-

60% of U.S. hedge funds bought Bitcoin as BTC/USDT broke out.

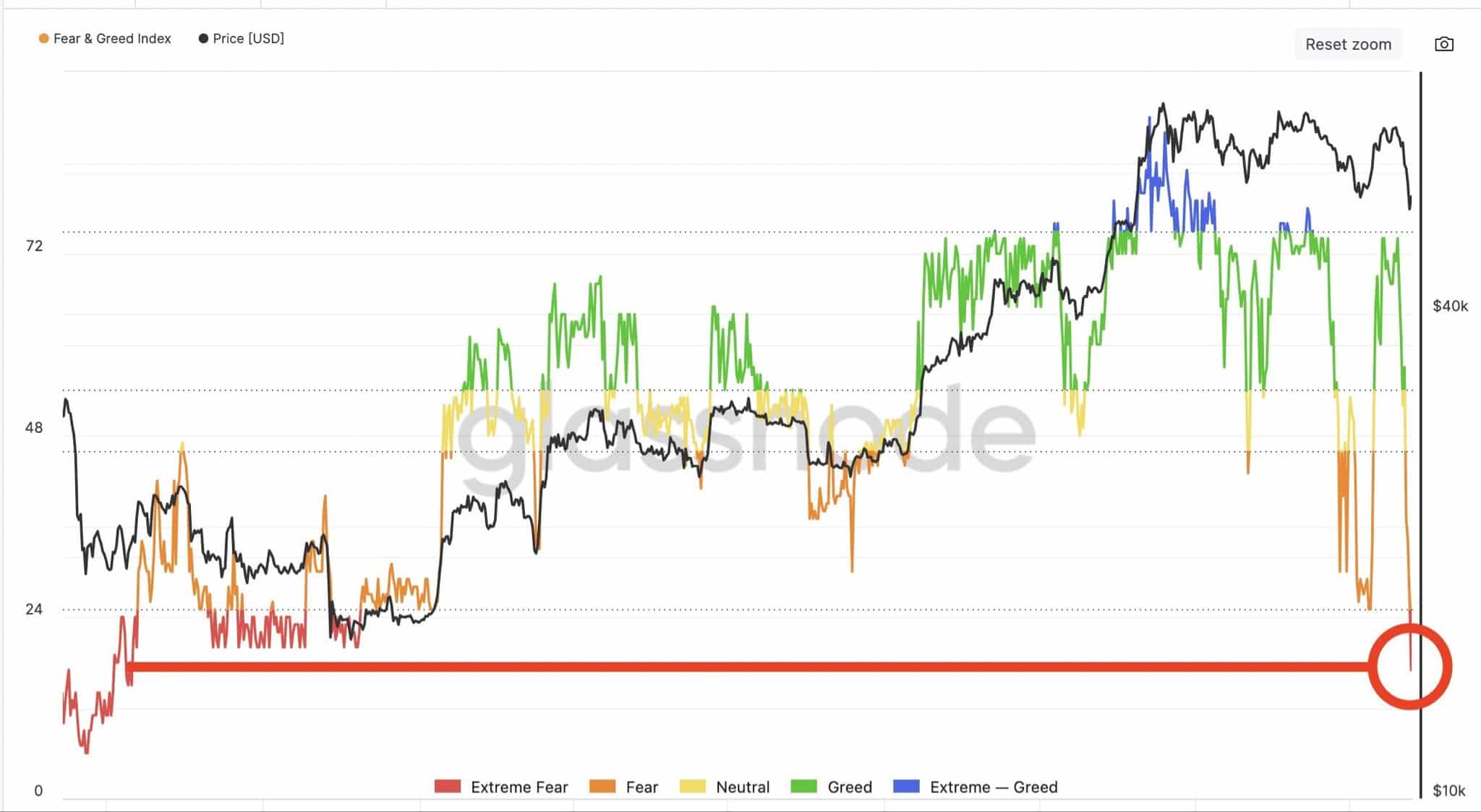

Bitcoin ETFs ownership surged as the Fear and Greed index matched sub-$30K levels.

As a seasoned crypto investor with over a decade of experience in this dynamic market, I must say that the recent developments in Bitcoin (BTC) are nothing short of exhilarating. The institutional influx into Bitcoin and the surge in ownership of Bitcoin ETFs is a testament to the growing acceptance of digital currencies by governments, financial institutions, and large traders.

Bitcoin (BTC) is seeing increased interest from governments, prominent financial organizations, and large investors often referred to as “whales.”

The increasing approval for this phenomenon is also strengthened by rumors that China might lift its prohibition on cryptocurrencies. In fact, around 60% of the biggest U.S. hedge funds have already invested in Bitcoin, as Quinten previously pointed out on X (previously known as Twitter).

In the second quarter of 2024, I found myself among esteemed firms such as Citadel Investment Group, Millennium Management, Mariner Investment Group, and Renaissance Technologies, who all made the strategic decision to invest in Bitcoin ETFs.

As someone who has been closely following the cryptocurrency market for several years now, I have witnessed a significant shift in institutional support towards Bitcoin and the broader crypto markets. From my perspective, this trend is a testament to the growing recognition of the potential that these digital assets hold for the future of finance.

Bitcoin price action analysis

In simpler terms, the price of Bitcoin (BTC) relative to the U.S. dollar (USDT) has burst free from a symmetrical pattern observed in the past 4 hours on the chart, and it’s currently being traded at around $60,000.

The increase in prices that occurred after the dip on August 5th can primarily be attributed to the active participation of institutions, providing significant support at current levels.

