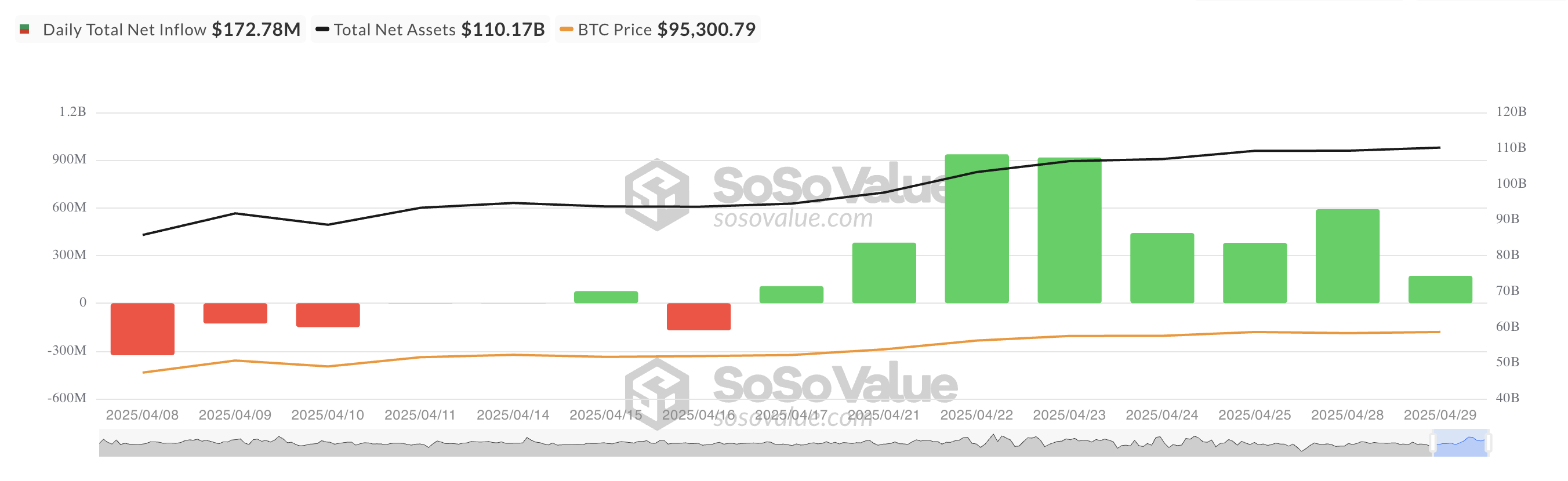

Oh, what a delightful sight! On Tuesday, our dear institutional investors continued to pour their riches into spot Bitcoin ETFs, marking the eighth consecutive day of this riveting inflow drama.

Yes, the total net inflows across all US-listed Bitcoin ETFs exceeded a rather smashing $170 million for the day. One would say it’s a bit of a “bullish fiesta” that has had the market shaking its proverbial tail since last week.

Bitcoin ETFs Celebrate an 8-Day Streak of Inflows—How Daring!

Yesterday, BTC-backed funds yet again posted a net inflow, this time a respectable $172.78 million. How utterly thrilling! It seems the market is positively giddy with confidence.

And leading the charge, as usual, is BlackRock’s iShares Bitcoin Trust (IBIT). This noble beast recorded the highest daily inflow of $216.73 million, bringing its historical net inflow to a dazzling $42.39 billion. Quite the show-off, wouldn’t you say?

IBIT, in its infinite grace, has consistently reigned supreme in recent sessions. Clearly, BlackRock is the darling of the crypto ETF world, having won the affection of institutional investors far and wide.

Not to be entirely left out, Bitwise’s spot Bitcoin ETF (BITB) took a bit of a tumble, with $24.39 million exiting the fund. But don’t fret—BITB’s historical net inflows are still a hearty $2.05 billion. We all have our off days, don’t we?

