-

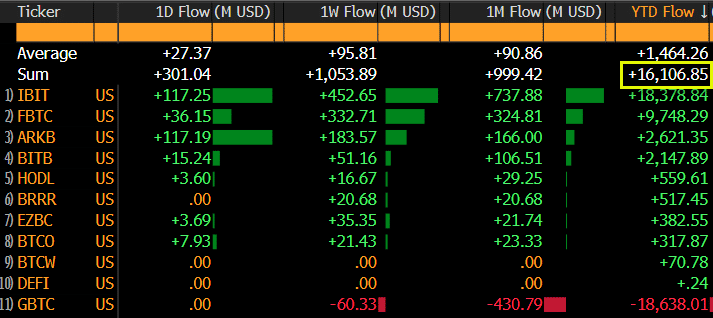

US spot BTC ETFs hit $16 billion in net flows, outperforming estimates in a record six months.

BlackRock’s IBIT tops with over $20 billion in net assets and $18.6 billion in net flows

As a seasoned researcher with extensive experience in following the crypto market, I have witnessed the remarkable growth and success of U.S. spot Bitcoin ETFs over the past six months. The recent milestone achieved by these ETFs, with $16 billion in net flows surpassing initial estimates, is truly awe-inspiring.

Without a doubt, the introduction of Bitcoin [BTC] ETFs in the U.S. markets has proven to be a major achievement in the crypto industry’s annals.

As a researcher studying the Bitcoin Exchange-Traded Fund (ETF) market, I’ve recently observed an impressive milestone: a total of $16 billion in net inflows within just six months. This surpasses the estimates provided by Bloomberg analysts, who projected a more gradual increase of between $12 and $15 billion in net flows over the course of twelve months.

At the festive event, Eric Balchunas, an ETF analyst at Bloomberg, admitted that their predictions had been surpassed.

For the first time, the YTD net total has surpassed the $16 billion mark. This is a significant milestone as our initial projections estimated a figure between $12 and $15 billion for the first twelve months. With six months still remaining in the year, we have already exceeded this target.