Although temporary dips might occur, the $60K figure represents a psychologically important level for Bitcoin. Even with possible ups and downs, Bitcoin seems poised to advance towards its record peak.

Bitcoin ETFs surge as mining difficulty reduces

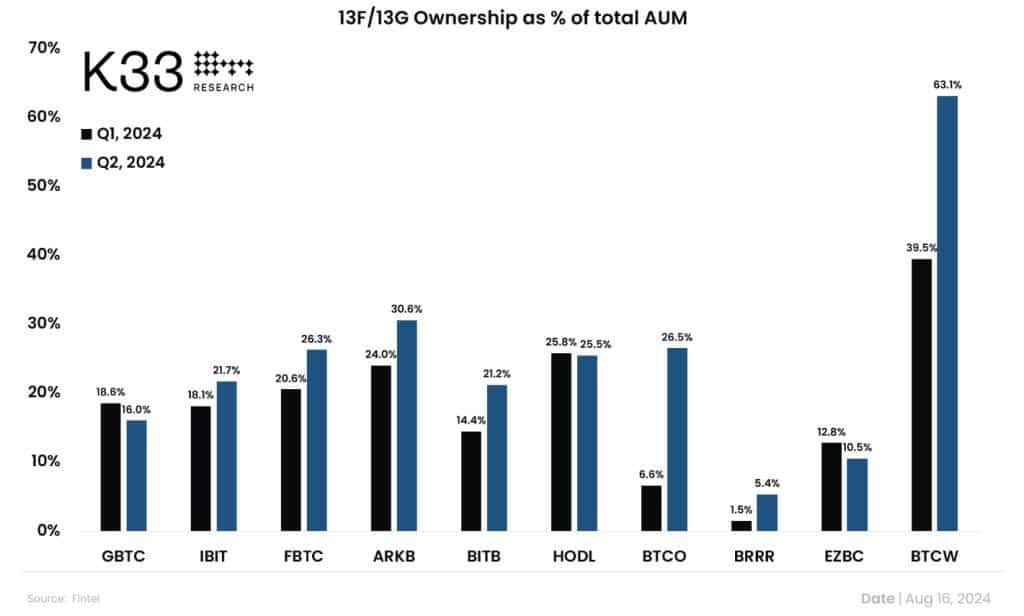

By Q2 of 2024, the ownership of Bitcoin ETFs by institutions experienced a significant jump of 27%. According to K33 Research, this increase was due to 262 new companies joining the U.S. spot Bitcoin ETF market, bringing the total number of firms participating to 1,199 as of June 30th.

The rise signifies a rising trust among institutions towards digital money, leading analysts to predict that Bitcoin might hit a record peak between the end of 2024 and the start of 2025.

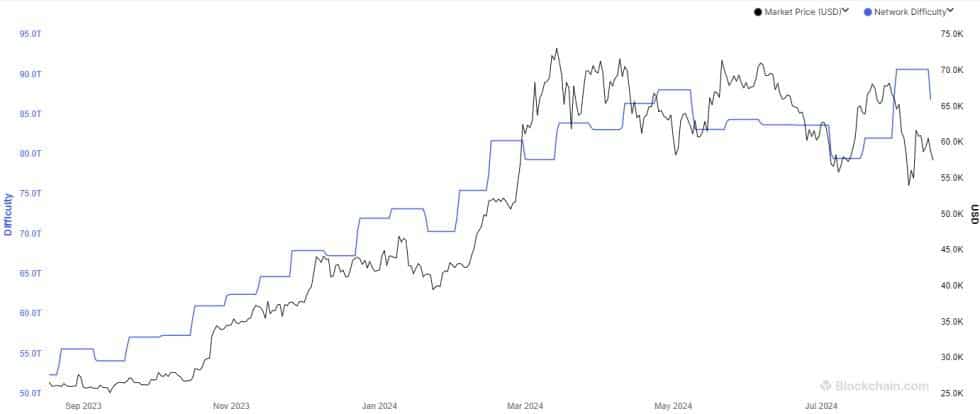

Over the past few days, I’ve noticed that the mining difficulty for Bitcoin has experienced a decrease during its recent bi-weekly readjustment. This alteration impacts the rate at which new blocks are generated within the network, thereby influencing the flow of Bitcoin supply.

A decrease in complexity implies a diminished total computational capacity, enabling miners to maintain a consistent block generation pace, despite having fewer processing capabilities.

Market sentiment at same level when BTC was below $30K

The market sentiment was reading fear at press time, per the Fear and Greed Index.

Read Bitcoin’s [BTC] Price Prediction 2024-25

Currently, the Fear & Greed Index holds similar values as it did when Bitcoin was priced under $30,000, suggesting a comparable level of investor sentiment. This situation previously triggered a surge in Bitcoin’s value, pushing its price up to and even surpassing $45,000.

If other measures continue to advance, the present cost of BTC represents an excellent opportunity to increase your holdings.

Read More

- WCT PREDICTION. WCT cryptocurrency

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- The Elder Scrolls IV: Oblivion Remastered – How to Complete Canvas the Castle Quest

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- AMD’s RDNA 4 GPUs Reinvigorate the Mid-Range Market

- Royal Baby Alert: Princess Beatrice Welcomes Second Child!

- New Mickey 17 Trailer Highlights Robert Pattinson in the Sci-Fi “Masterpiece”

- Studio Ghibli Creates Live-Action Anime Adaptation For Theme Park’s Anniversary: Watch

- SOL PREDICTION. SOL cryptocurrency

2024-08-21 01:14