Well, well, well! Last week, our beloved Bitcoin ETFs saw a shocking $713 million in daily net outflows. That’s more than three times the pitiful $172.69 million we laughed at the week before. Oh, how the mighty have fallen! 😂

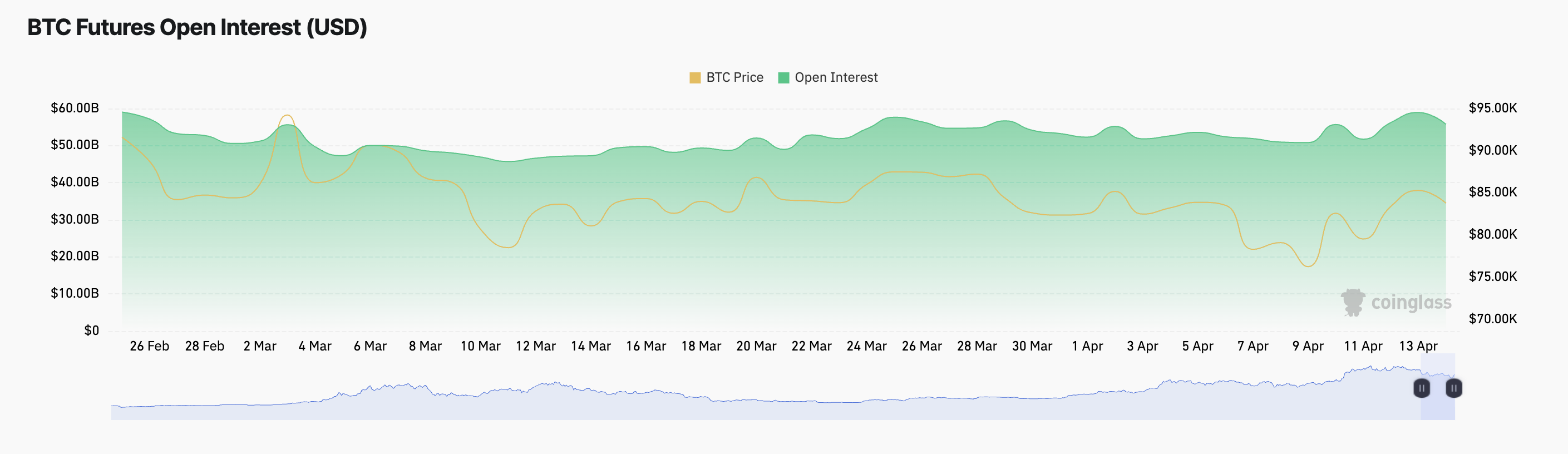

In other news, the derivatives market is having a bit of a midlife crisis. BTC‘s open interest is on a downward spiral, though funding rates are still in the positive zone. Talk about mixed signals! 🌪️

The Bitcoin Diaries: ETFs Bleed While everyone panics in the market

Between April 7 and April 11, institutional investors grabbed their capital and ran for the hills, pulling out of BTC funds like it was a bad date. Why? Because, surprise, surprise, the broader market isn’t playing nice! Our dear BTC couldn’t manage to stay above that golden $85,000 mark and dipped as low as $74,000. Is this the end? Who knows! 🥴

During this wild ride, total net outflows reached a staggering $713 million—an eye-watering 314% increase from last week’s “tiny” withdrawals of $172.69 million. Someone call the paramedics! 🚑

The biggest drama unfolded with BlackRock’s IBIT, which saw a whopping $343 million in net outflows—48% of the total sums yanked out. As if that weren’t enough, Grayscale’s GBTC also joined the pity party with $161 million in outflows. How charming! Their total just hit a vacation budget of $22.78 billion in net outflows. 🤑

But hold your horses! Not all funds were chasing the great escape; some actually recorded inflows. Grayscale’s Bitcoin Mini Trust strutted in with a modest $2.39 million. Lucky them! 🎉

Bitcoin’s Derivatives: A Tender Love Story of Cautious Optimism

Meanwhile, on the derivatives side, BTC’s futures open interest is performing a slow waltz downward. Currently sitting at a safe $55.73 billion, it’s had a 5% dip lately. But hey, at least BTC’s value climbed by a “whopping” 1% in the last day. Progress? We’ll call it that! 🙈

The decline in open interest as BTC’s price tries to lift itself off the mat suggests traders are closing shop rather than diving into the new. Caution is the name of the game this week; or is it just reluctance? 🤷♂️

But here’s the kicker! The funding rates are still smiling, implying that long positions are holding strong among those perpetual futures traders, but they’re definitely looking a bit more cautious lately. 🤨

Over in the options market, the put contracts are overselling the calls. Could it be signals of doom? More traders are placing their bets on a potential downside, or maybe they just collided with the reality of crypto trading. Ouch! 💔

The sudden ETF outflows, plunging open interest, and the bearish vibes in the options market hint that the entire BTC ecosystem is holding its breath. Sure, the funding rates still offer a glimmer of hope, but everyone’s bracing themselves for an emotional roller coaster in the coming days. Hang onto your hats, folks! 🎢

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

2025-04-14 10:56