-

Bitcoin ETFs showed signs of recovery, with net inflows of $73 million as of the 28th of June.

Despite recent bearish signals for BTC, ETH, and SOL, declining price volatility suggested a stabilizing market.

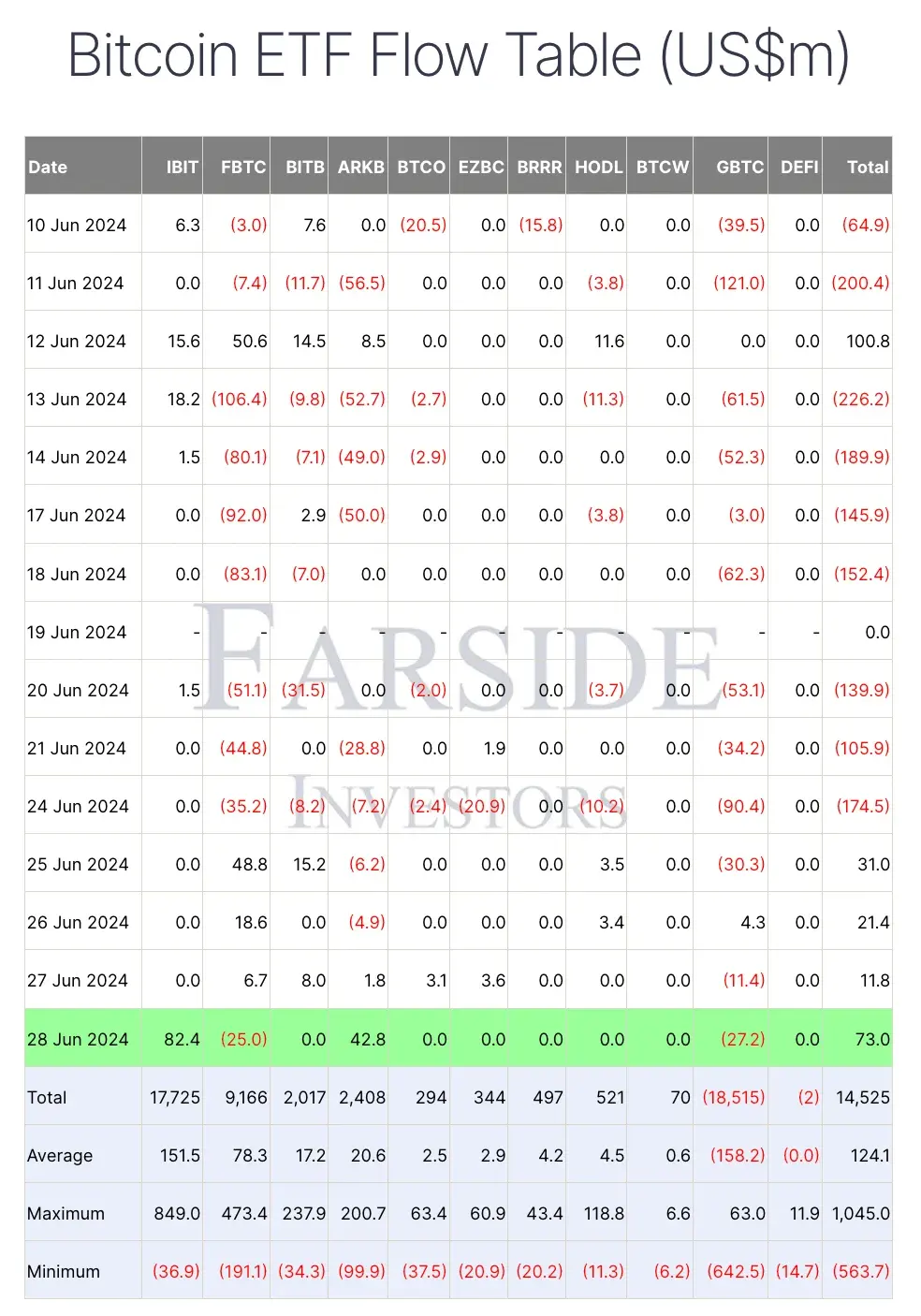

As an experienced financial analyst, I’ve closely monitored the trends in Bitcoin ETFs and their impact on the cryptocurrency market. The recent turnaround in net inflows, with BTC ETFs recording a net inflow of $73 million as of June 28th, is a positive sign after weeks of outflows. However, it’s important to note that BlackRock’s iShares Bitcoin Trust led the charge with significant inflows, while Grayscale Bitcoin Trust and Fidelity’s Bitcoin ETF saw outflows.

