-

BTC ETFs ramped up accumulation despite recent drawdowns.

Glassnode founders were bullish on BTC despite overhead obstacles on price charts.

As an experienced analyst, I believe that the recent accumulation of Bitcoin (BTC) ETFs despite the drawdowns is a positive sign for the digital asset’s future price action. The resilience of these funds in the face of volatility indicates strong investor confidence and a belief in BTC’s long-term potential.

In contrast to Bitcoin‘s almost 20% decrease, bringing its price down below $55K, US-listed spot Bitcoin exchange-traded funds (ETFs) seized the opportunity and purchased the dips.

In the month of June, Bitcoin (BTC) experienced a significant decrease in value, going from $71,900 to $58,400. A more pessimistic outlook prevailed in July, pushing BTC down further to a record low of $53,400. However, by the time of publication, Bitcoin had regained some ground and was trading at around $58,000.

Bitcoin ETFs holding steady

As a researcher, I’d rephrase it like this: Despite the recent market downturn being described as “nasty” by Eric Balchunas, an analyst at Bloomberg ETF, it’s important to note that the assets under management (AUM) and year-to-date (YTD) inflows for Exchange-Traded Funds (ETFs) have remained relatively stable.

As a crypto investor, I’ve experienced a significant setback with Bitcoin, as its value dropped by 20% within just a month. Quite a nasty surprise, if I may say so myself. I must admit, I would have been impressed if more than 90% of the assets under management (AUM) had stayed put during this volatile period. But surprisingly, over 100% of the investors kept their cool and even saw inflows. All things considered, they managed to keep the all-important year-to-date net number at a positive $15 billion.

Balchunas stated that Bitcoin ETFs, which he compared to baby boomers’ investments, exhibited resilience during market downturns.

The data from Farside Investors confirmed Balchunas’ assertion, as the total year-to-date inflows regained the $15 billion threshold in July, having dipped to $14.3 billion in late June prior to that.

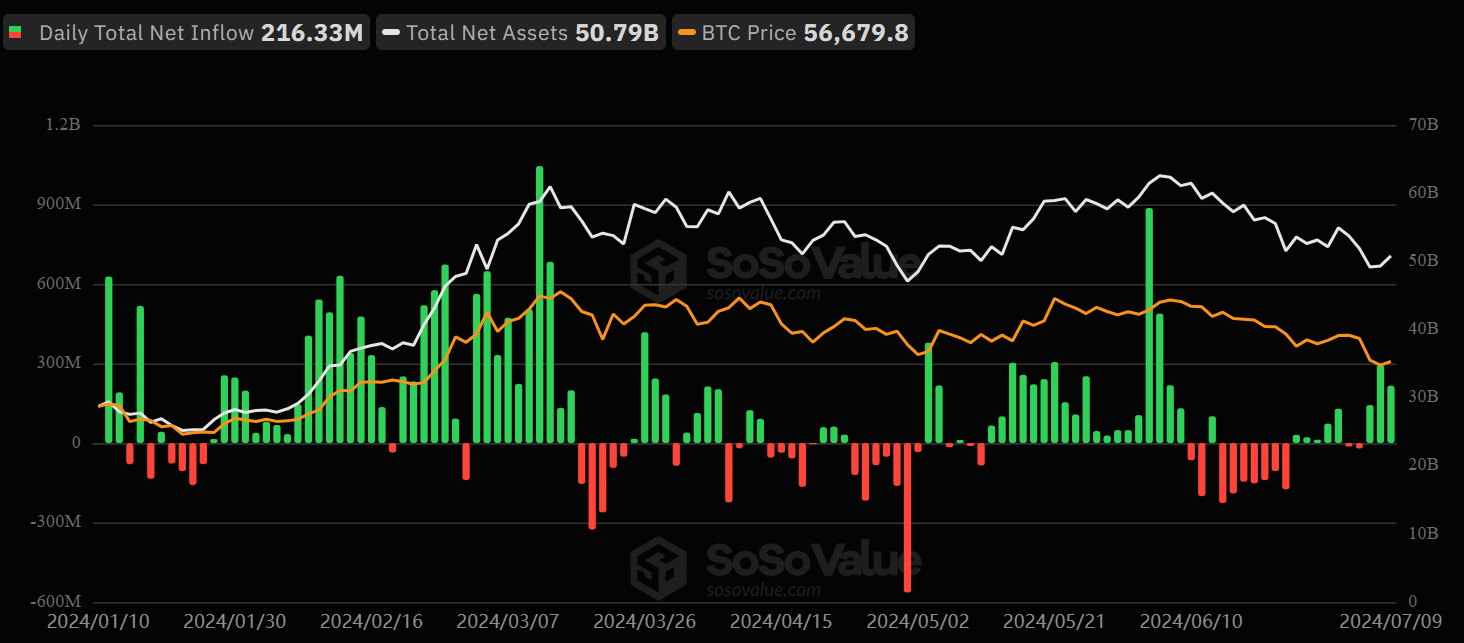

As a crypto investor, I’ve closely monitored the Soso Value data, and I was taken aback when I noticed that the assets under management (AUM) of Bitcoin Exchange-Traded Funds (ETFs) had seen a significant decrease. The numbers revealed that we were looking at nearly $10 billion worth of withdrawals in recent times. Just a short while ago, the AUM stood proudly at around $62.5 billion; however, the current figure now hovers below the $50 billion mark. This decline comes amidst recent market volatility and downward trends.

Community reactions on BTC ETFs

Since last Friday, there have been positive inflows into AUM’s products, leading to their recovery.

On Monday and Tuesday, BTC ETFs saw $294.9 million and $216.3 million in inflows, respectively.

