- The crypto market saw two-way volatility in July as speculators reacted to events.

- The Federal Reserve held the benchmark interest rate at the current 23-year high for the eighth consecutive time.

As a seasoned analyst with over two decades of experience in the financial markets, I find myself intrigued by the ongoing dance between Bitcoin and the broader economic landscape. The Fed’s decision to hold rates steady, while hinting at a potential rate cut in September, is a classic example of the cat-and-mouse game central banks play with market speculators.

On the final day of July, Bitcoin‘s trading remained relatively stable following the announcement of the Federal Open Market Committee’s decision regarding interest rates.

At their latest meeting, Federal Reserve officials chose to maintain the target federal funds rate within the 5.25% – 5.50% bracket, which aligns with market predictions. Since the June FOMC meeting has passed, investors are now anticipating a potential first rate reduction in September this year.

During the discussion following the FOMC meeting, Chair Jerome Powell suggested that they might consider reducing interest rates in September. This potential move could be made if the economy continues to grow robustly.

If interest rates are reduced (rate cut), it could increase the availability of money in the market (liquidity). This increased liquidity is often seen as beneficial for cryptocurrencies overall.

Trends across July

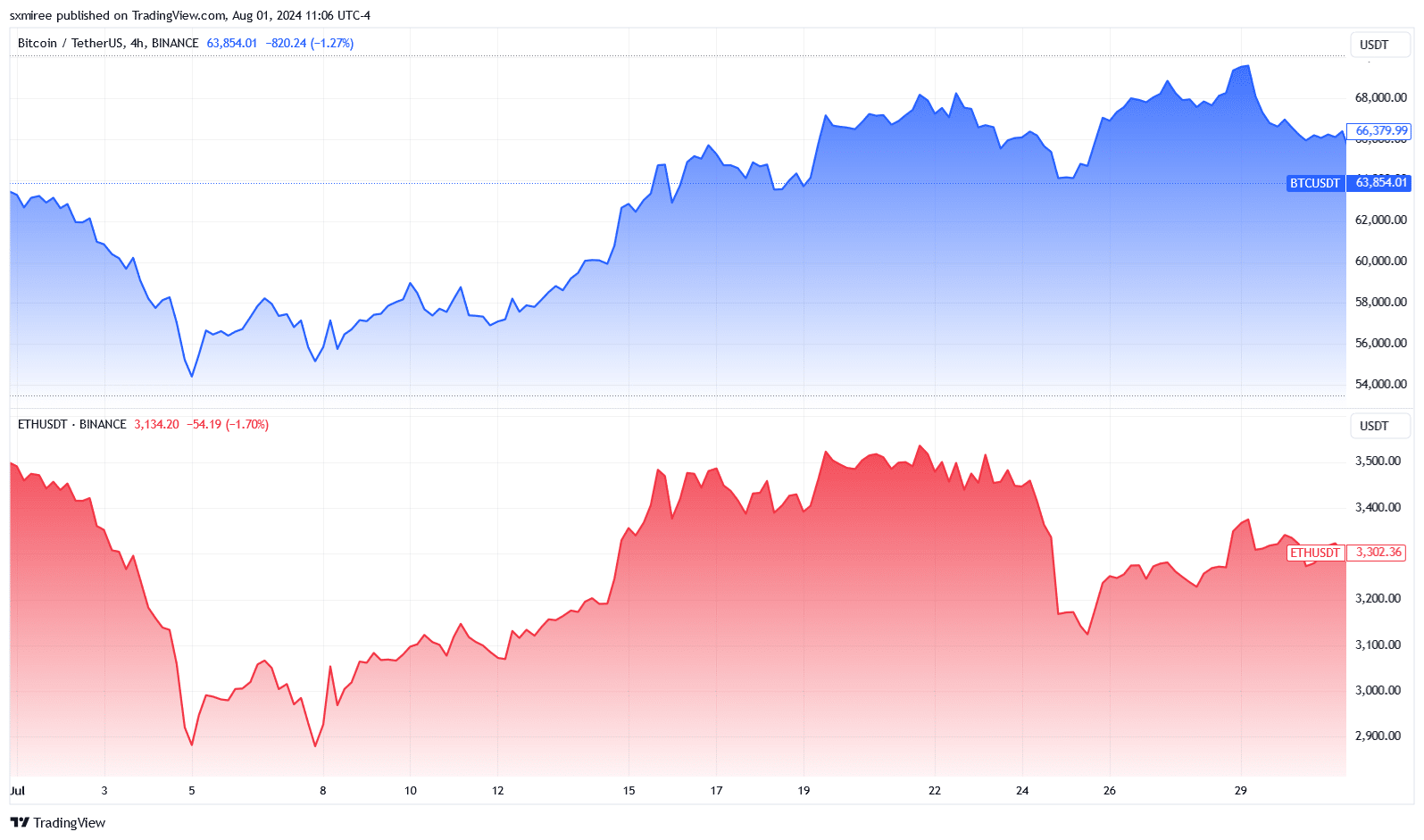

In simpler terms, before the end of July, a slight drop in cryptocurrency prices temporarily reduced Bitcoin’s advance, as indicated by Coinglass. The total return for Bitcoin during this month was approximately 2.95%.

