As a seasoned researcher with over a decade of experience in the financial markets, I have witnessed numerous market cycles and their unique behaviors. The recent events in the cryptocurrency sphere have been nothing short of fascinating.

For the past month, the cryptocurrency market has shown exceptional fluctuations. The previous two days witnessed a plunge followed by a rebound, with Bitcoin dropping to less than $49k while other digital currencies like altcoins also dipped concurrently.

However, while the crypto markets crashed, the BTC spot ETF trading volume doubled.

BTC ETF trading volume hits $5.7 billion

Despite the stock market downturn, trading activity for Bitcoin ETFs has skyrocketed to more than $5.7 billion. This increase in demand followed two days of intense cryptocurrency market fluctuations as reported.

According to data from Coinglass, the outflow of ETFs has slowed down and maintained a stable pace over the past 2 days, reaching approximately $84.1 million, which can be considered as a moderate level.

Similarly, Coinglass indicates that the total assets stand firm at approximately $48 billion. This data suggests a favorable reaction in the market towards ETFs, as cryptocurrencies persist in exhibiting volatility.

BTC and ETH ETFs rebound after high outflows

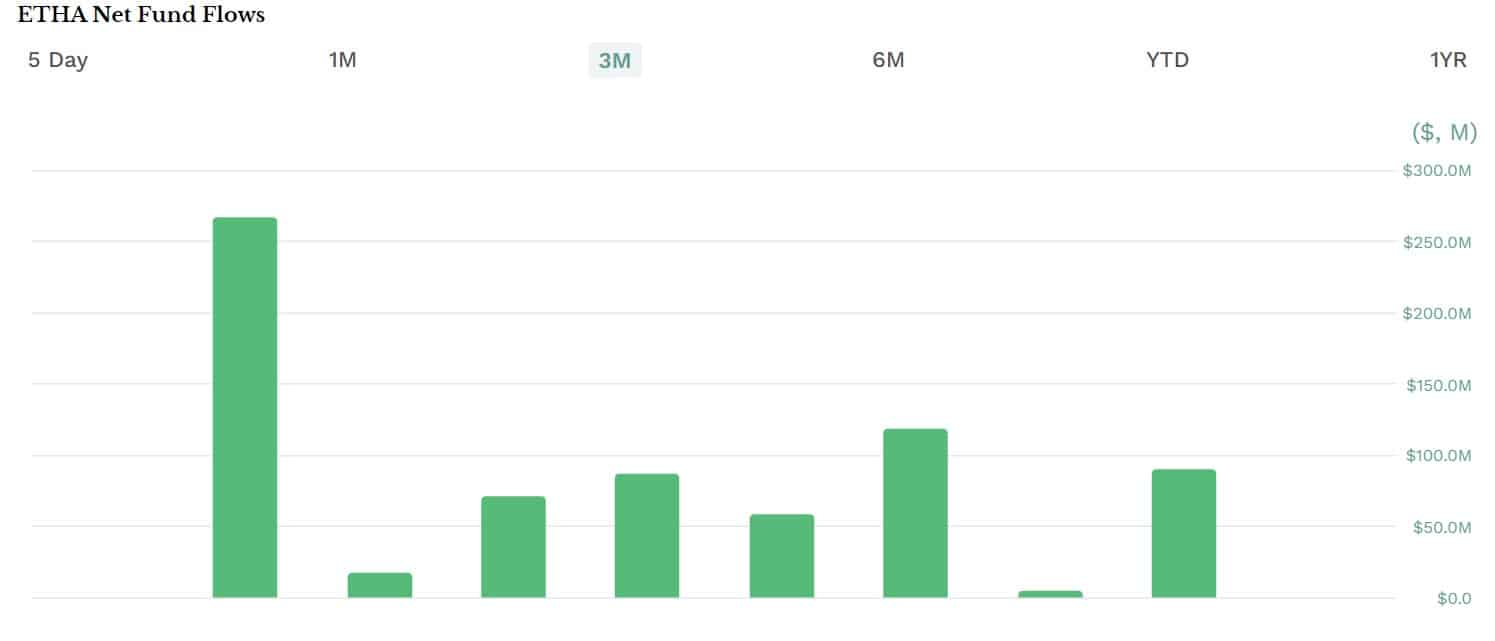

Over the past month since the introduction of Ethereum ETFs, there’s been a significant withdrawal of funds from these products, leading to a noticeable impact on ETH prices.

For several weeks now, there has been a significant withdrawal of funds from ETH-based Exchange Traded Funds (ETFs), totaling more than $2 billion. The large-scale outflow, amounting to $2.1 billion, has sparked worries about the competitiveness of these ETH ETFs against their Bitcoin counterparts.

For the past six months, Bitcoin ETF withdrawals have reached an all-time high. On the 5th, when the market took a downturn, Bitcoin ETF withdrawals peaked at $168.4 million. The Grayscale Bitcoin Trust ETF and the ARK 2iShares Bitcoin ETF experienced the most outflows during this period.

