Well, well, well! It seems Bitcoin exchange-traded funds (ETFs) have decided to throw a party, and guess what? They’ve managed to rake in over $350 million in net inflows just yesterday! This little financial fiesta followed BTC’s audacious leap past the $105,000 resistance level, closing above the $110,000 mark. Talk about a dramatic entrance!

With bullish pressure building like a pressure cooker on the verge of explosion, our leading coin is all set to keep the rally going, which, of course, means more folks are clamoring for those ETF products. Who knew finance could be this exciting? 🎉

BTC ETFs See $386 Million Inflows as Investor Confidence Returns

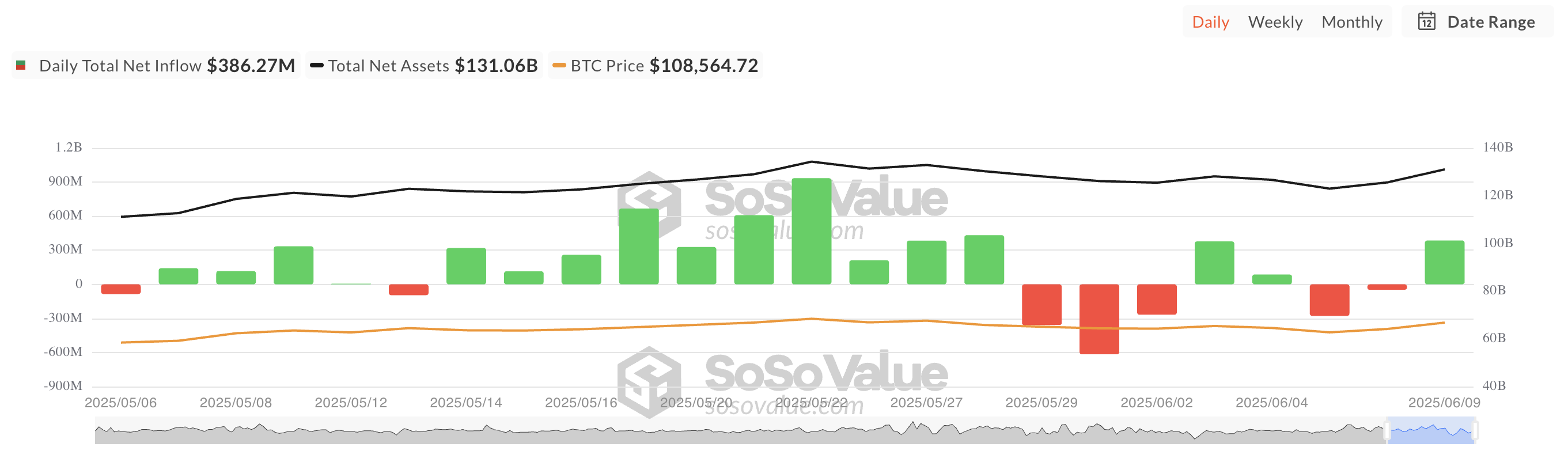

On Monday, BTC spot ETFs recorded a jaw-dropping net inflow of $386.27 million. Yes, you read that right! This capital influx is like a breath of fresh air after last week’s market hiccup. It’s as if investors suddenly remembered that Bitcoin exists and decided to throw their money at it.

These inflows have turned the tide, reversing last week’s trend of net outflows. Apparently, BTC’s previous lackluster performance and the waning confidence of investors were just a phase—like a bad haircut that you eventually grow out of. The surge followed BTC’s breakout above the $105,000 resistance level, with the asset closing at a cool $110,263 during yesterday’s trading session. Not too shabby!

As a result, optimism has spread across the market like a viral cat video, driving up ETF trading activity. On Monday, Fidelity’s CBOE-listed FBTC fund took the lead, boasting the largest single-day net inflow among all US BTC ETF issuers. It’s like the prom queen of the Bitcoin world!

BTC Futures and Options Flash Bullish as Price Holds Above $109,000

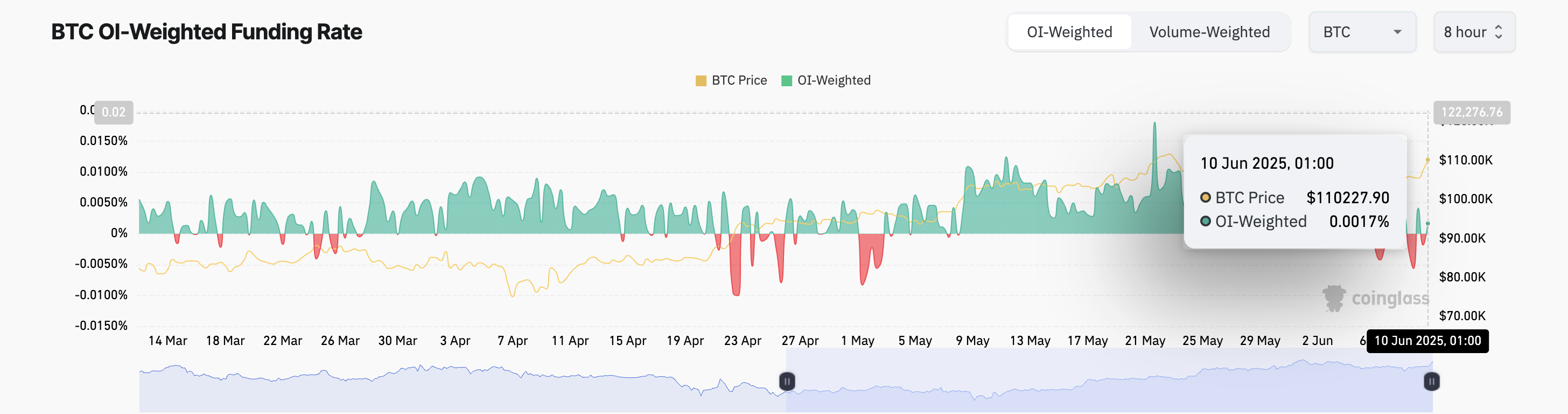

As of now, BTC is trading at $110,227, up a delightful 4% over the past day. The coin’s funding rate has flipped back into positive territory on the derivatives front, signaling a shift toward bullish market positioning. It currently stands at 0.0017%. Yes, that’s right—math is involved, but don’t worry, I won’t make you do any!

//beincrypto.com/wp-content/uploads/2025/06/Screenshot-2025-06-10-at-06.48.07.png”/>

So, with institutional inflows, rising price momentum, and a return to positive sentiment in derivatives, it seems the market might just be entering a renewed accumulation phase. Buckle up, folks; it’s going to be a bumpy ride!

Read More

2025-06-10 10:16