-

Bitcoin traders have capitalized on significant gains from the recent rally when BTC tested the $64K resistance level.

With the price now down, should you buy the dip?

As a seasoned crypto investor with a decade of experience under my belt, I’ve seen plenty of market swings and learned to read between the lines. The recent drop in Bitcoin price following the $64K resistance test has left many traders wondering whether they should buy the dip or wait it out.

While investigating the cryptocurrency market, I’ve observed that Bitcoin [BTC] encountered robust resistance at approximately $64,000, seemingly shifting the advantage towards the bearish sentiment. Over the past 24 hours, there has been a 5.55% decline in its value, with current trading occurring at $59,532.

It came as a surprise to me, given the recent surge in economic optimism driven by anticipation of interest rate reductions. This led me to explore if traders are adopting strategic positions, aiming to capitalize on any potential future market downturns.

BTC traders locked in profits after recent rally

After the downturn in early August, investors hoping for an uptrend are looking forward to surpassing the earlier $70K barrier for Bitcoin. Yet, surmounting the current $60K level appears challenging at this moment.

Based on this finding, AMBCrypto looked back at previous data and spotted a consistent trend that offers insights into how traders are strategically arranging themselves.

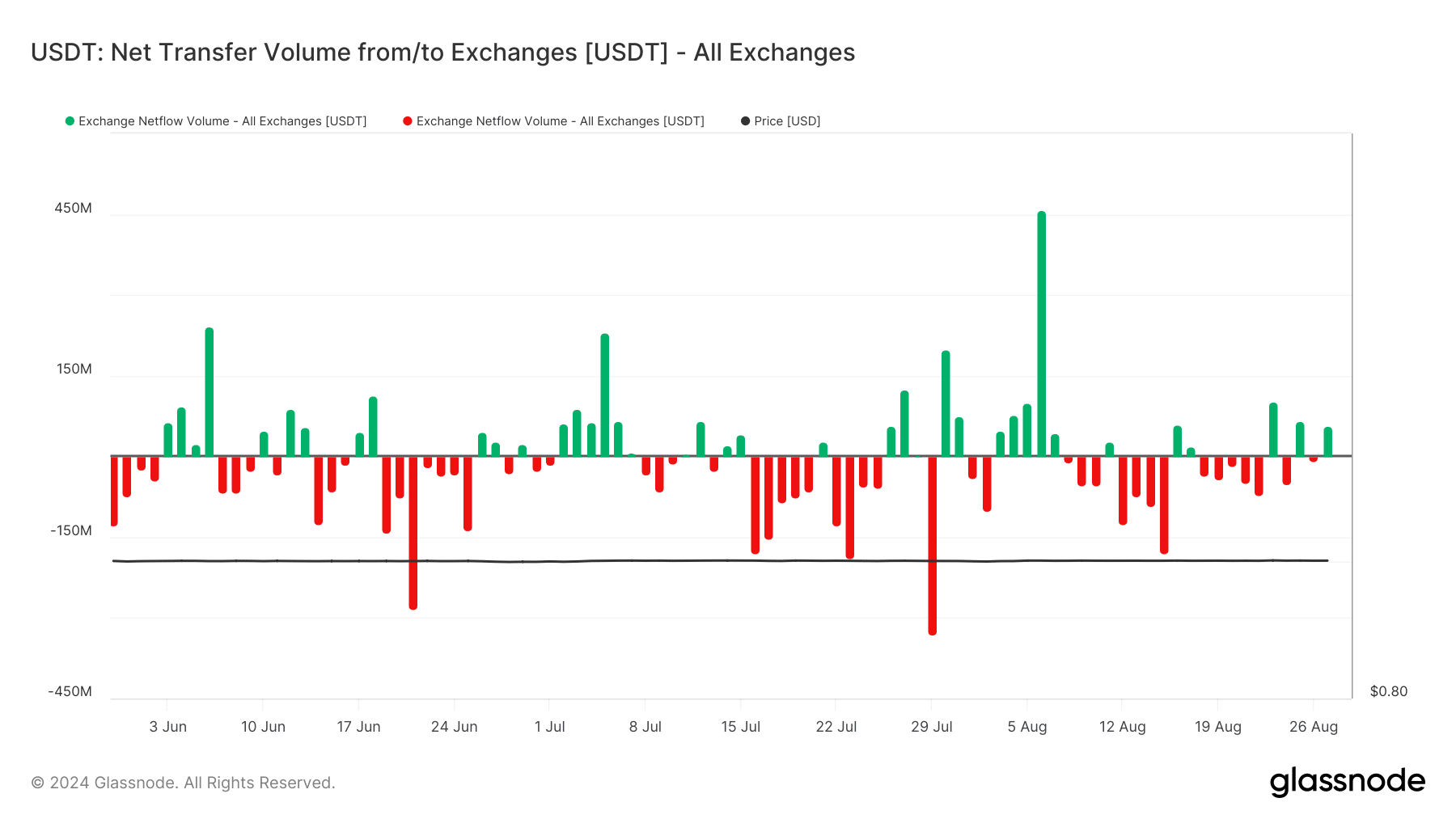

Source : Glassnode

On July 29th, following a surge in Bitcoin’s price close to $70,000 due to a bullish trend, there was a significant increase of USDT (Tether) being withdrawn, amounting to approximately $330 million. This suggests that traders were taking profits from their earlier profits.

This significant withdrawal from the exchanges indicates a pattern of Tether (USDT) being taken off the platforms, often used as a secure destination or for holding earnings.

In a similar fashion, during late August, traders took advantage of their gains over a two-week period when Bitcoin bulls successfully breached the $62K resistance point. This resulted in a subsequent decrease in BTC‘s price.

Blending this analysis with data from future participants in the continuous market would offer a more transparent understanding.

