-

Hashdex filed for the first index-based US crypto ETF holding Bitcoin and Ethereum.

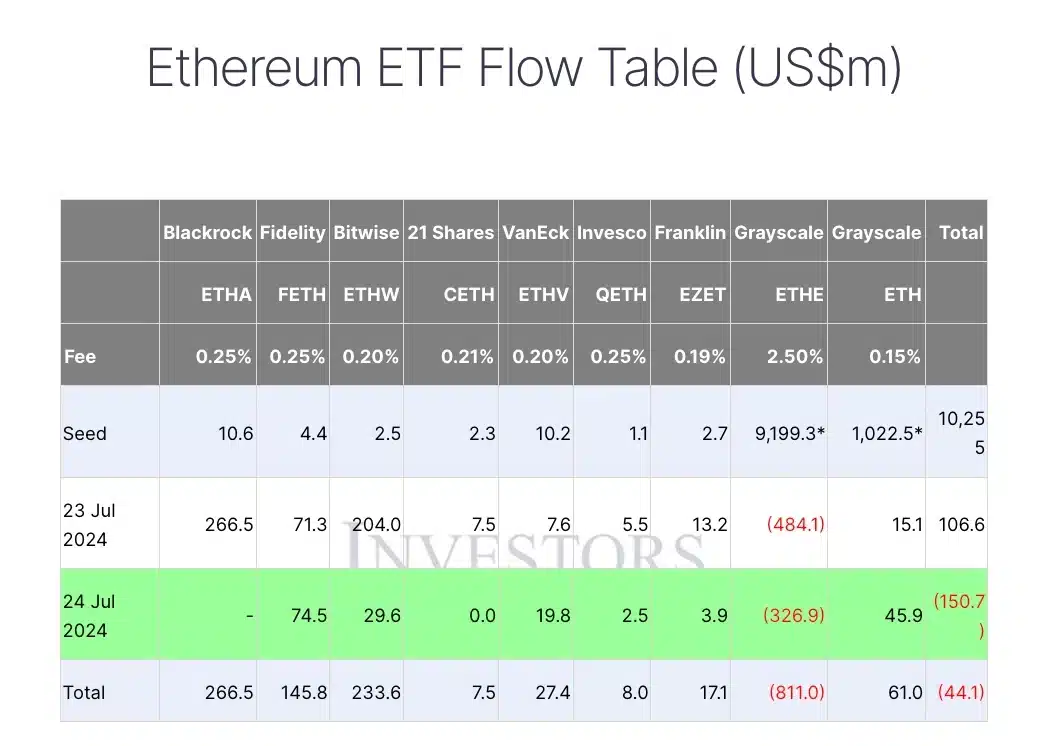

ETH ETFs saw $176.2 million inflows; Grayscale experienced $326.9 million outflows.

As a seasoned financial analyst with extensive experience in the crypto market, I find Hashdex’s move to file for the first index-based US crypto ETF holding Bitcoin and Ethereum an exciting development. The potential launch of the Hashdex Nasdaq Crypto Index US ETF marks a significant milestone, potentially paving the way for more institutional investors to enter the crypto space.

Hashdex, a leading crypto asset management company, is making strides in the industry with plans to introduce an innovative exchange-traded fund (ETF). This ETF will be unique as it will directly own and hold Bitcoin (BTC) and Ethereum (ETH) instead of using derivatives or futures contracts.

Hashdex filed an S-1 registration statement with the US Securities and Exchange Commission, signifying a potential first step towards launching the country’s inaugural crypto ETF based on indexes.

Hashdex’s ETF plans

As a seasoned financial analyst with years of experience in the ever-evolving world of cryptocurrencies, I am excited about the prospect of the Hashdex Nasdaq Crypto Index US ETF. This fund holds great potential for investors seeking exposure to the crypto market through a regulated and diversified investment vehicle.

After several weeks of meticulous planning, Hashdex has reached an significant achievement in its cryptocurrency investment goals with this milestone.

Expanding on the same, the S-1 filing filed by Hashdex noted,

If a cryptocurrency aside from Bitcoin and Ethereum qualifies for addition to the Index, the Sponsor will shift to a representative sampling approach, maintaining equal weights solely for Bitcoin and Ethereum.

Reiterating the same, Bloomberg ETF Analyst James Seyffart took to X and said,

“I’ll begin with investing only in Bitcoin and Ethereum, but I’m open to adding other assets to my portfolio if they receive SEC approval.”

In a separate post, the analyst emphasized that this move was not unexpected, and added,

“Shouldn’t be a surprise to anyone — makes a lot of sense.”

What’s more to it?

Suggestion: Seyffart indicated a possible timeline for the SEC’s verdict on the Hashdex Nasdaq Crypto Index US ETF, implying that the decision is expected “around the beginning of March 2025.”

Following this announcement from Hashdex, it’s worth noting that the regulatory green light for trading spot Ethereum ETFs was granted only two days prior.

As a crypto investor, I’d explain it like this: Unlike the recently approved crypto ETFs that allow for Ethereum staking, Hashdex’s proposed combined spot cryptocurrency ETF does not include this feature in its offerings when it comes to Ethereum.

Bitcoin & Ethereum ETF analysis

During that period, there were large investments in ETFs based on Ethereum, specifically. However, the Grayscale Ethereum Trust experienced a notable outflow of approximately $326.9 million on July 24th. Contrastingly, BlackRock’s Ethereum ETF showed no signs of activity during this time.

According to Farside Investors’ data, Bitcoin ETFs experienced inflows totaling $44.5 million on a given day. Among these, Grayscale’s GBTC recorded inflows of $26.2 million, and BlackRock’s IBIT attracted $66 million.

Read More

- Gold Rate Forecast

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

2024-07-25 12:08