- Bitcoin has entered the $69,000 price zone.

- The new price zone could impact the week’s ETF flow.

As a seasoned crypto investor with several years of experience under my belt, I’ve witnessed the ebb and flow of Bitcoin prices and ETF trends alike. The latest update on Bitcoin ETF flows and price action has piqued my interest.

Recent Bitcoin ETF developments disclosed a week’s worth of net income for most ETF companies, signifying robust investor demand.

Among the major ETF firms, only one experienced a net outflow during this period, making it the lone exception in an otherwise robust trend of ETF investment inflows. Furthermore, every day but one registered positive flows.

The Bitcoin ETF flow trend

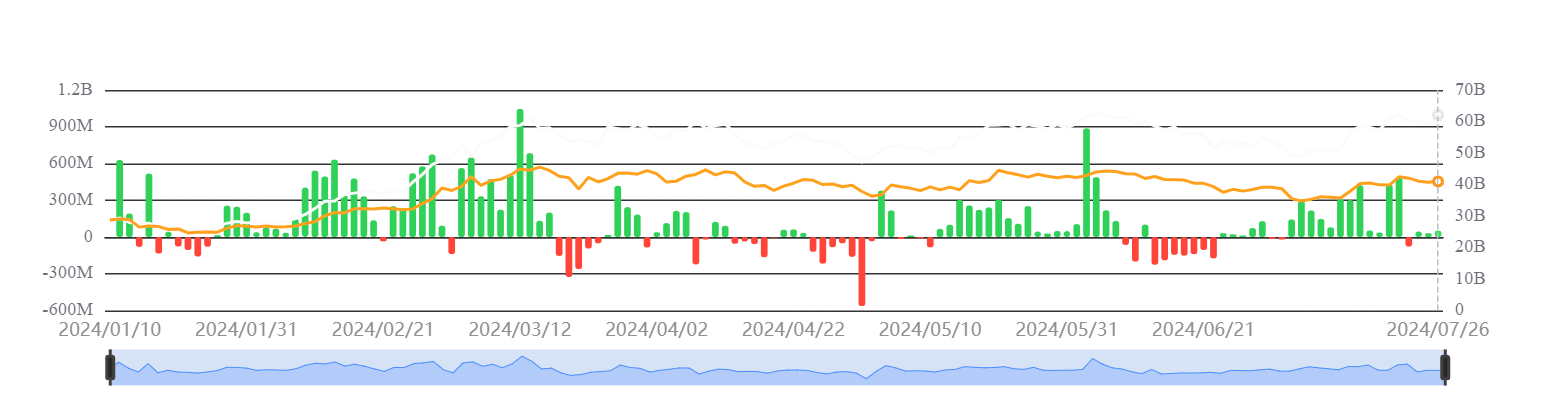

Based on the most recent Bitcoin ETF report by Sosovalue, there was a total inflow of approximately $535 million into spot ETFs during the last week.

While some investment funds experienced gains, Grayscale’s (GBTC) fund was an exception, reporting a net withdrawal of $120 million during the past week, resulting in being the sole ETF demonstrating a negative flow.

In contrast, BlackRock’s Bitcoin ETF (IBIT) experienced the largest influx of funds, with approximately $758 million being invested over the past week. Fidelity’s Bitcoin ETF (FBTC) also attracted a substantial amount of capital, bringing in around $29.61 million.

The combined value of all Bitcoin spot Exchange-Traded Funds (ETFs) amounts to a staggering $62.095 billion. In relation to the entire Bitcoin market, these ETFs represent a 4.67% share.

To date, the total amount of money poured into Bitcoin spot ETFs has amounted to $17.587 billion, signifying a substantial and escalating appetite for Bitcoin via this investment channel.

Bitcoin starts the week strong

I’ve noticed an encouraging uptick in Bitcoin’s price this week. At present, it trades around $69,500 – that’s a noteworthy surge of more than 1.8%! This upward trend has brought Bitcoin back into the $69,000 price bracket for the first time since early November.

Also, it edged closer to the significant $70,000 threshold.

Additionally, the price increase has brought the asset nearer to the overbought zone, according to its Relative Strength Index (RSI). At present, the RSI value is approximately 69.

Read Bitcoin’s [BTC] Price Prediction 2024-25

How the price could affect Bitcoin ETF trends

With a robust beginning to the week for Bitcoin, it’s reasonable to expect a responsive shift in the Bitcoin ETF market. ETFs typically react to substantial price fluctuations in their underlying assets.

“My findings suggest that implementing this strategy could potentially lead to an uptick in trading activity for Exchange-Traded Funds (ETFs). Consequently, there might be adjustments in ETF holdings and investment strategies as market participants respond to new information.”

Read More

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- WCT PREDICTION. WCT cryptocurrency

- Royal Baby Alert: Princess Beatrice Welcomes Second Child!

- PI PREDICTION. PI cryptocurrency

- Sea of Thieves Season 15: New Megalodons, Wildlife, and More!

- SOL PREDICTION. SOL cryptocurrency

- Playmates’ Power Rangers Toyline Teaser Reveals First Lineup of Figures

- Superman Rumor Teases “Major Casting Surprise” (Is It Tom Cruise or Chris Pratt?)

- Buckle Up! Metaplanet’s Bitcoin Adventure Hits New Heights 🎢💰

- Owen Cooper Lands Major Role in Wuthering Heights – What’s Next for the Young Star?

2024-07-29 16:07