- Bitcoin ETFs face significant outflows, indicating growing caution in the market.

- Ethereum ETFs show mixed performance with recent inflows amid ongoing skepticism.

As a seasoned crypto investor with over a decade of experience navigating the ever-changing digital currency landscape, I find myself intrigued by recent developments in the BTC and ETH ETF markets. The outflows from Bitcoin ETFs have caught my attention, particularly the significant withdrawals from ARKB and GBTC. This trend points to a growing sense of caution among investors, which may be a temporary response to market volatility or indicative of a larger shift in sentiment.

In simpler terms, there’s been a trend of money moving out of Bitcoin ETFs over the last few days, from August 26th to August 30th, indicating a bearish sentiment in the market.

Bitcoin ETF analyzed

Based on Farside Investors’ findings, there was a significant withdrawal of approximately $277 million over a span of four days from Bitcoin Exchange-Traded Funds (ETFs).

As a researcher, I’ve observed some notable shifts in investment flow patterns recently. Specifically, I’ve seen ARK Invest and 21Shares’ ARKB fund experiencing substantial withdrawals to the tune of approximately $220 million. On the other hand, Grayscale’s GBTC has seen a surge in outflows, totaling around $119 million.

On three out of four days recently, BlackRock’s IBIT experienced no new investments, and the modest inflow of $13.5 million on August 29th was barely noticeable.

This trend underscores a growing cautious sentiment in the Bitcoin ETF sector.

Community remains positive

Nevertheless, even though Bitcoin’s current market trend shows a decline, many key figures in the industry continue to express positivity regarding its future prospects.

Remarking on the same, Chip from onthechain.io took to X to express this sentiment, and said,

“Bitcoin seems unlikely to vanish in the near future given its current strong backing.”

He emphasized that the arrival of Bitcoin Exchange-Traded Funds (ETFs) has significantly boosted Bitcoin’s credibility within the financial sector.

However, he also pointed out of word of caution and added,

“Though Bitcoin currently holds significant value, it may gradually become less attractive over time as markets evolve and novel technologies emerge.”

Ethereum ETF explained

In contrast to Bitcoin ETFs, Ethereum [ETH] ETFs have demonstrated a more stable performance.

Although there were withdrawals amounting to $12.6 million during the given timeframe, Ethereum ETFs have demonstrated indications of a rebound.

Grayscale’s Ethereum ETF (ETHE) experienced a notable outflow of $27.86 million.

On the other hand, BlackRock’s ETHA and Grayscale’s Mini Ethereum Trust have seen growth, as they attracted investments worth $8.4 million and $3.57 million respectively. This trend indicates a tentative yet hopeful perspective towards Ethereum in the ETF market.

Although there has been an increase in funds flowing into Ethereum ETFs, there is still doubt among some about their true potential, as pointed out by TourBillion.

“Ethereum is just hanging on hopeium.”

Impact on price

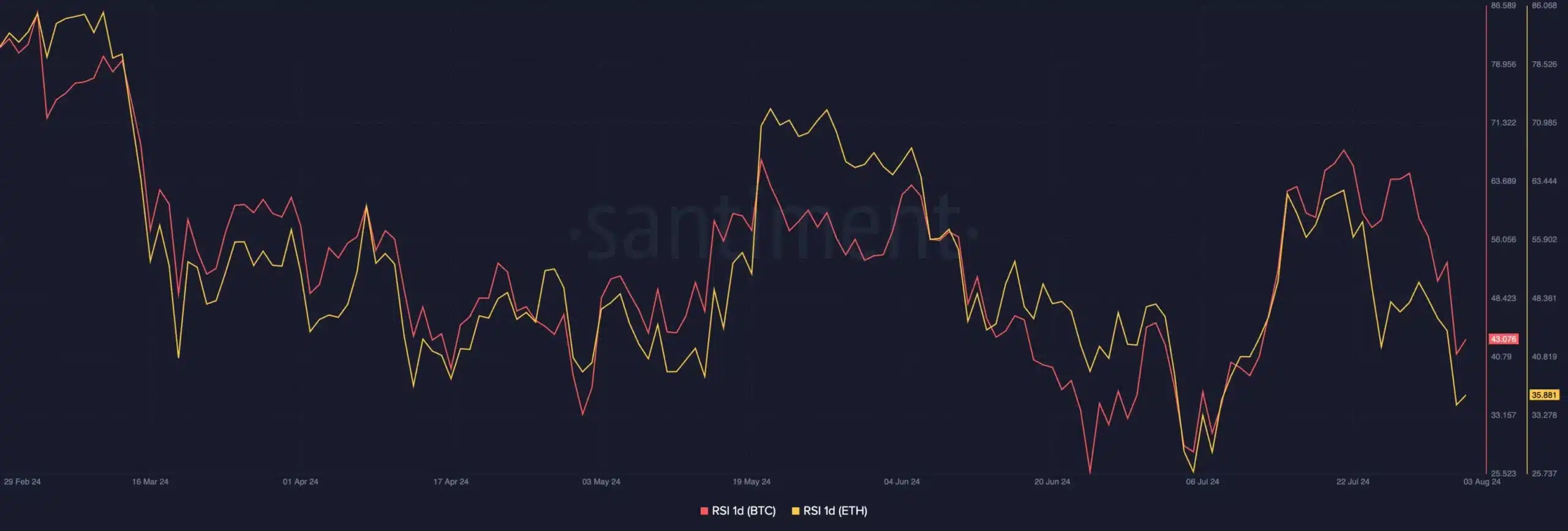

Currently, while Bitcoin and Ethereum have seen modest increases by 0.42% and 1.82%, respectively, a closer examination of Santiment’s data indicates that there is an overall bearish outlook lurking beneath the surface.

According to AMBCrypto’s examination, while the prices of the two tokens are increasing, their Relative Strength Indicator (RSI) values still fall below the neutral point.

It seems the current mood in the market remains tentative, and it might require some time before we start seeing a more optimistic trend emerge.

Read More

- Jujutsu Kaisen Reveals New Gojo and Geto Image That Will Break Your Heart Before the Movie!

- Gaming News: Why Kingdom Come Deliverance II is Winning Hearts – A Reader’s Review

- We Ranked All of Gilmore Girls Couples: From Worst to Best

- How to Get to Frostcrag Spire in Oblivion Remastered

- Why Tina Fey’s Netflix Show The Four Seasons Is a Must-Watch Remake of a Classic Romcom

- Is the HP OMEN 35L the Ultimate Gaming PC You’ve Been Waiting For?

- S.T.A.L.K.E.R. 2 Major Patch 1.2 offer 1700 improvements

- First U.S. Born Pope: Meet Pope Leo XIV Robert Prevost

- Disney Cuts Rachel Zegler’s Screentime Amid Snow White Backlash: What’s Going On?

- Kylie & Timothée’s Red Carpet Debut: You Won’t BELIEVE What Happened After!

2024-09-03 11:04