- Ethereum, Bitcoin ETF trends were positive all through the past week.

- BTC has dropped slightly from its ATH of $100,000, while ETH also fell below its $4,000 price level.

As a seasoned researcher who has witnessed the cryptocurrency landscape evolve over the past decade, I must say this week has been nothing short of remarkable for Bitcoin [BTC] and Ethereum [ETH] ETFs. The growth trajectories of these assets are reminiscent of a rocket launching into the stratosphere.

This past week was filled with excitement for the exchange-traded funds (ETFs) tied to Bitcoin [BTC] and Ethereum [ETH], as they reached notable achievements while their values surged.

As Bitcoin ETFs hit a record high in total assets, Ethereum ETFs experienced unprecedented weekly investments from institutions, indicating increased institutional involvement in the cryptocurrency sector.

Bitcoin ETF hits new all-time high

Last week saw significant expansion in the Bitcoin ETF market, mirroring Bitcoin’s price increase to an unprecedented peak.

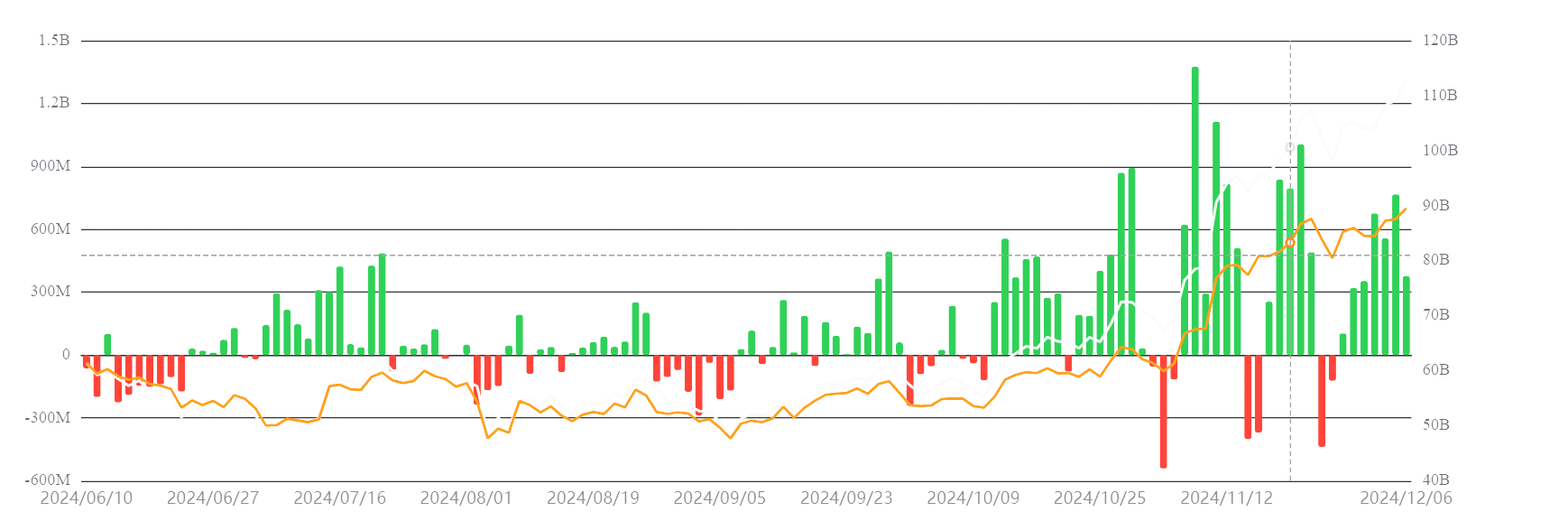

At the current moment, data from SosoValue indicates that Bitcoin Exchange-Traded Funds (ETFs) collectively hold an impressive net asset value of approximately $112.74 billion. This significant amount represents about 5.62% of the entire market capitalization for Bitcoin.

For the last seven days, a grand total of $2.73 billion flowed in, with every day showing a positive balance. The majority of these funds, approximately $2.6 billion, went to BlackRock’s IBIT, which is the world’s largest Bitcoin ETF.

This strengthens BlackRock’s leading role in the Exchange-Traded Fund (ETF) market, indicating a rising interest among institutions to gain Bitcoin exposure.

