- Bitcoin’s pre-halving volatility questioned post-Hong Kong’s ETF approval, drawing mixed sentiments.

- Historical data indicates post-halving price surges.

During a week when cryptocurrencies experienced substantial drops of over 10%, the announcement of Bitcoin ETF approval in Hong Kong brought renewed optimism to BTC investors.

Based on estimates, introducing Bitcoin ETFs might bring about a $25 billion inflow in the initial year.

Although Peter Schiff expresses positivity in some quarters, he raised doubts about the expansion of Bitcoin ETFs in his latest social media update.

“Why are Bitcoin-linked stocks experiencing bear markets if Bitcoin ETFs have the potential to drive Bitcoin prices up to $100K or more? For instance, COIN is dropping by 21%, GLXY is decreasing by 26%, and MSTR is falling by 33%.”

Bitcoin’s volatile moves

Based on CoinMarketCap’s data, the daily price chart of Bitcoin showed numerous red candles.

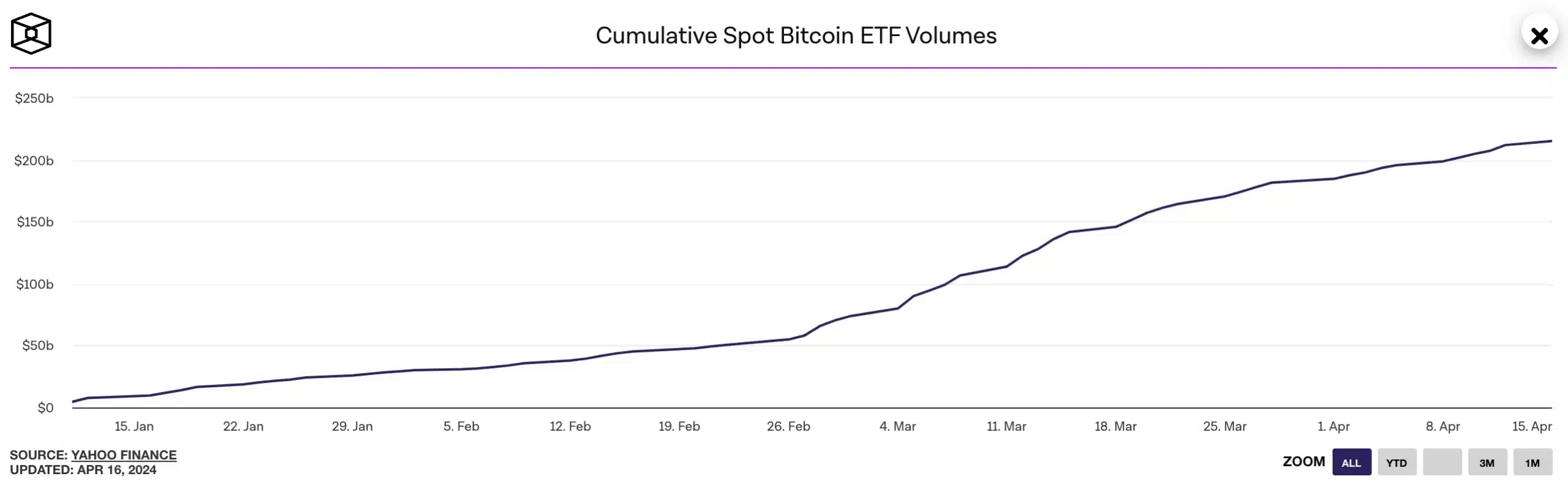

Instead, The Block noted that the total Bitcoin ETF trading volume chart was trending upwards as indicated in their report.

The contrast between these events raised a query: Could the approaching Bitcoin halving be causing such price fluctuations?

Responding to the same, Anthony Pompliano in conversation with LizClaman, noted,

“Bitcoin serves as the world’s early warning signal for financial markets. It tends to take the lead during market downturns, signaling a potential crisis for other assets, while also paving the way during periods of significant growth.”

This highlights the divergence of views between bullish investors and cautious “halving bears.”

Some people believe the price of cryptocurrency will go up because of limited supply (optimists), while others are worried it may decrease since miners earn less reward (skeptics).

The conflict in feelings about this is more evident in the present market situation, as Bitcoin exhibits increased price fluctuations.

