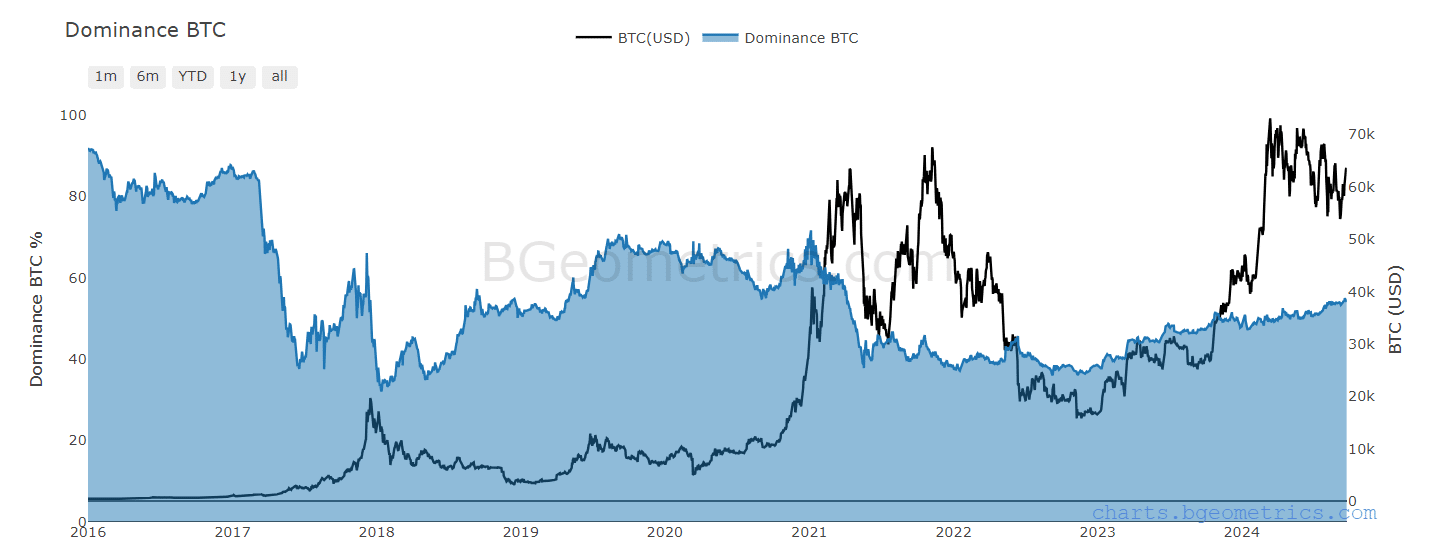

- Bitcoin dominance weakens as altcoin performance rises.

- A potential price correction may be tempered if this trend holds.

As a seasoned researcher with years of experience navigating the dynamic and unpredictable crypto market, I find myself intrigued by the recent trend of altcoins outperforming Bitcoin. Historically, Bitcoin’s dominance has been a reliable indicator, but its current decoupling from price action suggests a shift in investor sentiment towards less risky alternatives like altcoins.

Bitcoin [BTC] detractors have once again blocked a surge past the expected mark, keeping up the strain while investors stay above $62,000. Currently trading at around $63,390, a swift jump to $70,000 might not occur immediately.

Some analysts foresee a recovery, while others indicate Bitcoin’s dominance may be nearing its peak, possibly leading to a decline. Under such circumstances, could we witness a surge in altcoins, also known as an “altcoin season”?

Bitcoin dominance might be at risk

Historically, the dominance of Bitcoin over other cryptocurrencies has been significant in predicting market peaks, as it represents Bitcoin’s substantial influence within the overall crypto market.

Generally speaking, as Bitcoin (BTC) nears a significant resistance point, it’s common to see an increase in its dominance over other cryptocurrencies.

As a researcher studying Bitcoin (BTC), I found an intriguing trend in the data. During BTC’s all-time high (ATH) of approximately $73K in March, the chart showed a divergence – while the price surged, the dominance of BTC remained stable. This suggests that the price action and market dominance might have decoupled during this period.

Source : BGeometrics

According to AMBCrypto’s report, this suggests an increasing interest in altcoins, as investors see them as potentially safer options compared to Bitcoin during its significant price increase.

