- Bitcoin ETFs surpassed $20 billion in inflows in their debut year, outpacing Gold ETFs by 10 times.

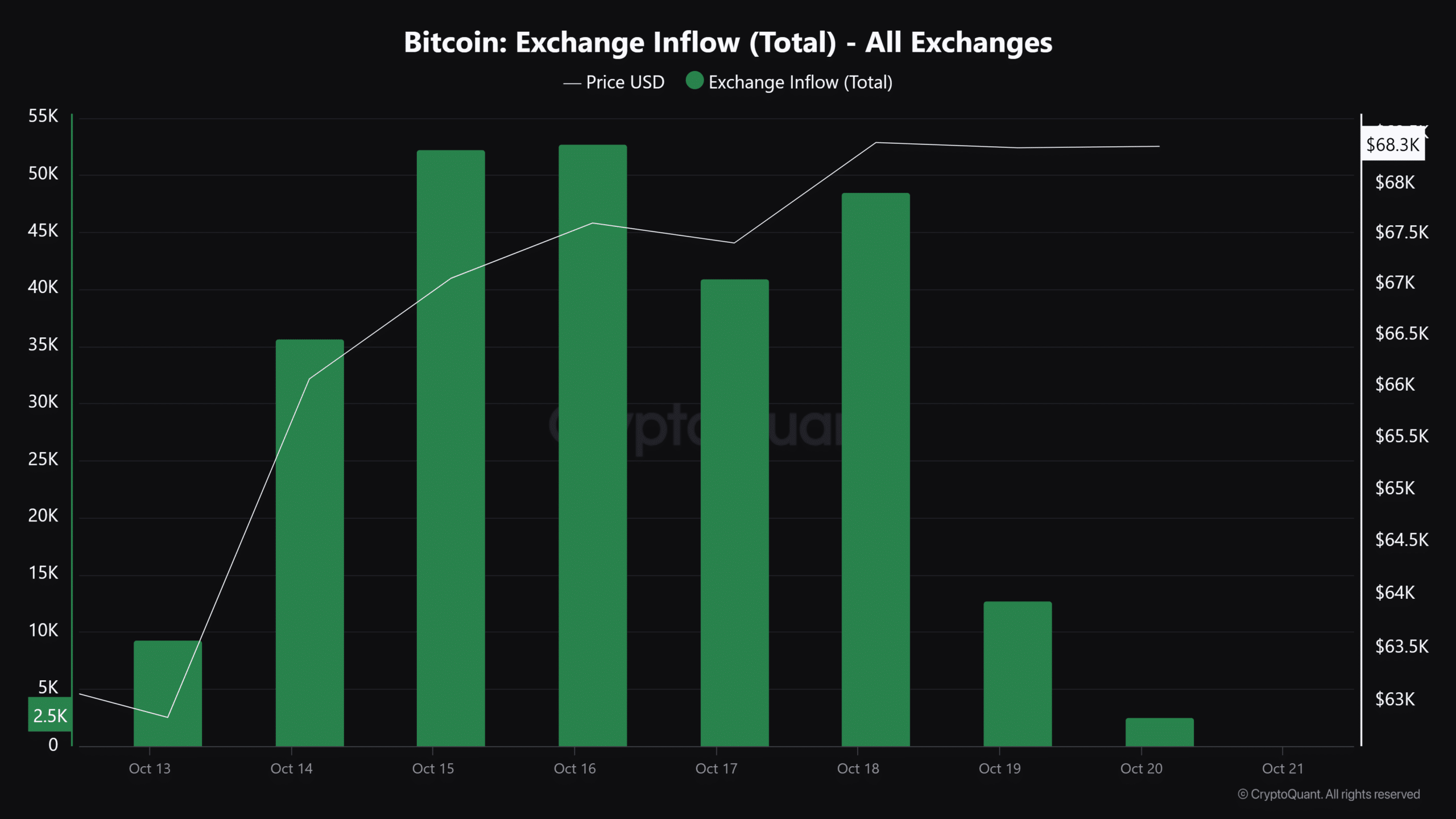

- BTC exchange inflows drop by 95.93% in 48 hours, while its social volume rises steadily.

As a seasoned analyst with over two decades of experience in the financial markets, I find myself intrigued by the dynamics unfolding within the Bitcoin ecosystem. The rapid success of Bitcoin ETFs, surpassing Gold ETFs by a whopping 10 times in their debut year, is a testament to the growing interest in digital assets and further solidifies Bitcoin’s position as a key player in the investment universe.

