- The SEC recently approved some BTC ETF Options.

- Spot Bitcoin ETF saw an increased net flow in the past week.

As a seasoned researcher who has closely followed the evolution of digital assets and traditional finance for over a decade now, I can confidently say that the recent approval of Bitcoin ETF Options by the SEC marks an exciting milestone. It’s like watching two worlds collide – the old guard of Wall Street meeting the new frontier of crypto.

Just last week, the Securities and Exchange Commission (SEC) gave its approval for the launch and trading of various Bitcoin ETF Options.

This was a major advancement in connecting conventional financial systems with the swiftly growing digital currency sector.

Key institutions such as Fidelity and Grayscale are pioneering the use of ETFs (Exchange-Traded Funds) as essential building blocks for a well-balanced investment portfolio.

The approval signals regulatory clarity

On October 18th, the Securities and Exchange Commission (SEC) authorized the listing and trading of options for 11 Bitcoin Spot Exchange-Traded Funds (ETFs). This move underscores the increasing endorsement of Bitcoin ETF Options by financial authorities.

This regulatory endorsement is instrumental in fostering wider adoption.

With an increasing number of ETFs being authorized for options trading, the curiosity and demand for these investment tools on Wall Street are steadily growing.

Now, institutional investors can more confidently participate in Bitcoin ETF Options due to a more defined set of regulations, providing greater clarity and security within the market.

As a crypto investor, I’m excited about the recent approval, as it signifies a significant step towards legitimizing Bitcoin ETF Options in the financial world. It seems that Wall Street is starting to see these options not just as another investment avenue, but as effective tools for diversifying our portfolios, making them more robust and resilient.

Achieving this regulatory certainty and rising confidence may indicate a significant leap towards integrating digital assets within traditional financial systems.

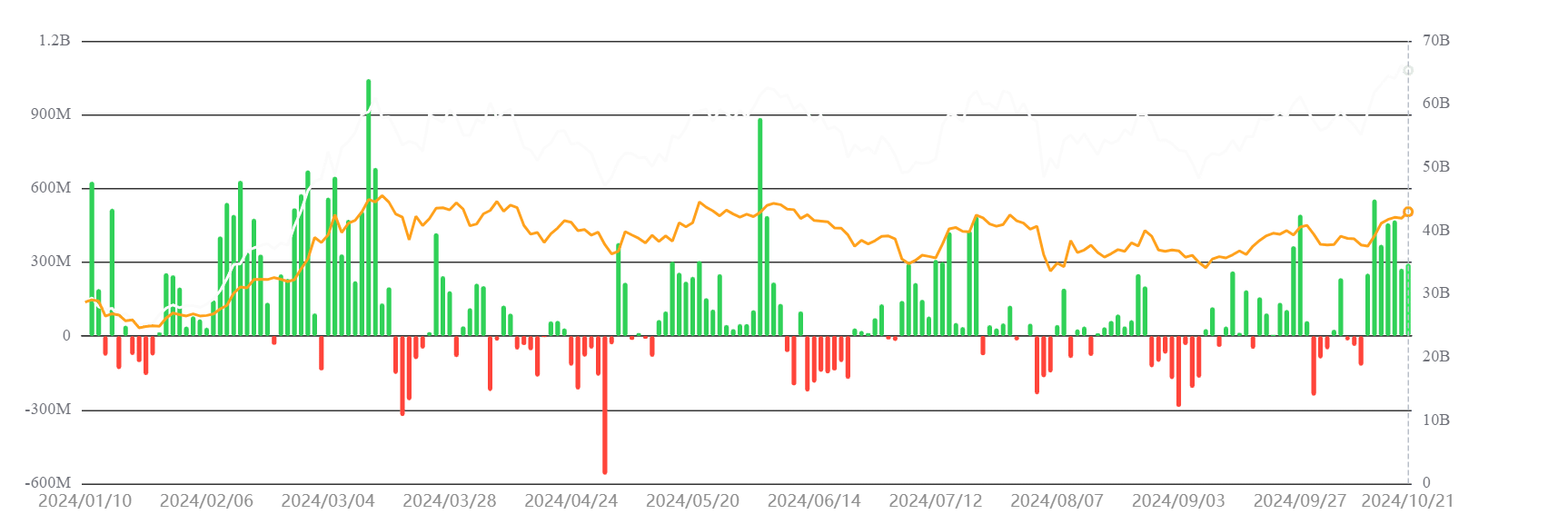

Bitcoin ETFs experience net flow surge

According to SosoValue’s latest findings, Bitcoin Exchange-Traded Funds (ETFs) have seen a surge in investments over the last seven days, with around $2.7 billion being poured in. This has increased their combined net worth to more than $65 billion.

This investment flow underscores a surge in institutional investor attention, as funds are being directed into and withdrawn from the market.

Introducing Bitcoin ETF Options could boost liquidity significantly. This increased liquidity would give investors novel opportunities to secure their investments or take risks by predicting future price fluctuations.

This could lead to a more stable price action for both Bitcoin and its associated ETFs.

How Options could shape Wall Street portfolios

As a crypto investor, I can’t help but see the immense potential that the emergence of Bitcoin ETF Options brings to both traditional financial institutions and the wider crypto market. This development could pave the way for increased institutional investment, potentially driving up demand and further legitimizing cryptocurrencies as a viable asset class.

Read Bitcoin’s [BTC] Price Prediction 2024-25

As a researcher, I’m excited about the opportunity to explore investment in Bitcoin through a regulated and adaptable framework. This innovative approach expands the horizons for potential investors like myself.

With regulatory guidelines adapting and an increasing number of financial entities adopting Bitcoin ETF Options, it’s expected that these financial instruments will become key components in the investment plans of Wall Street in the near future.

Read More

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- PI PREDICTION. PI cryptocurrency

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

2024-10-23 05:11