The meager positive returns nonetheless set the stage for Bitcoin to pursue new yearly price highs.

Contrarily, Ethereum [ETH] experienced a steeper decline by approximately 5.88%, even amid favorable factors such as the launch of U.S.-based spot Ether ETFs.

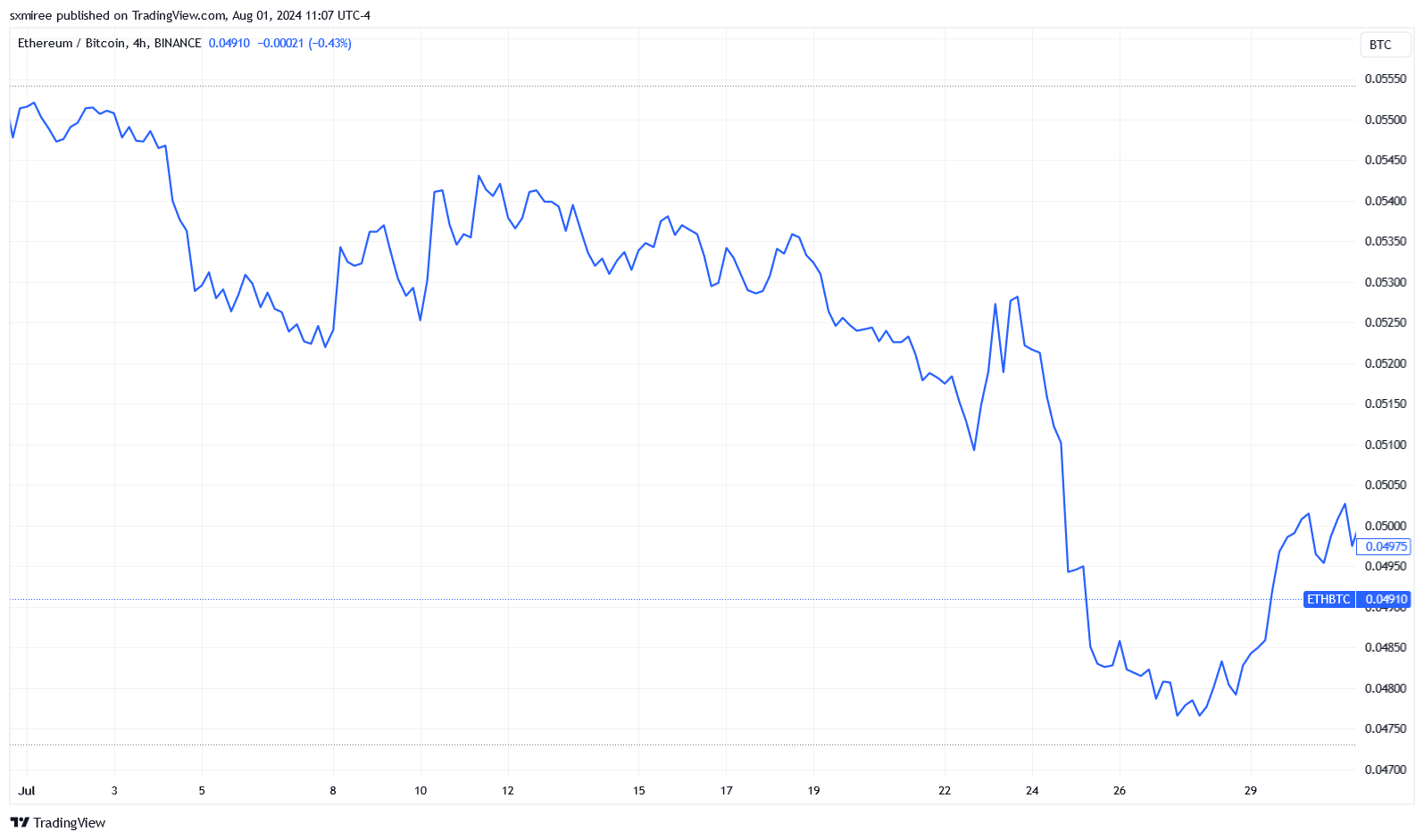

Consequently, the ETH/BTC ratio fell across July, shrinking by 10.72% by the end of the month.

In July, MANTRA DAO [OM] and Helium [HNT] stood out among large-cap altcoins, each recording impressive gains. Specifically, MANTRA DAO saw a return of approximately 44%, while Helium achieved a return of about 36%.