In the past year, American Exchange-Traded Funds (ETFs) focused on Bitcoin (BTC) have accumulated approximately $20 billion in investments, according to a recent tweet from MartyParty.

In comparison, Gold ETFs experienced far less investment during their initial year compared to the significant inflows seen here.

The rapid adoption of BTC ETFs underlines increasing interest in digital assets, further cementing Bitcoin’s position as a key player in the investment universe.

Bitcoin exchange inflows dip

Over the past two days, there’s been a substantial decrease – more than 95.93% – in the inflow of Bitcoins into exchanges, while ETFs are experiencing increased investments instead.

This suggests a shift in investor behavior as fewer participants are moving their BTC to exchanges.

As a result, a decrease in incoming assets might suggest that the owners are confident (bullish) about their investment, choosing to keep the assets instead of selling them.

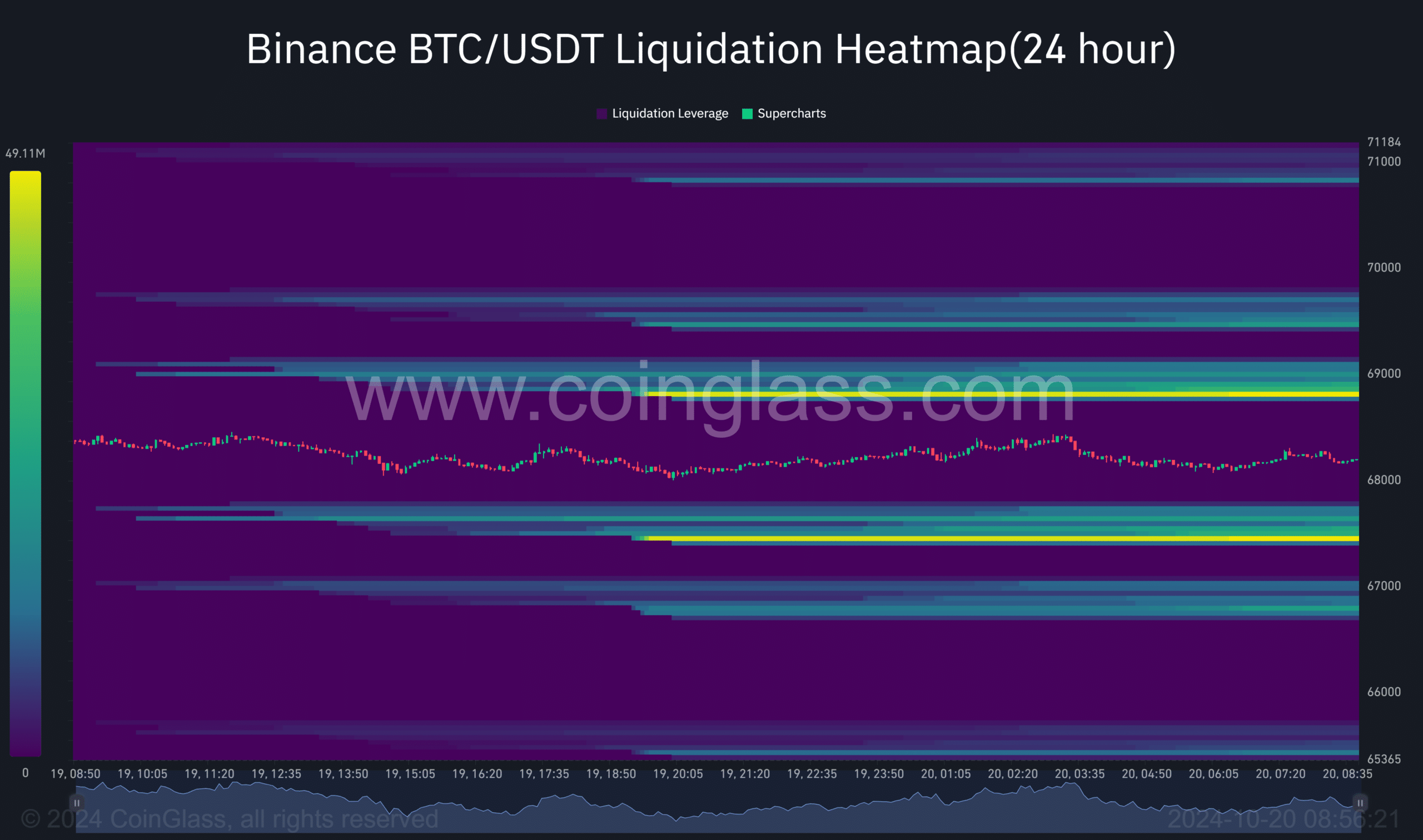

Liquidity heatmap settles at equilibrium

AMBCrypto analysis of the liquidity heatmap data revealed a balance in Bitcoin’s liquidity levels.

