- Ethereum has a slightly more bullish bias for the coming week.

- The Bitcoin consolidation phase was still ongoing, and a revisit to $60k was growing more likely.

As a seasoned crypto investor with a few market cycles under my belt, I’ve learned to read between the lines of on-chain data and market sentiment. Based on the current market conditions and analysis from AMBCrypto, I believe Ethereum [ETH] has a slightly more bullish bias for the coming week than Bitcoin [BTC].

Recently, Bitcoin [BTC] traders faced some challenges after experiencing extended periods of simple and consistent gains since late last year.

Ethereum [ETH] has become more complex lately, but the Bitcoin [BTC] halving that occurred last month has significantly altered market circumstances, leading to erratic price movements and choppy trends across the board.

Over the past weekend, AMBCrypto examined the prevailing attitudes among traders and potential direction for this week’s cryptocurrency market prices.

One of the two has speculators expectant of bullish returns in the near term

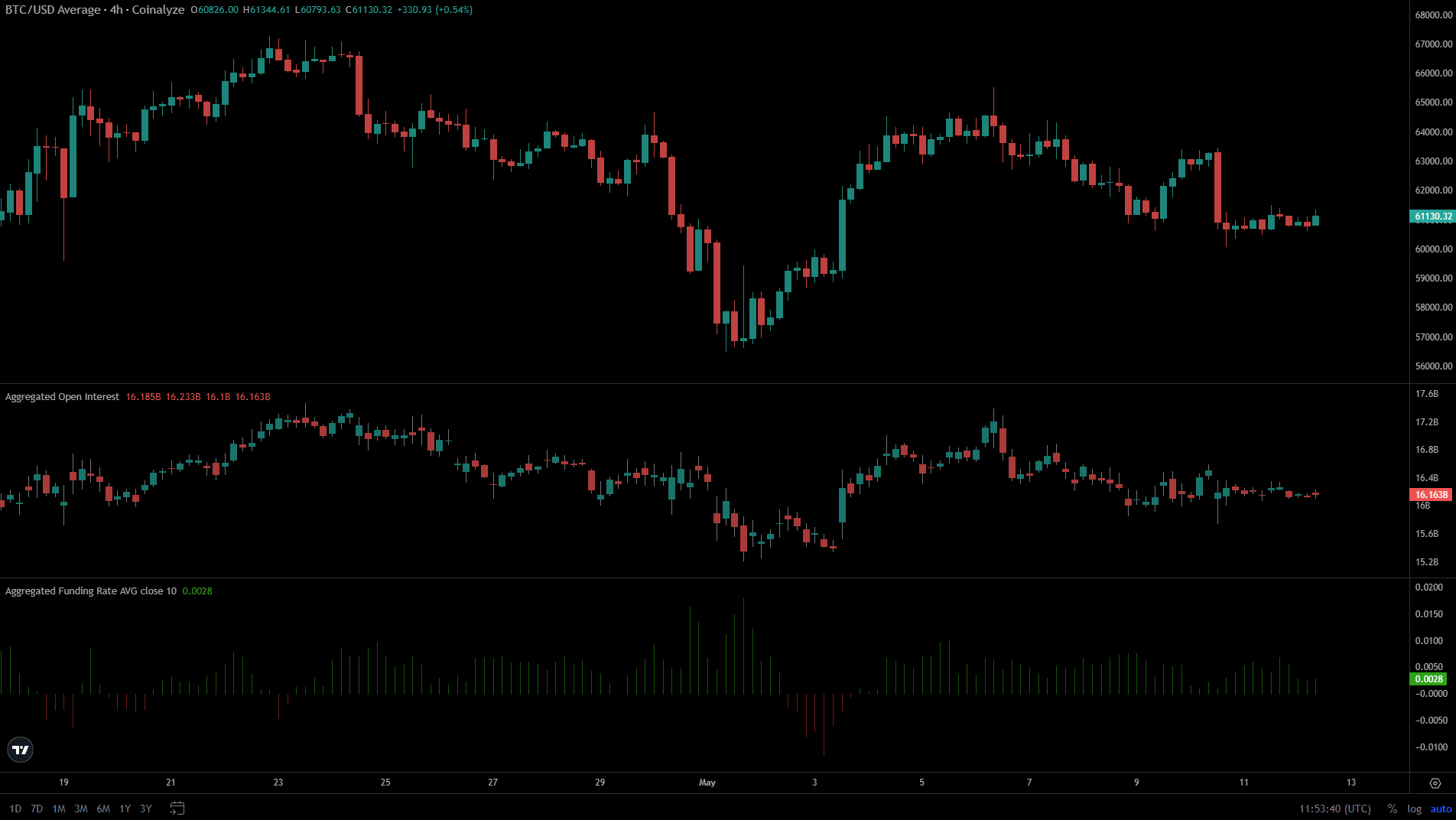

As a researcher observing the Bitcoin market, I noted an uptick in Open Interest on the 10th of May. However, this trend contrasted with the general downward trajectory of Open Interest that had been observed since the price spike on the 6th of May.

Over the past week, I’ve noticed that the cryptocurrency market displayed a downward trend in my portfolio. Specifically, the price hit a peak of $64,000 but subsequently formed a string of decreasing highs, reaching $61,100 at the moment I’m checking.

At the onset of May, the Bitcoin market experienced a significant drop, causing the Funding Rate to turn negative. However, since that time, the Funding Rate has rebounded.

In recent days, the temperature has hardly risen above freezing, reflecting a relatively weak bullish outlook.

