Ah, the curious spectacle of Bitcoin exchange-traded funds in the United States, swallowing more than $3 billion as if at an all-you-can-eat buffet last week.

One might say this is among the grandest weeks for Bitcoin ETFs in the year 2025—a robust upsurge enlivened by the recovering pride of BTC’s price and the insatiable curiosity of institutional patrons.

Bitcoin ETFs’ Six-Day Stampede of Inflows

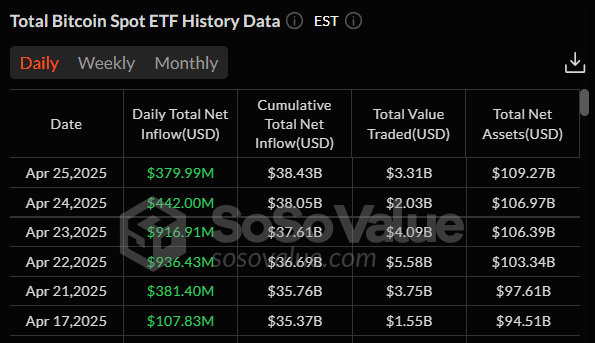

According to the trustworthy scribes at SoSoValue, eleven spot Bitcoin ETFs united their fortunes, attracting a sum near $3.06 billion over no fewer than six trading days in succession.

This tempest of investment stands as the second mightiest inflow recorded, a testament to the growing appetite for financial curiosities entwined with cryptographic enchantments.

The zenith of this fever blazed on the 22nd and 23rd days of April, when the coffers filled with $936 million and $916 million respectively—figures so grand, one jestingly compares them to political theatrics spawned by a certain former U.S. president’s return to the capital.

Such a torrent of solid gold has swelled the total managed treasure for Bitcoin ETFs to $109 billion, where the venerable BlackRock’s iShares Bitcoin Trust (IBIT) reigns supreme, wielding over $56 billion in its coffers—a neat slice of roughly three percent of the mystical Bitcoin circulating in the ether.

Michael Saylor, once the grand strategist of MicroStrategy, now Chairman of… well, Strategy, has declared that this mighty IBIT may well become the largest ETF under the sun within a decade. Perhaps we should mark our calendars accordingly.

Meanwhile, the learned analysts muse that this flourishing influx is buoyed by Bitcoin delicately slipping free from the shackles of traditional risk assets—stocks and gold alike. Add to the kettle the global tariff squabbles, and Bitcoin’s aura as a safe harbor swells among the anxious masses.

Moreover, commentators from The Kobeissi Letter hint that Bitcoin’s escape from macroeconomic chains has paved the way for its spirited rebound. Since it tumbled beneath the $75,000 threshold on April 7, our eccentric hero has leapt over 25%, dancing above $94,000 with carefree abandon.

“As the world merrily prints its paper promises to oblivion, so too shall Bitcoin’s worth ascend, for the flimsy currency rests on naught but debt—debt running wild in folly. Bitcoin, my friends, is the balm for this monetary madness,” proclaims Mark Wlosinski, seer of crypto horizons.

Looking ahead, David Puell of ARK Invest peers into the mist with optimism fit for a bard. He predicts Bitcoin may soar to the dizzying heights of $2.4 million by the year 2030—a rise spurred by institutional affection and its regal ascent as a treasury jewel for mighty corporations and even sovereign realms.

For those who prefer their visions tempered by prudence, Puell offers a gentler forecast: Bitcoin nestling comfortably between $500,000 and $1.2 million within the same span.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

2025-04-27 12:28