From my perspective as an analyst, while some market observers considered the enhanced ETF inflows insignificant to Bitcoin’s price movements depicted on the chart, I respect their viewpoint but would like to present a different take. Let me explain. Even though ETF flows might not have an immediate and direct impact on the price of Bitcoin, they can influence the market sentiment and potentially attract more institutional investors. This influx of new participants could lead to increased buying pressure and ultimately contribute to the long-term growth of Bitcoin’s price. Therefore, while it’s true that ETF flows might not be the sole determinant of Bitcoin’s price action, they should not be dismissed as irrelevant altogether.

As a researcher investigating the claims made by a user regarding Bitcoin (BTC) inflows, I came across an assertion that these inflows could be attributed to hedge funds engaging in cash-and-carry trades to short BTC on the futures market. This means they buy the actual Bitcoin in the spot market and simultaneously sell the same amount in the futures market at a different price to profit from the price difference between the two markets.

Another market analyst, Jim Bianco, countered Balchunas’ boomer narrative in BTC ETFs.

As a crypto investor, I’d like to emphasize that the baby boomer demographic holds only a minuscule portion of the Bitcoin ETF shares. The vast majority of these holdings are in the hands of self-directed investors.

How’s Bitcoin price action?

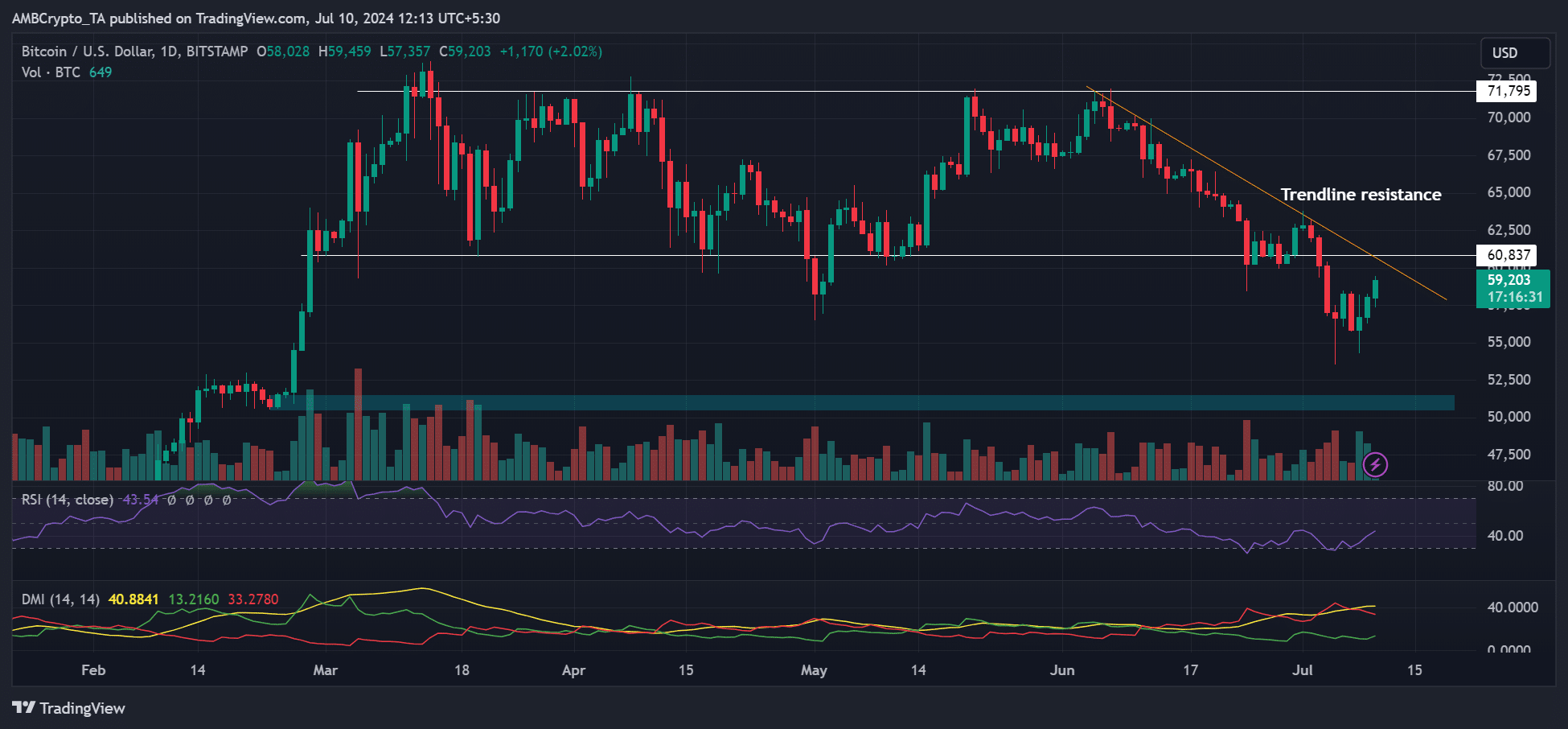

At the moment of publication, Bitcoin had increased by 5.8% over the past week and was hovering around $59,000. Yet, in order to demonstrate more robust growth, it is essential for BTC to surpass the trendline resistance and retake the support level of $60,800.

The Relative Strength Index (RSI) and Directional Movement Index (DMI) indicated impressive gains in strength.

Despite a subpar Relative Strength Index (RSI) reading and a DMI (Directional Movement Index) yet to display a positive crossover, the bulls’ control over the market remained uncertain.

As an analyst, I’ve noticed an intriguing claim made by Glassnode founders, Negentropic. They believe that Bitcoin’s Relative Strength Index (RSI) has reached a bottom on the daily chart. Based on this observation, they are advising a bullish stance on Bitcoin.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Masters Toronto 2025: Everything You Need to Know

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

2024-07-10 17:12