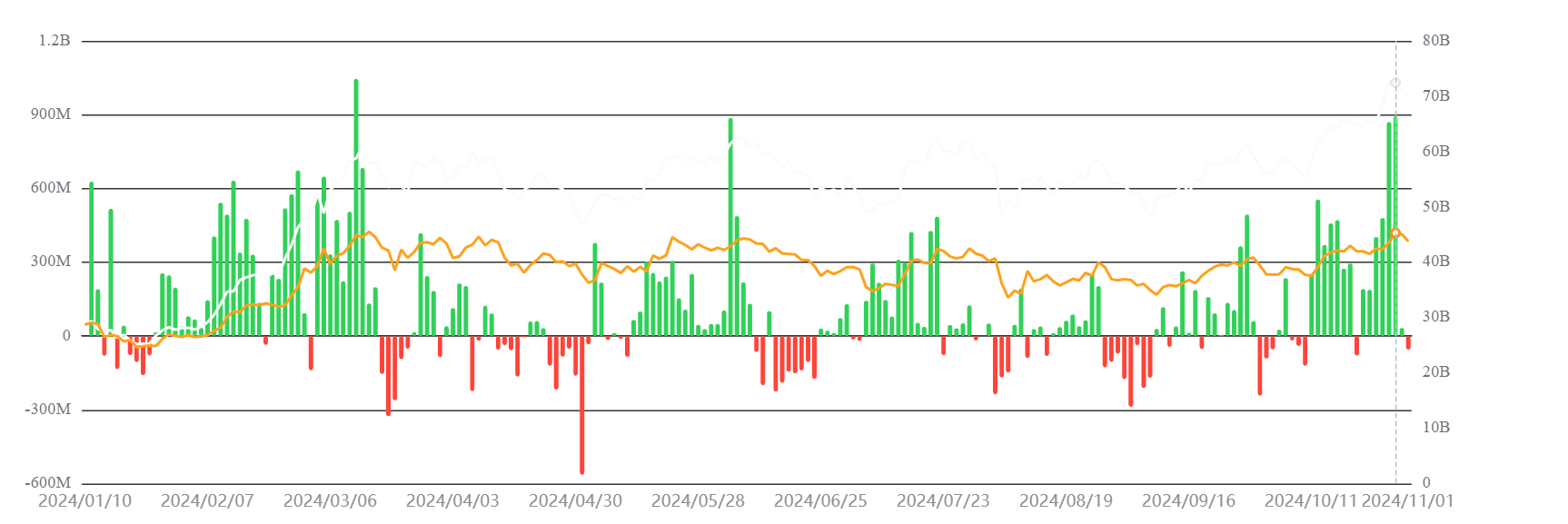

- ETF inflows for the past week were the fourth-highest in its history

- During this period, BTC’s price crossed $72,000 in an attempt to cross its ATH

As a seasoned analyst with over two decades of experience in financial markets, I have witnessed numerous trends and cycles that shaped the investment landscape. In recent weeks, the Bitcoin market has been captivating due to its close correlation with the influx of funds into Bitcoin ETFs – a phenomenon that I find intriguing given my longstanding fascination with the intersection of traditional finance and emerging technologies.

Over the past few weeks, the Bitcoin market has mirrored the surge of investments into Bitcoin Exchange-Traded Funds (ETFs). There was a noticeable spike in trading during October, as demand for Spot Bitcoin ETFs persistently increased among investors.

The ETF flows for the week ending 1 November, in particular, reflected a strongly bullish sentiment, setting a noteworthy trend against previous weeks.

Bitcoin ETF’s record-setting inflows in recent weeks

Based on data from Sosovalue, it was found last week (ending October 31) that Bitcoin ETFs experienced significant net inflows totaling approximately $2.22 billion. This amount is one of the highest recorded in 2024, suggesting robust investor interest and demand.

In mid-March, there was an increase in investments totaling approximately $2.57 billion. Similarly, during the week concluding on February 16, investments amounted to around $2.27 billion as well.

The surge in interest suggests an increase in optimism, making these products an attractive choice for people looking to invest in Bitcoin.

A consistent influx of investment money indicates that both institutional and individual investors are growing more confident, which could establish a robust demand foundation for Bitcoin over the long haul.

