- BlackRock’s IBIT now holds over 500,000 BTC, becoming the third-largest Bitcoin holder globally.

- Spot Bitcoin ETFs near Satoshi’s 1.1M BTC holdings, reshaping institutional dominance in crypto.

As a seasoned researcher with over two decades of experience in finance and technology, I’ve seen my fair share of market shifts and evolutions. The recent surge in institutional adoption of Bitcoin, as exemplified by BlackRock’s iShares Bitcoin ETF (IBIT), is nothing short of extraordinary.

The iShares Bitcoin ETF managed by BlackRock, known as IBIT, has become a significant player in the cryptocurrency sector, currently possessing more than half a million Bitcoins. This makes it the third largest Bitcoin holder worldwide.

Is BlackRock’s Bitcoin ETF ready to surpass Satoshi Nakamoto’s holdings?

In about 233 trading days following the launch of IBIT, BlackRock has accumulated a stake worth around $48 billion in Bitcoin, representing roughly 2.38% of the total Bitcoin supply.

Through the creation of an Exchange-Traded Product (ETP), BlackRock has made it simpler for investors to invest in Bitcoin, avoiding the intricacies of direct ownership. This move underscores their dedication to promoting increased institutional adoption of Bitcoin.

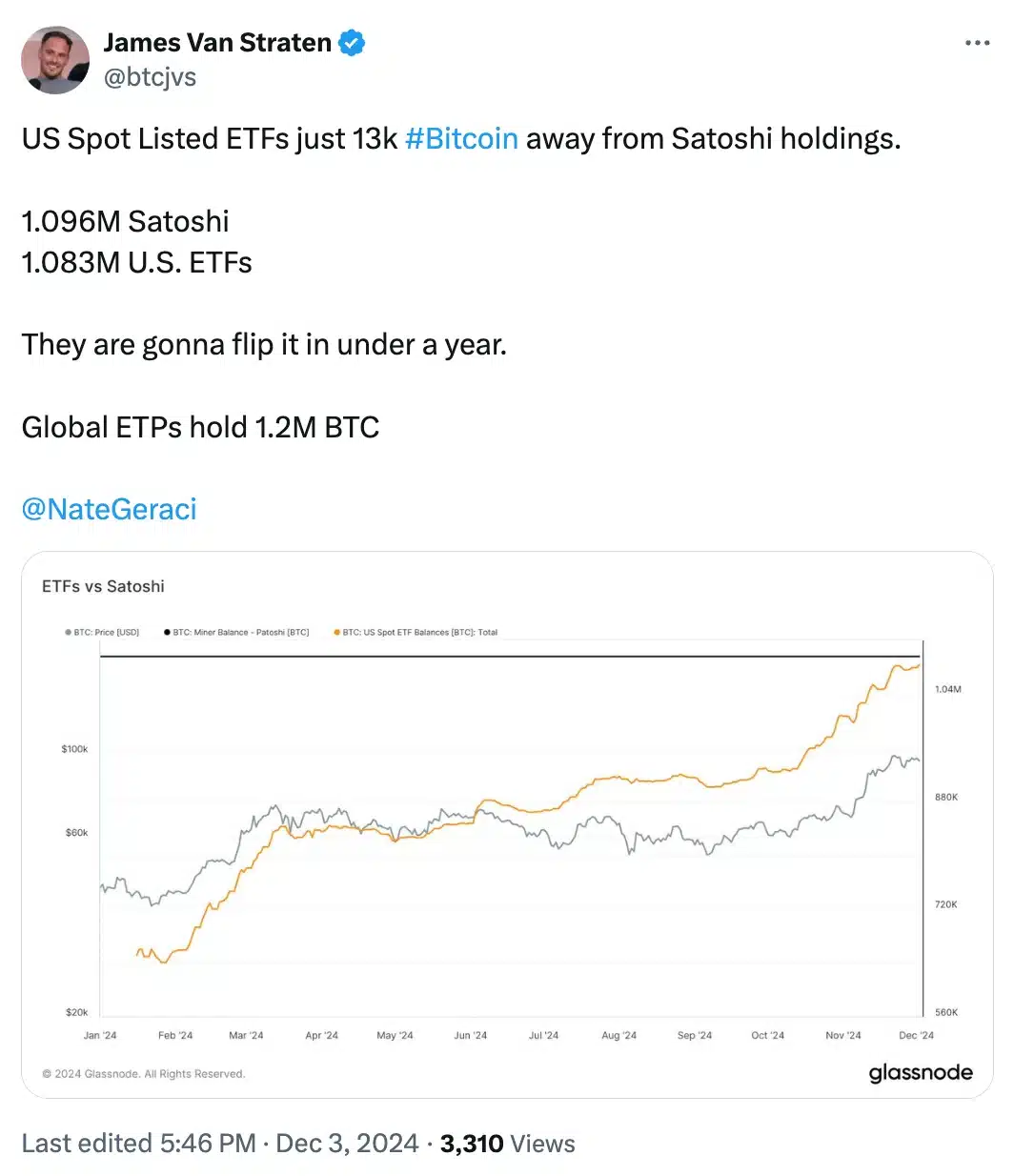

Indeed, just as anticipated, the mysterious inventor of Bitcoin, Satoshi Nakamoto, maintains control over a substantial amount of the digital currency – approximately 1.096 million Bitcoins, which accounts for around 5.22% of the total Bitcoin supply that has been predetermined.

Meanwhile, there’s a possibility that Nakamoto’s control over Bitcoin could be challenged due to the swift increase in accumulation of U.S. spot Bitcoin ETFs.

These funds, having previously outpaced MicroStrategy’s holdings this year, currently hold only about 13,000 Bitcoin fewer than the colossal hoard amassed by Satoshi Nakamoto.

This competition highlights how institutional investors are increasingly shaping the Bitcoin environment with their expanding impact.

Spot Bitcoin ETF update

On December 2nd, the assets held by Bitcoin ETFs have almost hit a major landmark, increasing to approximately 1.083 million Bitcoins following a $353.67 million investment, as reported by Sosovalue.

According to the most recent report from Farside Investors, there were inflows totaling $676 million into the Bitcoin ETF on December 3rd.

Consequently, for these ETFs to equal the 1.1 million BTC held by Nakamoto, they would need an extra $1.23 billion investment at present market values.

