- Oh look, BTC outflows have taken a nosedive! Who knew money could be so dramatic?

- Coinbase is practically swimming in liquidity, while investors are playing the spot market like it’s a game of Monopoly.

So, Bitcoin, the big boss of cryptocurrencies, is still hanging out at levels that make it feel like it’s in a sad rom-com. Currently, it’s just over $81,000, which is like being invited to a party but showing up in last season’s outfit. 😩 After a 24-hour dip of almost 2%, it’s clear that the crypto world is having a bit of an existential crisis.

But wait! As Bitcoin flirts with its critical support levels, spot traders are starting to accumulate like they’re hoarding toilet paper during a pandemic. Let’s dive into the juicy details to see if BTC is gearing up for a price pump or just another sad story.

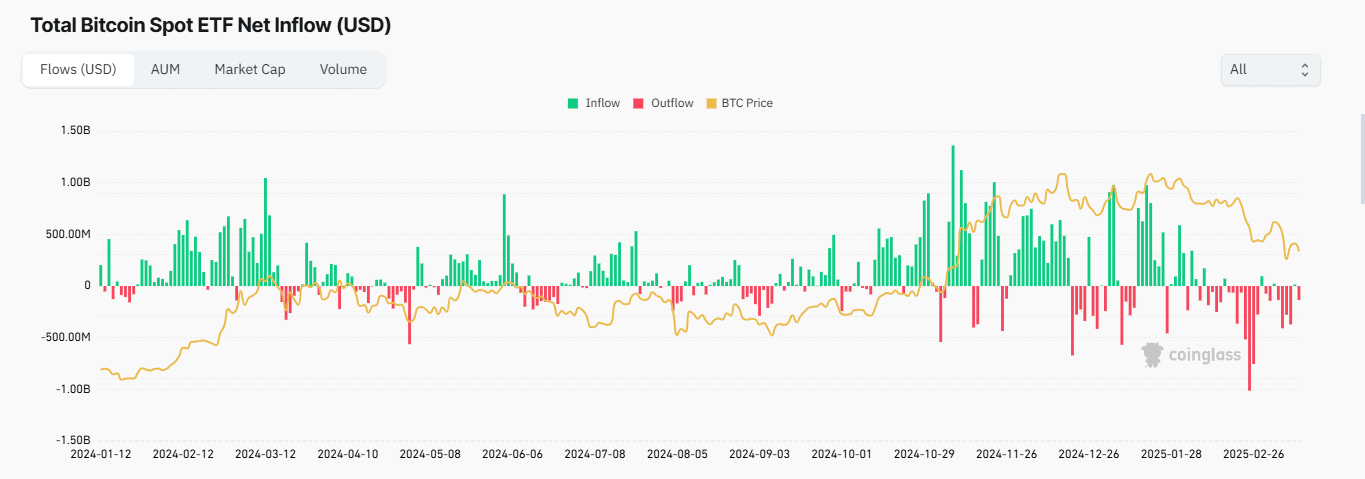

Spot ETF outflows slow down

Recent gossip from the crypto world reveals that BTC outflows from ETFs have taken a significant tumble. It’s like watching a soap opera where the villain suddenly decides to be nice.

As of now, after a dramatic peak of $1.01 billion in outflows on February 25, the selling pressure has cooled down faster than a hot cup of tea left out in the cold. In the last 24 hours, a whopping $135.20 million was withdrawn, with assets under management at a staggering $97.62 billion. Talk about a hefty wallet!