Ethereum ETF breaks weekly net inflow records

Ethereum ETFs mirrored Bitcoin’s success, achieving a milestone of their own.

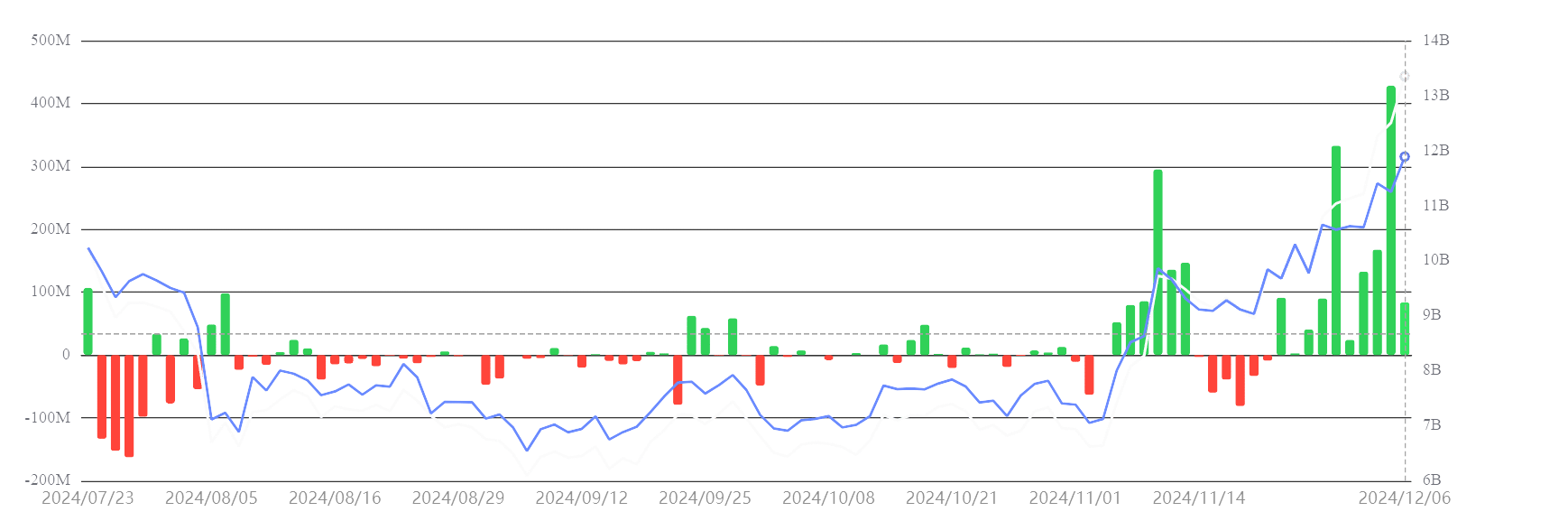

In a historical high, weekly investments amounted to approximately $836.69 million, marking the largest weekly net inflows ever seen in an Ethereum ETF. This significant surge boosted the overall value of assets managed by these funds to an unprecedented $13.6 billion.

For the initial time since they were authorized, Ethereum Exchange-Traded Funds (ETFs) have experienced two straight weeks with positive net investments, indicating a notable change in investor attitudes towards these funds.

On December 5th, Ethereum Exchange-Traded Funds (ETFs) broke their own record by taking in a whopping $428.44 million in a single day, which marks the greatest daily net inflow the asset category has ever seen.

These incoming funds indicate an increasing belief in Ethereum’s long-term value, fueled by its growing usefulness in Decentralized Finance (DeFi) and smart contract applications.