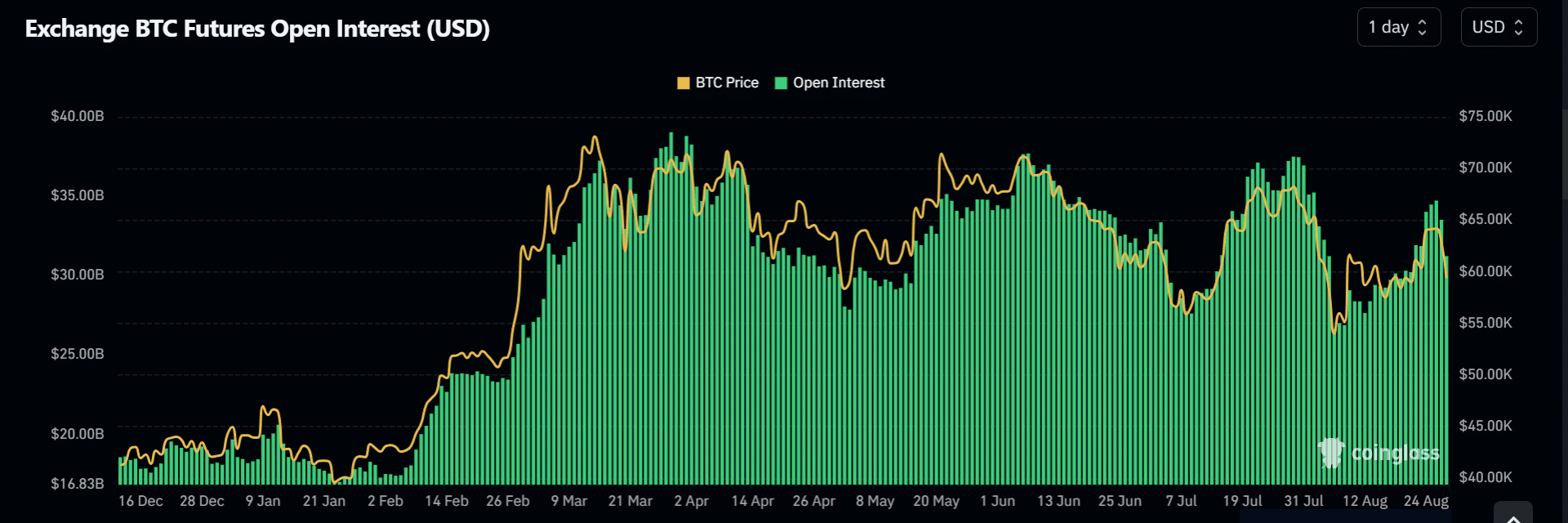

Source : Coinglass

Based on AMBCrypto’s examination of the Open Interest (OI) chart, it appears that whenever Bitcoin (BTC) approaches a resistance level and has a bullish surge, the quantity of closed positions tends to rise afterwards. This suggests a recurring pattern where traders are taking profits as they test resistance levels.

For the last week, a well-known cryptocurrency expert predicted that $64K would be the next barrier for BTC‘s price increase. When the cost touched this level, it experienced a drop, demonstrating the readiness of traders to secure their profits.

After a substantial decrease in price due to traders cashing out their substantial profits, is it advisable to seize this opportunity and invest (buy the dip)? Let’s delve into it with AMBCrypto.

High USDT inflows signal…

On the graph provided, you’ll see that Bitcoin closed above the $64,000 mark on August 24th. Following this, a significant amount of approximately $69 million worth of Tether was withdrawn from exchanges, suggesting traders were cashing out their earnings. This withdrawal led to a decrease in the price, causing it to fall below $60,000.

