-

Cboe has re-filed its Bitcoin ETF application to include options.

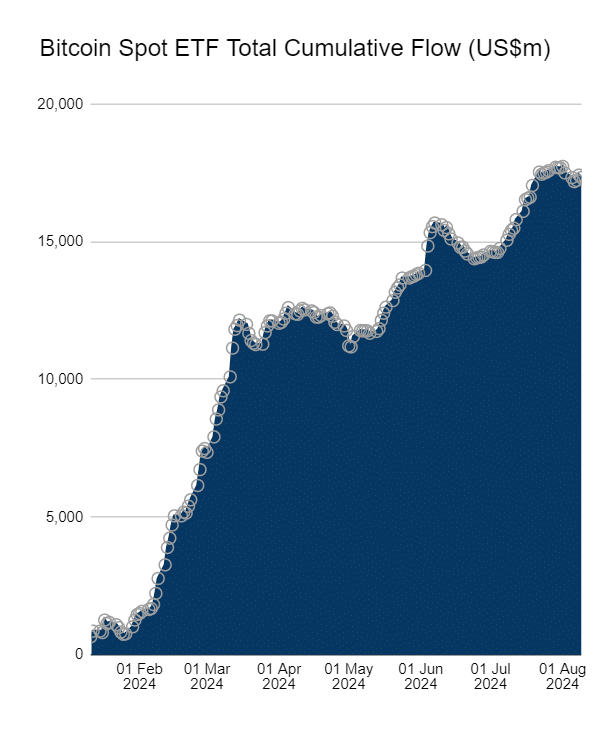

BTC ETF has seen an outflow of over $17 billion.

As a seasoned crypto investor with a decade of experience navigating the ever-evolving digital asset landscape, I find myself both excited and cautiously optimistic about the latest developments in Bitcoin ETF options. Having witnessed the transformative impact of the initial BTC ETF approval, I can only imagine the potential benefits that could come with options trading.

Previously, the approval of the Bitcoin ETF served as an important milestone. This expanded the possibilities for investment avenues and encouraged greater participation from institutions.

With this new development, it seems that Bitcoin ETF options might be approaching faster than some people thought.

Bitcoin ETF options applications see movements

It appears that upcoming events might make Bitcoin ETFs accessible by the last quarter of 2024.

This speculation has been fueled by comments from Bloomberg Intelligence analyst James Seyfarrt, who expressed optimism about the timeline for these options.

Additional proof that progress is being made towards offering Bitcoin ETFs emerged when Cboe resubmitted its application to list options for spot Bitcoin ETFs, following an initial withdrawal. This resubmission happened late on a Thursday, according to industry observers.

Eric Balchunas, a different analyst, pointed out that the Securities and Exchange Commission’s (SEC) remarks on Cboe’s application were favorable, resembling the regulatory feedback preceding the green light for Bitcoin ETFs.

The comparison suggests that it’s getting easier to understand how we might soon see Bitcoin ETF options being introduced.

An option for a Bitcoin Exchange-Traded Fund (ETF) lets investors interact with Bitcoin using the benefits of options trading, such as flexibility, combined with the security measures typical of conventional ETFs provided by regulators.

Investors are granted the choice, but not required, to either purchase or offload Bitcoin Exchange-Traded Fund (ETF) shares at a predetermined cost prior to an expiration date. This feature could introduce an element of tactical investing within the realm of cryptocurrencies.

How the Options ETF could Impact Bitcoin

By allowing Bitcoin ETFs, we might greatly boost market liquidity and facilitate better pricing estimation. This increased appeal could draw in a larger number of institutional investors.

Furthermore, this growth could potentially lead to higher price fluctuations as a result of excessive speculation and possible market manipulation.

Additionally, an increase in demand might drive up the cost of Bitcoin, potentially fostering a more integrative relationship between the cryptocurrency market and conventional financial structures.

On the other hand, stricter regulations and a possible rise in correlation between Bitcoin and conventional markets might be outcomes as well.

BTC ETF in the past week

Based on data from sosovalue, Bitcoin spot ETFs collectively witnessed a withdrawal of approximately $169 million over the past week. Notably, Grayscale ETF GBTC experienced a substantial outflow totaling $392 million. Conversely, BlackRock ETF IBIT and WisdomTree ETF BTCW recorded inflows of $220 million and $129 million respectively during the same period.

Additionally, data accumulated by Farside Investors indicates that United States Bitcoin spot ETFs have attracted a total investment of $17.341 billion since they were first launched.

Grayscale GBTC had a net outflow of $19.451 billion, contrasted by BlackRock IBIT’s net inflow of $20.317 billion and Fidelity FBTC’s $9.722 billion inflow.

Read More

- Why Tina Fey’s Netflix Show The Four Seasons Is a Must-Watch Remake of a Classic Romcom

- OM PREDICTION. OM cryptocurrency

- Disney’s Animal Kingdom Says Goodbye to ‘It’s Tough to Be a Bug’ for Zootopia Show

- The Weeknd Shocks Fans with Unforgettable Grammy Stage Comeback!

- Hut 8 ‘self-mining plans’ make it competitive post-halving: Benchmark

- Jujutsu Kaisen Reveals New Gojo and Geto Image That Will Break Your Heart Before the Movie!

- Taylor Swift Denies Involvement as Legal Battle Explodes Between Blake Lively and Justin Baldoni

- Gaming News: Why Kingdom Come Deliverance II is Winning Hearts – A Reader’s Review

- Oblivion Remastered: The Ultimate Race Guide & Tier List

- The Elder Scrolls IV: Oblivion Remastered – How to Complete Canvas the Castle Quest

2024-08-12 18:16