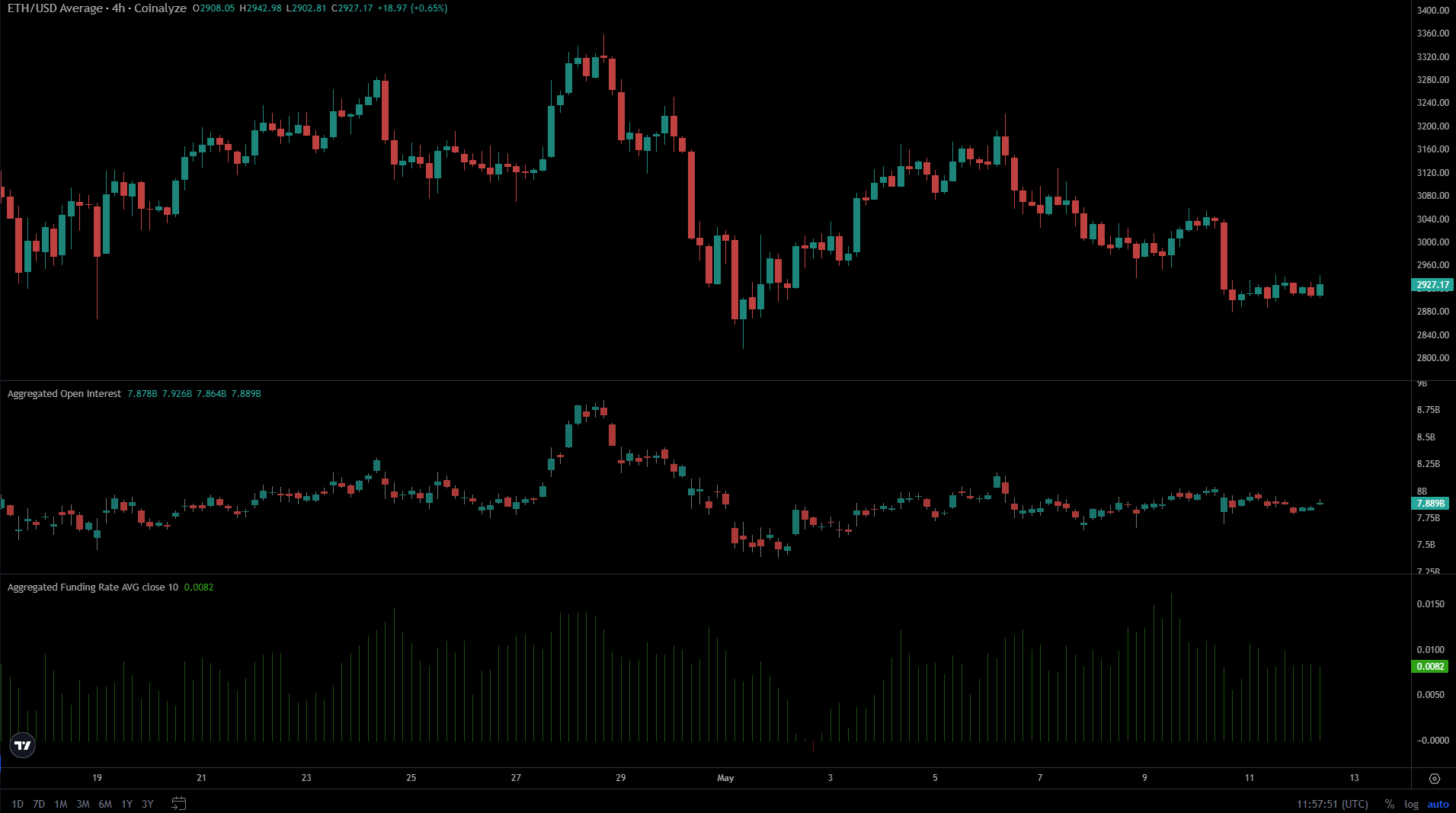

In early May, Ethereum experienced a dip in Funding Rates and went below zero. However, it has bounced back since then. Recently, the downward trend caused the Funding Rates to hover around the average of +0.01.

On May 9th, there was a small increase in price from $2980 to $3040, which led to an uptick in Open Interest and the funding rate.

Despite a comparable price surge, Ethereum did not follow Bitcoin’s pattern, implying a stronger appetite among speculators for buying Ethereum over Bitcoin.

What are the next liquidity pockets that could attract prices?

