- Stablecoin reserves surged to 48 billion USDT equivalent, suggesting significant dry powder on the sidelines

- Bitcoin exchange outflows intensified while ETH saw mixed flows

There’s a noticeable decrease in the cryptocurrency market, with less money flowing in and trading at record-low levels. This indicates increasing uncertainty among investors about the current market situation. In particular, there was a substantial 56.70% drop in capital inflows from $134 billion to $58 billion. Moreover, trading activity has dropped to levels not witnessed since before last year’s U.S elections.

Crypto market trading volume hits pre-election lows

The trading activity or transaction count for significant cryptocurrency categories such as meme coins, artificial intelligence/big data initiatives, layer 1 and layer 2 networks, has reached a minimal level not seen since 4th November.

Based on Santiment’s findings, the decrease in activity seems to indicate a state of “investment immobility” as investors find it challenging to take firm actions in the current market scenario. Upon examining the chart, it showed a steady decline across all areas, with significant dips observed in sectors that were previously quite active, such as AI and memecoins.

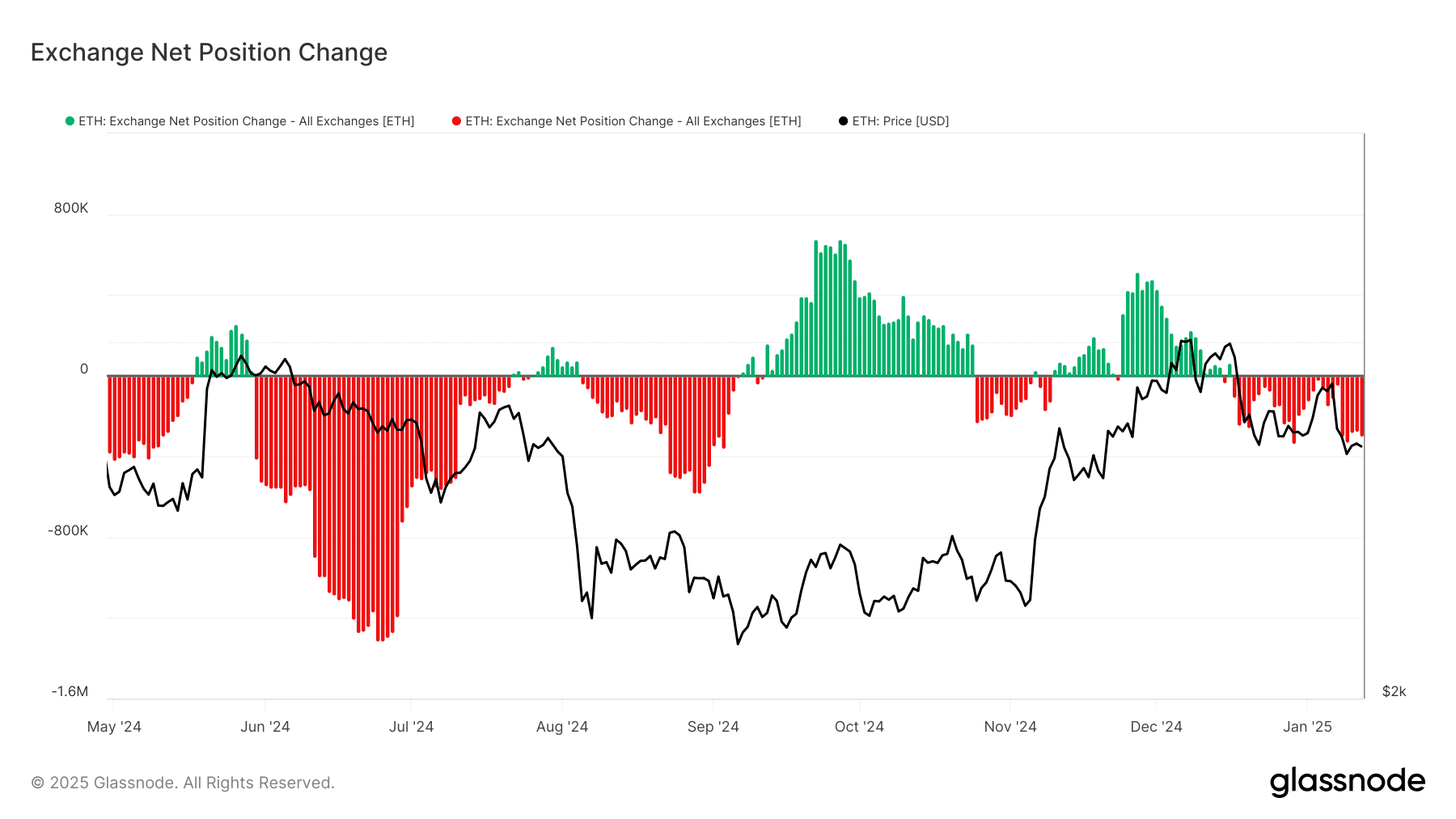

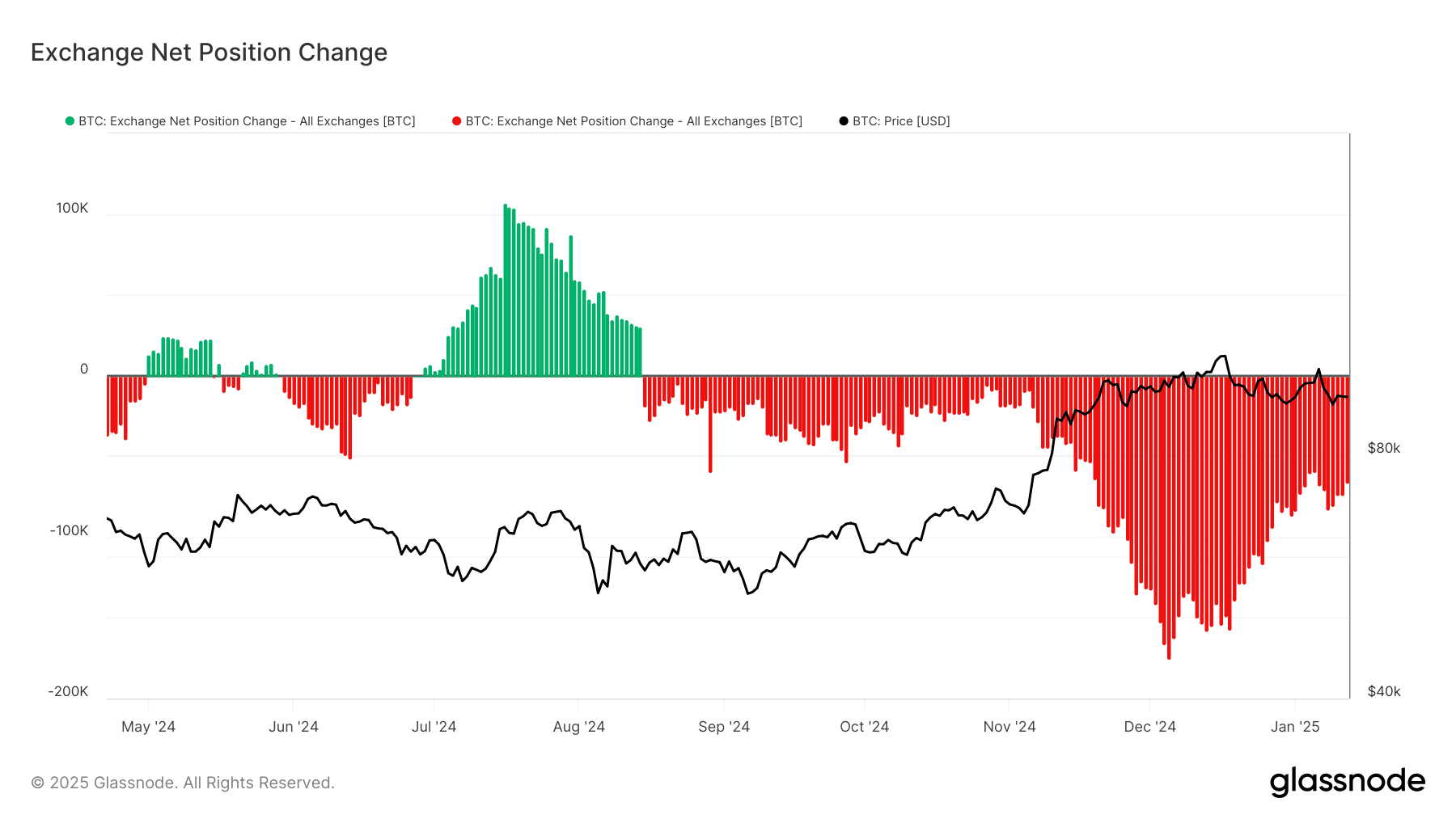

Exchange net positions show mixed signals

2024 saw some striking differences between Ethereum and Bitcoin’s exchange flow patterns. Notably, Ethereum experienced its largest outflows during July, with roughly 1.6 million Ether leaving exchanges. Interestingly, this was followed by a period of accumulation in October, as inflows reached their peak at around 700,000 Ether.

By early January 2025, Ethereum experienced outflows totaling approximately 400,000 Ether, suggesting that users are once again withdrawing their funds from the platform.

Bitcoin’s exchange positions presented a different narrative though.

In August 2024, there was a high point of accumulation, as 100,000 BTC flowed in. But by December 2024, there was a significant reversal, with withdrawals spiking to almost 200,000 BTC – The highest withdrawal volume during the observed period. This trend has continued into early 2025, with consistent outflows averaging around 80,000 BTC.