Remarkably, Ethereum‘s [ETH] current market behavior aligns well with this theory. In fact, during the last seven days, ETH has shown a remarkable 2x growth compared to Bitcoin (BTC), reaching a high of $2,656 as reported at the time of press.

To put it simply, it’s important for altcoin investors to keep an eye on Bitcoin’s significant resistance level. If this level is breached, it might indicate a possible rise, which can help in forecasting upcoming market trends.

Diversification signals potential market top

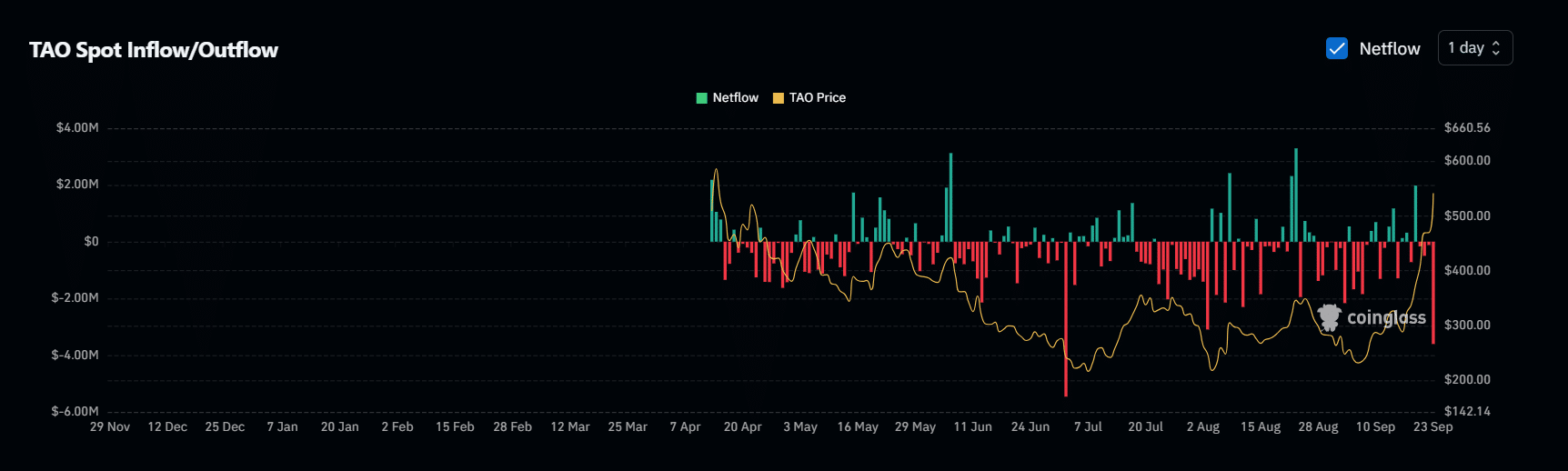

Based on recent statistics, it appears that 15 alternative cryptocurrencies, or altcoins, have surpassed Bitcoin’s performance over the past 90 days. Among these, TAO stands out as the top performer, registering a notable increase of approximately 80% compared to Bitcoin.

Although this figure represents only half of the required amount for an altcoin boom, it undeniably poses a considerable threat to Bitcoin’s supremacy.

Moreover, TAO experienced an impressive 18% increase within the past 24 hours, significantly outpacing Bitcoin’s 2%. This growth supports the theory initially proposed by AMBCrypto.

Notably, TAO’s surge coincided with Bitcoin breaching the key $63K range.

At present, the outflow of TAO (Tether) has peaked at a two-month maximum of $3 million, suggesting that investors are shifting their assets towards altcoins, possibly due to increasing Bitcoin prices. This trend seems to demonstrate a strong connection between Bitcoin and these altcoins.

Source : Coinglass

In simpler terms, this relationship suggests that the market may be nearing a peak, given that many investors have started doubting a trend reversal and are instead moving their funds to safer investment options.

If this trend continues, it’s possible that a price adjustment to around $68K (the next resistance level) could be moderated. This might particularly occur since Bitcoin’s dominance decreases as more altcoins join the top 50, potentially signaling an upcoming ‘altcoin season’. What are the chances?