Data analysis by Sosovalue reveals that, with the exception of the Grayscale Bitcoin Trust (GBTC), all other Bitcoin ETFs available on spot markets have seen a net increase in investments, up to and including the 2nd of December. On the 3rd of December, no flows were recorded for GBTC.

Critics never miss the opportunity

On the other hand, even as optimism thrives about institutional acceptance of Bitcoin, there are skeptics within the cryptocurrency realm who express worries about its possible centralization.

It’s suggested that firms such as BlackRock, due to their increasing ownership of Bitcoin, might potentially challenge the core values of decentralization that underpin the creation of Bitcoin.

Some people argue that the increasing influence of institutions could conflict with Bitcoin’s core principles, as it was created to give individuals more control and lessen dependence on centralized authority. This raises concerns about how these developments might impact Bitcoin’s original values in the future.

For instance, one user on X noted,

“There once was a dream that was Bitcoin… this is not it,”

Blackrock’s Bitcoin ETF outshines major Bitcoin holding firms

As a researcher, I’ve recently observed an intriguing evolution in Bitcoin holdings amongst significant corporate entities, as per the recent disclosures from BitcoinTreasuries.

Despite MicroStrategy being the biggest corporate Bitcoin owner after buying an additional 402,100 BTC for $1.5 billion through stock sales, institutional Exchange-Traded Funds (ETFs) such as BlackRock’s IBIT are now outpacing corporate treasuries in terms of Bitcoin accumulation.

Currently, MARA Holdings, a significant player in crypto mining, has strengthened its status as the second-largest corporate holder of Bitcoin. This is due to their acquisition of 6,484 Bitcoins worth approximately $618.3 million over the past few months, adding to their existing stockpile of 28,310 BTC.

The increasing rivalry underscores the swift uptake of Bitcoin by not only large-scale investors but also corporations, as well.

In the midst of all the current excitement, Bitcoin was being exchanged for approximately $96,635.38. This increase came from a rise of about 1.35% over the previous 24-hour period, according to CoinMarketCap’s data.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- Playmates’ Power Rangers Toyline Teaser Reveals First Lineup of Figures

- FANTASY LIFE i: The Girl Who Steals Time digital pre-orders now available for PS5, PS4, Xbox Series, and PC

- SOL PREDICTION. SOL cryptocurrency

- Solo Leveling Arise Tawata Kanae Guide

2024-12-04 14:16