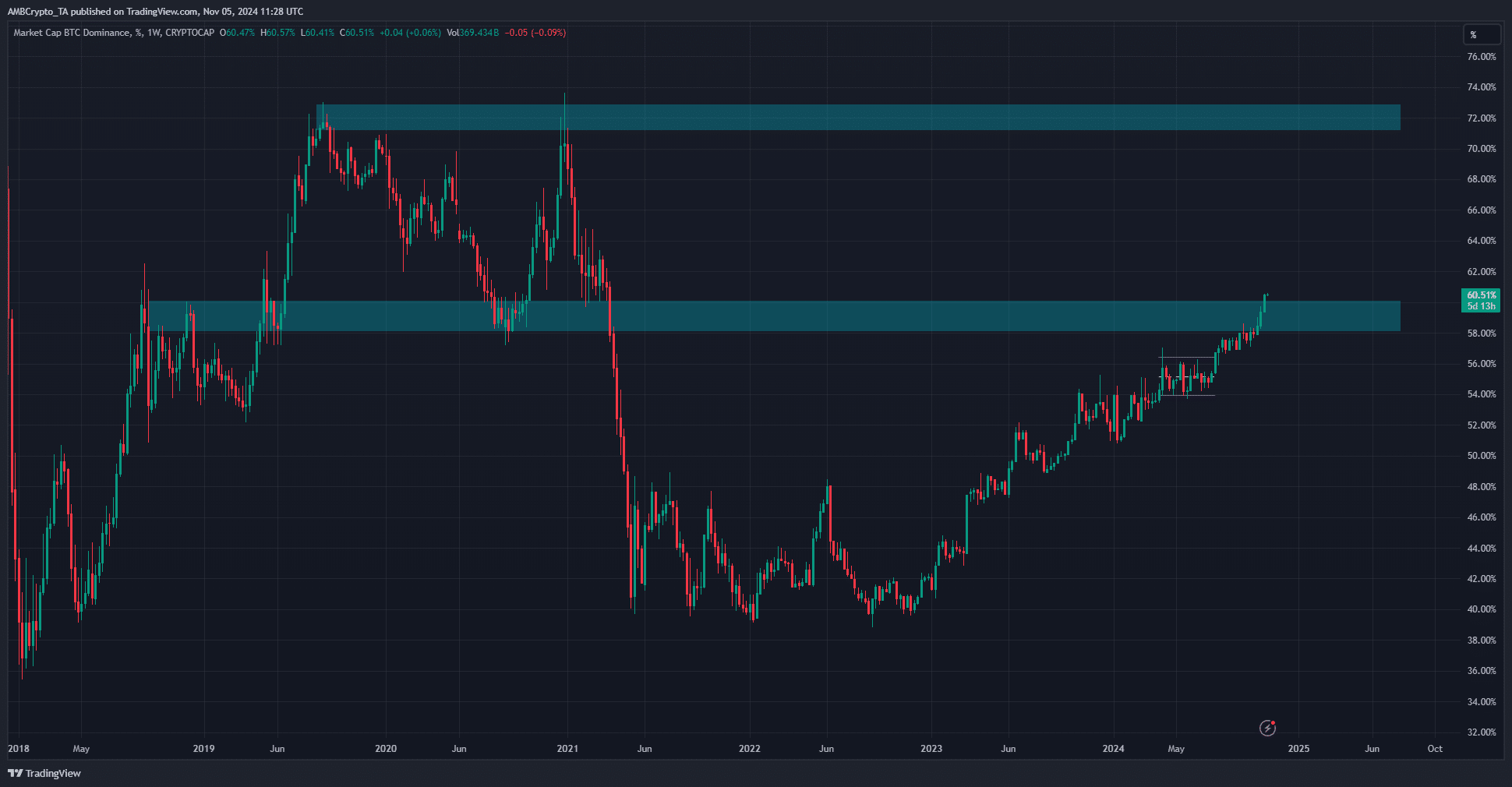

- The combined dominance chart was nearing its previous tops.

- Capital influx into the crypto sphere through rising BTC prices was essential for a healthy altcoin season.

As a seasoned researcher with a decade of experience in the cryptoverse, I find myself closely watching the combined dominance chart and the capital influx into the crypto sphere. The almost palpable anticipation for an altcoin season is growing among us crypto enthusiasts, and the recent trends are giving us hopeful signs.

🌪️ EUR/USD Turmoil Warning as Trump Escalates Trade Wars!

New research shows euro-dollar volatility about to spike — are you ready?

View Urgent ForecastIn September and October, Bitcoin [BTC] experienced an upward trend following a gradual decline that started in March. It almost touched its record high on October 29th, reaching approximately $73,600, but subsequently faced resistance.

Examining the data related to blockchain transactions showed a rise in larger transaction amounts, as well as a more optimistic outlook among traders in shorter periods.

In the current market cycle, significant investments and shifts (influx and rotation) will play a crucial role in determining Bitcoin and altcoin prices when viewed on larger time periods.

