-

Bitcoin ETF inflows see renewed vigor, led by Fidelity’s FBTC and BlackRock’s IBIT.

Ethereum ETFs experience no new inflows, with declining trading volume on the 7th of October.

As a seasoned analyst with over two decades of experience in the financial markets, I’ve seen plenty of trends come and go. The recent developments in Bitcoin and Ethereum ETFs are particularly intriguing.

Regardless of a sluggish beginning to October for Bitcoin [BTC] ETFs, the market indicates positive developments are on the horizon.

On October 7th, as reported by Farside Investors, there was a significant increase in investments into Bitcoin Exchange-Traded Funds (ETFs), totaling approximately $235.2 million. This marks the second day in a row where these funds experienced positive capital growth.

Fidelity’s leads Bitcoin ETF

At the forefront, it was Fidelity’s FBTC ETF that experienced the largest investments, with a total of $103.7 million flowing into it.

Furthermore, last week saw a notable influx of $97.9 million into BlackRock’s IBIT (the largest Bitcoin spot ETF by assets). This follows no activity recorded on October 4th.

Just as anticipated, Bitwise’s BITB raked in approximately $13.1 million, while Ark and 21Shares’ ARKB collected around $12.6 million. VanEck’s HODL also saw an inflow of about $5.4 million, with Invesco’s BTCO managing to bring in $2.5 million.

However, Grayscale’s GBTC and six other ETFs recorded no new flows on the 7th of October.

To put it simply, over the past few days, the total trading volume for all 12 ETFs has been climbing steadily. On the 3rd of October, it was at $1.13 billion, then rose to $1.19 billion on the 4th, and most recently hit $1.22 billion.

Balchunas had already anticipated this

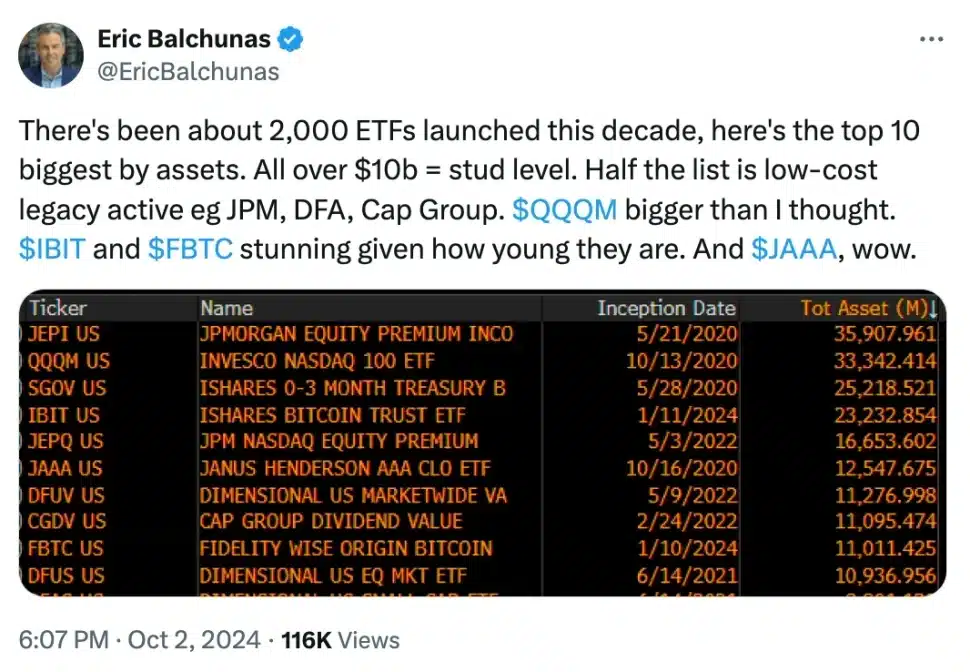

Notably, Eric Balchunan, a senior ETF analyst at Bloomberg, has highlighted IBIT and FBTC as exceptional Bitcoin ETFs that have stood out over the past decade.

He noted their impressive rise to “stud level” status, each amassing over $10 billion in Assets Under Management (AUM).

Balchunas emphasized,

Bitcoin’s price shows bearish momentum

Surprisingly, with more investors taking notice of Bitcoin ETFs, Bitcoin’s price seems to be facing some difficulties.

At present, the cryptocurrency is approximately valued at $62,497, representing a decrease of 0.48% over the last day. It has yet to reach its recent high of $66,000.

These advancements occurred at the same time as a substantial court ruling, since the U.S. Supreme Court has chosen not to review an appeal regarding the possession of approximately 69,370 Bitcoin that were previously confiscated from the Silk Road darknet marketplace.

Ethereum ETF analyzed

As an analyst, I noticed that while Bitcoin ETFs continued their activity, U.S.-listed Ethereum [ETH] ETFs saw a lull in transactions on the 7th of October. The last inflow amounting to $7.39 million was recorded on the 4th October, followed by an outflow of $3.2 million on the 3rd of October.

During this tranquil spell, the trading activity in nine Ethereum-based ETFs decreased significantly, with the total volume dropping from $148.01 million on October 4th to $118.43 million.

Currently, in the world of cryptocurrency, Ethereum experienced a decrease of 1.35% and is being traded at approximately $2,436. This adjustment mirrors the evolving trends in the crypto market.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Masters Toronto 2025: Everything You Need to Know

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Elden Ring Nightreign Recluse guide and abilities explained

- Solo Leveling Arise Tawata Kanae Guide

- Despite Bitcoin’s $64K surprise, some major concerns persist

2024-10-09 06:16