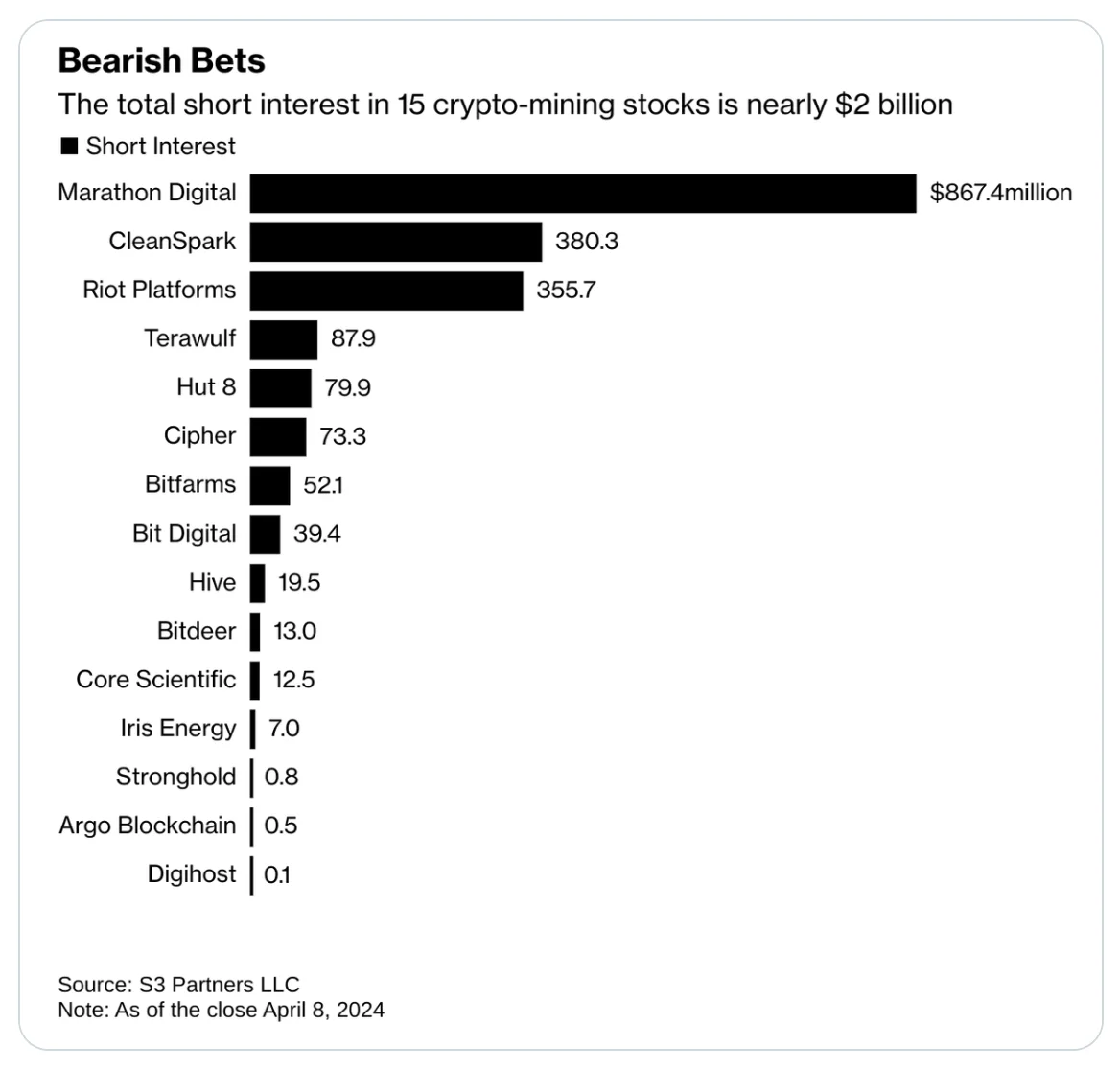

Insights indicate that Bitcoin miners might incur substantial losses following the halving event, potentially intensifying pessimistic views as suggested by Barchart.

BTC’s price action

In an interview with Bloomberg, Kris Marszalek, the CEO of crypto.com, expressed his detailed viewpoint on the impending Bitcoin halving.

As the date for the “halving” approaches, signs of Bitcoin being sold off may emerge. However, this event is expected to boost the price of Bitcoin in the long run.

Contributing to the ongoing discussion, Ash Crypto explained that Bitcoin typically undergoes considerable price growth following every halving occasion.

“Bitcoin pumps heavily after each halving.

- 2012 halving: 9900%

- 2016 halving: 2900%

- 2020 halving: 700%

But this time, something interesting will happen.”

In the upcoming year, 2024, the Bitcoin and cryptocurrency community will experience something special with the highly anticipated halving event. This event is sure to make 2024 a distinctive year in the world of digital currency.

Read More

- LDO PREDICTION. LDO cryptocurrency

- JASMY PREDICTION. JASMY cryptocurrency

- Can Ethereum ETFs outperform Bitcoin ETFs – Yes or No?

- Chainlink to $20, when? Why analysts are positive about LINK’s future

- Citi analysts upgrade Coinbase stock to ‘BUY’ after +30% rally projection

- Why iShares’ Bitcoin Trust stock surged 13% in 5 days, and what’s ahead

- Spot Solana ETF approvals – Closer than you think?

- Orca crypto price prediction: Buying opportunity ahead, or bull trap?

- Top 10 Stocks and Crypto Robinhood Alternatives & Competitors

- ‘China’s going to have it’ – Donald Trump crypto stance, finally explained

2024-04-16 18:16