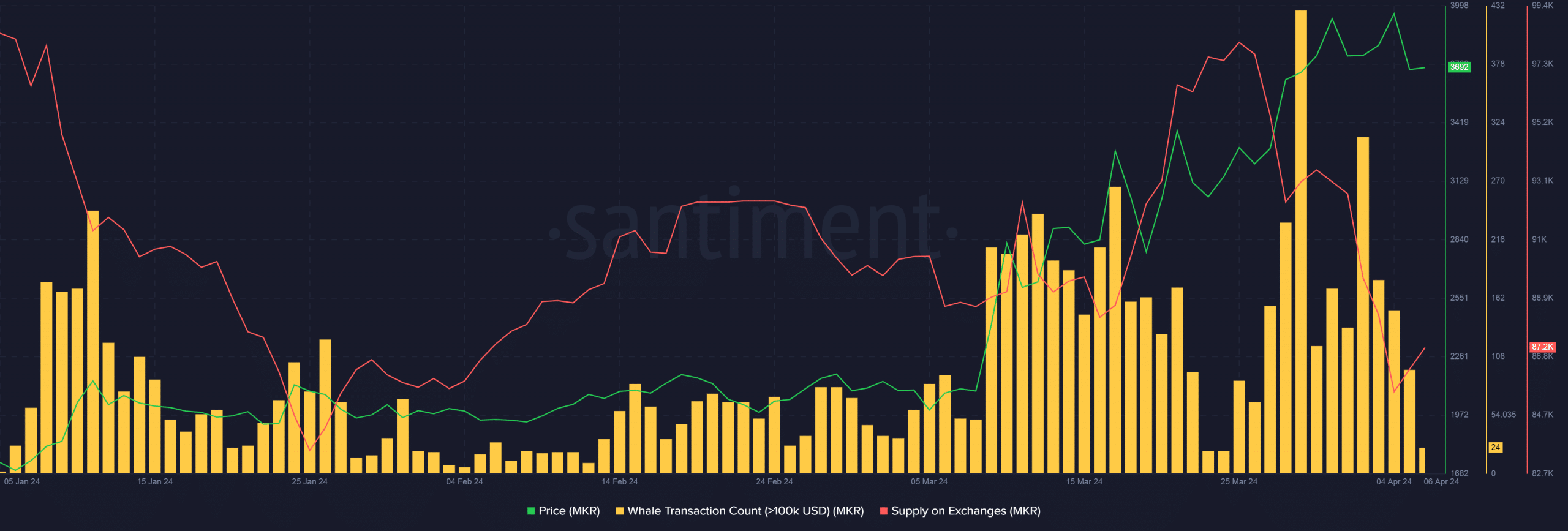

- Whale transactions have risen significantly over the last few weeks

- Steady accumulation supported MKR’s price, with the same hiking by 36% in a month

Institutional investors have taken notice of MKR, the token that governs the popular stablecoin lending platform MakerDAO.

MKR accumulation on the rise

Based on data from the monitoring platform Spot On Chain, approximately 13 wallets extracted a total of 13,560 MKR tokens, equivalent to around $46 million at present market values, from Binance within the past week. Notably, over half (around 65%) of these tokens were taken out in just the last day.

Three more wallets conducted trial withdrawals and may draw out additional MKR in the near future.

It’s intriguing to note that the same source, believed to be Anchorage Digital, a reputable cryptocurrency custodian for financial institutions, reportedly funded all 16 wallets. This discovery has sparked rumors that these wallets could be connected and possibly owned by a single entity.

Instead of only affecting a specific group, the trend of increasing accumulation was a widespread occurrence throughout the market.

According to AMBCrypto’s interpretation of Santiment’s findings, there was a notable increase in large-scale cryptocurrency transactions during the past month. This trend was further supported by the decline in MKR’s exchange reserves, suggesting that investors have been actively accumulating the asset.

In fact, the aggressive accumulation helped MKR, pushing its price up by 36% in a month.

Is this the reason?

The drive to hold onto MKR stems from MakerDAO’s upcoming major initiative, Endgame, spearheaded by co-founder Rune Christensen. This ambitious undertaking, set to launch around summer 2024, seeks significant changes in the governance and token economics of the Maker system.