Leverage Takes a Breather in the Bitcoin Market

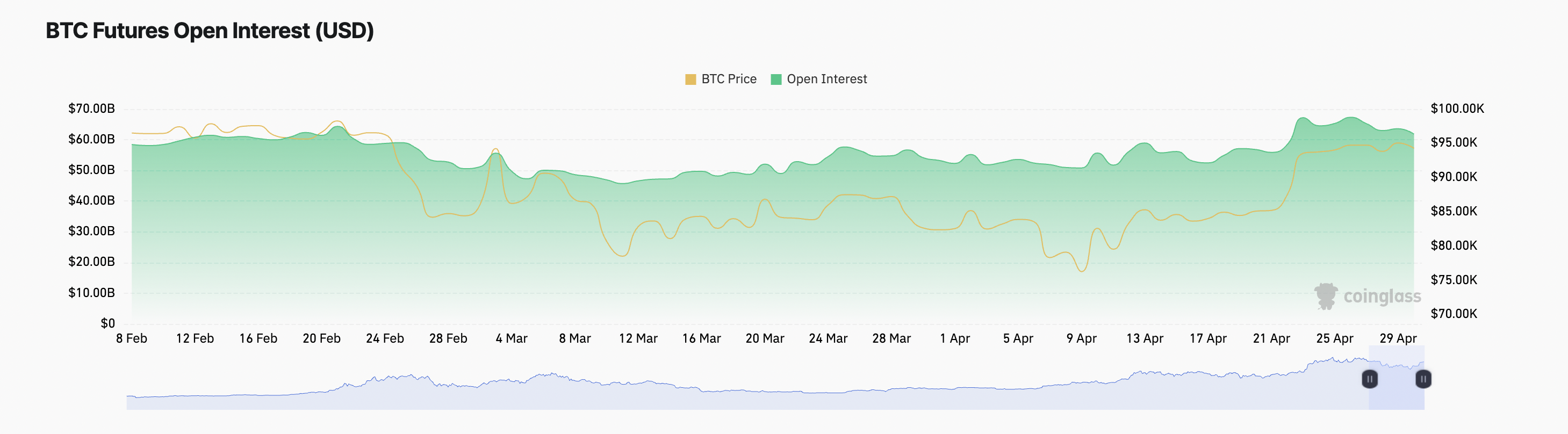

Meanwhile, the open interest (OI) in Bitcoin futures markets seems to have decided to take a little nap. It’s down by a modest 3% over the last 24 hours, standing at $61.81 billion. Clearly, some traders have chosen to close positions and perhaps book a spa day.

Oddly enough, BTC’s price rose by 1% during this decline. It’s almost as if the market’s taking profits and exercising a touch of caution. How droll! Traders don’t seem entirely convinced by BTC’s rally, as fewer participants are rushing to take on new leveraged positions.

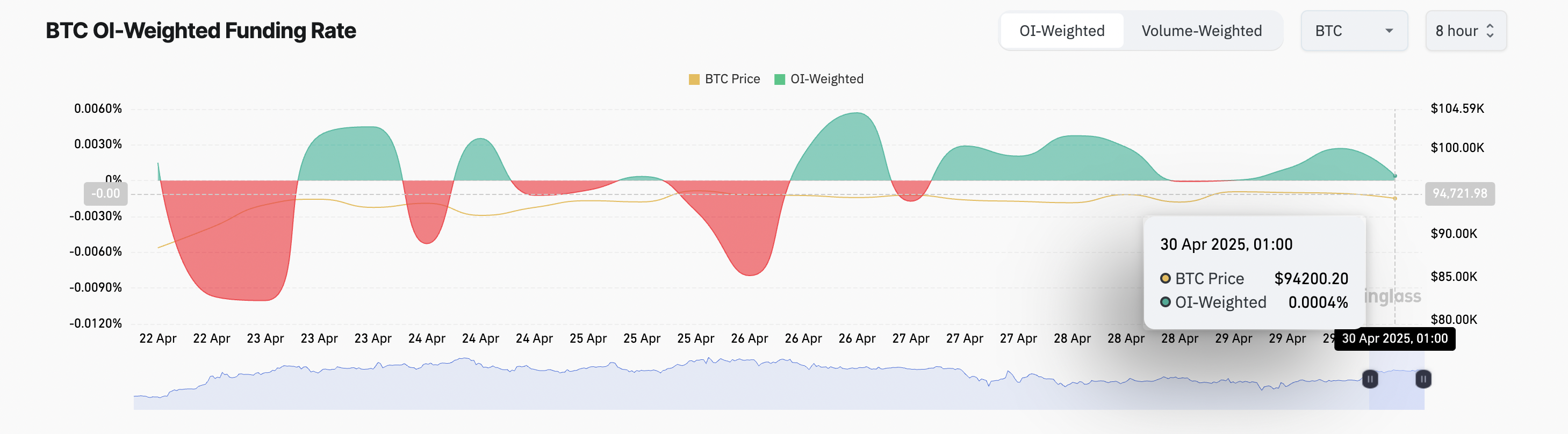

But not to fear—optimism remains in the air. BTC’s funding rate sits at a tantalizing 0.004%, a sign that long positions are still happy to pay to maintain their leverage. Longs are paying shorts, darling—it’s bullish all the way!