In the previous 24 hours, Bitcoin ETFs have reached an all-time peak, with over $1.3 billion traded in the opening minutes of trading on July 6th.

With the surge, iShares Bitcoin Trust made the highest in trading activity, surpassing $1.27 billion.

Impacts on BTC and ETH?

The prices of Bitcoin (BTC) and Ethereum (ETH) have significantly rebounded since reaching their lowest points over the past couple of months. Bitcoin dipped to a two-month low when it fell below $50,000, while Ethereum reached an equally low point at approximately $2116.

As an analyst, I observed a significant decrease in our performance stemming from a surge in crypto liquidations totaling approximately $1.2 billion. This trend can be attributed to a ripple effect triggered by the recent downturn in global equities markets.

Even though Bitcoin prices dropped, data indicates that ETF holders maintained their positions during the market slump. Currently, Bitcoin is trading at approximately $56,888 after a 1.97% rise over the past 24 hours and a significant rebound from its lowest point of $49,577.

Consequently, as investors retained their positions, the trading volume for Bitcoin ETF skyrocketed to an impressive $5.2 billion, surpassing the trading volume experienced during January following its launch.

Similarly, Ethereum ETFs, which have previously experienced significant withdrawals, have recently seen an influx of approximately $49 million.

In essence, the surge in ETF trading activity and investments has significantly contributed to the rise in Bitcoin and Ethereum prices following their 2-month price drops.

BlackRock, Nasdaq File for spot Ethereum ETF

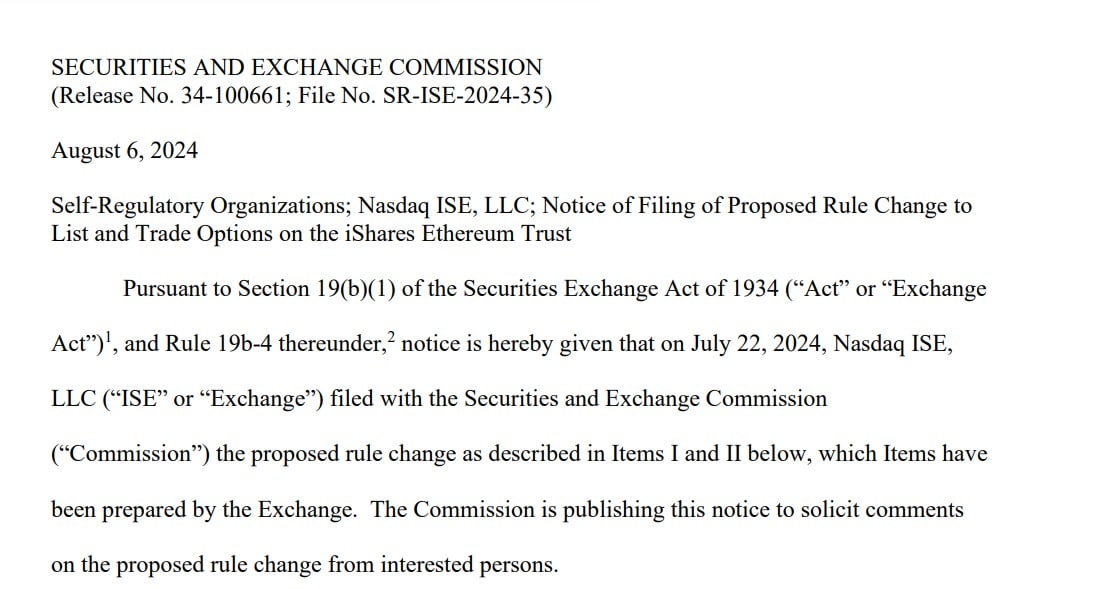

Another positive development for Ethereum ETFs during heightened market turmoil comes from Blackrock and Nasdaq’s latest actions.

Based on recent reports, I’ve found that the two firms, Nasdaq and Blackrock, have suggested adding options trading for Ethereum ETFs within the iShares Ethereum Trust (ETHA). This proposal is outlined in a SEC filing by both parties, aiming to amend their rules to accommodate this change.

The filing stated that,

“The Exchange thinks that making it possible for investors to trade options based on the Trust is advantageous. This extra option offers them a less expensive method to invest in real Ether, plus it serves as a risk management tool to handle their Ether-related investment requirements.”

Approximately three weeks following the debut of Ethereum-based Exchange Traded Funds (ETFs), the market has shown strong signs of acceptance despite initial uncertainties. Traders are now expressing a desire for expanded trading opportunities, such as additional options.

Read More

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Royal Baby Alert: Princess Beatrice Welcomes Second Child!

- SOL PREDICTION. SOL cryptocurrency

- Sea of Thieves Season 15: New Megalodons, Wildlife, and More!

- PI PREDICTION. PI cryptocurrency

- `SNL’s Most Iconic SoCal Gang Reunites`

- Disney’s CEO Search Delayed as Internal Candidates Face Criticism

- 7 Must-See Movies After Watching Saturday Night

2024-08-07 17:12