Fantom [FTM], Flare [FLR], and Starknet [STRK], on the other hand, all lost more than 30%.

Expectations for August

Last month saw a recurring theme of accumulation and investment in Bitcoin, as owners with at least 0.1% of the total supply amassed approximately 84,000 Bitcoins based on information from IntoTheBlock’s Bitcoin holdings data.

The scoop marked the highest accumulation pace since October 2014.

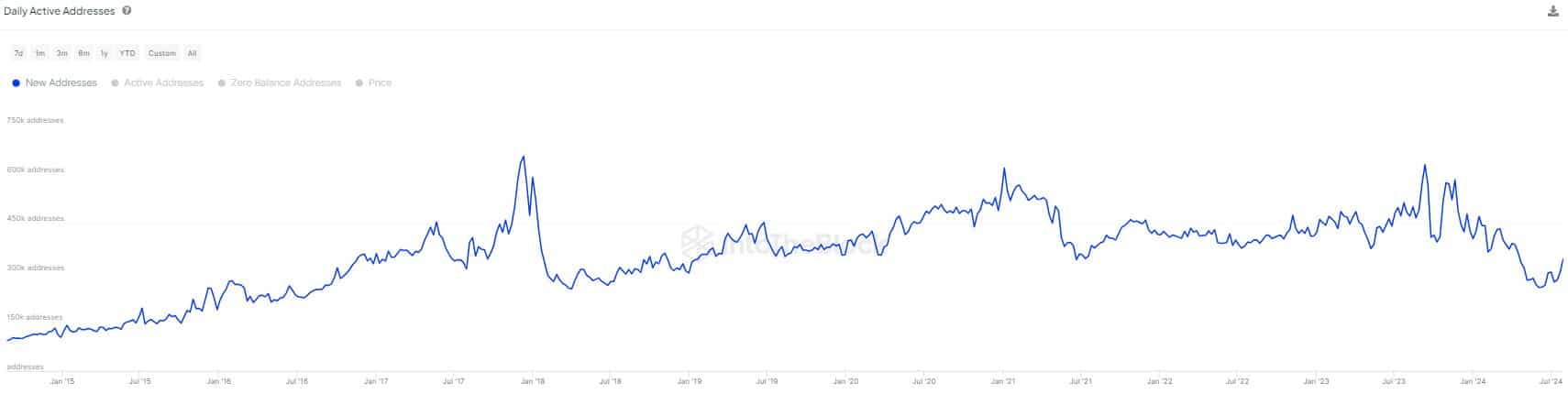

On July 30th,IntoTheBlock shared via a post (previously known as Twitter) that there had been a 35% increase in newly created addresses compared to previous lows in early June, which were the lowest in several years.

Historically, the strategic build-up of assets by large marine predators (whales and sharks) among investors might indicate their expectation for an upward price surge beyond the existing price limits.

Renewed inflows of capital into the crypto market further support the bullish sentiment.

In July, according to CCData’s recent study on Stablecoins and Central Bank Digital Currencies, the overall value of stablecoins experienced a growth of 2.11%, reaching an all-time high of $164 billion since April 2022.

Technical outlook

Bitcoin has been trading between the bounded ranges of $58,000 and $70,000 for five months.

Optimistic investors aim to surpass the current resistance level at $69,600, a feat that could potentially expose the next substantial hurdle around $72,000. This level, if breached, might offer an opportunity to challenge March’s record high.

Read Bitcoin’s [BTC] Price Prediction 2024-25

So far, bears (those who believe prices will fall) have aggressively guarded the highest level of the current price range, effectively preventing a breakthrough over the $70,000 barrier.

Numerous refusals at prices over $69,600 since March suggest that Bitcoin requires a significant trigger to surpass its current obstacle.

Read More

- PI PREDICTION. PI cryptocurrency

- How to Get to Frostcrag Spire in Oblivion Remastered

- Gaming News: Why Kingdom Come Deliverance II is Winning Hearts – A Reader’s Review

- We Ranked All of Gilmore Girls Couples: From Worst to Best

- How Michael Saylor Plans to Create a Bitcoin Empire Bigger Than Your Wildest Dreams

- Kylie & Timothée’s Red Carpet Debut: You Won’t BELIEVE What Happened After!

- S.T.A.L.K.E.R. 2 Major Patch 1.2 offer 1700 improvements

- The Elder Scrolls IV: Oblivion Remastered – How to Complete Canvas the Castle Quest

- Florence Pugh’s Bold Shoulder Look Is Turning Heads Again—Are Deltoids the New Red Carpet Accessory?

- PS5 Finally Gets Cozy with Little Kitty, Big City – Meow-some Open World Adventure!

2024-08-02 05:12