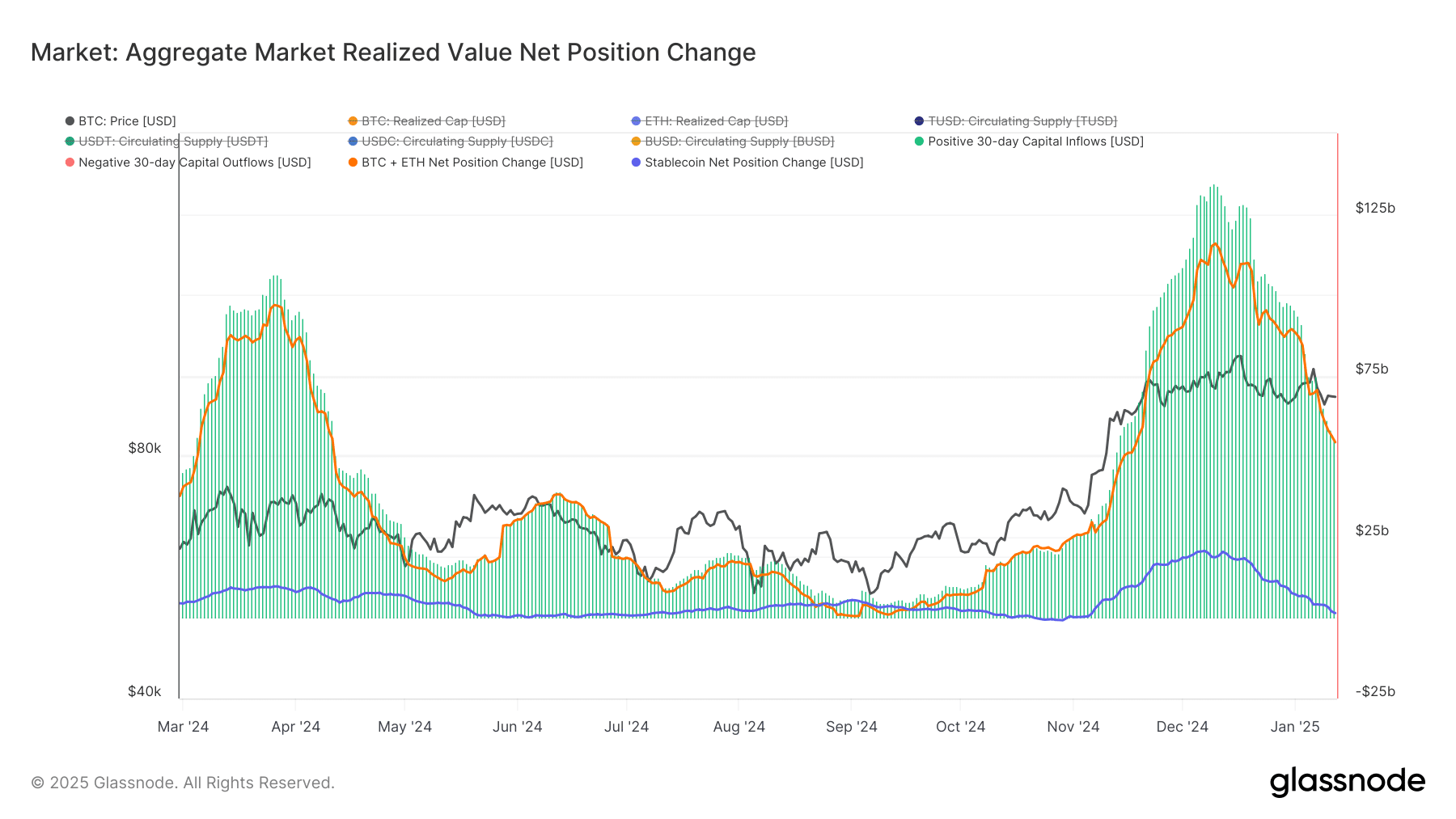

Stablecoin reserves signal untapped potential

Since March 2024, the world of stablecoins has undergone a substantial shift. The combined supply of all stablecoins has grown from an equivalent of 16 billion USD to a staggering 48 billion USD.

During this time frame, USDT consistently held its leading market position, increasing from $16 billion to $32 billion. Meanwhile, USDC managed to stay relatively steady at around 4-5 billion. In November 2024, the combined supply showed remarkable resilience, jumping from 24 billion to 40 billion – Indicating a substantial amount of untapped resources ready to enter the market.

Market realized value shows declining confidence

2024 saw the market value exhibit clear stages, peaking in value at a record high of $100 billion between March and April. However, this peak was followed by a prolonged period of decline, with capital flows averaging around $25 billion each month from May to September.

In October-November, there was a significant rebound that reached, peaking at about $125 billion. However, this inflow dropped down to around $58 billion by early 2025 following another downturn.

1. The decline indicated a decrease in available funds and less enthusiasm for taking risks, especially after the active market period in December. This trend mirrored the general feeling within the cryptocurrency market, which may have been caused by economic uncertainties, discouraging fresh investments.

(Or)

2. The dip showed a lack of funds and reduced risk tolerance, particularly in the aftermath of December’s bustling market activity. This pattern echoed the prevailing sentiment across the cryptocurrency sector, which might be linked to economic uncertainties, discouraging new investment opportunities.

