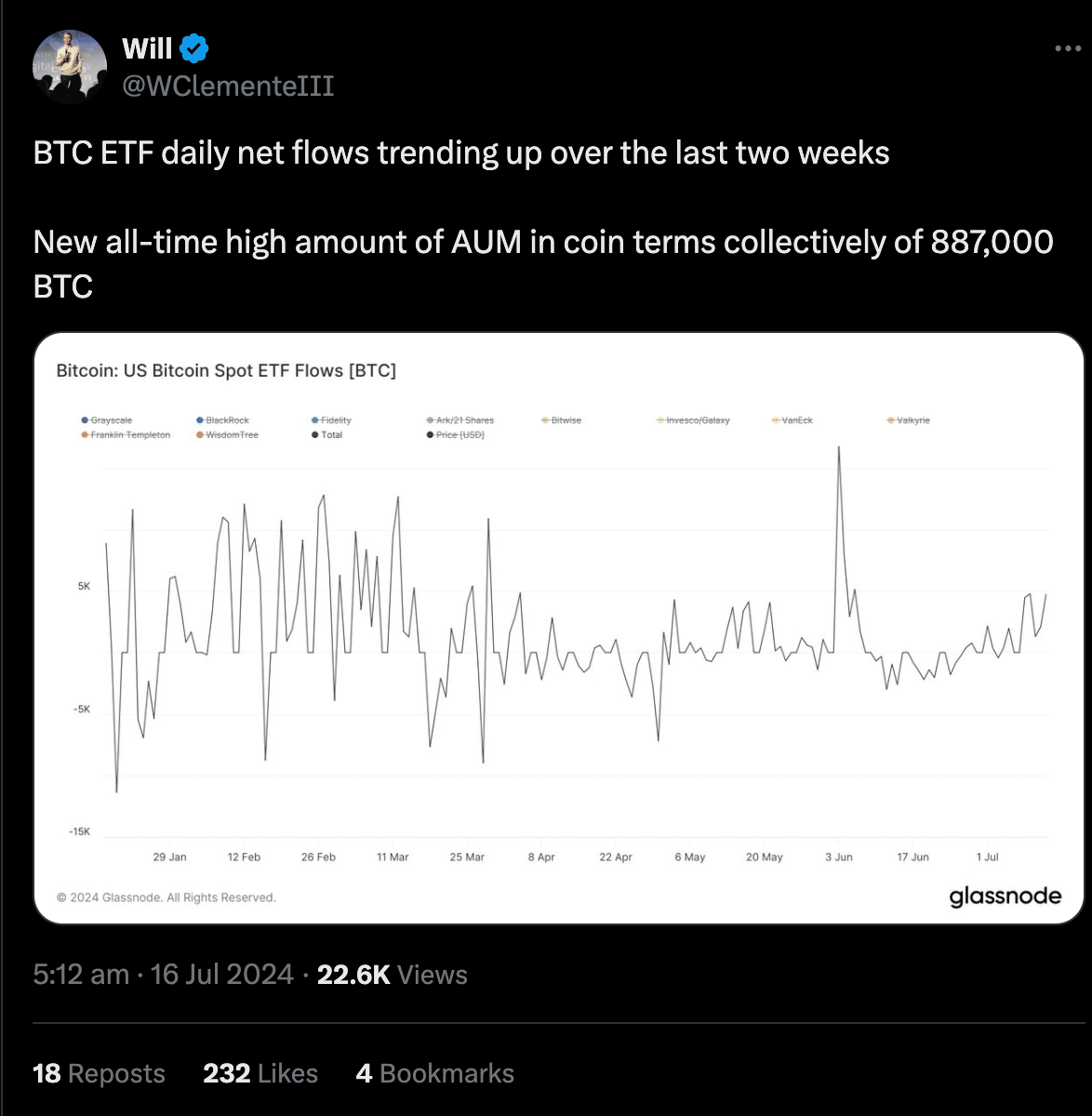

- Bitcoin ETF inflows surged over the past week as prices increased.

