- U.S. Bitcoin ETF holdings are rapidly approaching that of Satoshi Nakamoto’s.

- With $3.4 billion inflow post-election, Bitcoin ETFs are also accumulating 17,000 BTC weekly

As a seasoned researcher with a penchant for all things crypto and a knack for deciphering market trends, I find this development quite intriguing. The rapid increase in Bitcoin ETF holdings is not just a numbers game; it’s a testament to the growing institutional acceptance of Bitcoin as a legitimate investment asset.

As a financial analyst, I’ve observed a notable surge in Bitcoin (BTC) prices approaching the $90,000 level, which has sparked a wave of enthusiasm throughout the financial sector. This upward trend appears to have significantly influenced the performance of spot Bitcoin ETFs within the U.S. market.

These ETFs could surpass the amount of Bitcoins owned by Satoshi Nakamoto, their creator, and become the single largest collectives holding Bitcoin.

Bitcoin ETFs to surpass Satoshi Nakamoto’s holdings?

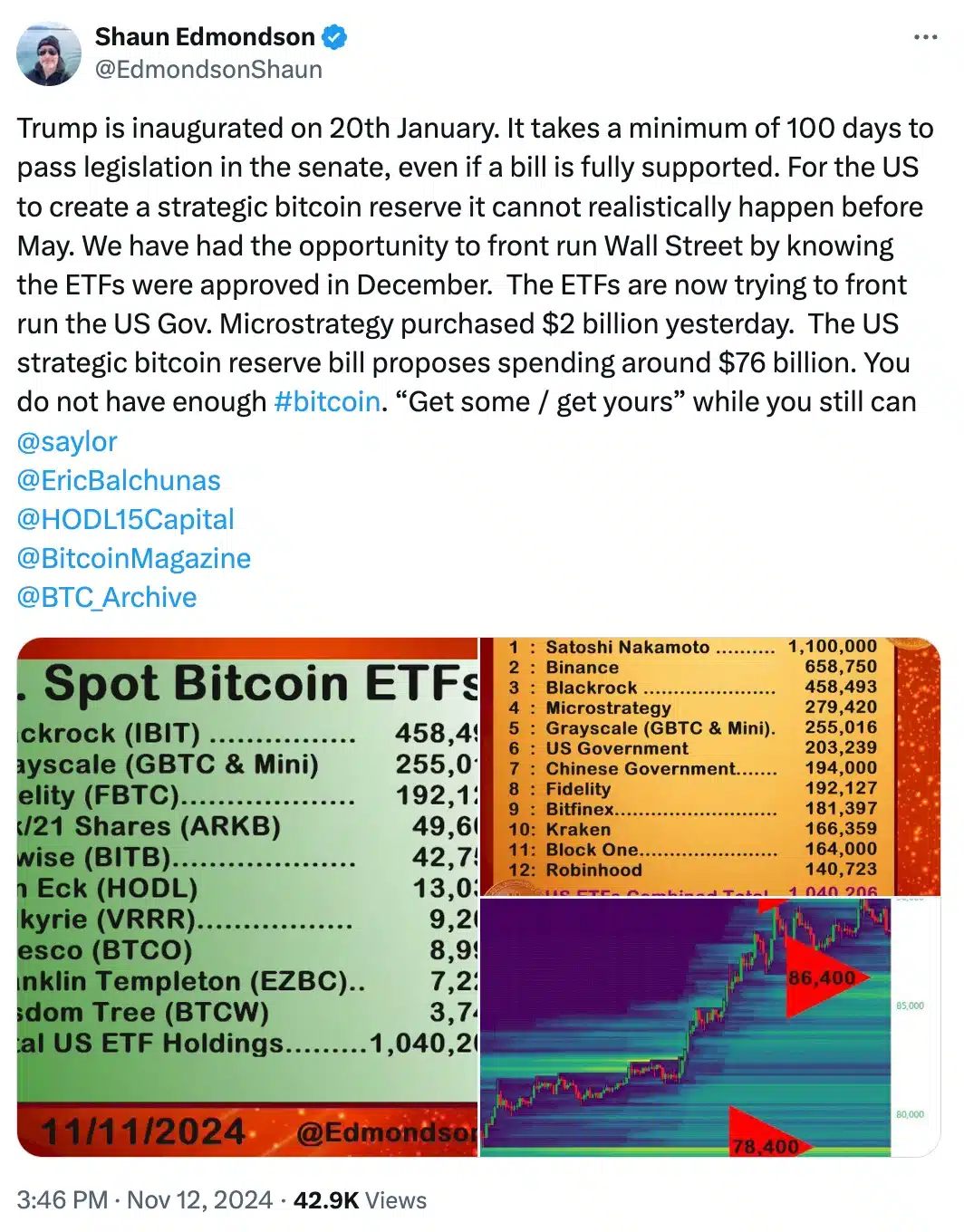

Based on information from analyst Shaun Edmondson and Eric Balchunas of Bloomberg, it’s been calculated that U.S. Bitcoin ETFs currently hold close to 1.1 million Bitcoins, slightly less than the estimated amount Satoshi Nakamoto is believed to have mined.

As I observe the increase in holdings, it’s evident that there’s a rising interest among institutions towards Bitcoin. This asset is increasingly finding its place in traditional investment strategies, signaling its growing acceptance within mainstream financial circles.

Remarking on the same, Edmondson noted,

Adding to which, Balchunas said in his prediction,

ETFs are almost at a point where they hold more Bitcoin than Satoshi Nakamoto, their creator. A timer has started, and we’re approaching the momentous occasion. I think Thanksgiving could be an interesting benchmark for predicting whether we’ll surpass or fall just short.

Bitcoin ETF update

By the 28th of October, American Bitcoin investment funds collectively held approximately 983,334 Bitcoins. This significant increase represents an additional 56,000 Bitcoins amassed over a period of around two weeks.

Additionally, data from Farside Investors reveals a significant increase in demand, as U.S. Bitcoin ETFs saw inflows of approximately $3.4 billion over a span of four days post-Election Day.

Last Thursday saw an unprecedented surge in Bitcoin ETF investments, with approximately $1.3 billion pouring in from enthusiastic investors.

In just one month, BlackRock’s IBIT received an astounding $1.1 billion investment, accompanied by unusually large trading activity.

Based on the most recent figures from Farside Investors, U.S. Bitcoin ETFs experienced significant investment on November 12th, accumulating approximately $817.5 million. Among these inflows, IBIT held the largest portion, accounting for around $778.3 million.

What’s behind this?

Analyst Eric Balchunas pointed out that these funds are quickly amassing approximately 17,000 Bitcoins each week, placing them on a path to eclipse the estimated Bitcoin holdings of Satoshi Nakamoto by December 2024.

In fact, some credit of this accelerated accumulation also goes to Donald Trump’s election win.

However, some believe the election isn’t the only factor at play. The fourth Bitcoin halving is also a significant influence, as highlighted by Jesse Myers, co-founder of OnrampBitcoin.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Masters Toronto 2025: Everything You Need to Know

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Elden Ring Nightreign Recluse guide and abilities explained

- Solo Leveling Arise Tawata Kanae Guide

- Despite Bitcoin’s $64K surprise, some major concerns persist

2024-11-13 18:15