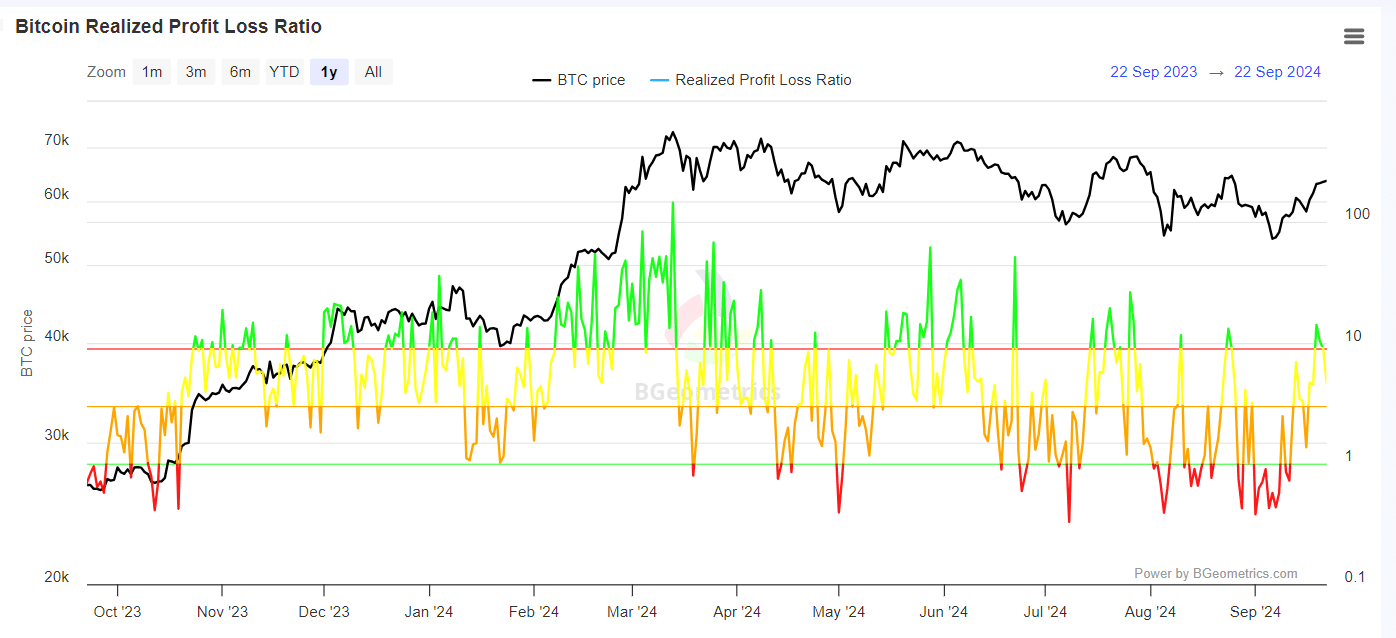

The market is at a crucial juncture

It’s worth noting that when Bitcoin approached the $63K level, a large number of investors found themselves in a profitable position, as evidenced by the nearly 14% of green (profitable) positions shown.

Yet, since bulls didn’t manage to initiate a breakthrough and bears regained control, many investors started facing losses.

Source : BGeometrics

If these investors doubt a price drop, they might react with mass sell-offs, which could potentially diminish Bitcoin’s market strength.

Furthermore, this could lead to a change in investment distribution towards alternative cryptocurrencies (altcoins), as some investors might perceive them as less risky investments.

To put it simply, we’re at a pivotal point in the market. If Bitcoin’s dominance continues and buyers help push it beyond its current level, the altcoin rally might slow down before Bitcoin hits its next resistance at approximately $68,000.

Read Bitcoin’s [BTC] Price Prediction 2024-25

If bulls can’t hold the $64K level and instead fall below $60K (which appears imminent), it could lead to a brief increase for many alternative cryptocurrencies.

To maintain a prolonged period of success for altcoins, faith in potential future returns is crucial, and this confidence is closely linked to the influence of Bitcoin’s dominance. Therefore, keeping track of its fluctuations is important.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

2024-09-23 23:04