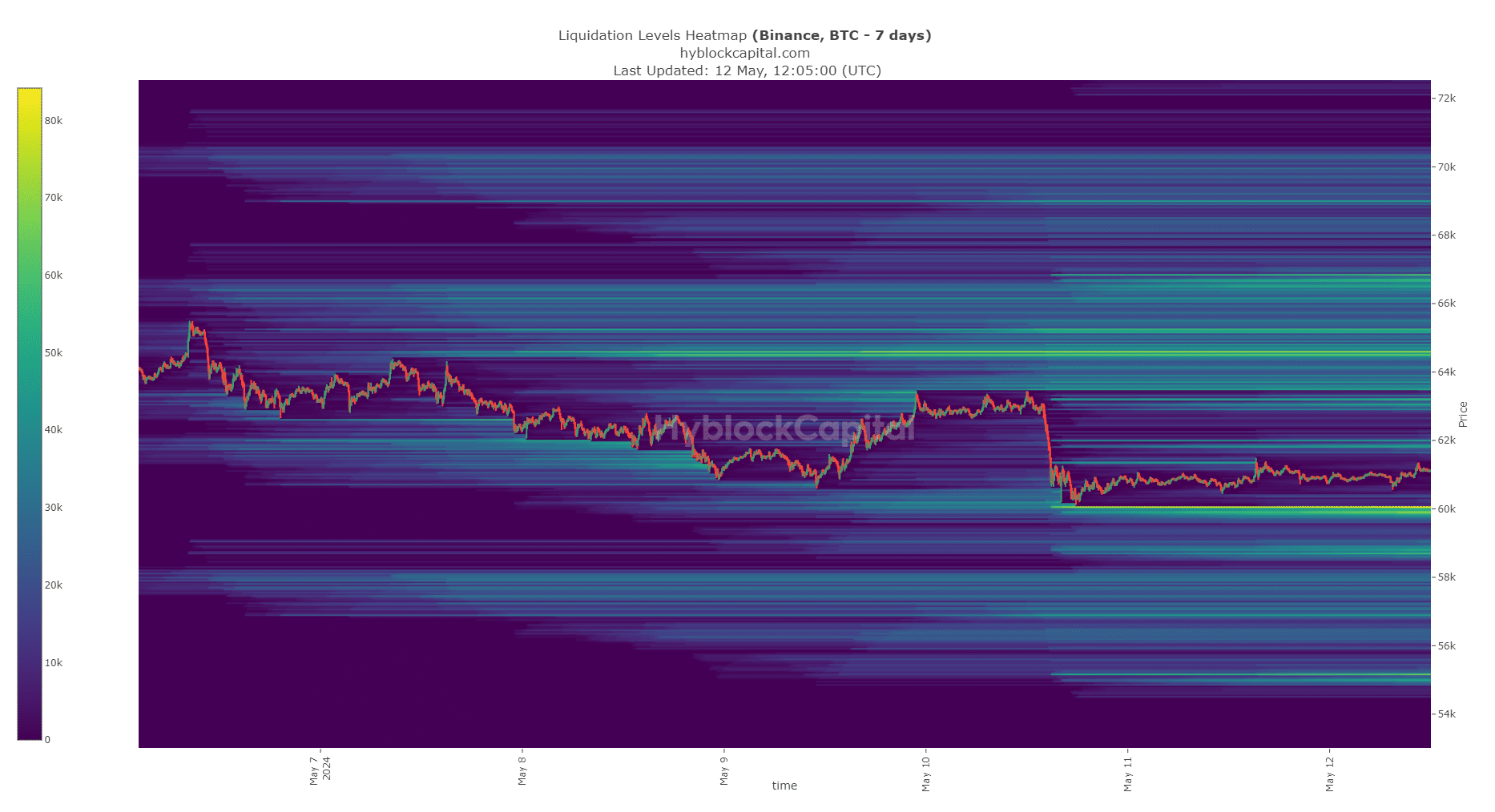

A seven-day Bitcoin liquidation chart displayed a prominent grouping of liquidations around the $60,000 mark. Looking upward, potential buying opportunities lie at $61,800 and $63,000.

On the 5th of May, the prices surpassed $64,000 to acquire liquidity, leading to a harsh correction afterwards.

Just as some investors may sell off their Bitcoin holdings on Monday in order to gather funds at a lower price of around $60,000, these same traders might then look to purchase the cryptocurrency again during its subsequent recovery. Consequently, potential buyers would be interested in scooping up BTC during this dip, which could occur between the prices of $50,600 and $60,000.

Traders need to anticipate a possible drop in Bitcoin’s price beneath $59.4k and arrange their stop-loss orders at $60k as a safety measure if the market takes a downturn.

