- Bitcoin ETFs saw significant inflows of $192.4 million after a brief outflow phase.

- Ethereum ETFs continue to struggle with inconsistent inflows, highlighting market volatility.

As a seasoned analyst with over two decades of experience navigating the volatile world of traditional and digital asset markets, I’ve seen my fair share of market ebbs and flows. The recent developments in Bitcoin and Ethereum ETFs have certainly piqued my interest.

Currently, institutional investors are pausing their rapid buying of Bitcoin, as its value stabilizes during a period of consolidation.

Based on recent reports from several sources like UK investor firm Farside Investors, outflows of funds into U.S. Bitcoin exchange-traded funds (ETFs) have now exceeded inflows for the past fortnight, marking the first negative net flow in two weeks.

This pause in buying activity highlighted growing caution among investors as they assess the next move in BTC’s volatile market.

Bitcoin ETF analyzed

On October 22nd, as per the recent report, there was an outflow of approximately $79.1 million from Bitcoin Exchange-Traded Funds (ETFs).

Of particular interest is that the 21Shares BTC ETF by Ark experienced the most significant withdrawal, totaling approximately $134.7 million, during the decline.

Yet, it’s important to note that not every ETF related to Bitcoin experienced a downturn. In fact, some Bitcoin ETFs actually saw an increase in investment, with BlackRock’s iShares Bitcoin Trust (IBIT) being the top performer, attracting $43 million in new funds.

As a crypto investor, I’ve noticed that the flow of funds into different Bitcoin ETFs is not uniform, indicating diverse sentiments among investors. Each product seems to be attracting investments based on its unique appeal or positioning in the market.

Moreover, starting from October 23rd, there was a significant increase in investments into Bitcoin ETFs, totaling approximately $192.4 million.

Although 21Shares (Ark) remained the chief contributor to outflows with a sum of $99 million, Bitwise’s BITB experienced outflows worth $25.2 million and VanEck’s HODL saw outflows of $5.6 million, the general direction of investments appears to have changed.

Significantly, the investment trust for Bitcoin by BlackRock’s iShares, known as IBIT, saw an impressive influx of $317.5 million, indicating strong interest from investors in this product.

The constant increase suggests that investors are increasingly trusting BlackRock’s Bitcoin ETF as their top pick for investment exposure in the market.

Execs weigh in

As I reflect upon this topic, similar thoughts were expressed by Nate Geraci, a co-founder of the ETF Institute. On his previous platform, he highlighted, or more precisely, tweeted about it.

