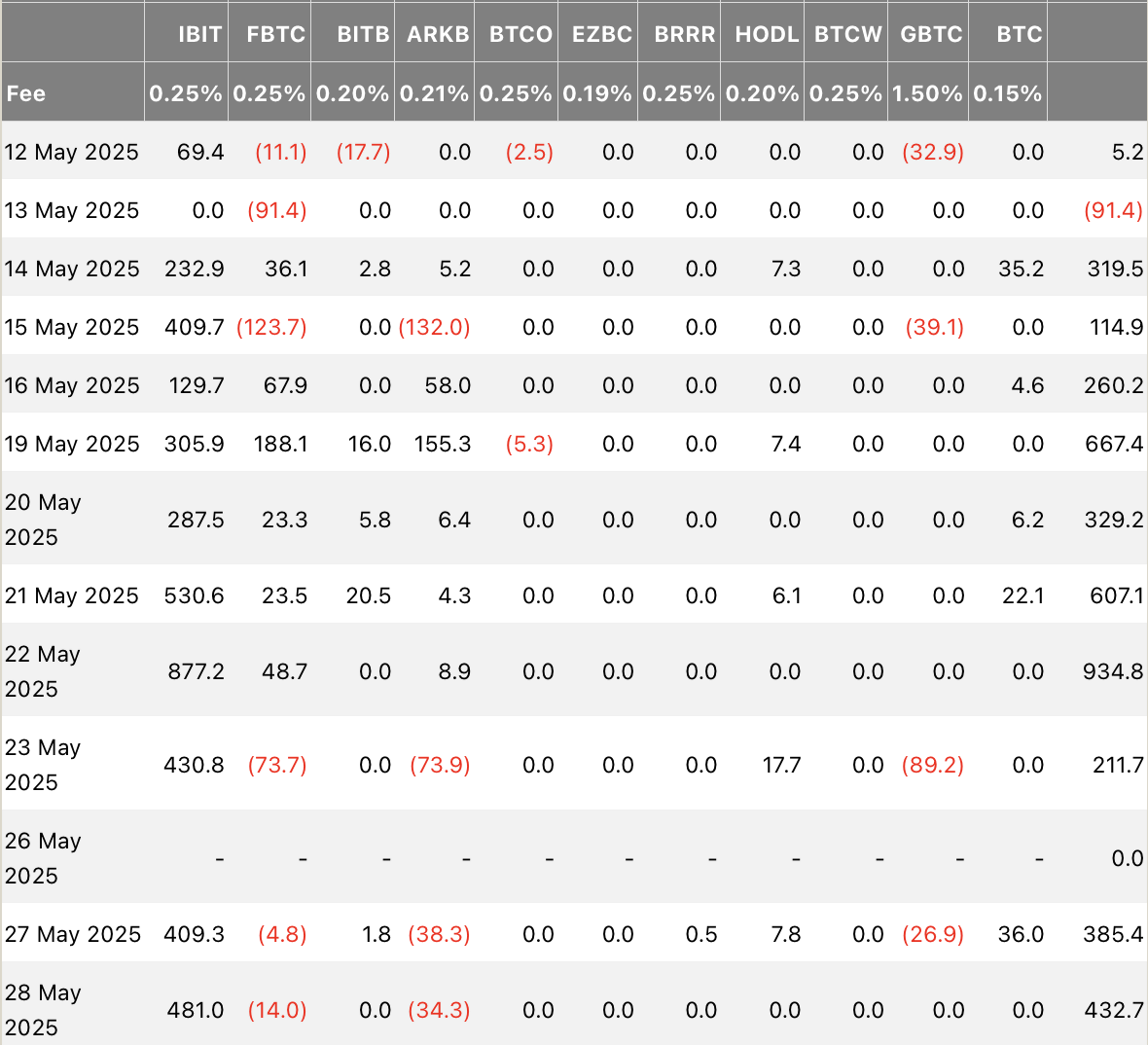

Oh, darling, gather ’round! It appears that our dear ETFs have decided to throw a rather lavish soirée, raking in a staggering $432.7 million in net inflows on Wednesday alone! 🎉 And who, pray tell, is the belle of the ball? Why, none other than BlackRock’s iShares Bitcoin Trust (IBIT), which waltzed in with a fabulous $481 million, leaving the other funds to sulk in the corner with their redemptions and stagnant flows. How positively tragic! 😏

Meanwhile, our friends at ARKB (Ark Invest) and FBTC (Fidelity) have taken a rather unfortunate turn, posting net outflows of $34.3 million and $14 million, respectively. One must wonder if they forgot to bring their wallets! The remaining ETFs? Well, they simply decided to take a day off—how quaint! 💤

But let’s not forget our star performer, IBIT! Over this current 10-day streak, it has contributed a jaw-dropping $4.09 billion, which is approximately 96% of the total inflows. Talk about stealing the spotlight! 🌟

Since its grand debut in January 2024, IBIT has charmed its way into the hearts of investors, attracting a whopping $49 billion in total inflows—more than the entire sector’s cumulative $45.6 billion, excluding Grayscale’s converted GBTC. Quite the overachiever, wouldn’t you say? 🎩

And despite the broader market’s rather dismal performance, with $23.1 billion in net outflows from Grayscale’s higher-fee GBTC, IBIT continues to shine like a diamond in the rough, solidifying its position as the darling of the spot BTC ETFs. It seems everyone wants a piece of this glamorous pie! 🥧

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- LPT PREDICTION. LPT cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- WCT PREDICTION. WCT cryptocurrency

2025-05-29 20:07