- Bitcoin’s staggering +$800M per day realized losses could be the dramatic bottom we’ve all been waiting for! 🎭

- Overall demand? Negative. BTC ETFs are bleeding more than a soap opera character in a cliffhanger—over $5 billion! 💔

So, Bitcoin [BTC] has decided to play hide and seek below $85k after a little dip to $76k. Bitfinex analysts are whispering sweet nothings about stabilization. 🥴

In their weekly market report, they noted that traders are experiencing a realized loss of $818 million per day. A market flush that’s like a pre-party clean-up before the potential bottom drops! 🎉

“Such widespread capitulation often precedes market stabilization, though geopolitical and macroeconomic concerns remain a significant overhang.”

Will BTC rebound? Or is it just a sad love story? 💔

But wait! Short-term holders (STH) are selling BTC at a loss for the first time since October 2024. If this trend continues, it could complicate our romantic reversal efforts. 😩

They mentioned the Bitcoin Spent Output Profit Ratio (SOPR)—it’s like the report card for traders’ profitability, and guess what? It dipped below 1. That’s right, folks, we’re selling at a loss! 📉

“Short-term holder SOPR recorded its second-largest negative print of this cycle at 0.95, signaling that new market entrants are capitulating.”

For a recovery shift, Bitfinex analysts are saying SOPR must surge above 1 again. It’s like saying we need to get back together for ‘re-accumulation’ and ‘bullish continuation.’ Classic! 💔➡️💖

