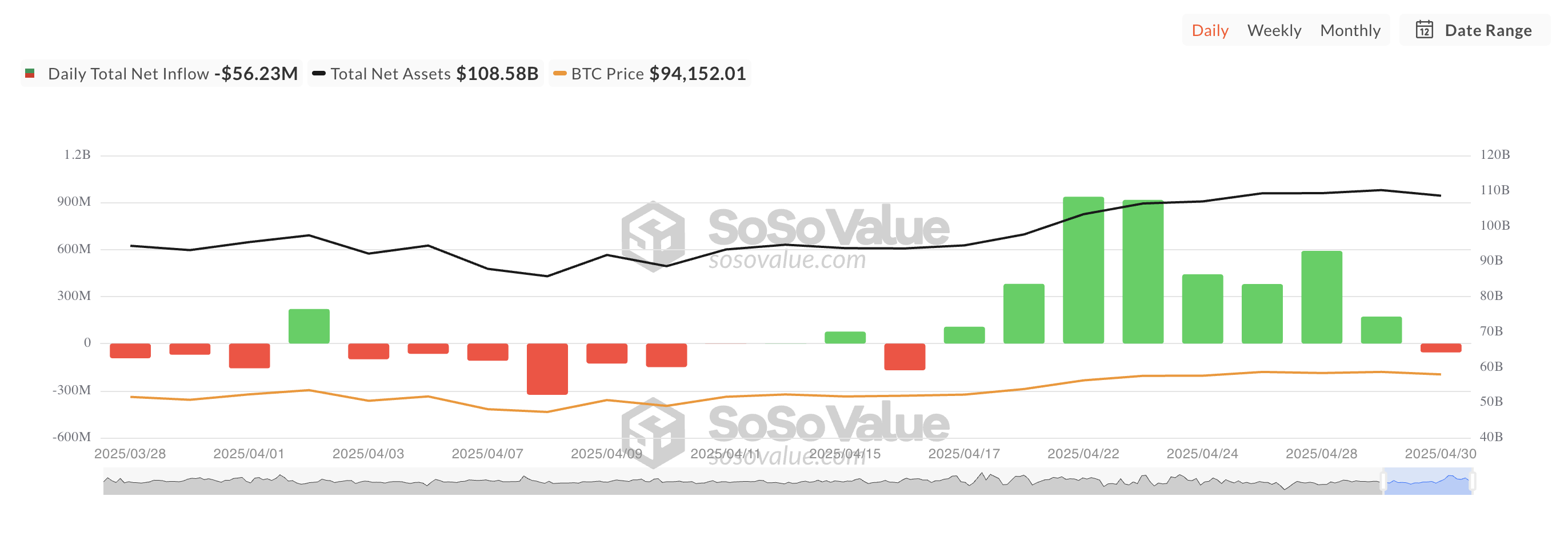

On Wednesday, the Bitcoin spot ETFs suffered their first net outflow since April 16, putting an end to an eight-day streak of relentless inflows. Oh, the horror! 😱

The outflow marked a dramatic reversal after these funds had collectively managed to pull in over $2 billion in net inflows during the previous eight trading sessions. A true tale of riches followed by… a sudden *sigh*.

Bitcoin ETFs Suffer a Shocking $56 Million Exit Amid a Dull Price Plateau 😬

Yesterday, the total net outflow from BTC spot ETFs came to a hefty $56.23 million. A move that, let’s face it, could have been avoided. This sudden shift in funds flow strongly suggests a potential “chill” in institutional demand after an extended period of accumulation. We all saw it coming, didn’t we? 😉

BTC’s price has been stuck in a rut since April 25, and, let’s be honest, nobody likes a stuck coin. A quick glance at the BTC/USD one-day chart shows that the leading coin has been trading within a tight range ever since, banging its head on resistance at $95,427 and finding solace (or maybe pity) at $93,749.

With BTC refusing to break free from its comfy box, some investors, those brave souls, are opting to “de-risk” their positions by withdrawing capital from BTC-backed funds. Because who wants to hang around in a stagnant pool, right? Not even the bravest of us. A prolonged sideways market brings uncertainty, and let’s face it, no one’s got time for that! 💸

But fear not, for BlackRock’s iShares Bitcoin Trust (IBIT) stood tall as the only fund to buck the trend, with a net inflow of $267.02 million. Such an overachiever! This little hero brings its total historical net inflow to a cool $42.65 billion. Not bad at all! 💪

On the other hand, Fidelity’s FBTC saw a dramatic $137.49 million exodus in just a single day. Gasp! But, despite the pain, FBTC’s total historical net inflow still holds strong at $11.63 billion. So, don’t feel too bad for it. It’ll be fine. 😌