How close are we to an altcoin season?

Benjamin Cowen, CEO and Founder of Into The Cryptoverse, expects an altcoin season “next year“.

In 2020 and 2023, it was observed that the collective strength of Bitcoin, Ethereum [ETH], Tether (USDT), and USD Coin (USDC) accounted for approximately 82% of the market. This dominance often peaked before a surge in the altcoin sector.

At the moment of reporting, it stood at approximately 80.51%, just shy of its peak. If there’s a rejection and continued downward trend, this suggests that Bitcoin and Ethereum might be lagging behind other cryptocurrencies in the altcoin market.

Additionally, a downtrend in stablecoin market share would signal investors buying crypto.

2025 is the projected start date according to Cowen, which implies that those holding altcoins should exercise a bit more patience before witnessing substantial returns.

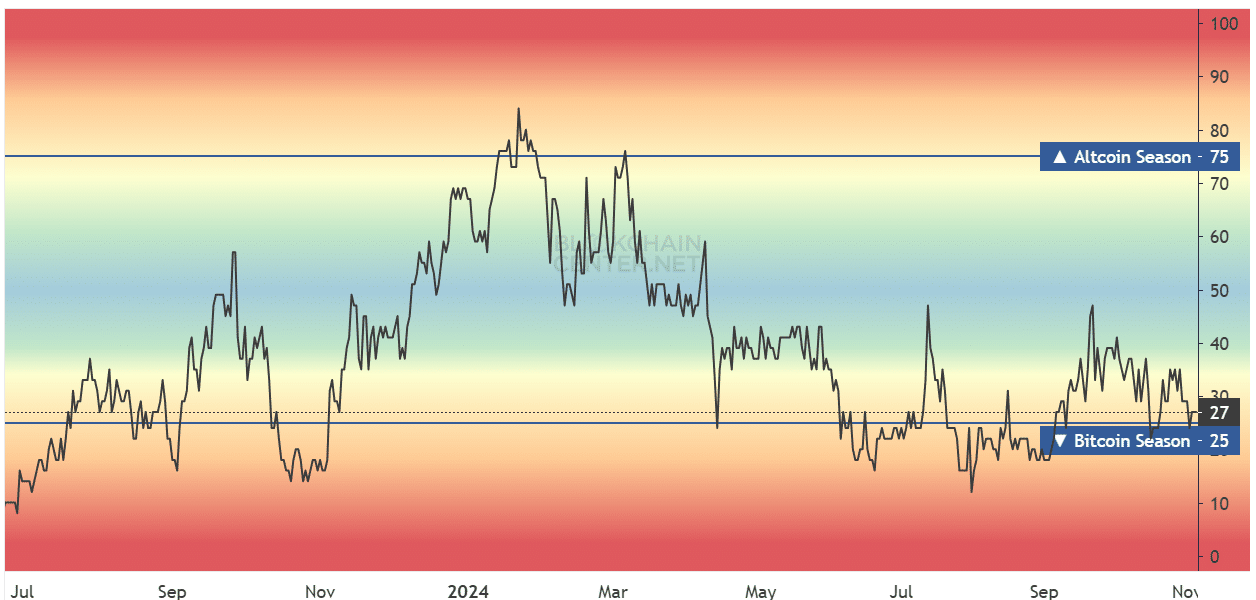

According to the altcoin season index, the altcoin market struggled to match Bitcoin’s price movements as indicated by a reading of 27.

One additional aspect to consider is that during a market crash, altcoins tend to be impacted significantly more than Bitcoin, resulting in larger price drops or declines.

Encouraging signs for investors

The chart indicating Bitcoin’s influence over the market demonstrated a breakthrough past a significant barrier from the prior cycle.

At 60.5%, BTC.D is poised to surge toward 72%, the previous cycle’s top.

However, it is not necessary that BTC.D must reach 72% before the altcoin season can ensue.

Rather than relying solely on technical analysis, a fracture in the bullish pattern of BTC.D could serve as a preliminary indicator suggesting that the ‘altcoin season’ is approaching.

Keep an eye on this additional aspect, as it’s relevant for both traders and investors. The greater the rise in BTC.D prior to a reversal, the potentially more significant the gains in altcoins that might ensue.

Read Bitcoin’s [BTC] Price Prediction 2024-25

This occurs as Bitcoin serves as the attractor for the majority of funds flowing into the cryptocurrency market. Furthermore, the shift in investment from Bitcoin to other alternative coins (altcoins) can trigger an ‘altcoin boom’ or ‘altseason’.

Given the current situation, it continues to be advantageous to gather additional alternatives that a market player strongly believes in.

Read More

- The Lowdown on Labubu: What to Know About the Viral Toy

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Masters Toronto 2025: Everything You Need to Know

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Microsoft Has Essentially Cancelled Development of its Own Xbox Handheld – Rumour

- There is no Forza Horizon 6 this year, but Phil Spencer did tease it for the Xbox 25th anniversary in 2026

2024-11-06 04:07