-

32,000 BTC and 206,000 ETH Options expiring soon could lead to major market shifts

BTC, ETH face high uncertainty with elevated implied volatility levels above 60%

As a seasoned researcher with years of experience navigating the ever-evolving crypto market, I find myself constantly on the lookout for significant events that could potentially shake the foundations of this dynamic landscape. The upcoming expiry of 32,000 BTC and 206,000 ETH Options has certainly piqued my interest. The high uncertainty surrounding these digital assets, coupled with elevated implied volatility levels above 60%, paints a picture of an unpredictable market in the near future.

🛑 Trump Tariffs vs. Euro: The Fight of the Decade?

Discover how the EUR/USD pair could react to unprecedented pressure!

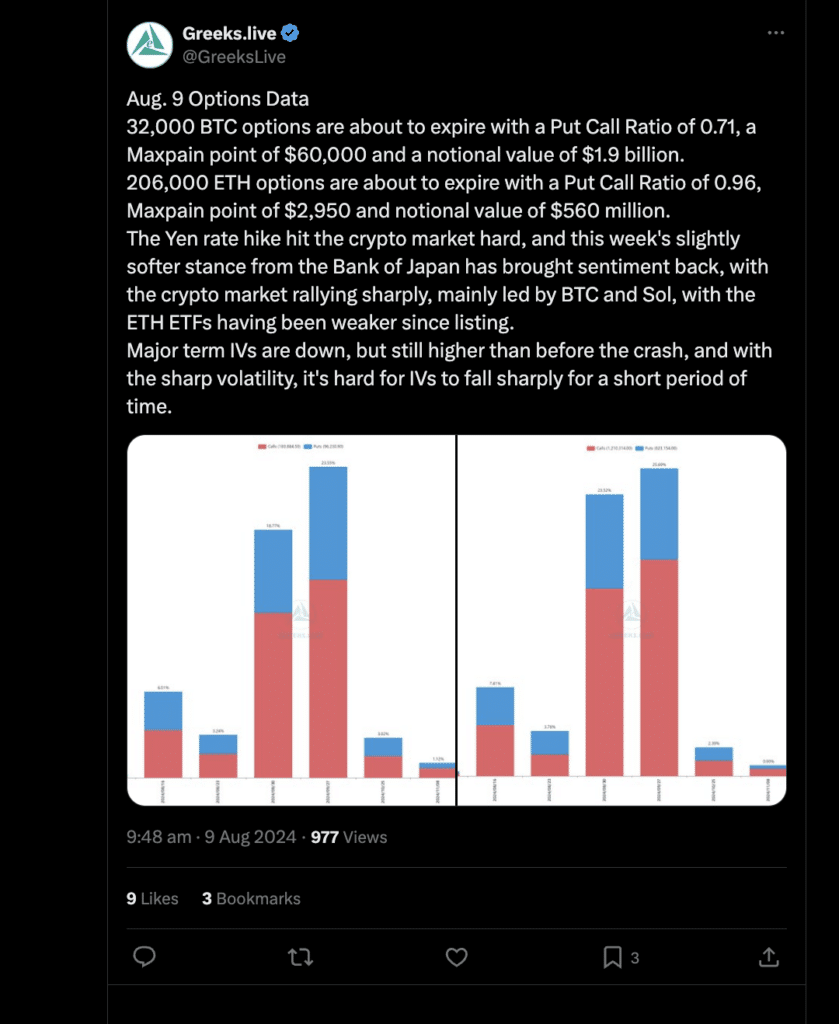

View Urgent ForecastThe upcoming expiry of significant BTC and ETH Options is drawing attention from market participants. In fact, according to Greeks.live on X, 32,000 BTC Options are set to expire with a Put/Call ratio of 0.71.

As for now, the price level where most options will likely end up worthless is set at $60,000. This situation implies a total value of around $1.9 billion in options expiring. Such a large volume could potentially lead to market instability as prices edge closer to this crucial threshold.

As a seasoned trader with years of experience in the cryptocurrency market, I’ve learned to keep a close eye on options expiry dates. Today, I find myself closely monitoring the upcoming expiration of approximately 206,000 ETH Options. The current Put/Call ratio of 0.96 indicates a more balanced sentiment in the Ethereum market, which is a refreshing change from the usually skewed ratios we often see.

These deadlines might cause substantial changes in the market, particularly when prices approach the maximum sensitivity levels. This situation could potentially ignite considerable monetary losses for Options traders.

Market reaction to macroeconomic shifts

In simple terms, the increase in Yen rates significantly affected the cryptocurrency market, causing prices to drop temporarily. But this week, the Bank of Japan’s more lenient approach has contributed to the market bouncing back.

In the past day, Bitcoin (BTC) and Solana (SOL) spearheaded a recovery, with Bitcoin reaching an impressive $60,678.35, representing a 5.99% increase in the last 24 hours. However, it’s worth noting that Bitcoin experienced a 6.23% drop over the last week, suggesting continuous price fluctuations.

As an analyst, I’ve observed a substantial increase in Ethereum (ETH) price today, climbing approximately 7.52% within the last 24 hours to reach $2,632.92. Nevertheless, over the past week, ETH has seen a drop of around 16.48%.

Despite recent price increases, the general apprehension in the market stays elevated, indicating that uncertainty persists over a prolonged period.

High implied volatility and realized volatility

Further analysis shows that data from options indicates a persistent high level of implied volatility (IV) over 60% for major assets, indicating ongoing market turbulence. In contrast, the 7-day realized volatility (RV) of Bitcoin skyrocketed to 100%, significantly surpassing the IV level – Indicating continued sharp price fluctuations.

In simpler terms, a high Implied Volatility (IV) indicates that the market doesn’t anticipate a substantial drop in volatility over the immediate future.

Swings in volatility can linger and cause significant price swings, resulting in extended periods where Implied Volatility (IV) remains high. This pattern indicates that market conditions could remain unpredictable for some time ahead. Particularly for options sellers, this situation might present chances to strategically accumulate positions over time, leveraging the robust support provided by high IV levels.

Experiencing significant option expiries, increased market volatility, and continuous economic changes sets the stage for possible fluctuations in the market.

In the end, with Bitcoin (BTC) and Ethereum (ETH) options approaching their maturity dates, it’s crucial for traders and investors to stay alert and attentive.

Read More

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Gold Rate Forecast

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- The Lowdown on Labubu: What to Know About the Viral Toy

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

2024-08-09 17:44