Well, darlings, yesterday was quite the spectacle as Bitcoin exchange-traded funds (ETFs) waltzed in with over $85 million in inflows! Can you believe it? Four days of positive movement, and yet, the momentum seems to be slipping through our fingers like sand at a beach party! 🏖️

But hold your horses! While these inflows might suggest a smidgen of investor confidence, the daily volume is doing a rather sad tango, as BTC struggles to regain its bullish charm. Oh, the drama! 🎭

BTC ETFs Lose Steam as Profit-Taking Accelerates

Our dear BTC closed at a rather dismal $105,671 on Thursday, as sellers decided to cash in their chips from the recent rally. This wave of profit-taking has put a damper on institutional interest, leading to a noticeable decline in our beloved daily ETF inflow volumes. How positively tragic! 😱

Net inflows into BTC-backed funds totaled a respectable $86.31 million yesterday. While this reflects a flicker of investor interest, it also highlights the gradual slowdown in daily inflow momentum as BTC’s price remains under pressure. Oh, the suspense! 🎢

Now, let’s talk about Fidelity’s spot Bitcoin ETF FBTC, which recorded the highest net outflow among all BTC ETFs yesterday, with a staggering $197.19 million exiting the fund. FBTC’s total historical net inflows currently sit at a rather impressive $11.49 billion. Quite the rollercoaster, wouldn’t you say? 🎢💸

Bitcoin Slides, But Derivatives Traders Remain Bullish

Ah, the king coin is down 3% over the past day, extending its multi-day slide that has stalled short-term bullish sentiment. But fear not! The decline in spot prices hasn’t deterred our brave traders in the derivatives market. They’re still strutting their stuff! 💃

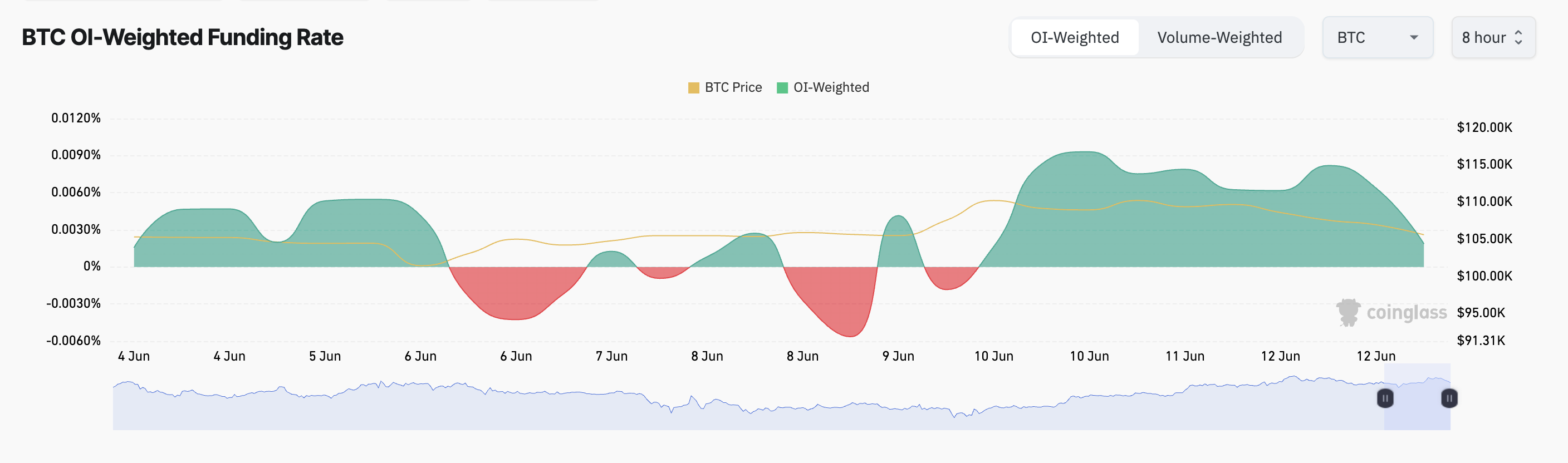

According to Coinglass, BTC’s funding rate across cryptocurrency exchanges remains positively buoyant despite recent price headwinds. At press time, it’s a delightful 0.0019%. How positively optimistic! 🌈

