- Bitcoin’s ETF options spark bullish sentiment, but low-cost contracts skew the true market outlook.

- Strategies like synthetic longs and covered calls offer income potential but come with risks.

As a seasoned analyst with over two decades of experience in the financial markets, I’ve seen my fair share of market hype and speculation. The recent launch of Bitcoin ETF options has certainly generated a wave of bullish sentiment, but as someone who’s been through various market cycles, I remain cautiously optimistic.

On November 19th, trading for Bitcoin [BTC] options tied to spot Exchange-Traded Funds (ETFs) commenced, propelling the digital currency to an unprecedented peak above $94,000.

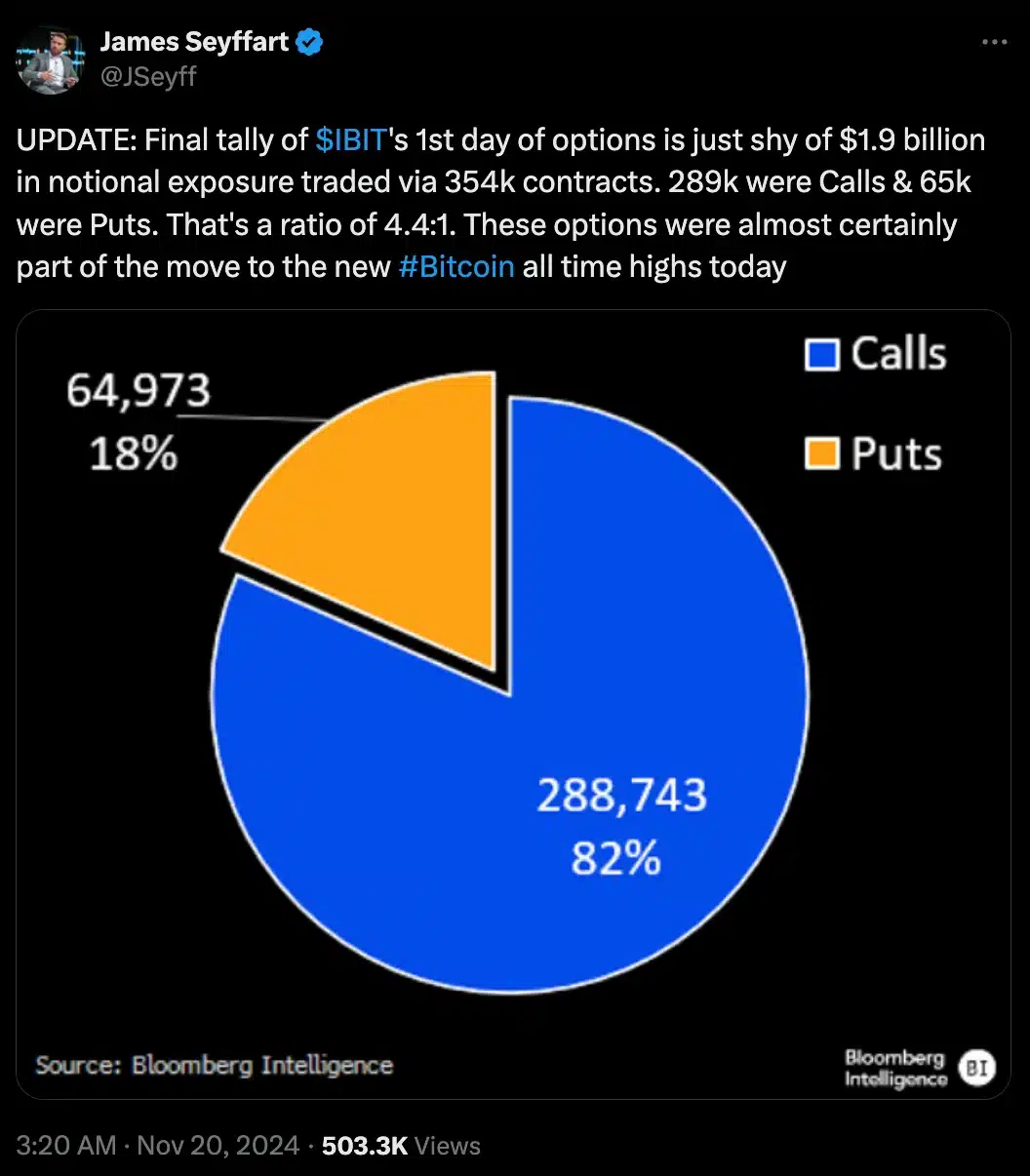

Experts at X (previously known as Twitter) swiftly declared the launch as a triumph, exhibiting a notable 4.4 times more calls for buying (calls) than selling (puts), suggesting a strong investor optimism.

Over twice as many call options (288,740) were bought compared to put options (64,970), indicating a strong increase in optimism about Bitcoin’s potential growth and faith in its future prospects.

Bloomberg ETF analyst James Seyffart remarked on the same thing and noted,

Why it matters

The significant increase in Bitcoin call options, notably those worth $100 due to expire on December 20th, originally indicated a positive perspective, as certain contracts seemed to point towards prices surpassing $170,000.

Conversely, considering they are sold for only $0.15 apiece, which equates to just 0.3% of the total value of IBIT at $53.40, these options suggest a minimal probability of hitting $175,824.

To some, these affordable alternatives seem like gambling “tickets,” leading to distorted perceptions of the market and fostering a false sense of hopefulness.

Let’s look at a more straightforward instance, such as the IBIT call option scheduled to end on the 17th of January, with a price of between 2.40% and 4.5% of IBIT’s total value of $53.40.

It will become profitable if Bitcoin hits $114,286, a 22% gain in two months.

Other possible strategies

That being said, advanced traders might also use strategies like synthetic longs.

For instance, an X user, “Ashton Cheekly,” shared a strategy of selling a $50 put and buying a $60 call for $2.15, replicating Bitcoin ownership without holding the asset directly.

A frequently used approach is the covered call, which involves an investor with IBIT selling a call option to generate instant revenue.

Here’s one way of paraphrasing it: In other words, when IBIT is priced at $53.40, choosing to sell a call option with a strike price of $55 for $5.20 means you pocket the premium, but your potential profit is capped if IBIT surpasses $55.

Now, if IBIT closes lower, the investor keeps the premium, reducing losses or boosting returns.

Given the present market dynamics, it seems doubtful that Bitcoin will reach a price of $170,000 as predicted, considering it’s mainly based on speculative options.

In other words, even though options can lead to substantial profits due to their leverage, they also carry the potential danger of losing all value.

Consequently, for individual investors venturing into stocks, Bitcoin ETFs and options open up fresh avenues for earning profits. However, it’s crucial to grasp the inherent risks and workings before expecting successful outcomes.

Read More

2024-11-22 02:15