BTC Derivatives Market: A Hot Mess of Confusion and Half-Hearted Optimism

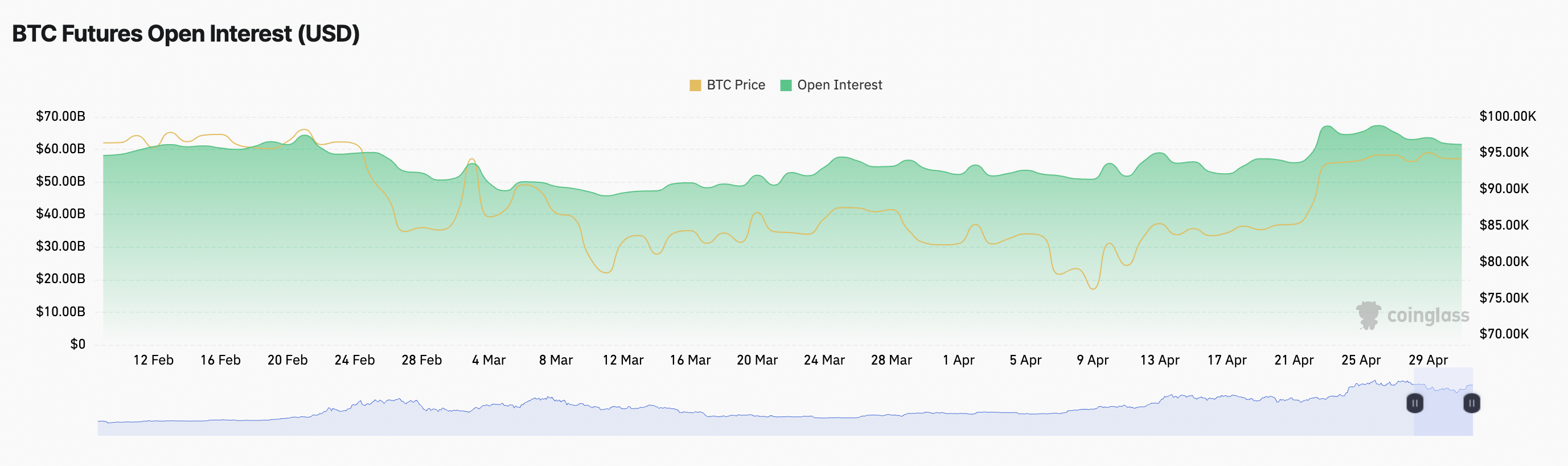

Meanwhile, in the land of derivatives, traders seem as confused as ever. Even though the price is stagnant, the data shows a mixed sentiment among them. Open interest in BTC futures has dipped ever so slightly, signaling that traders are getting a bit tired. Or perhaps they’re just waiting for a better show? 👀

At press time, open interest stands at $61.50 billion, with a 1% dip over the last 24 hours. A drop in open interest? Yeah, it probably means people are cashing out, not jumping in. When everyone’s pulling back, you can’t help but wonder: is this a case of fear, or just “eh, whatever”? 🤷♂️

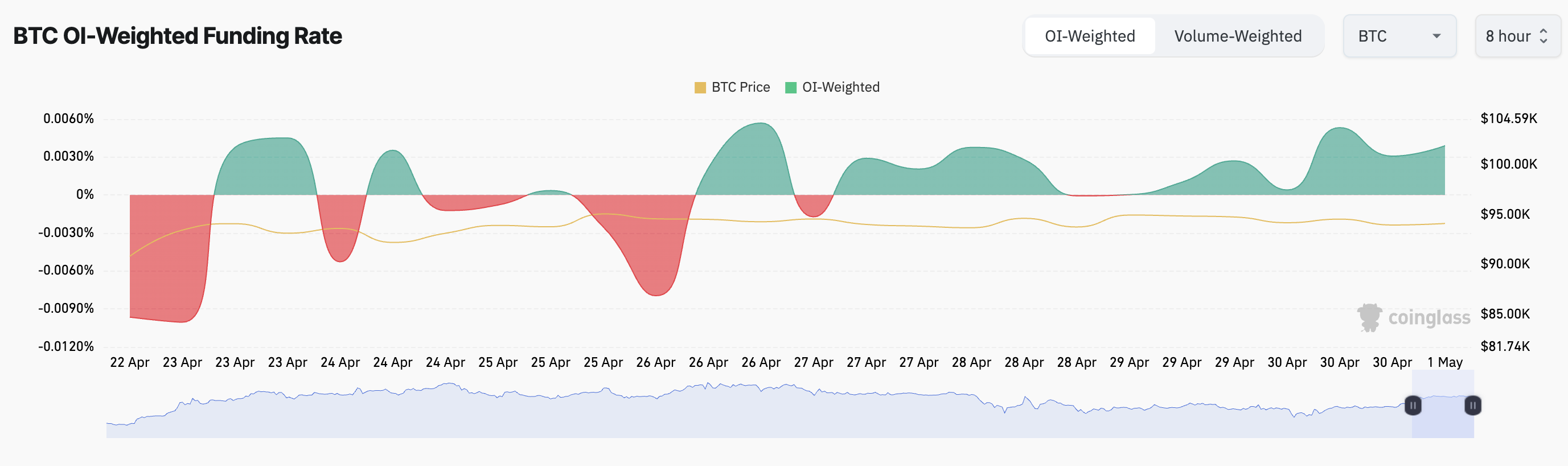

Yet, amidst all the uncertainty, the coin’s funding rate remains positive. This tiny glimmer of hope at 0.0039% suggests that long traders are still holding onto their dreams of a future rally. I mean, there’s always hope, right? 🌟