Bitcoin price consolidates after historic rally

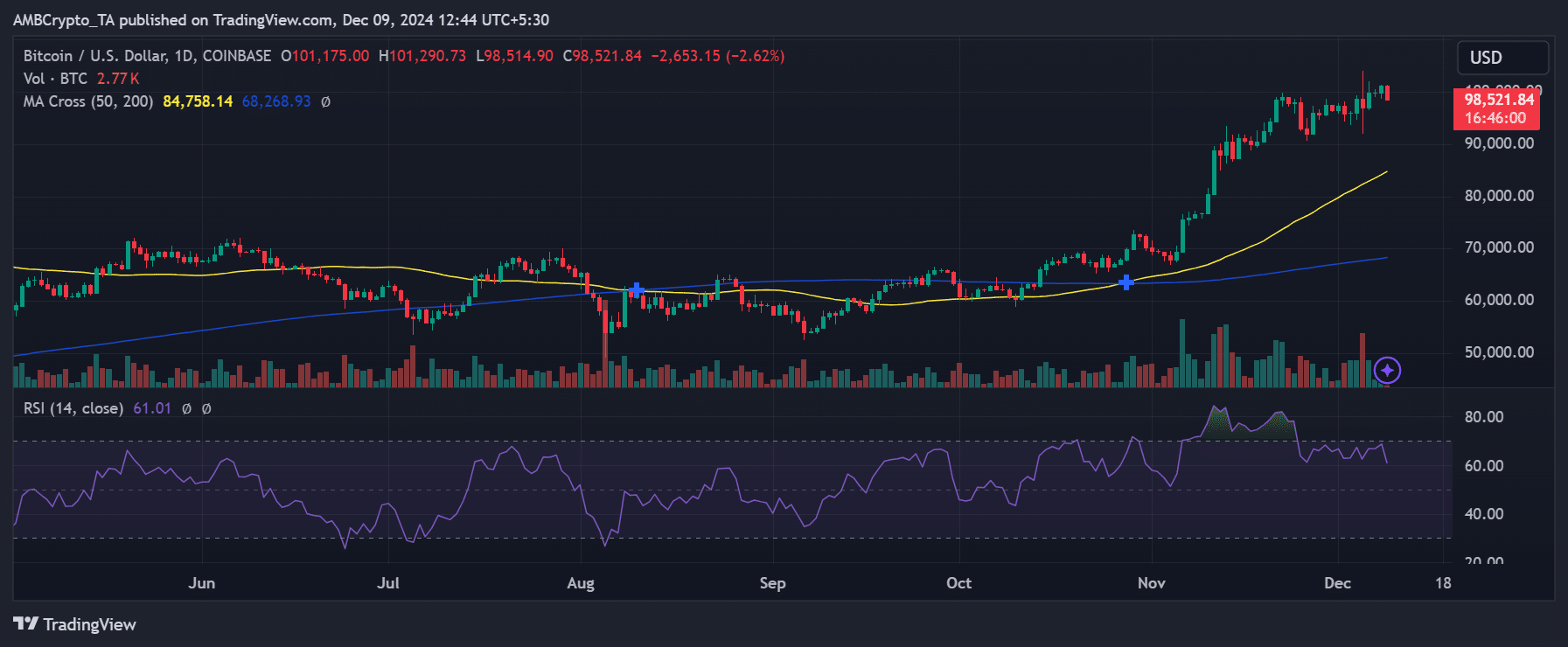

At the moment of reporting, the value of a single Bitcoin was approximately $98,521, showing a stable period of consolidation following its significant surge beyond the $100,000 threshold.

As an analyst, I’ve noticed a significant shift in our trend analysis: the 50-day moving average has ascended above the 200-day moving average, creating what we call a ‘golden cross’. This technical pattern is often interpreted as a robust bullish signal, suggesting potential growth and upward momentum for the asset under examination.

In simple terms, with a Relative Strength Index (RSI) of 61, Bitcoin continues to offer potential for additional price increases as it stays within a steady trading corridor.

Bitcoin ETFs, boasting a groundbreaking $112.74 billion in total assets, serve as a testament to the digital currency’s enduring prominence within institutional investment portfolios.

Despite Ethereum garnering increased attention due to its growth prospects, Bitcoin is still seen by investors as a trusted form of value storage.