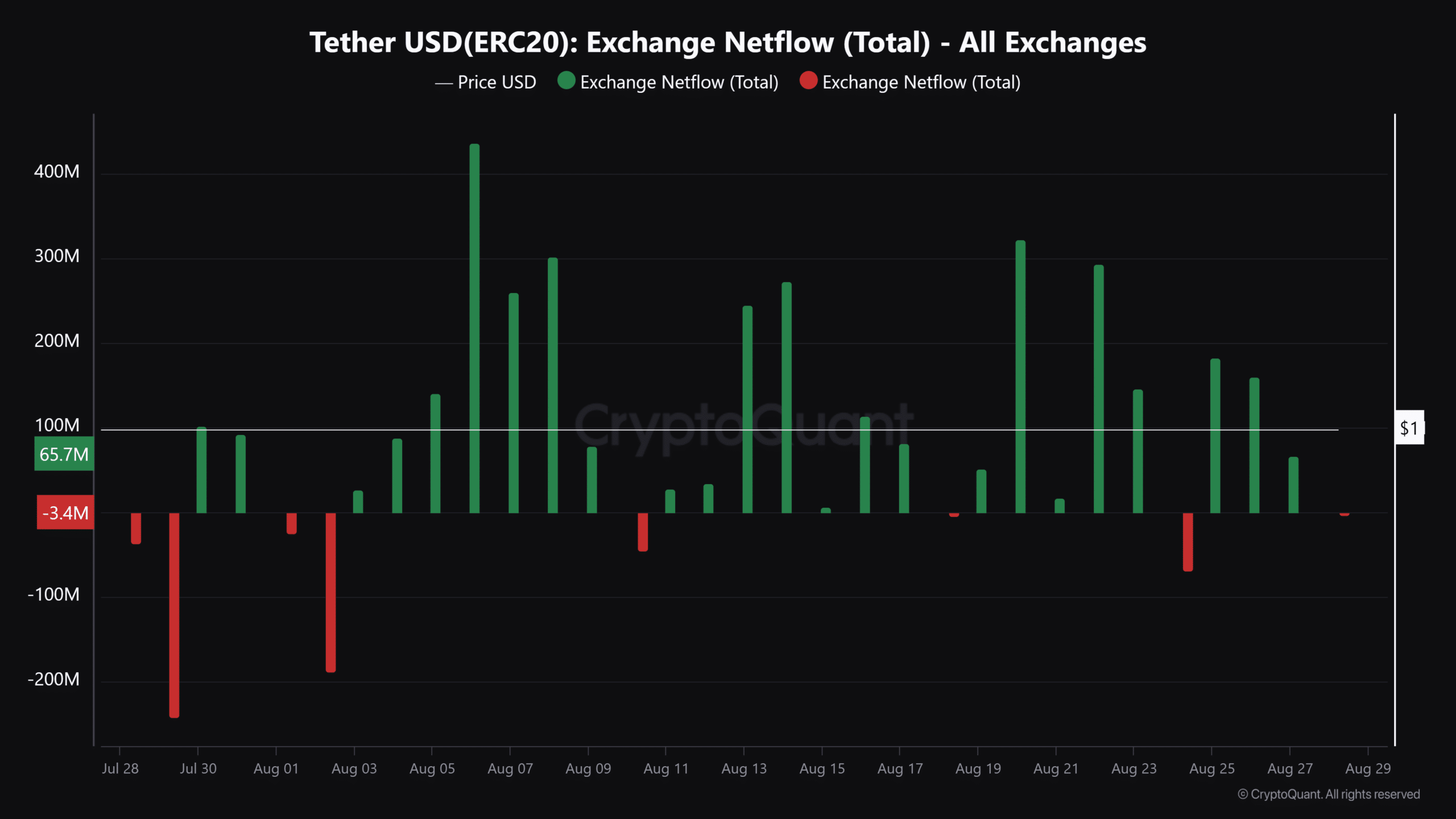

Source : CryptoQuant

After the significant USDT outflow, there has been a resurgence of inflows totaling $182 million, suggesting renewed curiosity and possible buying pressure, indicating that control over USDT flows has been reestablished once more.

On the platform previously known as X (Twitter), Santiment pointed out an achievement by the Tether network – a record high from five months ago with more than 31,300 new wallets created in just one day. Additionally, they mentioned that multi-collateral Dai is also experiencing growth.

The increase in newly created wallets, coupled with consistent figures for Bitcoin and Ethereum wallets, implies that