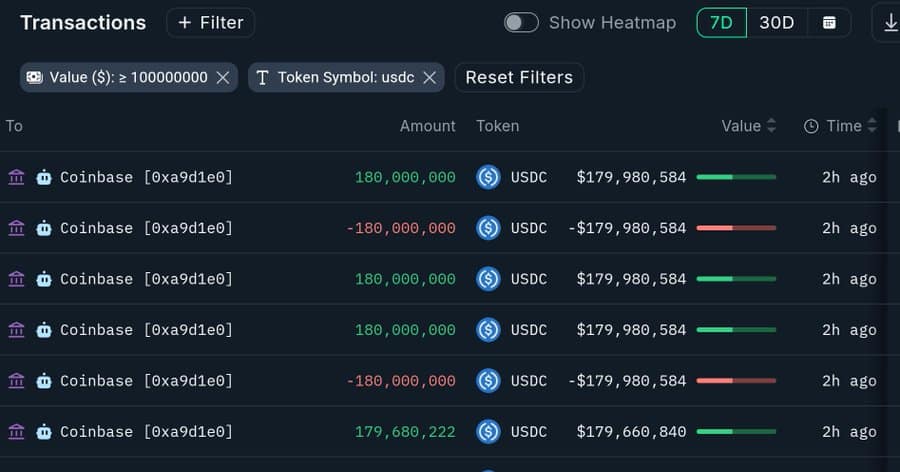

While the selling in BTC Spot ETFs has slowed down, Coinbase is practically throwing a liquidity party! 🎉 Over the last week, inflows have totaled 719 million USDC. It’s like everyone is buying in anticipation of a rally, or maybe just trying to impress their friends.

Looking at Bitcoin’s exchange netflows on Coinglass, it’s confirmed: traders are buying like it’s Black Friday! Spot traders have purchased around $57 million worth of BTC in just two days, flipping exchange netflows negative. Negative netflows? That’s just fancy talk for “people are buying!”