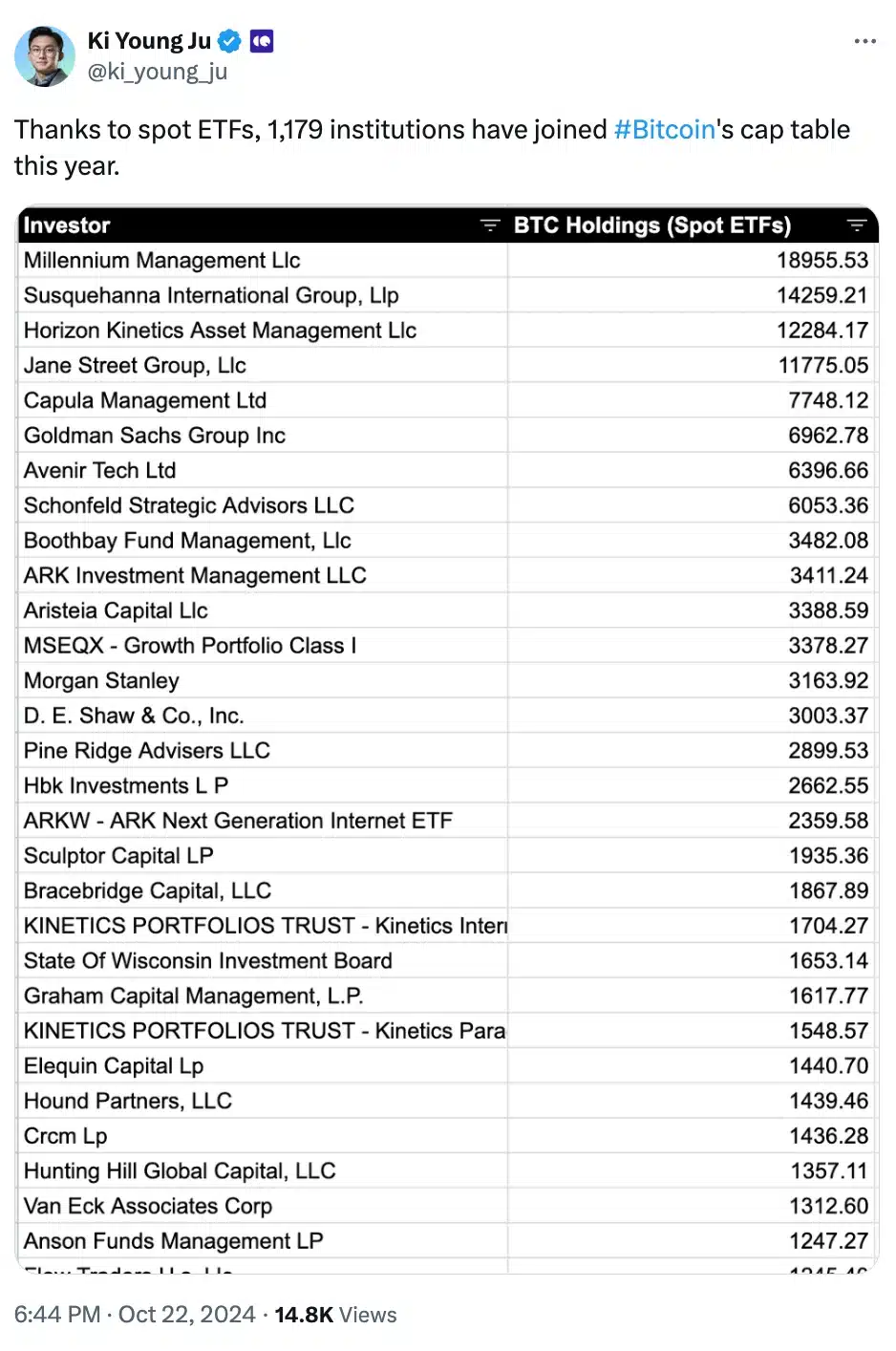

Adding to the fray was Ki Young Ju, co-founder of onchain analytics platform CryptoQuant who said,

Ethereum ETF update

Contrarily, Ethereum ETFs showed varying outcomes on both October 22nd and 23rd. However, they haven’t received the same degree of attention as Bitcoin ETFs.

On October 22nd, there was an overall withdrawal of approximately $11.9 million from ETFs tied to Ethereum (ETH). Interestingly, only BlackRock’s ETHA product experienced inflows, as the rest of the ETFs in this category remained unchanged and did not see any new investments.

The following day, Ethereum ETFs saw modest inflows of $1.2 million.

On the contrary, Grayscale’s ETHE saw withdrawals totaling $7.6 million, while only Fidelity, 21Shares, and Invesco’s Ethereum ETFs experienced investments, suggesting a volatile trend in Ethereum ETF investment choices.

ETH’s and BTC’s price action explained

Currently, according to recent market information, Bitcoin is being traded at approximately $66,811, experiencing a slight upward movement of 0.51% over the last day, demonstrating a consistent trend.

Instead, the value of Ethereum saw a decrease, falling by 2.29% to reach $2,519.34 as reported by CoinMarketCap.

The ups and downs clearly show the persistent instability in the cryptocurrency sector, as Bitcoin continues to climb while Ethereum experiences temporary setbacks.

Read More

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Masters Toronto 2025: Everything You Need to Know

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- The Lowdown on Labubu: What to Know About the Viral Toy

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Microsoft Has Essentially Cancelled Development of its Own Xbox Handheld – Rumour

- Gold Rate Forecast

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

2024-10-24 17:12