- Bitcoin dominance has reached a local high, warning investors of a potential market overheating.

- THIS highlights the next best “dip” opportunity.

As a seasoned researcher with over a decade of experience in the cryptocurrency market, I’ve seen my fair share of bull runs and bear markets. The current surge in Bitcoin dominance has caught my attention, as it often serves as a signal that the market may be nearing an overextension.

In the past two days, Bitcoin’s dominance reached a noteworthy 57%, thanks to a daily increase of more than 5% that raised its value above $66K – a threshold it hadn’t crossed for over 150 days.

Currently valued at approximately $67,350, Bitcoin has seen a surge of more than 10% within the last seven days. This swift climb has sparked discussions among analysts at AMBCrypto about the possibility of the market approaching an extended state.

If this situation arises, there might be a retreat towards a nearby low point before Bitcoin tries to challenge its record peak again.

High bitcoin dominance signals overheating

Over the last seven days, significant daily increases surpassing 2% have contributed to Bitcoin rebounding from its dip at $60K, signifying that this point now serves as a fresh foundation of support.

Moreover, the increase was further bolstered by an escalating Relative Strength Index (RSI), suggesting robust momentum. The trading volume skyrocketed to a fresh peak, implying heightened interest from individual investors.

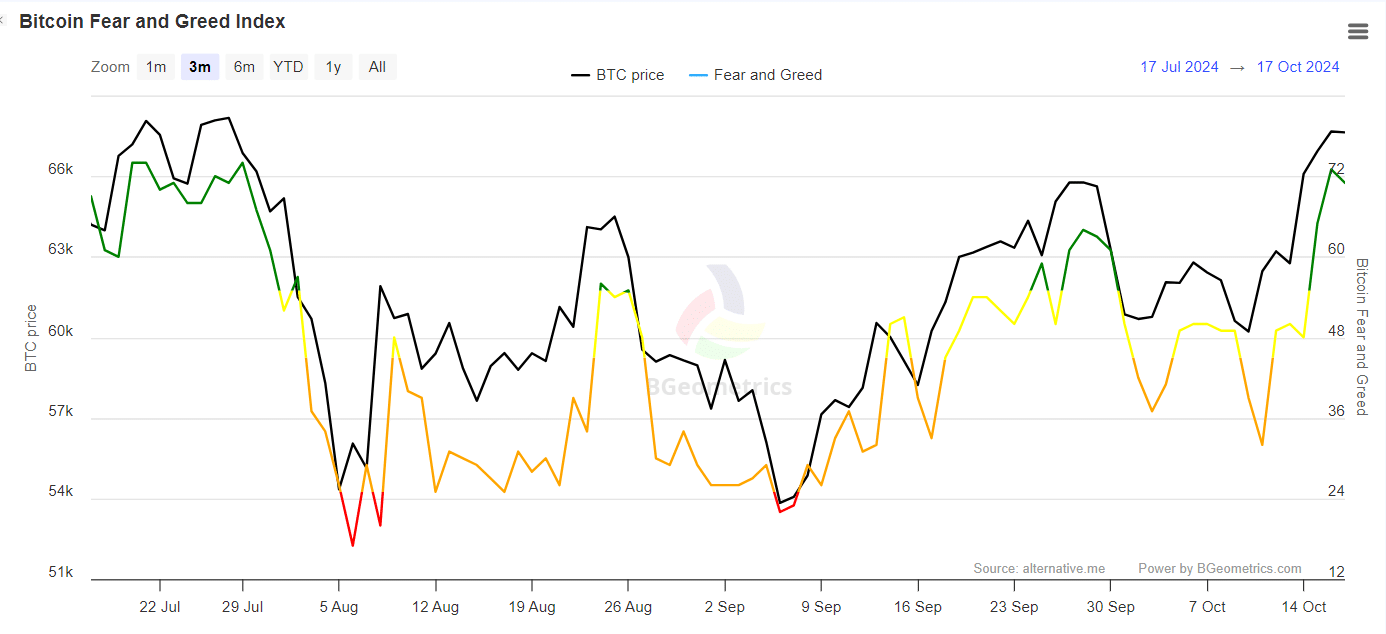

Consequently, Bitcoin’s dominance reached an all-time peak. Yet, this upward trend indicates that Bitcoin is currently moving towards “greed” levels, which may suggest early warnings of market overheating.

Source : BGeometrics

Historically, when Bitcoin reaches its market peak, there tends to be an increase in greed among investors, which can often result in a steep drop in prices following this phase.

Currently, a lot of traders are choosing to cash out, capitalizing on their profits, as they anticipate potential adjustments or corrections. Meanwhile, some potential buyers may be holding back due to apprehension about these impending changes.

Consequently, these traders often look for a drop in price to buy, profiting from the rise at the revival of Bitcoin’s dominance in the market.

As an analyst, I find myself observing a striking surge in Bitcoin’s dominance, coupled with various indicators suggesting a potential market peak. This could potentially pave the way for a correction in Bitcoin’s price trajectory.

Making this adjustment might cause trouble for less experienced investors, thereby providing an opportunity for new buyers to purchase at a lower price should there be a market drop.

Bitcoin could retrace to a local low

Previously, Bitcoin encountered resistance at around $64,000, but if this level becomes a point of support in the future, it could indicate a possible drop in price. This situation arises when fresh investor interest views this price zone as a promising opportunity for entry.

Furthermore, since Bitcoin (BTC) may grow increasingly susceptible to volatile price fluctuations due to speculation, there’s a higher chance that traders will open more short positions in futures markets. Their aim is typically for BTC to reach another dip around $64,000.