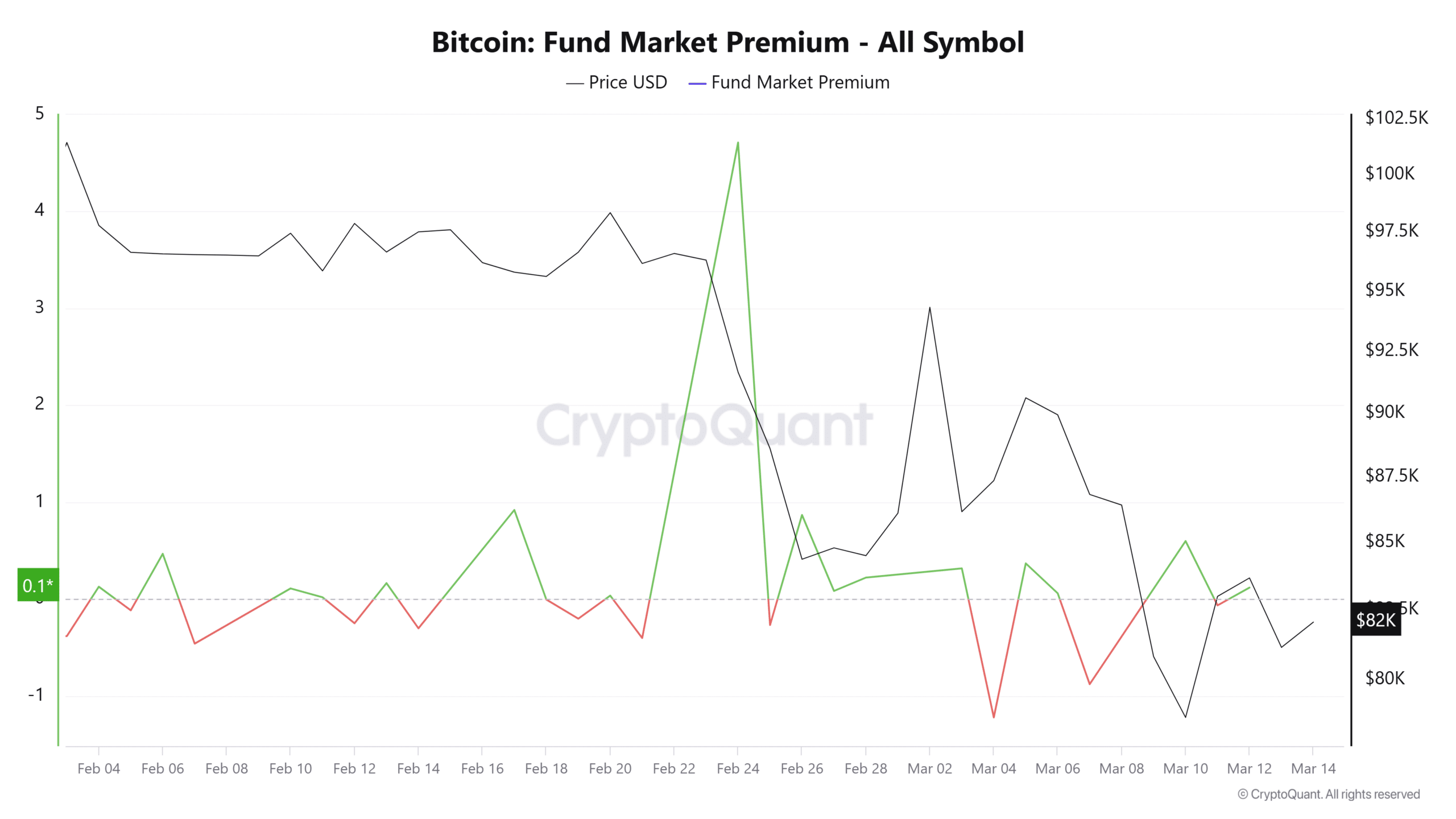

Even institutional investors are getting in on the action, as the funds market premium has turned positive. It’s reading 1.03 at press time, which is like a thumbs up from the cool kids.

Just a quick note: the funds market premium is like a mood ring for institutional demand and supply for BTC. A reading above 1 means they’re buying, while a negative reading is like a breakup text.

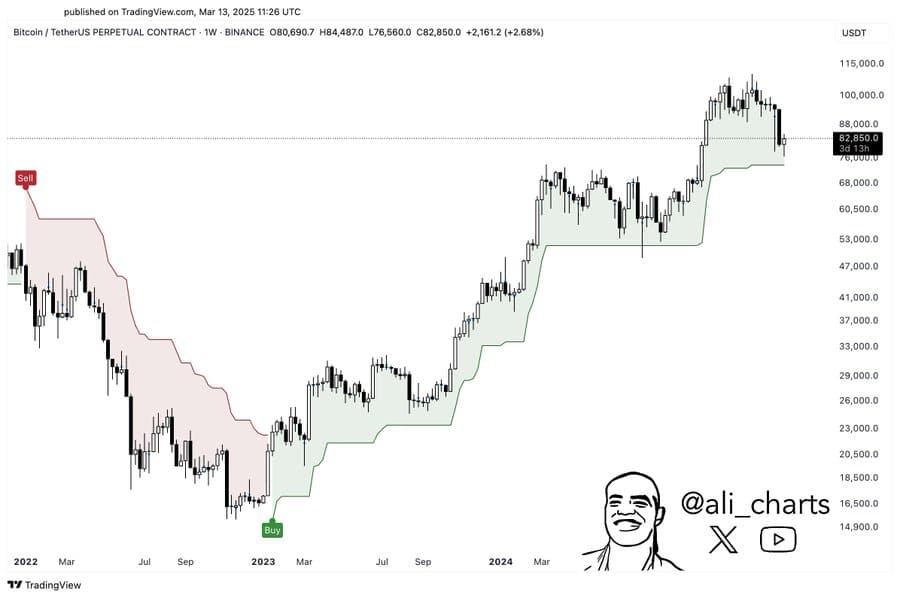

Weekly support remains a key factor

As Bitcoin tries to regain its strength, hinting at a possible rally, the market sentiment could shift faster than a plot twist in a thriller. If things go south, the next notable support level is at $74,000. Yikes!

This support level has been holding strong since January 2023, like a loyal friend who never leaves your side. If the price reacts positively and trends higher, we might just see a major Bitcoin rally. But if it breaches this support, it could be a sign of high bearish sentiment, leading to more price declines. Drama alert!

For now, the market is well-positioned for an upswing, as long as the bullish sentiment keeps the party going. 🎈

Read More

- WCT PREDICTION. WCT cryptocurrency

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- LPT PREDICTION. LPT cryptocurrency

- PI PREDICTION. PI cryptocurrency

- SOL PREDICTION. SOL cryptocurrency

- Royal Baby Alert: Princess Beatrice Welcomes Second Child!

- FANTASY LIFE i: The Girl Who Steals Time digital pre-orders now available for PS5, PS4, Xbox Series, and PC

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

2025-03-14 23:07