- Spot Bitcoin ETFs have accumulated over $22 billion in inflows, reflecting strong market demand.

- Retail investors now hold 80% of total assets in Bitcoin ETFs, driving significant interest.

As a seasoned crypto investor with over a decade of experience under my belt, I must admit that the current market dynamics surrounding Bitcoin ETFs are nothing short of exhilarating. The staggering inflows of over $22 billion into these funds is a testament to the growing institutional and retail interest in BTC.

Ever since the launch of Bitcoin [BTC] ETFs, there’s been an impressive spike in their demand, with collective investments exceeding a staggering $22 billion.

Out of the leading contenders, it’s BlackRock’s IBIT that shines with substantial investment inflows amounting to $23 billion, whereas Grayscale’s GBTC has experienced significant withdrawals worth approximately $20 billion.

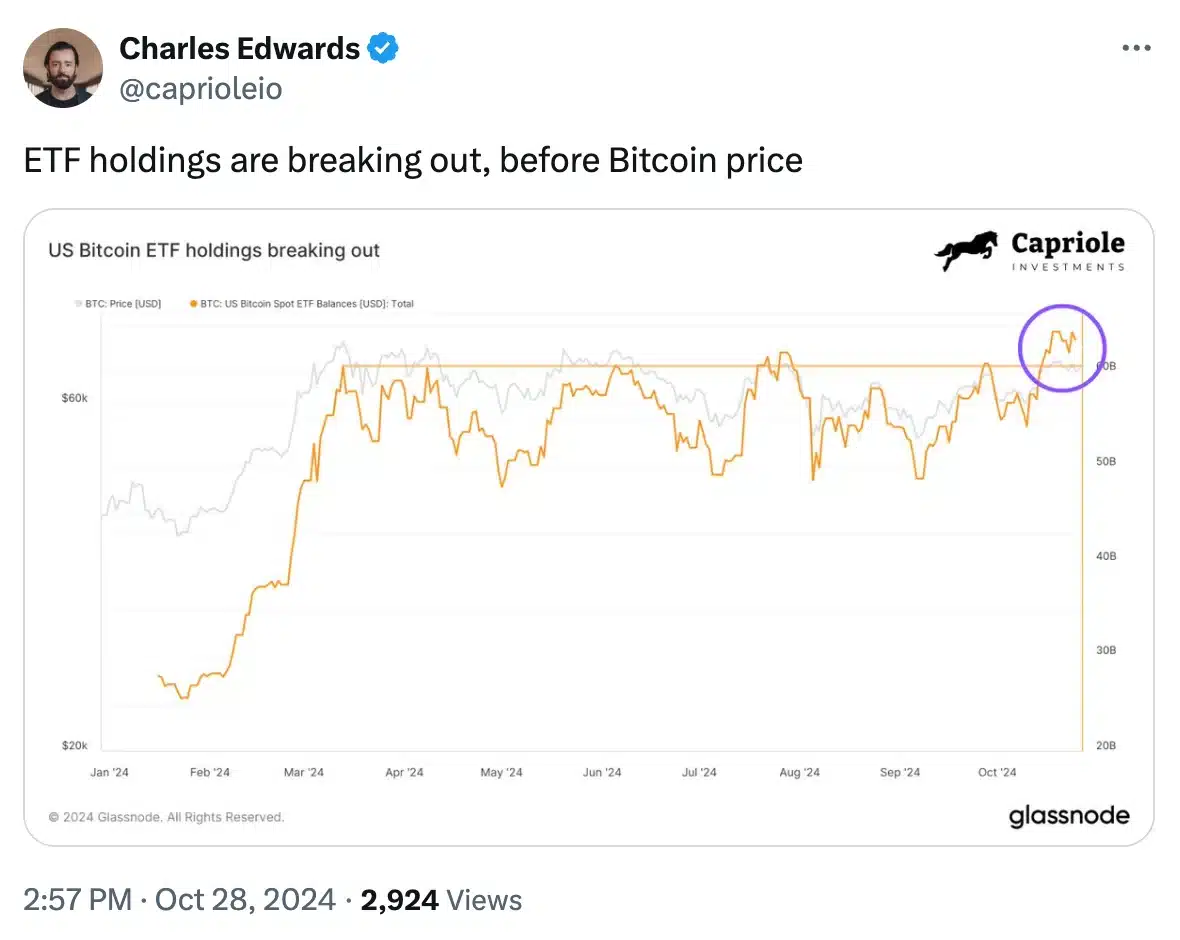

Indeed, as anticipated, there was a significant increase in investments in Bitcoin ETFs last week, recording approximately $1 billion in total inflows – the highest level of interest in half a year.