As a crypto investor, I’m finding myself pondering over the current market conditions. It seems we might be on the verge of a potential correction for Bitcoin, as it may be preparing to challenge its All-Time High (ATH) once more.

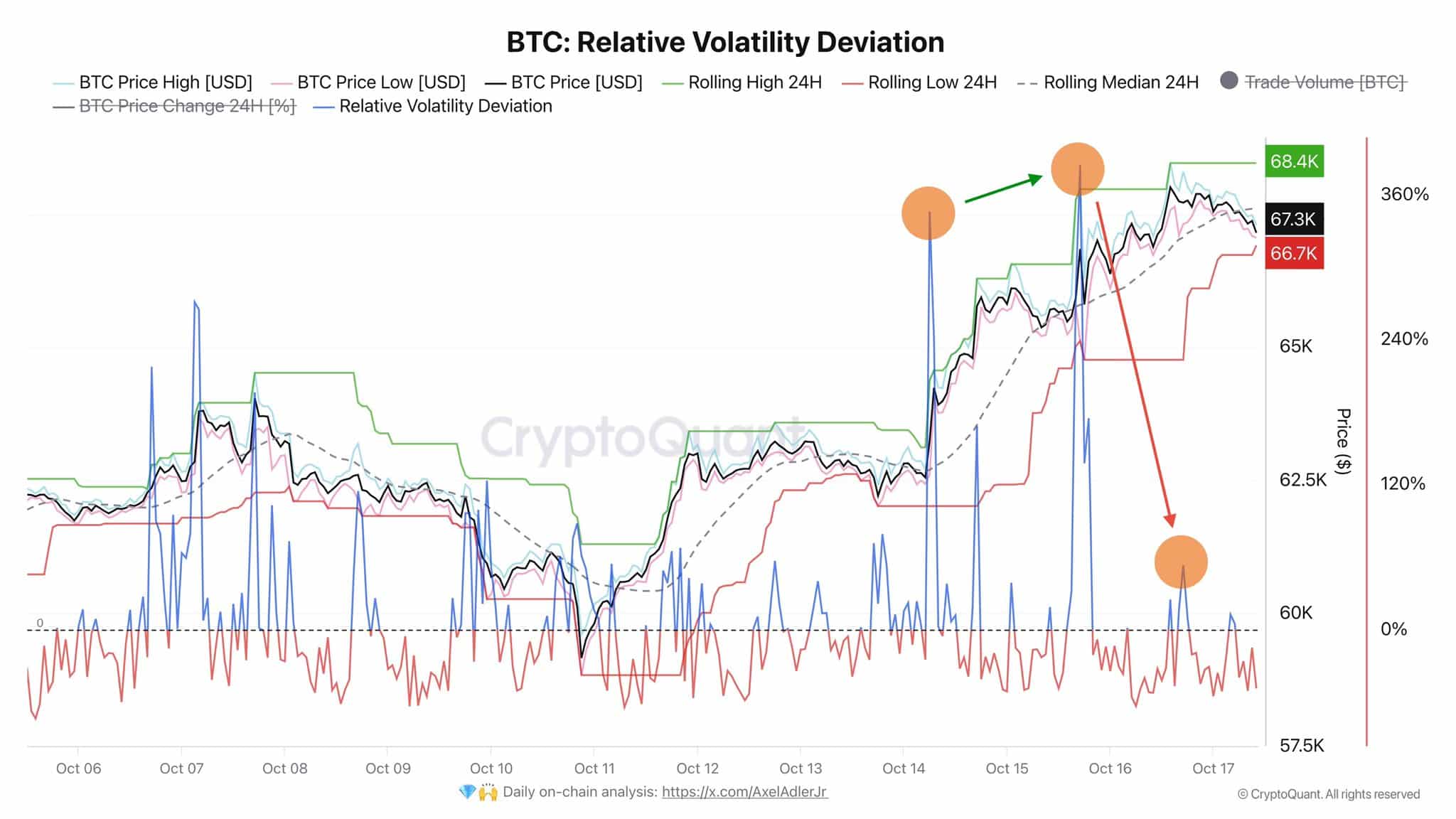

Source : CryptoQuant

Additionally, a well-known analyst has also issued a warning to investors due to a shift in market volatility moving into unfavorable conditions. This trend seems to be linked with the significant increase in Bitcoin’s influence over the market.

At present, the Bitcoin price is oscillating between approximately $68,400 and $66,700, with a concurrent increase in Open Interest across major trading platforms to around $20.3 billion. This surge makes Bitcoin potentially more susceptible to abrupt price surges or drops.

Read Bitcoin’s [BTC] Price Prediction 2024–2025

In summary, Bitcoin’s significant dominance in the market may indicate an extended phase, considering additional factors. The swift rise to around $67K appears to have driven the market towards excessive optimism or ‘greed,’ which could imply that the current price level potentially marks a market peak.

According to AMBCrypto’s analysis, it appears that $64K could be the next temporary minimum before a possible rebound, offering a good chance for investors to purchase at a lower price.

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- ANKR PREDICTION. ANKR cryptocurrency

- Isabella Strahan Shares Health Journey Update After Finishing Chemo

- Black State – An Exciting Hybrid of Metal Gear Solid and Death Stranding

- 2 Astronauts Stuck in Space After 8-Day Mission Goes Awry

- Solo Leveling Arise Tawata Kanae Guide

- Everything Jax Taylor & Brittany Cartwright Said About Their Breakup

- Quick Guide: Finding Garlic in Oblivion Remastered

- This School Girl Street Fighter 6 Anime Could Be the Hottest New Series of the Year

2024-10-17 22:16