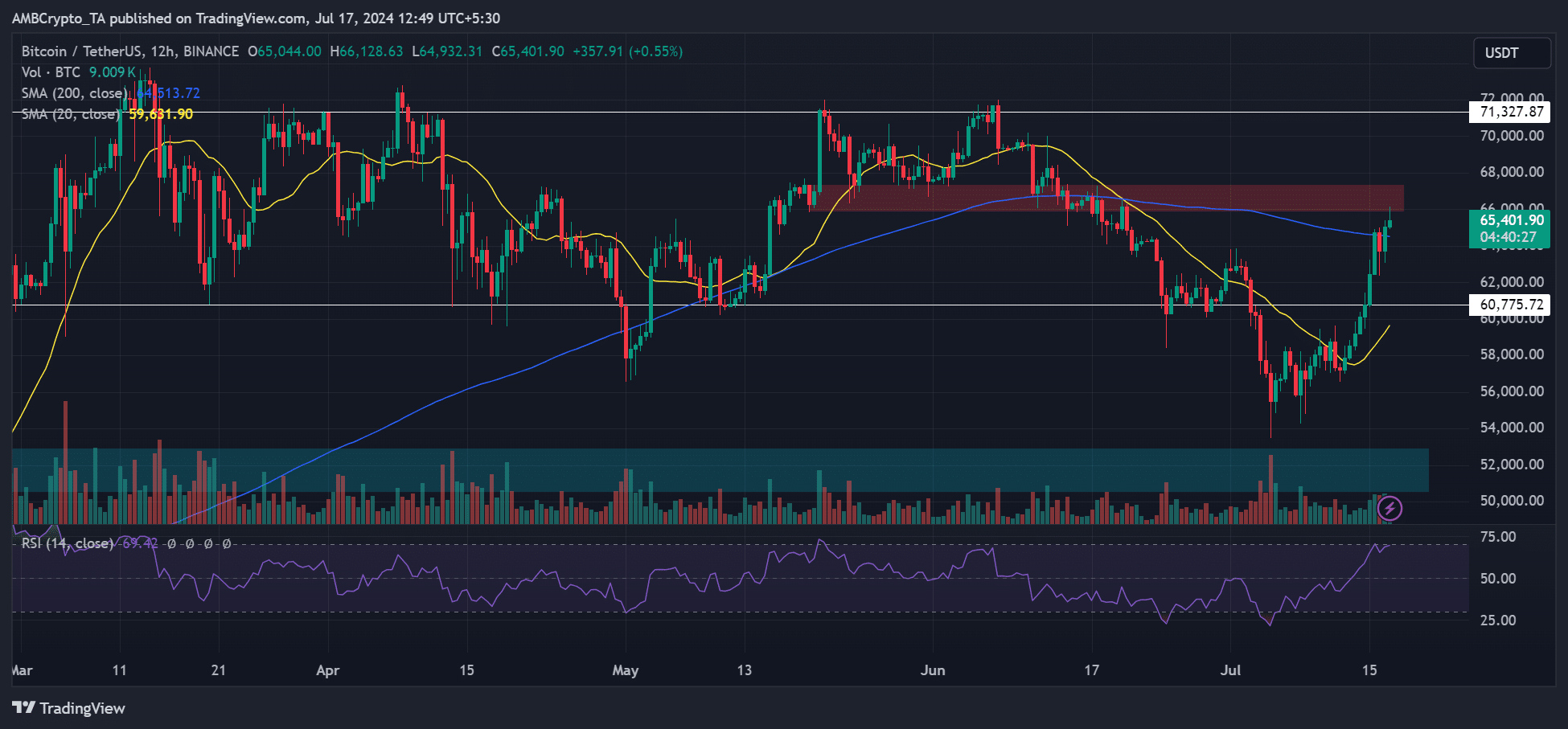

Interestingly, the recent BTC recovery above $60K also saw renewed inflows into the ETFs.

Balchunas stated that the products had made significant strides, having earned over $300 million on the 15th of July and approximately $1 billion on a weekly adjusted basis.

BlackRock leads BTC ETFs

As a crypto investor, I’m thrilled to share that BlackRock’s growth in the US spot Bitcoin ETFs has been truly impressive. Just last Tuesday, their iShares Bitcoin Trust (IBIT) attracted an impressive net inflow of $260 million and reached a daily trading volume value of an astounding $1 billion.

According to recent data from Soso Value, BlackRock’s Bitcoin Investment Trust (BTC ETF) boasted the largest net assets at $20.9 billion as of the current report, outperforming Grayscale’s GBTC and Fidelity’s FBTC with respective net assets of the second and third ranks.

In the latest data, BlackRock came out on top with a net inflow of approximately $18.6 billion, while Fidelity trailed behind with around $9.8 billion in new investments.

Nate Geraci of ETF Store was surprised by the rapid expansion of BlackRock, leading him to observe that financial advisors and institutional investors have been flocking to join this growing trend.

The iShares Bitcoin ETF has surpassed $20 billion in assets and recorded over $2.5 billion in investments on an ordinary Tuesday – a significant milestone just six months after its debut. Institutional investors and financial advisors are increasingly participating in this burgeoning market.

Will Mt. Gox’s repayment derail the party?

As a crypto investor, I’ve noticed that Mt. Gox has recently transferred a significant quantity of Bitcoin to Kraken. This action has sparked fresh concerns among the community following the massive Bitcoin sell-off in Germany last week.

Market analysts generally advised that Mt Gox’s distribution estimate was too high, considering the impending debut of US-listed Ethereum spot ETFs the following week.

As a crypto investor, I observed an uptrend in Bitcoin’s price on the charts. The short-term and long-term trends were indicated by the 20-day Simple Moving Average (SMA) and 200-day SMA respectively, both of which had BTC trading above them.

The price reached $65,400 before encountering significant resistance and a potential roadblock, denoted by the red markings. Overcoming this hurdle might lead to a renewed attempt to touch the high end of the range at $71,000.

The founders of Glassnode expressed optimism, but cautioned that any unfavorable market news could dampen their bullish perspective.

“The chart indicating our primary risk and reward dynamics indicates a move toward a more optimistic market scenario for Bitcoin. The Bitcoin Risk Indicator has bounced back, though it still signifies a high level of risk.”

Read More

- WCT PREDICTION. WCT cryptocurrency

- LPT PREDICTION. LPT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

- SOL PREDICTION. SOL cryptocurrency

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- Peter Facinelli Reveals Surprising Parenting Lessons from His New Movie

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

2024-07-17 14:15