Execs weigh in…

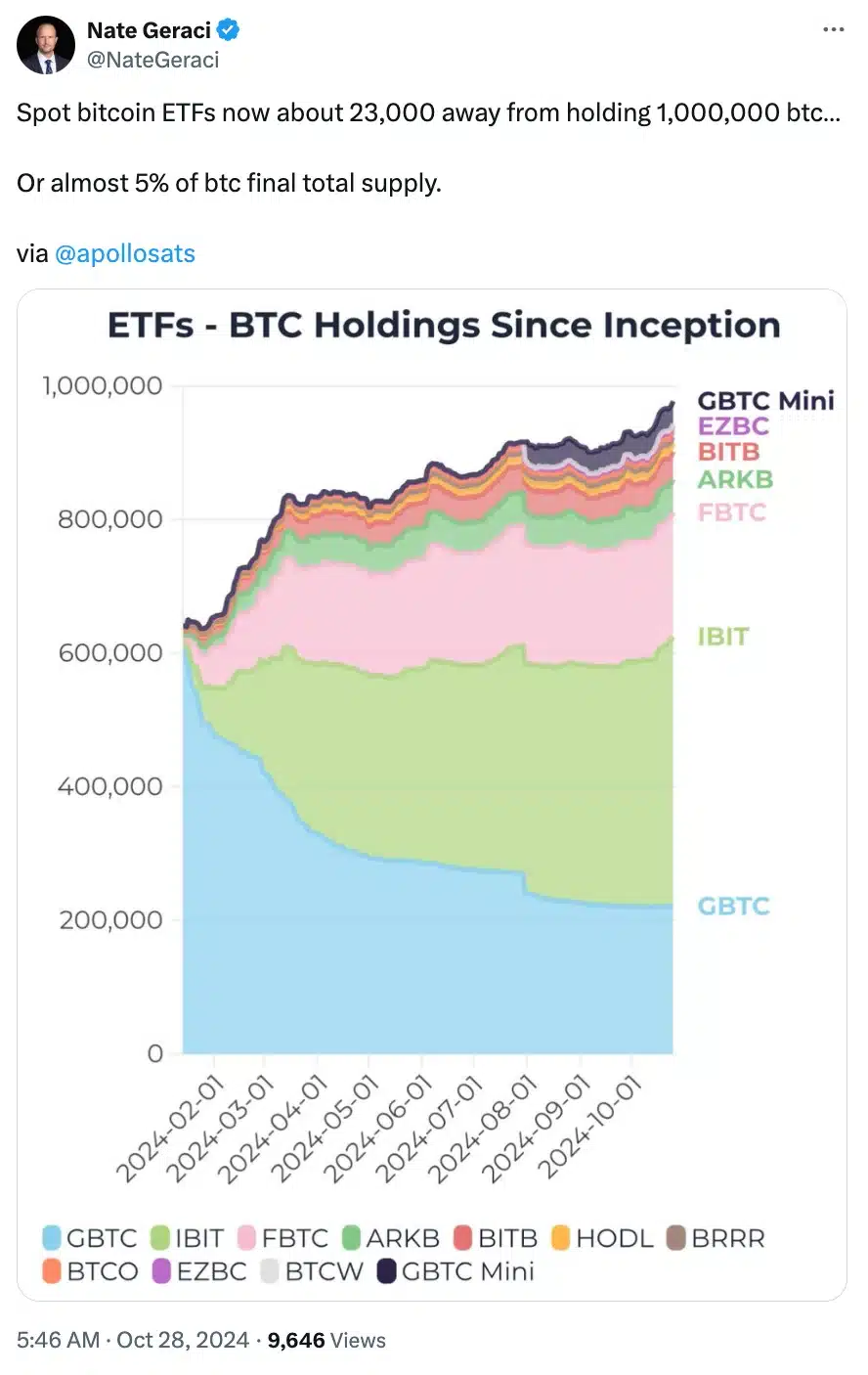

Given the impressive performance of Bitcoin Spot ETFs, Nate Geraci, the President of ETF Store, expressed his thoughts on this topic via X, stating:

Joining the conversation, Charles Edwards, Founder of Capriole Investments and The Ref, remarked,

Are retail investors driving the Bitcoin ETF market?

Despite spot BTC ETFs creating pathways for institutional investors, recent insights from crypto exchange Binance reveal that retail investors are significantly fueling the growing demand.

As per the report, an impressive 80% of all assets in these Exchange-Traded Funds (ETFs) are currently held by retail participants. This significant figure highlights the pivotal part these investors play in driving the market’s growth trajectory.

This pattern underscores a significant change in the investment landscape, with individual investors not just participating but leading the surge of enthusiasm for Bitcoin using these financial tools.

The report noted,

Approximately 938,700 Bitcoins, worth around $63.3 billion, have been amassed by Exchange-traded funds (ETFs) focused on Bitcoin. When you add in other similar investment vehicles, this represents about 5.2% of the total amount of Bitcoins in circulation.

What’s more to it?

The report emphasized a substantial rise in transactions involving crypto ETFs, as net deposits surpassed 312,500 BTC (equivalent to around $18.9 billion) and positive investments were made in 24 out of the previous 40 weeks. On average, these ETFs are withdrawing approximately 1,100 BTC each day from circulation, demonstrating a strategic buying strategy.

Lessening the amount available, along with an increase in interest, might boost Bitcoin costs, signaling a surge in Bitcoin investment via ETFs and a significant change in market trends.

Bitcoin ETFs vs Gold, Ethereum ETFs

That being said, the report also shows that spot BTC ETFs have significantly outperformed early Gold ETFs, recording net inflows of around $18.9 billion within a year, compared to just $1.5 billion for Gold ETFs. This surge has drawn over 1,200 institutional investors to Bitcoin ETFs, a notable rise from the 95 institutions in Gold’s first year.

Contrarily, Exchange Traded Funds (ETFs) based on Ethereum [ETH] have faced challenges, with a net outflow of around 43,700 ETH or approximately $103.1 million over the past few weeks. In fact, these ETFs have seen negative inflows in eight out of the last eleven weeks.

Read Bitcoin’s [BTC] Price Prediction 2024–2025

In other words, when you consider the trading volume of Bitcoin ETFs alongside regular trading, it shows that these ETFs have a greater influence on market movements, indicating strong institutional interest in Bitcoin.

The patterns observed are consistent with Bitcoin’s price reaching an all-time high of $68,266.17 recently. This surge was preceded by a daily increase of 1.87% and a monthly growth of 4.38%, as reported by CoinMarketCap.

Read More

- Gold Rate Forecast

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

2024-10-29 01:12