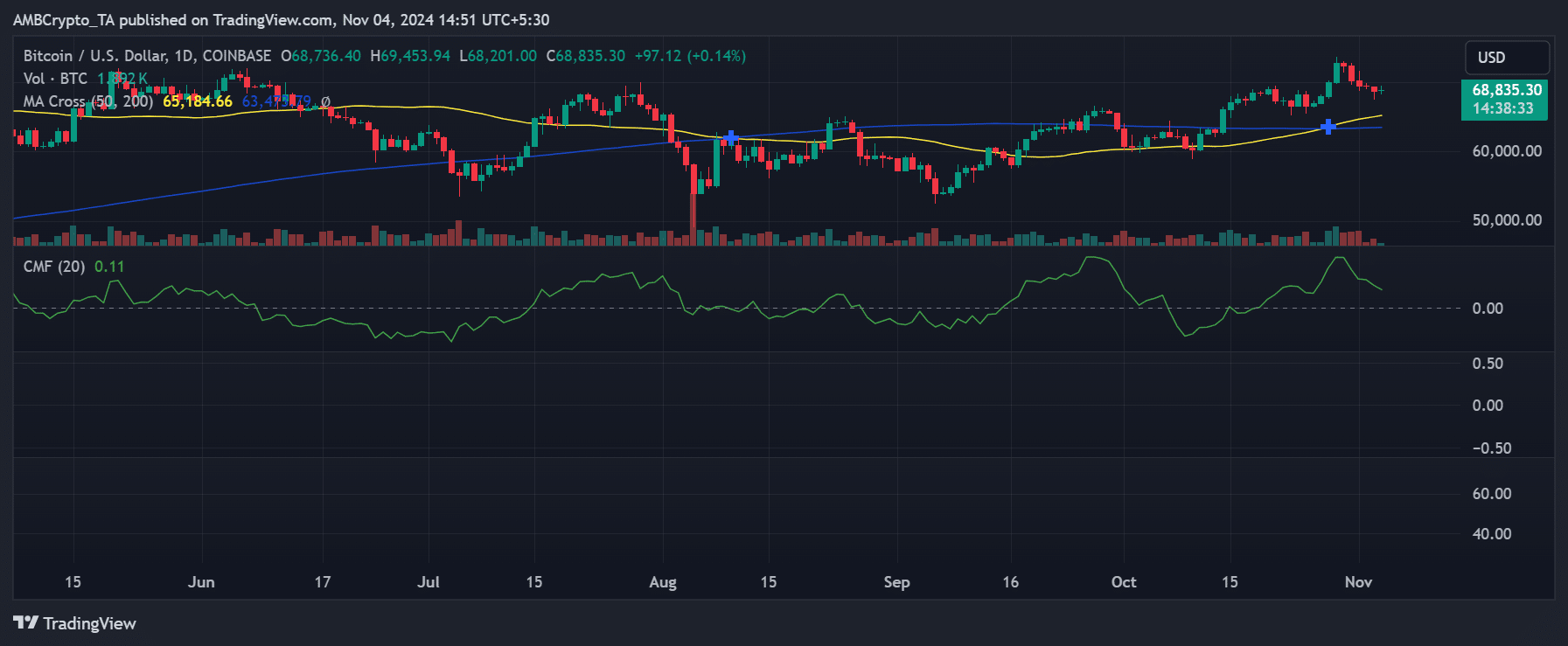

Price reaction to ETF inflows

The latest movements in Bitcoin’s value demonstrate the impact of Exchange-Traded Fund (ETF) investments. In the last seven days, Bitcoin reached a high of approximately $72,724, but then dipped slightly to about $68,835.30.

The surge in ETF investments is aligning with Bitcoin’s rise, implying that the optimistic attitude from ETF investors might be driving Bitcoin’s value. If this bullish trend persists and investment continues to flow into the market, we may see Bitcoin’s price climb higher as long as the regulatory landscape stays supportive.

It appears that the level of activity surrounding Bitcoin ETFs might be influencing Bitcoin’s price, potentially boosting the current market surge.

This answer might indicate that Bitcoin’s popularity is starting to grow due to increased interest from Exchange Traded Funds (ETFs), a trend that may continue if there are favorable regulatory decisions in the future.

Are Bitcoin ETF inflows a lasting signal?

Although an increase in Bitcoin ETF investments could potentially shape the future, it’s uncertain if these flows will significantly impact Bitcoin’s long-term pricing. Previously, such influxes have sparked price surges. However, factors such as regulatory decisions, economic conditions, and market liquidity continue to play crucial roles in shaping the broader cryptocurrency landscape.

Investing in Bitcoin through Exchange Traded Funds (ETFs) provides a simpler route for conventional investors to dive into the cryptocurrency market. This could result in steadier price trends or even more growth. On the other hand, the surge in interest might also cause temporary market fluctuations as people take profits, leading to increased volatility.

– Read Bitcoin (BTC) Price Prediction 2024-25

Currently, the increase in Bitcoin ETF investments indicates a positive outlook, boosting Bitcoin’s recent price increases. However, it’s unclear if this enthusiasm will sustain a prolonged uptrend. Nonetheless, continuous ETF involvement should bolster Bitcoin’s position within the financial market.

Read More

- OM PREDICTION. OM cryptocurrency

- Why Tina Fey’s Netflix Show The Four Seasons Is a Must-Watch Remake of a Classic Romcom

- Jujutsu Kaisen Reveals New Gojo and Geto Image That Will Break Your Heart Before the Movie!

- The Elder Scrolls IV: Oblivion Remastered – How to Complete Canvas the Castle Quest

- Oblivion Remastered: The Ultimate Race Guide & Tier List

- Serena Williams’ Husband Fires Back at Critics

- WWE’s Braun Strowman Suffers Bloody Beatdown on Saturday Night’s Main Event

- The Weeknd Shocks Fans with Unforgettable Grammy Stage Comeback!

- Elevation – PRIME VIDEO

- Christina Haack and Ant Anstead Team Up Again—Awkward or Heartwarming?

2024-11-05 04:07