fresh funds are flowing into the cryptocurrency market, potentially suggesting that more investors are taking advantage of price drops to purchase digital assets.

Source : X

Read Bitcoin’s [BTC] Price Prediction 2024-25

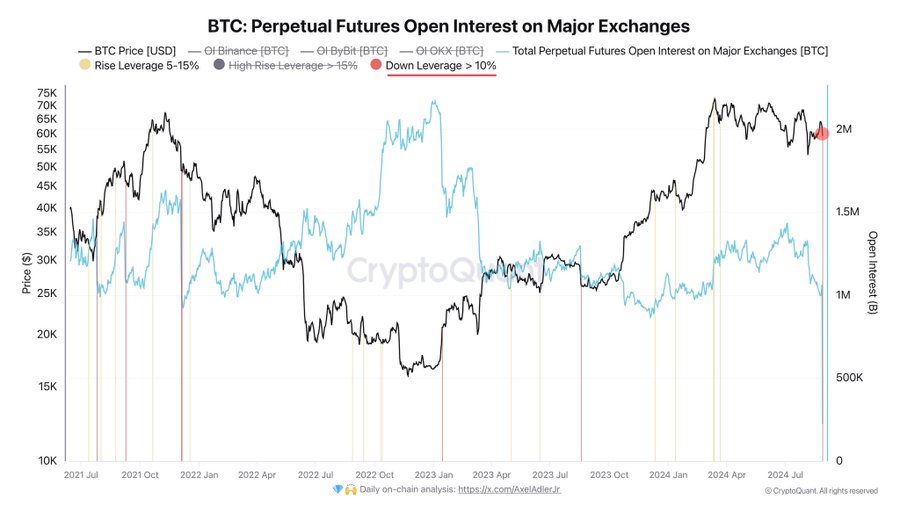

As I delve into my analysis, I can’t help but sound a note of caution, echoing the warning issued by a fellow analyst. His findings suggest that open interest remains unrestored, resulting in a net loss of $100 million for the bullish traders, largely due to their long position liquidations.

Therefore, a strong whale activity could be the key to healing the wound.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

2024-08-28 17:12