The funding rate is a charming little payment exchanged between long and short traders in perpetual futures contracts to keep prices aligned with the spot market. When it’s positive, long traders are paying shorts, indicating bullish sentiment and a higher demand for leveraged long positions. Quite the financial ballet! 💃💰

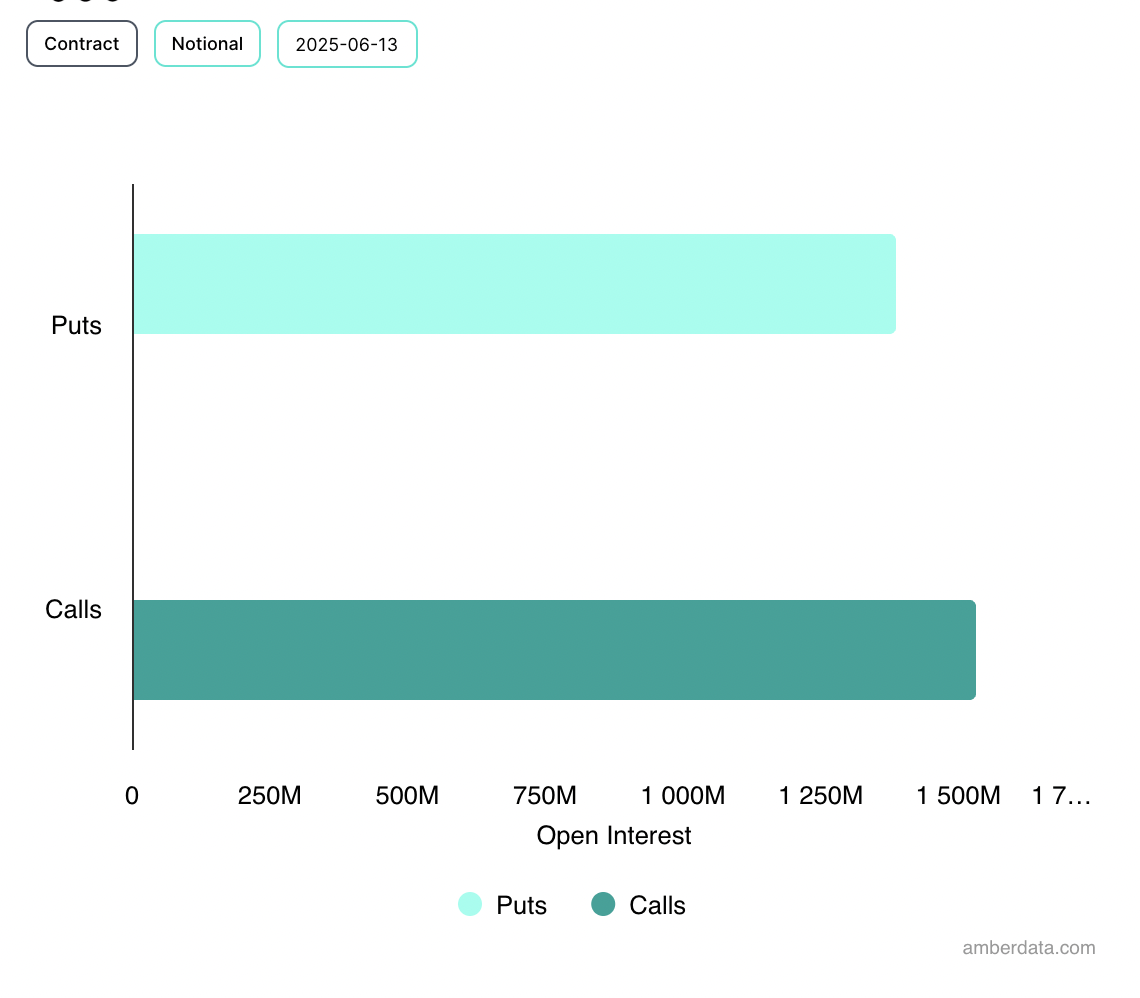

Moreover, on the options front, the demand for calls outweighs that for puts, indicating that many market participants expect a rebound or are positioning for upside volatility in the near term. How thrilling! 🎉

As we head into next week, with inflows tapering off and BTC under pressure, the key question remains: will this resilient ETF trend hold, or will the market record net outflows as investor sentiment cools further? Stay tuned, darlings! The drama continues! 🍿

Read More

2025-06-13 12:06