Read Bitcoin’s [BTC] Price Prediction 2024-25

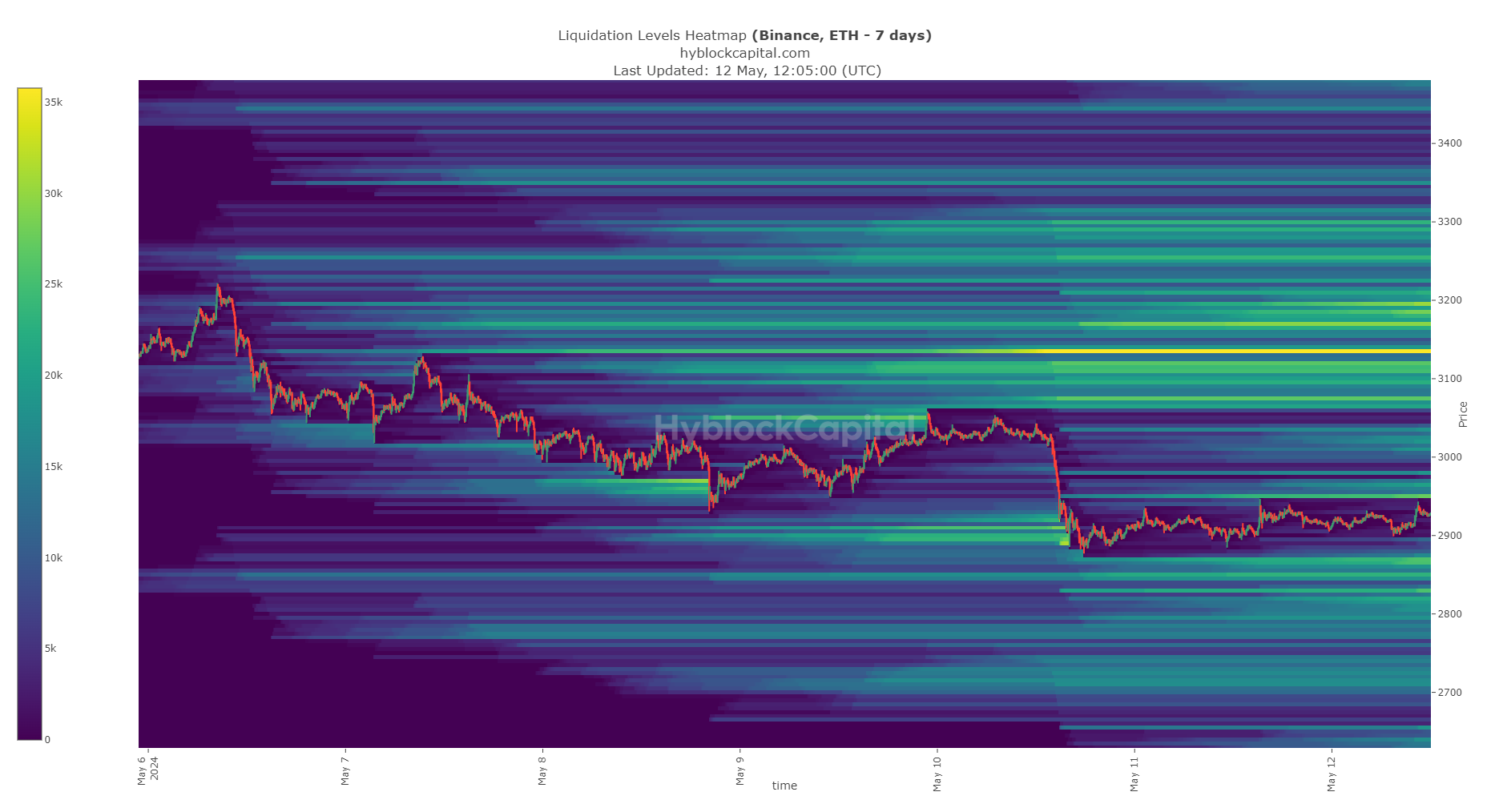

Alternatively, Ethereum boasts a pool of liquidity in its vicinity to the north around $2950. This is not far from the current market rate of $2928. A potential drop down to the $2860 area could offer a promising buying chance.

Around the $3.1k to $3.2k mark, the liquidation levels offer an alluring opportunity. If the price falls beneath $2.8k, it may signal a significant short-term decline, allowing traders to minimize their losses.

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- Gold Rate Forecast

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Elden Ring Nightreign Recluse guide and abilities explained

- Solo Leveling Arise Tawata Kanae Guide

- Despite Bitcoin’s $64K surprise, some major concerns persist

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

- Playmates’ Power Rangers Toyline Teaser Reveals First Lineup of Figures

2024-05-13 04:07