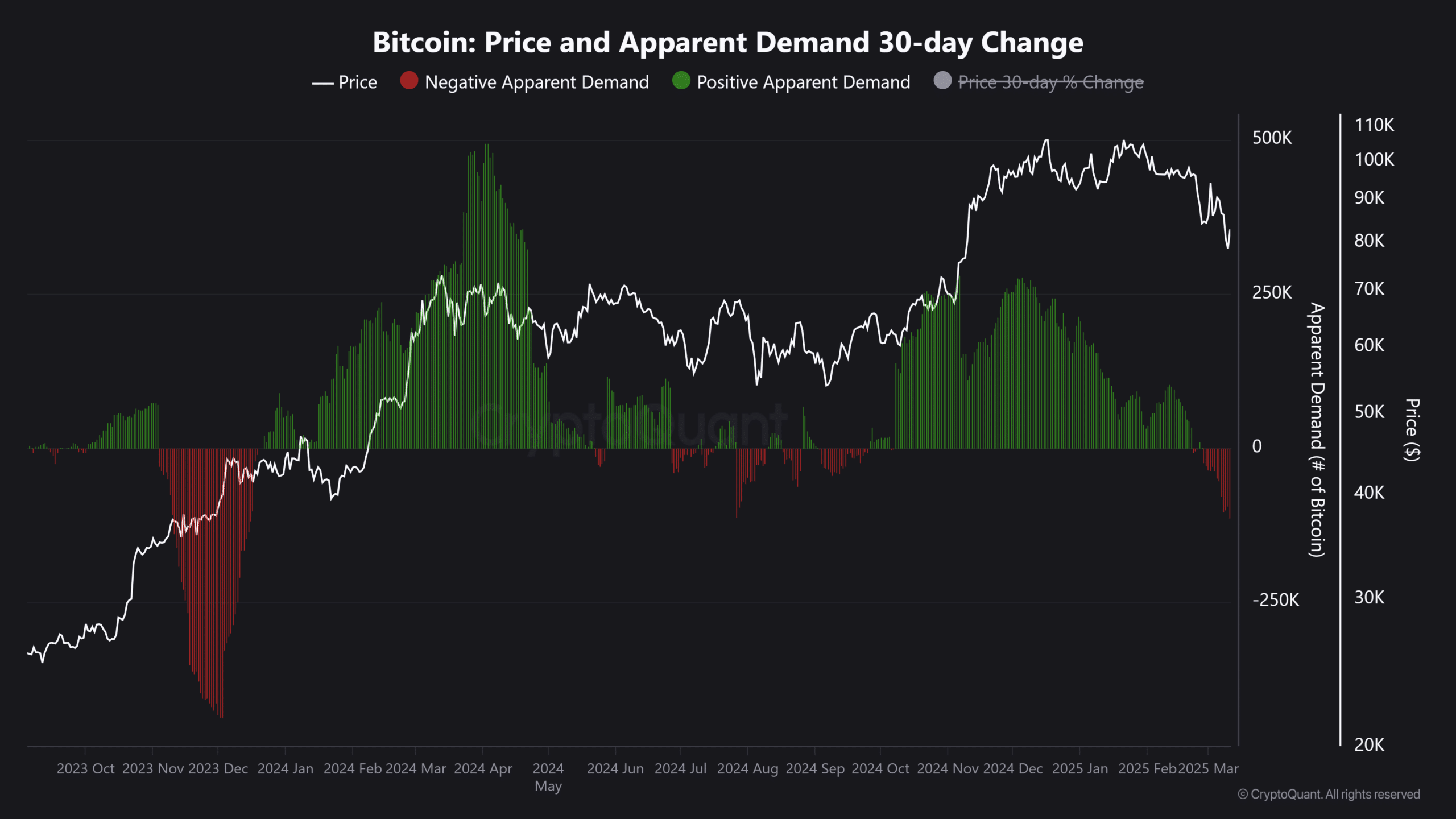

The weak BTC demand is just confirming Bitfinex’s warnings. According to CryptoQuant’s data, demand for our beloved cryptocurrency has been negative since late February. Ouch! 😬

U.S. spot BTC ETFs have bled $1.5 billion in the first half of March. In February alone, they saw $3.56 billion outflows. That’s over $5 billion bleeding out in the last 6 weeks! Someone call a doctor! 🩺

Bitfinex analysts are also warning that mixed readings on U.S. macroeconomic factors could still dent crypto markets. Despite Trump’s tariff wars, the U.S. CPI inflation data came in cooler than expected for February. Who knew? 😲

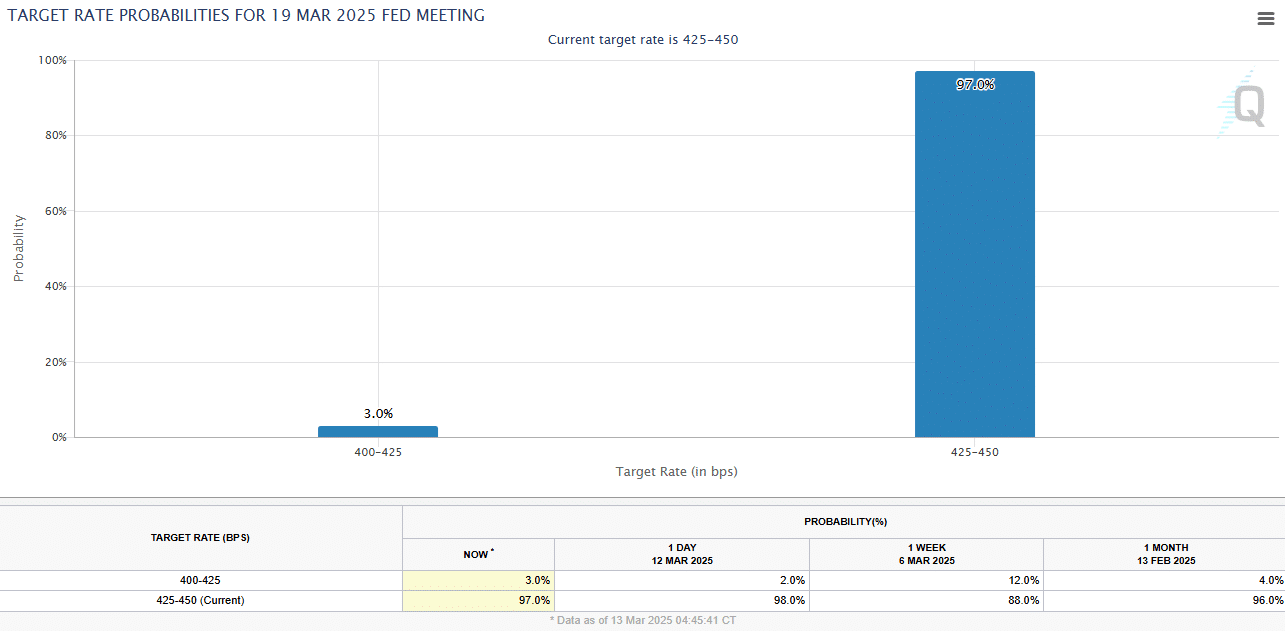

Unfortunately, the market isn’t expecting any Fed rate cut in the next FOMC meeting scheduled for March 19. Traders are pricing a 97% chance that the Fed will keep the rates unchanged at the current target of 4.25%-4.50%. Yawn! 😴

There’s only a 3% chance of a 25bps rate cut during next week’s FOMC meeting. So, BTC might still be stuck in choppy waters for a while. Grab your life jackets! 🚣♂️

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Gold Rate Forecast

- FANTASY LIFE i: The Girl Who Steals Time digital pre-orders now available for PS5, PS4, Xbox Series, and PC

- Playmates’ Power Rangers Toyline Teaser Reveals First Lineup of Figures

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- SOL PREDICTION. SOL cryptocurrency

- Despite Bitcoin’s $64K surprise, some major concerns persist

2025-03-14 11:09