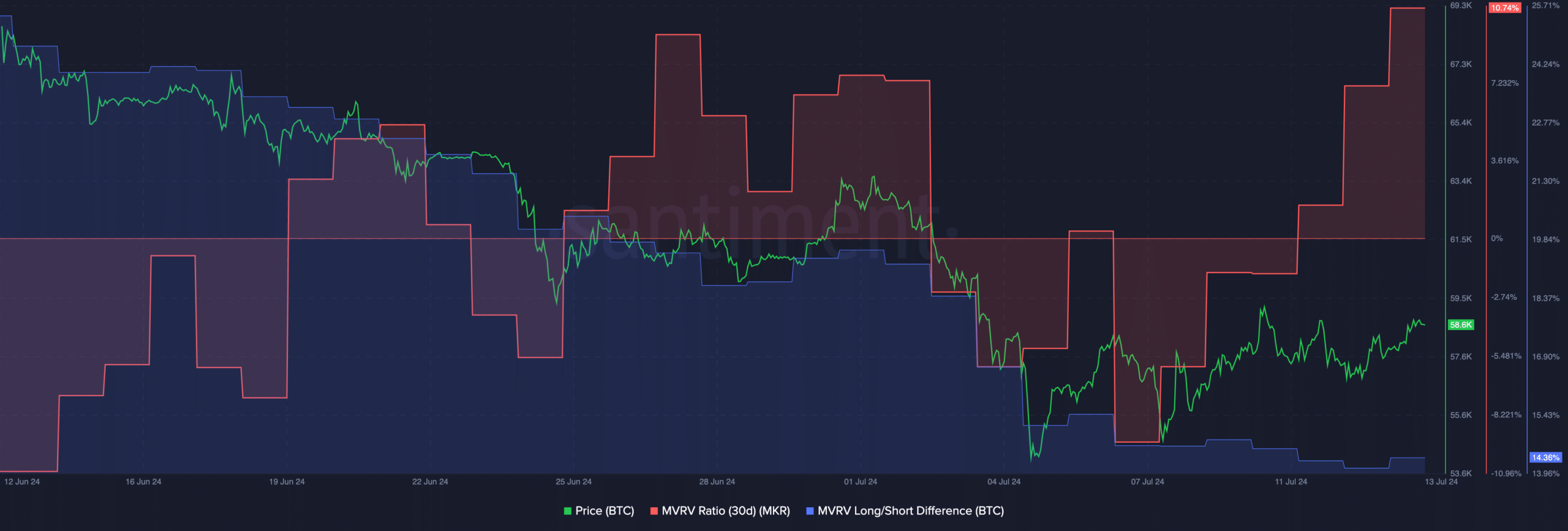

- MVRV also spiked, indicating that profitability of holders had surged.

As a seasoned crypto investor with several years of experience under my belt, I’ve witnessed the volatile nature of this market firsthand. The recent surge in Bitcoin ETF inflows and spiking MVRV ratio are two significant indicators that have piqued my interest.

Over the past several days, Bitcoin [BTC] has experienced a rebound and undergone a significant price increase. The entrance of Exchange-Traded Funds (ETFs) into the market has significantly contributed to this uptrend.

ETFs come to the rescue!

Since their debut in January 2024, Bitcoin exchange-traded funds (ETFs) have experienced an extraordinary influx of funds to the tune of $16.35 billion. This significant increase in investor attention reached a new pinnacle during the week ending on July 15th, with a historic $1.05 billion added to these ETFs.

Market analysts interpret the significant increase in assets managed by Bitcoin ETFs as a positive sign, sparking suspicion that the cryptocurrency might have reached its lowest point and could potentially recover.

Together, these ETFs currently possess around 888,607 Bitcoins in aggregate, which represents roughly 4.5% of the existing Bitcoin supply.

The intense interest in investing is fueled by a combination of large institutions and individual investors. Some funds have reported impressive weekly inflows, reaching up to $310 million.

