- Bitcoin Spot ETFs have bled $900M in just five weeks, with a staggering $5.4B fleeing since February. Talk about a mass exodus!

- BTC’s price has taken a nosedive, plummeting nearly 12% to hover around $77,000. Institutional sentiment? More like institutional panic!

So, here we are, watching Bitcoin Spot ETFs experience a dramatic decline in inflows, with over $900 million packing its bags and leaving in the last five weeks. It’s like a bad breakup, and the only thing left is speculation about whether investor confidence is on the rocks. 🍷

As institutional investors scramble to adjust their portfolios amidst a whirlwind of economic and regulatory uncertainty, Bitcoin’s price has also decided to join the party, dipping nearly 12% in the past month. It’s like watching a soap opera, but with more spreadsheets.

With market sentiment shifting faster than a teenager’s mood, a closer look at Bitcoin Spot ETF flows and price trends is essential to deciphering where this rollercoaster is headed next.

BTC Spot ETF outflows: A five-week decline

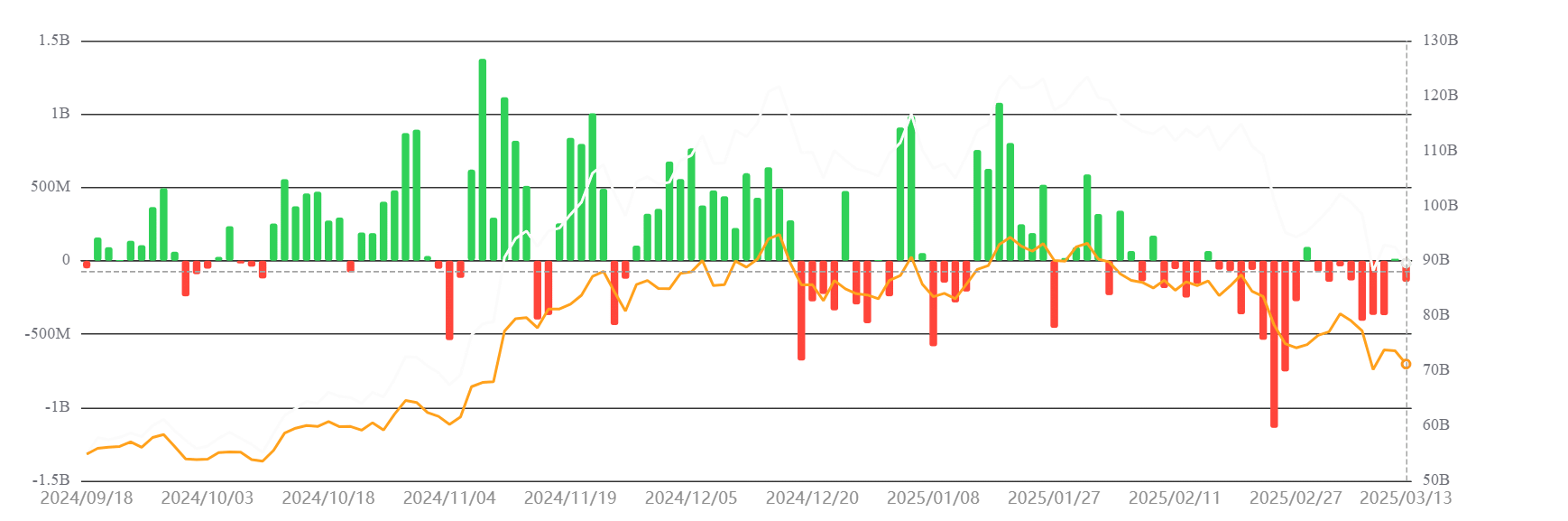

According to the latest gossip from Sosovalue, BTC Spot ETFs have seen sustained outflows, with the latest weekly figures revealing a net outflow of $921.4 million. That’s right, folks, it’s the fifth week in a row that these funds have been on a downward spiral. Can someone please check if they’re okay?

This brings the total outflow to a jaw-dropping $5.4 billion since mid-February. It’s like watching a slow-motion train wreck, but with more zeros involved.

Initially, BTC Spot ETFs were the belle of the ball, attracting significant inflows after their approval. But now? Recent redemptions suggest a shift in investor sentiment, and it’s not looking good.

The timing of these outflows has coincided with Bitcoin’s price decline, which has dropped from a lofty $84,000 to a more humble $77,000. It’s like watching your favorite restaurant go out of business—devastating.

While broader market factors contribute to Bitcoin’s volatility, the persistent ETF outflows indicate that institutional investors might be more cautious than a cat on a hot tin roof when it comes to Bitcoin allocations.

The role of institutional investors in BTC Spot ETFs

One of the key advantages of BTC Spot ETFs is their ability to lure institutional investors into the cryptocurrency market like moths to a flame. Or maybe more like flies to a picnic—either way, it’s a bit messy.

Prominent asset management firms like BlackRock and Fidelity introduced Bitcoin ETFs, offering a regulated investment option that provided Bitcoin exposure without requiring direct ownership. This led to an initial surge in inflows, contributing to Bitcoin reaching an all-time price high. Cue the confetti! 🎉

However, institutional investors are like that friend who can’t make up their mind at a restaurant. They often utilize strategic, short-term capital allocation methods. During periods of market uncertainty, they tend to adjust positions faster than you can say “volatile market,” which might explain the current outflows.

Analysts suggest that institutional investors could be redirecting funds to traditional assets or higher-yield opportunities as global financial markets react to inflation concerns and regulatory changes. Because who doesn’t love a good game of musical chairs?

Factors influencing the outflows

There are several contributing factors to the recent BTC Spot ETF redemptions. One of the most significant concerns is macroeconomic conditions. Surprise, surprise!

Rising interest rates and inflation fears have led investors to reevaluate their portfolios, often prioritizing lower-risk assets over the wild ride that is cryptocurrencies. With traditional markets offering more attractive risk-adjusted returns, Bitcoin Spot ETFs may face increased competition from traditional investment vehicles. It’s like a high school popularity contest, and Bitcoin is losing.

Additionally, Bitcoin’s price volatility plays a role.

Read More

- Solo Leveling Season 3: What You NEED to Know!

- OM PREDICTION. OM cryptocurrency

- Oshi no Ko Season 3: Release Date, Cast, and What to Expect!

- Why Tina Fey’s Netflix Show The Four Seasons Is a Must-Watch Remake of a Classic Romcom

- Captain America: Brave New World’s Shocking Leader Design Change Explained!

- Lisa Rinna’s Jaw-Dropping Blonde Bombshell Takeover at Paris Fashion Week!

- Serena Williams’ Husband’s Jaw-Dropping Reaction to Her Halftime Show!

- Matty Healy’s Cryptic Response Fuels Taylor Swift Album Speculation!

- Oblivion Remastered – Ring of Namira Quest Guide

- Fantastic Four: First Steps Cast’s Surprising Best Roles and Streaming Guides!

2025-03-18 01:15