This bullish sign indicates that, despite BTC’s price stagnation, many futures traders are still betting that a rally is right around the corner. We love a good underdog story, don’t we? 🎉

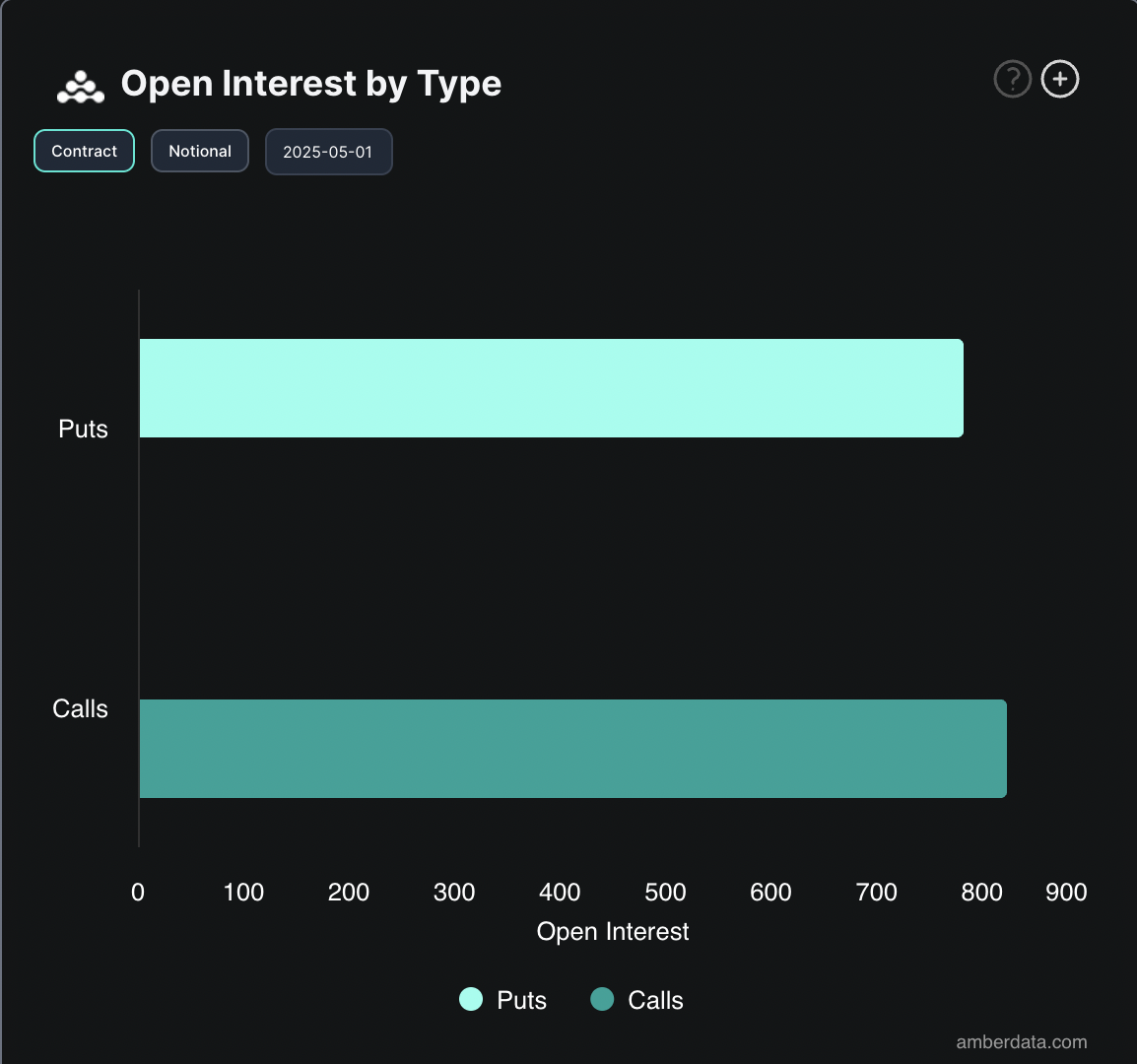

Furthermore, the options market is showing a preference for calls over puts, which means some market participants still believe in an upward breakout. Maybe they’re just trying to will it into existence? 📈

The ETF outflow might just be a little profit-taking after an impressive April performance, but don’t worry, futures and options data suggest investors aren’t ready to turn bear just yet. The drama continues! 🍿

Read More

- Gold Rate Forecast

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

2025-05-01 09:31