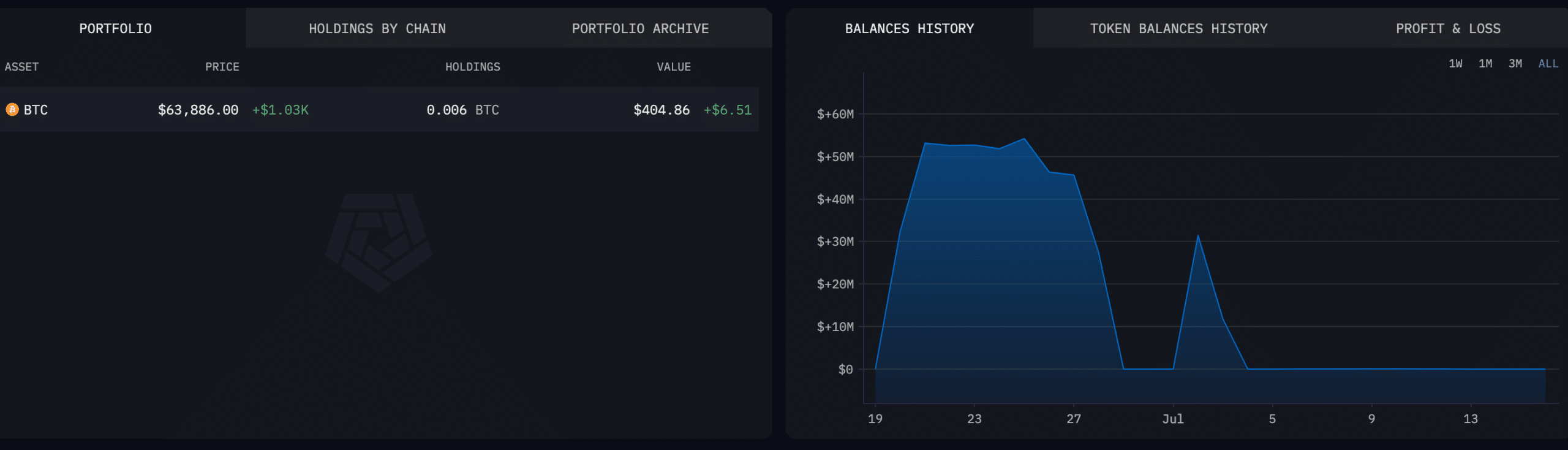

Germany’s BTC holdings

The German government’s actions contributed to the drop in price prior to the recent increase.

Recently, Germany sold bitcoin worth approximately $3 billion in total through different crypto exchanges and trading companies. This sudden large-scale disposal caused a significant ripple effect in the bitcoin market. Fortunately, this major transaction was completed by the end of last week.

It’s quite unexpected that since then, the government has amassed around $420 worth of Bitcoin from various digital wallets.

Over forty-five transactions were processed for the received funds, with the largest transaction being $118 and taking place on the 13th of July, according to an analysis of the blockchain data conducted by Arkham.

The German administration has clandestinely acquired a modest amount of Bitcoin through various transfers. These Bitcoins were transferred by individuals voicing their dissatisfaction towards the German government.

Certain transactions contained uncommon mentions, like Adolf Hitler and Elon Musk, as well as other profanities.

Read Bitcoin (BTC) Price Prediction 2024-25

As a crypto investor, I’m seeing some positive movements in the market at present. Specifically, Bitcoin (BTC) is currently priced at $63,882.81 according to the latest updates. Over the past 24 hours, its value has risen by an impressive 1.53%. This price increase has triggered a surge in the MVRV (Maker’s Realized Value) ratio for Bitcoin. In simpler terms, this means that most Bitcoin holders are currently sitting on profits as the price hike has made their initial investment cost lower than the current market value.

Although the positive effect of profits on sentiment is a factor, Bitcoin holders may feel compelled to sell their BTC, thereby increasing the supply and potentially putting downward pressure on its price.

Read More

- The Weeknd Shocks Fans with Unforgettable Grammy Stage Comeback!

- Gaming News: Why Kingdom Come Deliverance II is Winning Hearts – A Reader’s Review

- The Elder Scrolls IV: Oblivion Remastered – How to Complete Canvas the Castle Quest

- Hut 8 ‘self-mining plans’ make it competitive post-halving: Benchmark

- Jujutsu Kaisen Reveals New Gojo and Geto Image That Will Break Your Heart Before the Movie!

- Taylor Swift Denies Involvement as Legal Battle Explodes Between Blake Lively and Justin Baldoni

- S.T.A.L.K.E.R. 2 Major Patch 1.2 offer 1700 improvements

- Solana – Long or short? Here’s the position SOL traders are taking

- Lilo & Stitch & Mission: Impossible 8 Set to Break Major Box Office Record

- Kylie & Timothée’s Red Carpet Debut: You Won’t BELIEVE What Happened After!

2024-07-16 15:03