Markets

What to know, in the voice of a slightly judgmental uncle:

- Bitcoin‘s market cap slid to about $1.62 trillion, ranking 12th among global assets, after shedding more than 9% in a week and stepping away from its October peak of $126,000. It’s the cool kid who shows up late to the party and finds the seating arrangement has changed-someone else is now sitting in your chair, and they brought a dog-eared ledger with them.

- Ether also took a dive, dropping to 56th place with a market cap just above $300 billion and losing 14.5% of its value. It’s no longer the gym class favorite; now it’s the kid who used to borrow your calculator and never returned it.

- The market downturn followed Trump’s nomination of Kevin Warsh as Fed chair, which triggered a major U.S. dollar rally and caused significant drops in both cryptocurrency and precious metal markets. It’s as if the world decided to rearrange the furniture while you were looking elsewhere-and none of the chairs matched the new room.

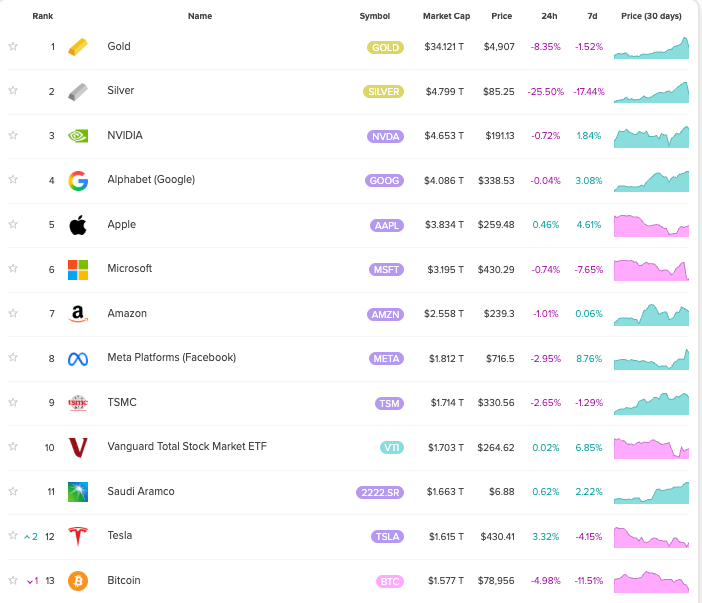

Bitcoin’s market capitalization is now around $1.57 trillion, making it the 13th-largest asset by this metric, behind Saudi Aramco and Tesla stock. It’s the sort of ranking that makes you wonder if the universe is keeping score on a giant spreadsheet that humans invented to feel important.

The move came after its price dropped sharply from around $90,000 to $78,500, a loss of more than 11% over the last 7-day period. The recent price decline comes amid geopolitical tension, a breakdown in the precious metals rally, the nomination of a “Hawkish” next Federal Reserve chair and a partial government shutdown. It’s like watching a soap opera where every plot twist is fueled by a currency pair and a committee vote.

Bitcoin falling out of the top 10 assets by market cap is significant because, in recent years, it remained in the list as prices stayed elevated. Just on Oct. 7, when the prices hit a new all-time high, it was at 7th place. Earlier last year, it even made it to the top five list, surpassing tech giants such as Google and Amazon. It’s the kind of brag that wouldn’t survive a family reunion, but there it was on the glossy spreadsheet anyway.

For comparison, during October’s record price, bitcoin briefly traded above $126,000 and approached a $2.5 trillion valuation.

The selloff

The recent decline in prices was partially the result of U.S. dollar’s strength.

Trump’s nomination of Warsh, a veteran of the 2008 financial crisis with Wall Street experience that’s known for favoring higher real interest rates and a smaller Fed balance sheet, led to the U.S. dollar’s biggest rally since May. It’s the financial equivalent of someone cranking up the air conditioning in a room that was already on “antique winter.”

That led to a retreat in not just bitcoin but also the precious metals rally, which saw gold plunge 9% in a single trading session to just under $4,900, while silver dropped an astounding 26.3% to $85.3.

Gold is still the largest asset by market capitalization despite its recent drawdown, with a market cap of $34.1 trillion. It’s followed by silver’s near $4.8 trillion market cap. The largest company by this metric remains NVIDIA, at $4.6 trillion, followed by Alphabet at $4.08 trillion.

Ether also took a hit, falling to 56th place and now with a market capitalization just above $300 billion, after the cryptocurrency lost 14.5% of its value in a week. Previously, it was among the top 50 assets by market cap, and before the October 10 crash, it was near the top 25.

The second-largest cryptocurrency is now worth less than companies such as Caterpillar, Inditex, Coca-Cola, and Cisco.

Read More

- Best Controller Settings for ARC Raiders

- ‘Crime 101’ Ending, Explained

- Every Targaryen Death in Game of Thrones, House of the Dragon & AKOTSK, Ranked

- The Best Members of the Flash Family

- The Pitt Season 2, Episode 7 Recap: Abbot’s Return To PTMC Shakes Things Up

- Battlefield 6 Season 2 Update Is Live, Here Are the Full Patch Notes

- The Strongest Dragons in House of the Dragon, Ranked

- Where Winds Meet: How To Defeat Shadow Puppeteer (Boss Guide)

- Dan Da Dan Chapter 226 Release Date & Where to Read

- 7 Best Animated Horror TV Shows

2026-01-31 21:19