The funding rate, as always, is a lovely little dance between long and short traders. A positive funding rate indicates that more traders are placing their bets on the price going up—quite the charming sign of bullish sentiment, if I may say so.

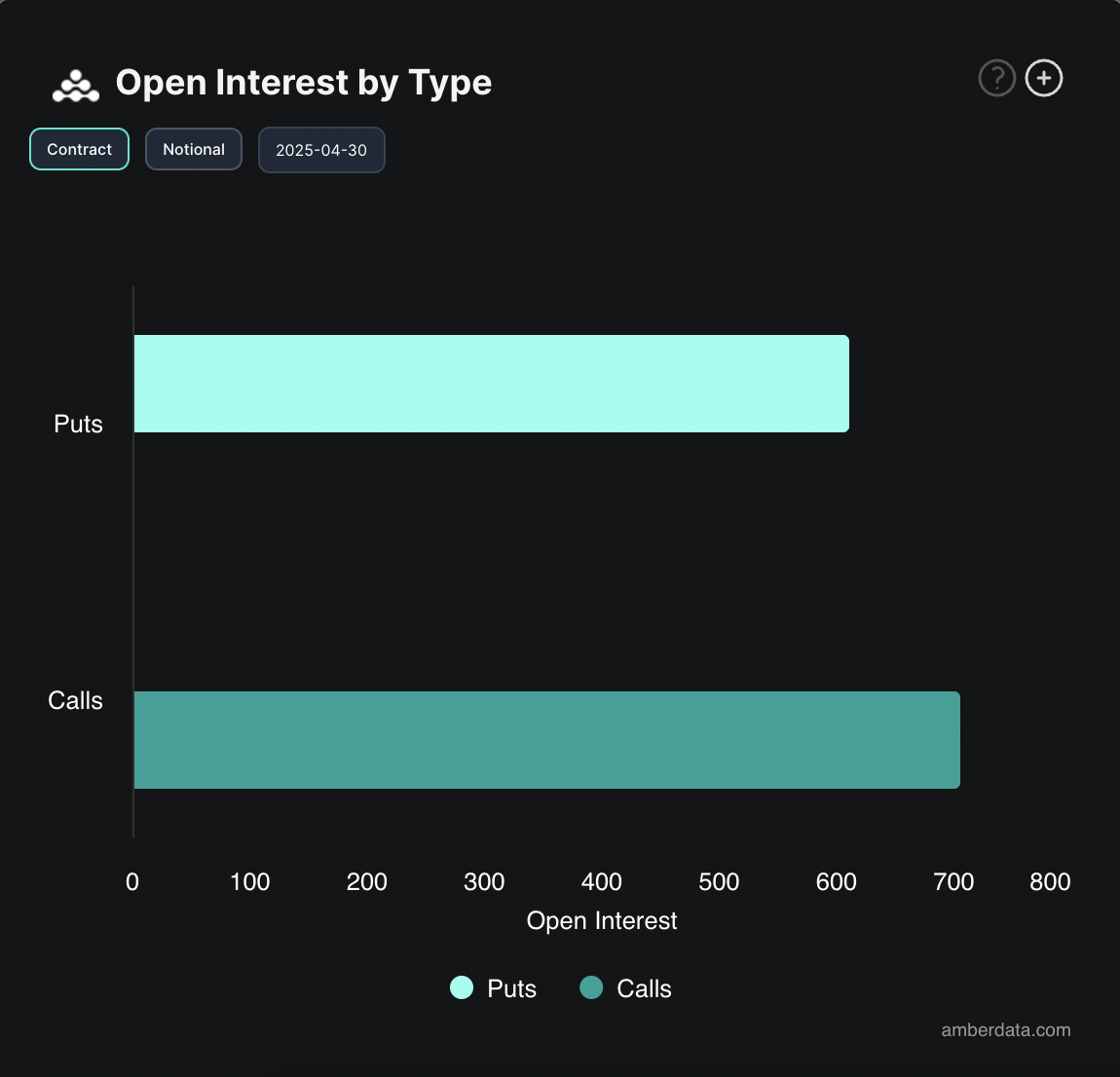

And don’t think for a second that things are slowing down. The volume of call options has increased, as traders seem poised for further upside in BTC’s price. Clearly, the market’s feeling a touch adventurous.

So, while there may be a few signs of hesitation in derivatives activity, the steady inflows into Bitcoin ETFs suggest that the market is still leaning bullish. Well, isn’t that a relief?

Read More

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Gold Rate Forecast

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- The Lowdown on Labubu: What to Know About the Viral Toy

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

2025-04-30 09:46