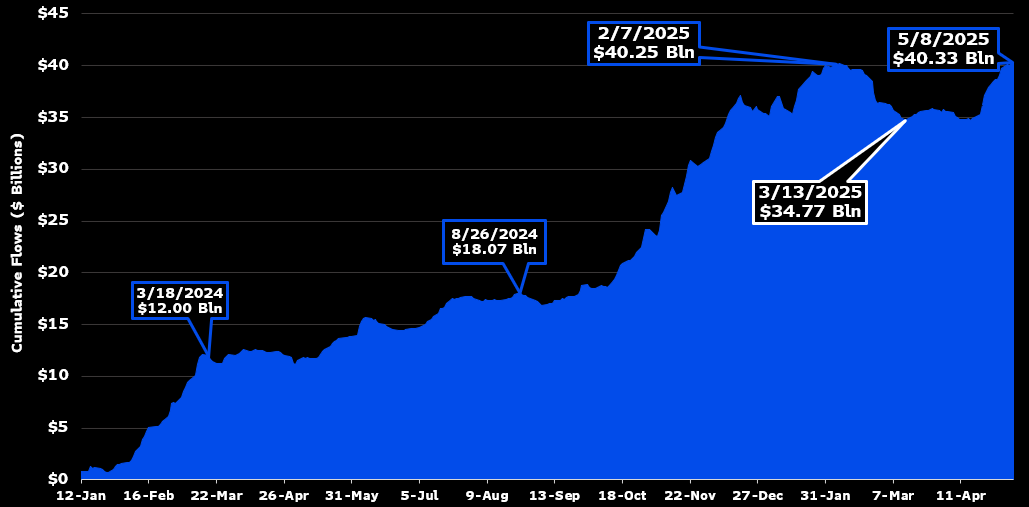

Hold onto your hats, dear reader, for the latest data has declared that Bitcoin Spot ETFs have shattered their previous inflow records! A cool $40.33 billion now flows like liquid gold into these ETFs, despite the tumultuous storm of over $5 billion in outflows over the last two months. Oh, the irony! 😅

In a world where crypto markets are drenched in a sea of Extreme Fear, the Bitcoin ETFs appear to have weathered the storm with all the grace of a ballerina pirouetting through a hurricane. It’s almost as if these digital assets have a secret recipe for resilience. 🧐

The Never-Ending Show: Bitcoin ETFs Break Inflow Records Once More

Ah, 2024, a year etched in history with the launch of Bitcoin ETFs. Their arrival sent shockwaves through the crypto industry, and some analysts were left sputtering words like “greatest launch in ETF history,” referring to BlackRock’s IBIT as if it were the Holy Grail of financial products. 👑

And lo and behold, here we are again—Bitcoin ETFs are on another victory lap as their inflows have surpassed the all-time record set in February. I can practically hear the applause echoing through the halls of the financial world. 💸

Shortly after Bitcoin Spot ETFs reached the $40 billion milestone, the market decided to throw a tantrum and reversed dramatically. Over $5 billion was sent packing, devouring all the gains of 2025, like a ravenous beast. Naturally, issuers had to unload some of their BTC reserves to calm the storm. 🔥

Now, one might think these firms were just casual investors, but no. They were on a Bitcoin binge, and when they collectively dumped their holdings, the market trembled with concern. Was it a recession? Was it Trump’s tariffs? Who knows! But the recovery started in late April—cue dramatic music. 🎶

Despite the wild ride, the Bitcoin ETFs managed to climb out of the hole they had been thrown into. The inflows dipped to a low point, but fear not, for there is a silver lining. ETF analyst Eric Balchunas is here to save the day, proclaiming that lifetime net flows are the purest metric to watch. He’s basically the crypto Nostradamus. 🧙♂️

“Lifetime net flows are the most important metric to watch in my opinion: very hard to grow, pure truth, no BS. [It’s] impressive that they were able to make it to a new high-water mark so soon after the world was supposed to end. Byproduct of barely anyone leaving, left only a tiny hole to dig out of,” Balchunas shared on social media, in case you missed it. 📱

Ah yes, the crypto community’s “diamond hands” mentality must have played a part in this miraculous recovery. During the height of the tariff panic, markets plunged into Extreme Fear, the lowest level of confidence seen since the FTX catastrophe. And yet, these ETFs fought valiantly like brave gladiators in the financial coliseum. 🏛️

Now, here we are again, with Bitcoin ETFs basking in the glory of consistent inflows. But let’s not get too carried away—this record doesn’t guarantee sunshine and rainbows for the future. After all, Bitcoin recently danced its way back to $100,000, and while that sparked a fresh surge of inflows, some bearish clouds are still looming over options trading. 🌩️

Nevertheless, let’s take a moment to appreciate the sheer spectacle of it all. The ETFs have been on fire, and Bitcoin has been drawing in TradFi liquidity like a moth to a flame. For now, the crypto rollercoaster continues, and we can only hang on for dear life. 🎢

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Solo Leveling Arise Tawata Kanae Guide

- Despite Bitcoin’s $64K surprise, some major concerns persist

- Flight Lands Safely After Dodging Departing Plane at Same Runway

- Elden Ring Nightreign Recluse guide and abilities explained

- Planet Coaster 2 Interview – Water Parks, Coaster Customization, PS5 Pro Enhancements, and More

2025-05-10 04:09