- Investors withdrew $563.7 million, signaling a potential sentiment shift post-inflows

- BNP Paribas revealed its Bitcoin investment, marking a reversal in attitude

As an analyst with a background in traditional finance and a growing interest in the crypto space, I find the recent developments surrounding Bitcoin (BTC) and institutional investment quite intriguing. The sudden halt in inflows into Bitcoin exchange-traded funds (ETFs), coupled with BNP Paribas’ reversal of its stance on Bitcoin, suggests that we might be witnessing a shift in investor sentiment.

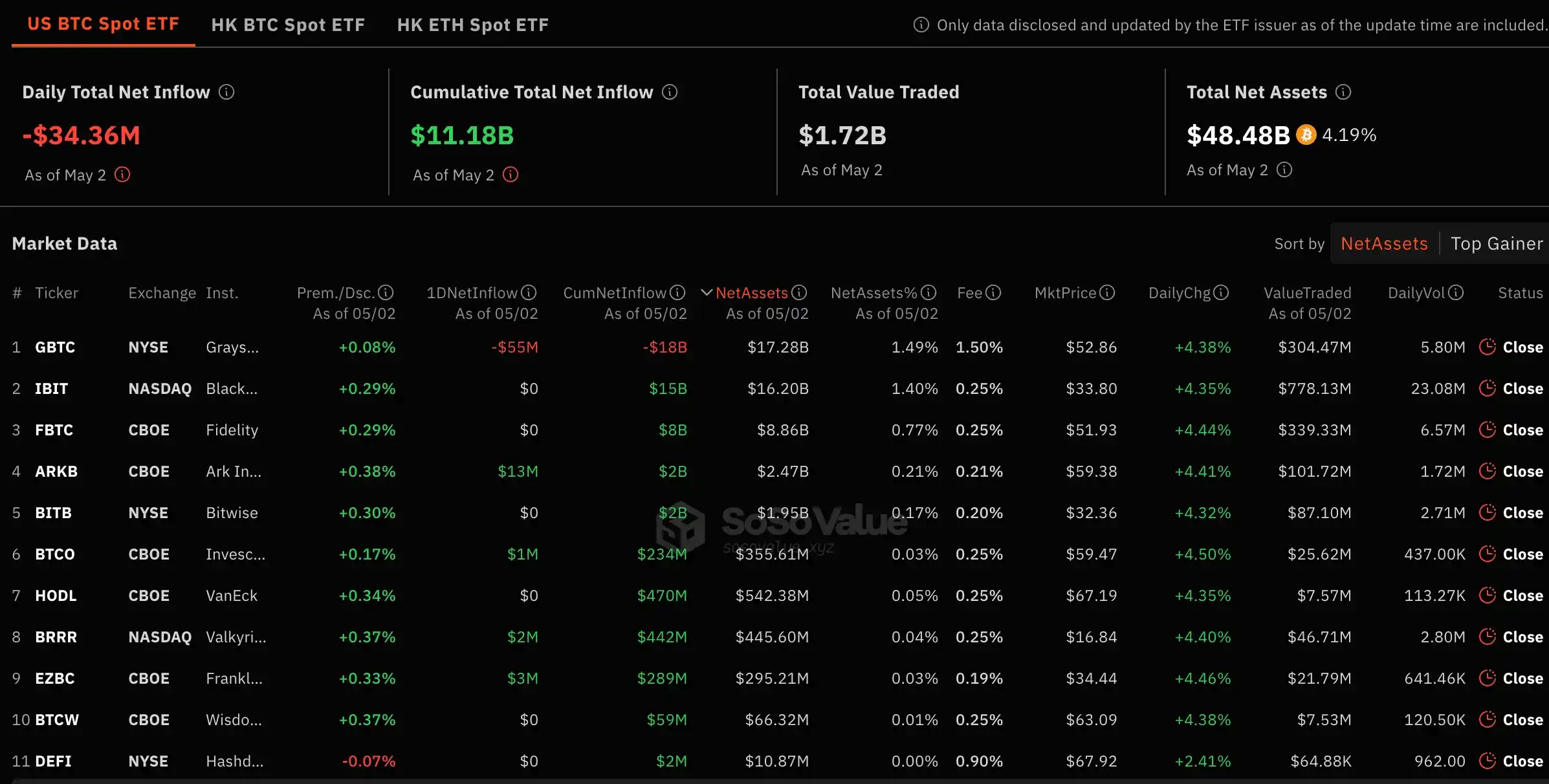

At present, Bitcoin [BTC] seemed to be rebounding from its slide under the $60,000 mark. Nevertheless, there was a downside as well – the daily inflow into spot Bitcoin exchange-traded funds (ETFs) halted following an impressive 71-consecutive day run.

According to a Bloomberg report, there was a massive withdrawal of approximately $563.7 million from Bitcoin spot ETFs on May 1st. This is the largest one-day outflow since these ETFs were launched in January, suggesting that investor sentiment may be changing after a lengthy influx of funds.

Robert Mitchnick clears the confusion

In a recent interview, Robert Mitchnick, who leads BlackRock’s Digital Assets team, addressed some misconceptions. He stated,

“Be cautious not to underestimate the current calmness…it could be preceded by a fresh surge from a distinct group of investors.”

In this context, the executive could be alluding to a renewed surge of institutional investment in Bitcoin from entities such as sovereign wealth funds, pension funds, and endowments.

As a crypto investor, I was thrilled to learn that BNP Paribas, one of Europe‘s leading banks, took a significant step into the cryptocurrency market by acquiring shares in BlackRock’s iShares Bitcoin Trust (IBIT). This move confirmed my belief in the growing acceptance and institutionalization of Bitcoin and other digital assets.

Based on a Form 13F filing submitted to the U.S. Securities and Exchange Commission (SEC), it was disclosed that BNP Paribas, Europe’s second-largest bank, acquired 1,030 shares of IBIT with a total investment of $41,684.10 during Q1 2024. The purchase price for each share was set at $40.47, which is notably less than the current market value of one Bitcoin.

It’s worth noting that in September 2022, Sandro Pierri, who heads the fund management team at BNP Paribas Asset Management, made some intriguing remarks.

“We are not involved in cryptocurrencies and we don’t want to be involved.”

As a crypto investor, I’ve noticed that the bank’s recent move signifies a change in their stance towards Bitcoin. Previously hesitant, they now seem open to exploring Bitcoin as a viable investment option. This shift in perspective is an exciting development for the crypto community.

Remaking on the same, Coinbase CFO Alesia Haas, in a conversation with CNBC, said,

“ETFs have triggered a cycle of user involvement on our platform. Indeed, there was an inflow of $11 billion into ETFs, yet we also noticed a rise in consumer trading activity on our system.”

Growing acceptance of digital assets

As an analyst, I have observed that the ongoing regulatory approvals and competition among Bitcoin Exchange-Traded Funds (ETFs) have intensified into a race for supremacy. Currently leading the pack are IBIT and Grayscale’s GBTC.

To summarize, the increasing involvement of institutions in Bitcoin (BTC) and Bitcoin Exchange-Traded Funds (ETFs) is a clear indication of the expanding acknowledgment of cryptocurrencies. BlackRock’s initiatives towards educating themselves on Bitcoin and Ethereum [ETH] ETFs and their potential inclusion in investment portfolios, as pointed out by Mitchnick, underline this shift in perspective.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

2024-05-04 01:11