In just the last day, the supply of cryptocurrency has balanced out at two key prices – $68,800 and $67,500. Remarkably, there is approximately equal volume of 49.12 million units at each price point.

It seems like this could suggest that Bitcoin (BTC) might be preparing for a period of consolidation, building up strength to potentially drive its prices higher.

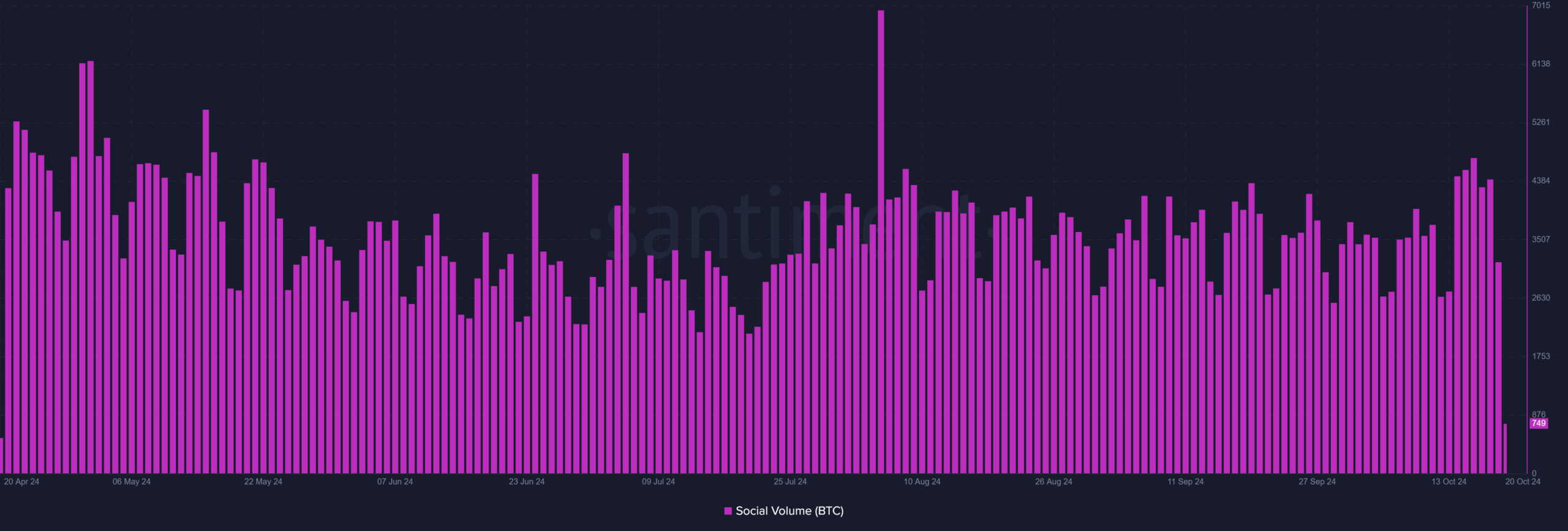

Bitcoin social volume on the rise

Boosting the funds flowing into the ETF and market stability are being complemented by a steady rise in Bitcoin’s social activity or engagement.

Starting from October 12th, there’s been a noticeable increase in the social activity surrounding Bitcoin. This suggests that more people are getting involved and showing greater enthusiasm within Bitcoin-related communities.

The recent increase in social conversations implies that Bitcoin has regained popularity as a widely-discussed subject, with many individuals expressing opinions on its value, features, and possible future developments, beyond just analysts and investors.

Read Bitcoin’s [BTC] Price Prediction 2024–2025

Historically, as social volume rises, so does market interest and activity.

As a researcher studying the Bitcoin market, I’ve noticed an optimistic perspective emerging. The thriving performance of Bitcoin-based Exchange Traded Funds (ETFs), dwindling exchange inflows, well-maintained liquidity levels, and a surge in social engagement all indicate a bullish forecast for Bitcoin’s future.

Read More

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- The Lowdown on Labubu: What to Know About the Viral Toy

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Microsoft Has Essentially Cancelled Development of its Own Xbox Handheld – Rumour

- Gold Rate Forecast

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

2024-10-20 21:11