Between fear and opportunity

Understanding the present market’s seemingly bearish nature may be challenging, but past trends indicate that extended periods of fear and low trading activity typically precede substantial market recoveries. Moreover, the substantial buildup of stablecoin reserves on exchanges, notably the increase to approximately 48 billion USDT equivalent, could potentially serve as the catalyst for a market rebound once investor sentiment stabilizes.

Despite improvements, uncertainties persist. If trading activity and investments continue to dwindle, the market could experience prolonged sluggishness until confidence is restored. The steep drop in market value since December 2024, representing a 56.70% decrease from its November high, highlights the present market instability.

A mix of dwindling deposits, minimal trading activity, and increasing stablecoin holdings paints a complex scenario in the market. The large-scale removal of Bitcoin from exchanges and Ethereum’s inconsistent trends hint at diverse investment tactics among various investor groups. Furthermore, the buildup of stablecoin reserves implies a substantial force ready to drive future market fluctuations.

In these times of market downturn, the accumulation of secure investments on trading platforms could potentially present chances for those ready to seize them once optimism returns. Keeping a close eye on the development of these indicators over the next few weeks will be crucial, ranging from exchange inflows to supply levels of stablecoins.

Read More

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Gold Rate Forecast

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- The Lowdown on Labubu: What to Know About the Viral Toy

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

2025-01-13 19:36