- Bitcoin ETFs saw $1 billion in inflows, nearing Satoshi’s holdings and gold ETFs.

- Bitcoin’s 160% rise in 2024, now worth $1.91 trillion, challenged gold’s market dominance.

As a seasoned researcher with a keen eye for market trends and a deep appreciation for the transformative power of technology, I find myself in awe of Bitcoin’s meteoric rise in 2024. The surge in Bitcoin ETF inflows is a testament to the growing confidence investors have in this digital asset, mirroring the excitement I felt during the dot-com boom of the late 90s.

After the U.S. Presidential election, there’s been a notable increase in Bitcoin’s [BTC] market, as well as an enormous inflow of funds into Bitcoin Spot ETFs.

Indeed, with Bitcoin’s price steadily approaching the $100K threshold, this trend is echoed in the Exchange-Traded Fund (ETF) sector as well.

Bitcoin ETFs update

On November 22nd, as reported by Farside Investors, there was a significant surge of $490.3 million into Bitcoin ETFs. This inflow continues the notable upward trajectory that has been observed.

By the 21st of November, Bitcoin ETFs collectively amassed more than a billion dollars in fresh investments, demonstrating strong interest from investors seeking access to the foremost cryptocurrency during a surge of positive market sentiment.

During the surge of Bitcoin ETF investments, BlackRock’s IBIT has stood out as the frontrunner, reporting a noteworthy $513.2 million on the 22nd of November and an even more substantial $608.4 million on the 21st of November.

Right on its heels is Fidelity’s FBTc, reinforcing its market presence. Conversely, not every Bitcoin ETF is thriving; Grayscale’s GBTC saw a decline, with a loss of $67.1 million on the 22nd of November.

Will they surpass Satoshi Nakamoto’s holdings?

Regardless, there’s been a lot of buzz surrounding the continuous investments into Bitcoin Spot ETFs. These funds are approaching a notable achievement, which could make them the world’s leading Bitcoin holders.

The data appears to indicate a strong possibility of exceeding the remarkable achievements of Satoshi Nakamoto, and it is rapidly approaching the level of gold exchange-traded funds (ETFs) in terms of total net assets.

Remarking on the same, Bloomberg’s Senior ETF Analyst, Eric Balchunas noted,

As a researcher, I’m tracking the growth of US Spot Exchange-Traded Funds (ETFs), and it appears we’re almost there – closing in at 98% of the way to surpassing Satoshi Nakamoto as the world’s largest holder. My best guess based on current trends is that this milestone might be reached by Thanksgiving, making my over/under date increasingly promising.

He added,

If the next three days continue in the same pattern as the last three, it’s almost certain to happen. Additionally, with an asset under management (AUM) of $107 billion, they trail behind gold ETFs by $23 billion. Given this gap, there is a strong possibility that they will surpass it before Christmas.

Journey so far

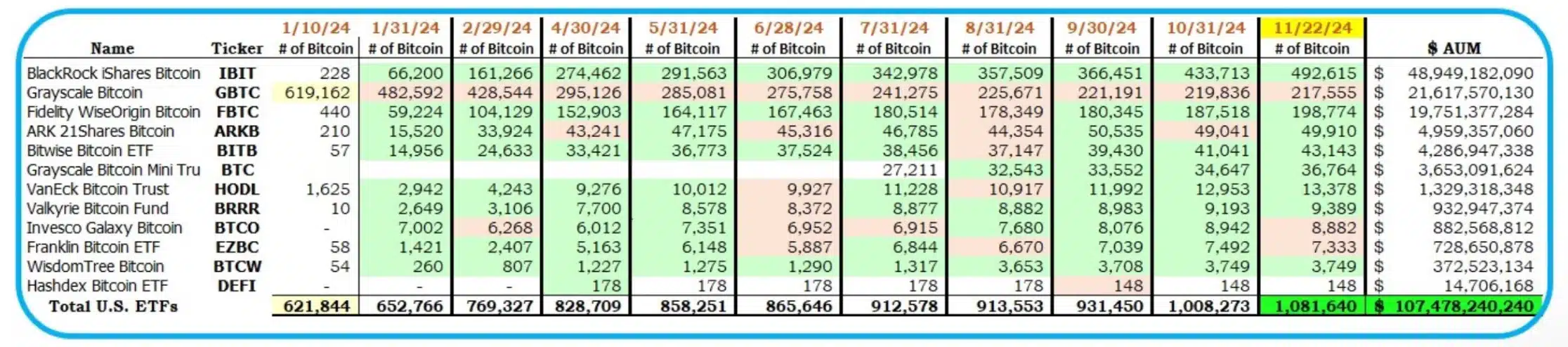

Well, since their debut in January, U.S. spot Bitcoin ETFs have experienced rapid growth.

According to the latest calculations by cryptocurrency expert HODL15Capital, they currently own approximately 1.081 million Bitcoins, nearly matching Satoshi Nakamoto’s rumored 1.1 million Bitcoin stash.

It’s believed that the anonymous inventor of Bitcoin, known as Nakamoto, controls approximately 5.68% of all existing Bitcoins, which equates to a staggering value of more than $100 billion.

Given that Nakamoto is an individual, if they were alive today, their substantial Bitcoin holdings would undoubtedly rank them amongst the world’s wealthiest persons.

The year 2024 and Bitcoin

It’s clear as day that Bitcoin’s outstanding achievements in 2024 have undoubtedly established it as a powerful player in the financial world.

Bitcoin’s price has soared by an impressive 160% since January, bringing it close to the $100,000 threshold. Its staggering market capitalization of $1.91 trillion now outvalues not only silver but also major players like Saudi Aramco in the industry.

Regardless of its significant expansion, Bitcoin remains behind gold, the globe’s most substantial asset, boasting a market value surpassing eighteen trillion dollars.

These trends highlight Bitcoin’s growing prominence but also underscore its ongoing journey to challenge traditional assets like gold for the top spot.

Read More

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Gold Rate Forecast

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

2024-11-26 04:08