Bitcoin [BTC] ETFs showed signs of bouncing back after a long run of outflows. According to the most recent data, on June 28th, these ETFs reportedly attracted approximately $73 million in new investments.

Bitcoin ETF cashflow: Analysis

BlackRock’s iShares Bitcoin Trust (IBIT) topped the list with inflows totaling $82.4 million. On the other hand, Grayscale Bitcoin Trust (GBTC) experienced outflows amounting to $27.2 million, and Fidelity’s FBTC followed suit with $25 million in outflows.

As a researcher studying the cryptocurrency market on the 26th of June, I came across an intriguing observation. Instead of the usual trend where multiple Bitcoin trusts recorded inflows, only FBTC and GBTC reported inflows, totaling $22.9 million. Additionally, VanEck’s HODL saw a smaller inflow of $3.4 million during this period.

Among all other ETFs, only ARK 21Shares’ ARKB experienced withdrawals to the tune of $4.9 million, while the others reported zero net inflows or outflows.

Peter Schiff critiques BTC ETF

As a financial analyst, I’ve observed the ongoing uncertainties surrounding Bitcoin Exchange-Traded Funds (ETFs). Not wanting to be left out, the vocal Bitcoin critic and stockbroker, Peter Schiff, saw this as an opportune moment to take action.

Drawing parallels with the Gold ETFs, Schiff took to X (formerly Twitter) and noted,

“Gold ended the second quarter with a 4% increase in value. Bitcoin, on the other hand, has two more trading days remaining, but currently, it is experiencing a loss of over 15%.”

He even went ahead and questioned various investors’ decisions and said,

Those who sold gold ETFs in the final weeks of Q1 to purchase Bitcoin ETFs instead have experienced a 20% loss. Unfortunately, this setback may only be the beginning as things are expected to worsen.

However, X user Bitcoin Clown responded to his tweet by asking,

Does Schiff’s analysis hold ground?

Schiff’s assessment of why Bitcoin ETFs weren’t performing well was lacking sufficient proof, as shown here.

Over the last four days, I’ve noticed a surge in investments towards U.S. Spot Bitcoin Exchange-Traded Funds (ETFs). It’s been an encouraging trend as there have been positive inflows for the past three consecutive days.

During this timeframe, a total of $137.2 million has flowed into these ETFs through new investments, signifying increasing investor enthusiasm and trust towards these financial instruments.

Remarking on the same, an X user Lord Cryptotook to X and explained,

As a crypto investor, I’m excited about the upcoming Ethereum ETFs, but I can’t help but wonder if the current enthusiasm for Bitcoin ETFs will persist after their launch.

As a researcher studying the world of cryptocurrency and exchange-traded funds (ETFs), I can’t help but notice the latest development: VanEck and 21Shares have filed applications for a Solana [SOL] ETF. This news adds to the uncertainty in this space.

Impact on the token’s price

Over the last 24 hours, Bitcoin, Ethereum, and Solana exhibited bearish trends, with Bitcoin dipping by 0.88%, Ethereum decreasing by 1.68%, and Solana experiencing a decline of 2.22% as indicated by CoinMarketCap.

Based on my analysis of Santiment’s data as a crypto investor, I noticed a decrease in price volatility for the asset under consideration. This means that the asset’s price swings have become smaller and less frequent, potentially signaling a more stable market situation.

The cost is exhibiting fewer price swings, indicating a more consistent market where investments may carry less uncertainty and risk.

Read More

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- PI PREDICTION. PI cryptocurrency

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

2024-06-30 10:16