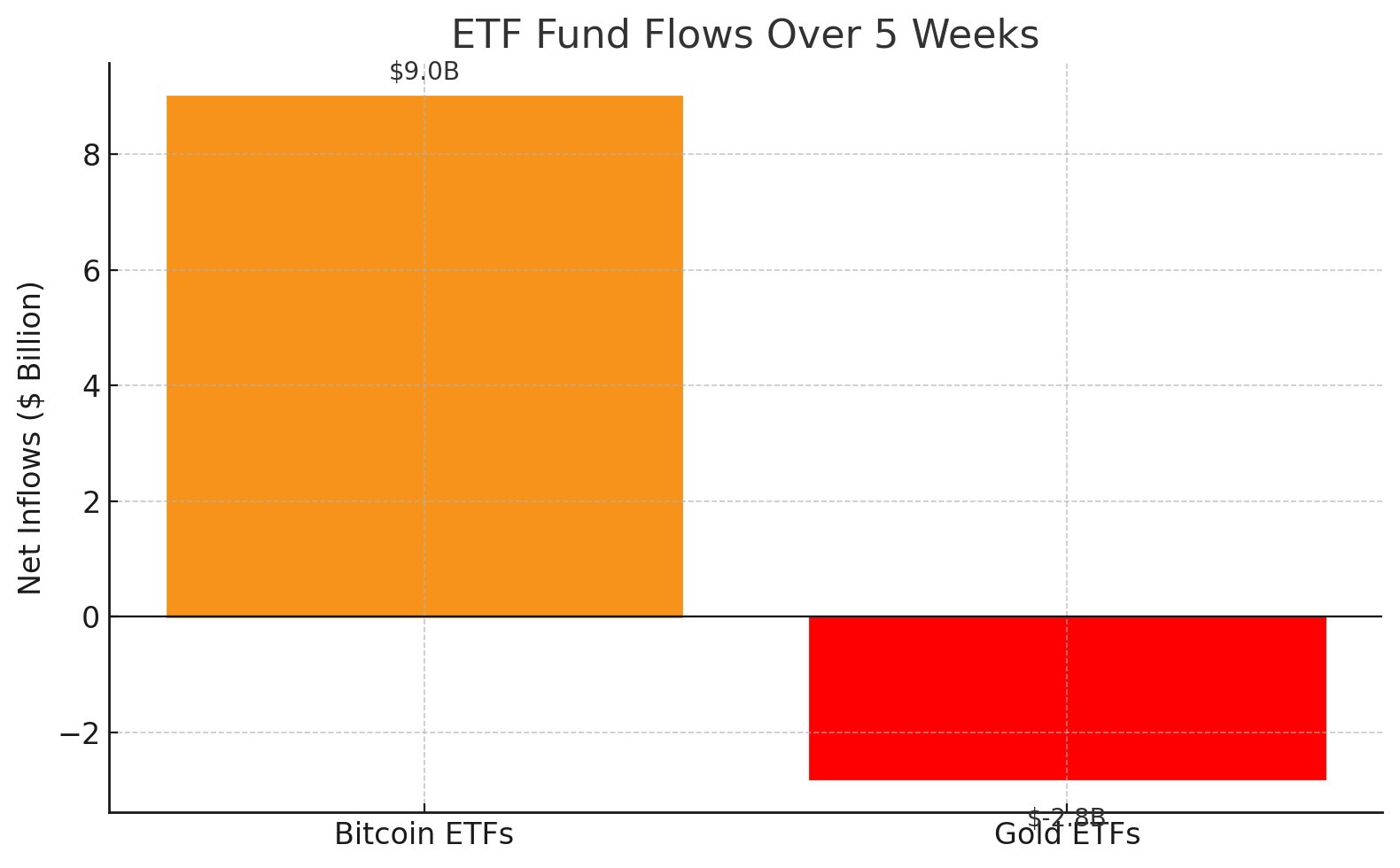

In a curious twist of fate, the Bitcoin ETFs in the grand old U.S. of A. have managed to siphon off a staggering \$9 billion over the past five weeks, led by none other than BlackRock’s iShares Bitcoin Trust (IBIT). Meanwhile, the once-mighty gold-backed funds have seen a rather sad loss of more than \$2.8 billion. Oh, how the mighty have fallen! 🥴

It appears that investors, in their infinite wisdom, are seeking refuge from the stormy seas of U.S. inflation and government debt. On May 22 alone, the Bitcoin ETF welcomed a whopping \$432 million inflow, its highest for the week. One can only imagine the champagne corks popping in celebration! 🍾

Bitcoin, that mischievous little rascal, recently reached an all-time high of \$111,970 on May 22nd, buoyed by the optimism surrounding the new stablecoin bill and the ongoing U.S.-China tariff war. Who knew that geopolitical tensions could be so profitable? 🤷♂️

As I pen these words, Bitcoin is trading at \$105,293.46, down a mere 1.35% in the last 24 hours, yet still boasting a remarkable 55% increase over the past year, according to the ever-reliable CoinMarketCap. Gold, on the other hand, is still basking in its own glory, up more than 25% this year, trading at \$3,310 per ounce, albeit \$190 shy of its record high. A tale of two metals, indeed! ⚖️

Analysts, those ever-optimistic seers, believe Bitcoin’s allure is rising amidst financial uncertainty. Christopher Wood, the Global Head of Equity Strategy at Jefferies, proclaims, “I remain bullish on both gold and Bitcoin. They remain the best hedges on currency debasement in the G7 world.” However, some critics argue that Bitcoin’s price swings are akin to a rollercoaster ride—thrilling, but not exactly a safe haven! 🎢

Geoff Kendrick of Standard Chartered chimes in, asserting that Bitcoin’s decentralized nature makes it a champion during both private and public sector shocks. “Bitcoin is more effective against financial system risks due to its decentralized nature,” he states, as if he were unveiling the secrets of the universe. 🔍

He further notes that Bitcoin can act as a hedge against private-sector failures, like the infamous collapse of Silicon Valley Bank in 2023, and public-sector concerns, such as deficits and threats to Federal Reserve independence. Quite the multitasker, isn’t it? 🦸♂️

Schiff Stays Silent on Bitcoin ETFs But Continues BTC Critic

Ah, but what of Peter Schiff, the gold advocate who has been vocally critical of Bitcoin? He has, rather mysteriously, ceased commenting on BTC ETFs, perhaps due to their impressive performance. Yet, he clings to the belief that gold’s long history and physical value make it the ultimate sanctuary. 🏰

This latest development only adds fuel to the fiery debate between Michael Saylor, the Chairman of Strategy (formerly MicroStrategy), and the ever-persistent Bitcoin critic, Peter Schiff. Saylor, known for his audacious conversion of Strategy into a Bitcoin holding firm, has repeatedly declared BTC as the world’s superior store of value. A bold claim, indeed! 💪

However, Schiff remains steadfast in his conviction that gold reigns supreme. In a recent post, he lambasted the media, stating, “Most of the so-called experts who regularly appear on CNBC don’t understand gold or Bitcoin. When it comes to investment, CNBC really is the blind leading the blind.” A fitting conclusion to this tale of two assets! 🥳

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Gold Rate Forecast

- FANTASY LIFE i: The Girl Who Steals Time digital pre-orders now available for PS5, PS4, Xbox Series, and PC

- SOL PREDICTION. SOL cryptocurrency

- Playmates’ Power Rangers Toyline Teaser Reveals First Lineup of Figures

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- Solo Leveling Arise Tawata Kanae Guide

2025-05-30 21:10