Ethereum’s price momentum aligns with ETF growth

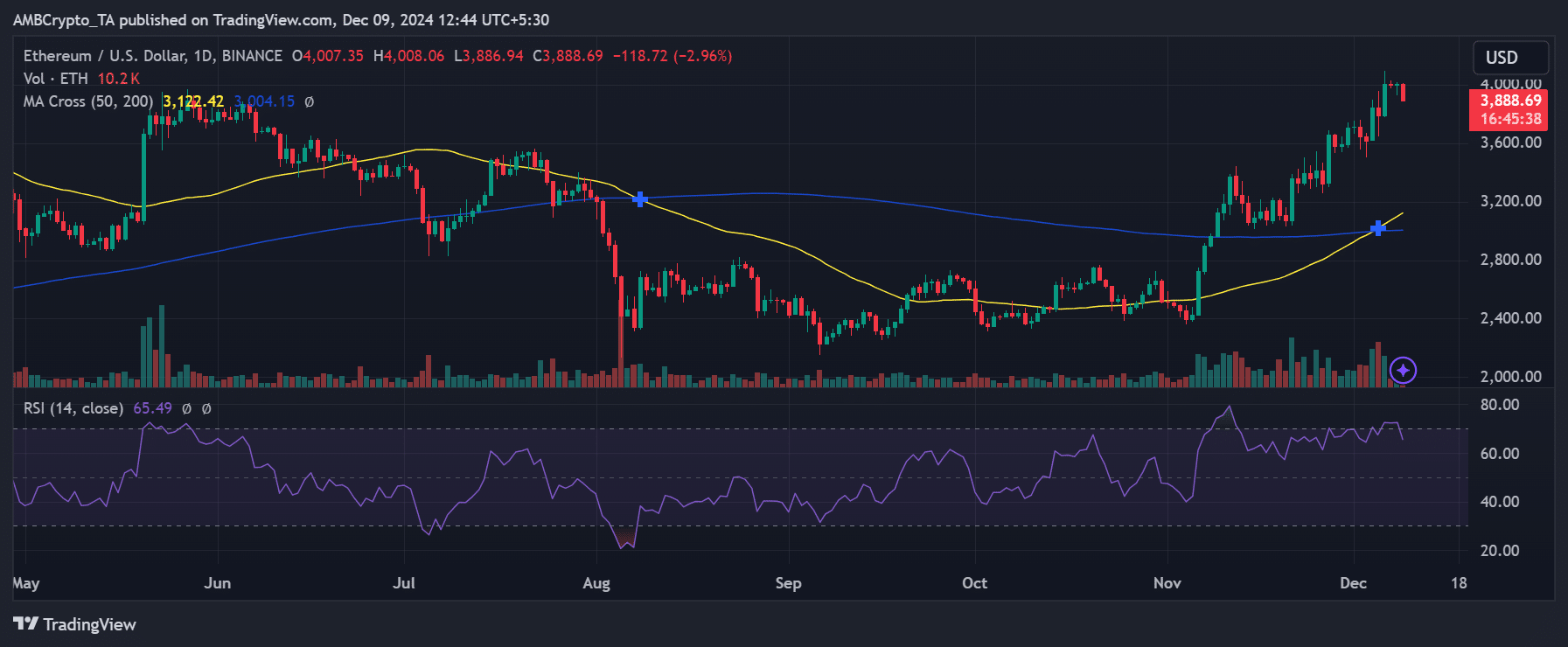

The price of Ethereum, currently standing at $3,888, has experienced a minor dip following its recent surge past the $4,000 threshold. Yet, its robust technical signs suggesting an upward trend continue to hold steady.

In simpler terms, when the 50-day and 200-day moving averages intersected in a positive manner (forming what’s known as a golden cross), it indicated that there might be more upward movement ahead for Ethereum. However, an RSI (Relative Strength Index) of 65 suggested that Ethereum was getting close to being overbought, but there’s still a possibility for further growth.

As an analyst, I’ve observed a correlation between the surging investments into Ethereum Exchange Traded Funds (ETFs) and the current market momentum. This trend indicates a strong institutional belief in Ethereum’s future potential, underscoring their confidence in its long-term prospects.

These influxes might spark continued price growth, reinforcing Ethereum’s role as a dominant contender in the market, challenging Bitcoin’s leadership.

As a passionate crypto investor, I’m thrilled to witness the unprecedented growth of Bitcoin and Ethereum ETFs. The surging institutional interest coupled with robust market trends is fueling this record-breaking journey.

Read Bitcoin’s [BTC] Price Prediction 2024–2025

As Bitcoin maintains its position as a reliable store for value, the significant increases in capital flowing into Ethereum each week underscore its expanding function as a vibrant investment opportunity.

These advancements signify a crucial stage in the exchange-traded fund (ETF) market for cryptocurrencies, emphasizing the growing tendency to incorporate digital assets within conventional investment portfolios.

Read More

2024-12-09 16:40