At the final stage, a new stablecoin and a new governance token will be introduced. For every MKR token holder, there would be an opportunity to exchange their current tokens for the new ones.

What’s happening in the broader market?

It’s important to note that while this factor is unique to Maker’s platform, it’s also worth examining how the trend of accumulation aligns with the wider market.

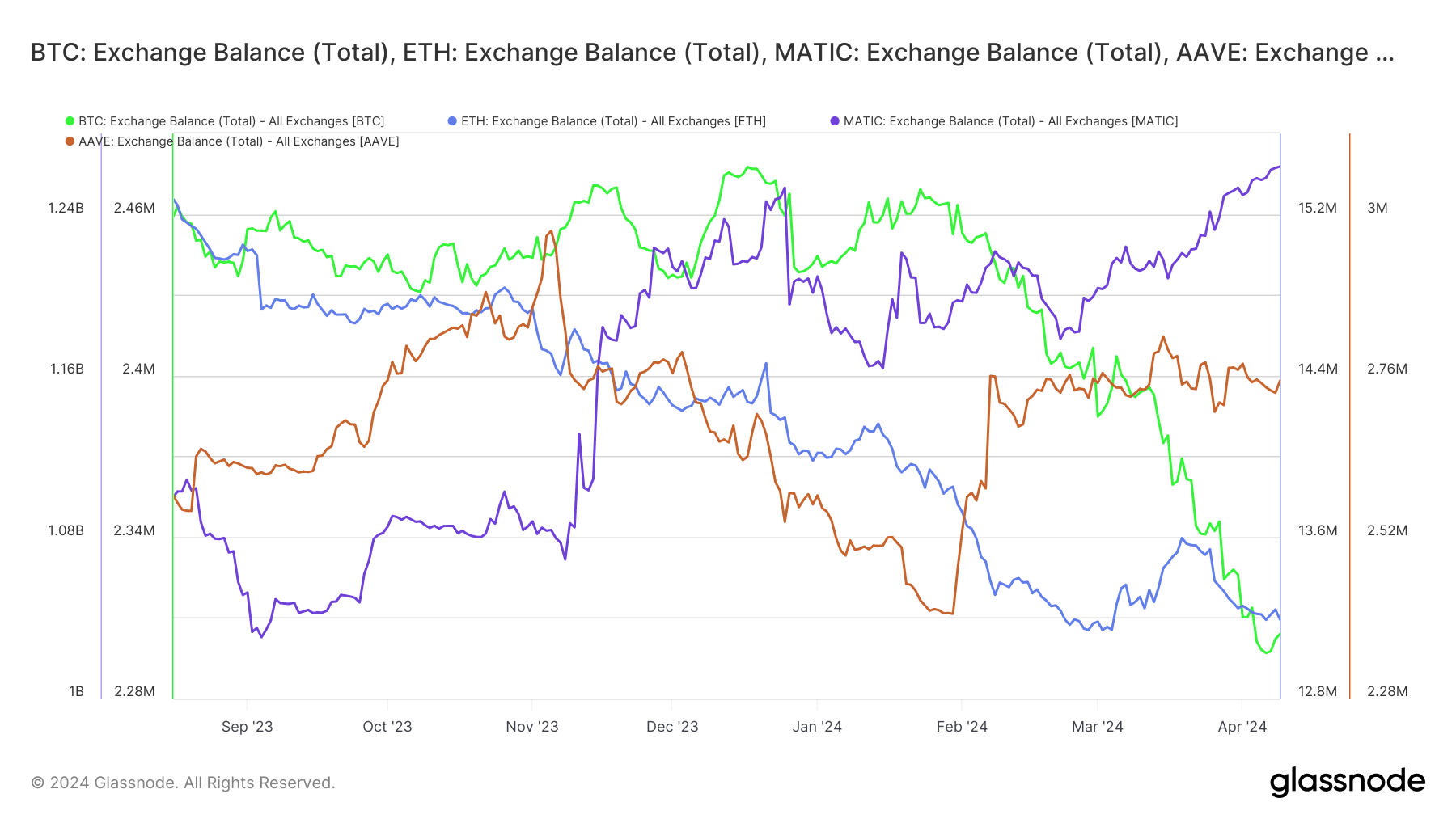

According to AMBCrypto’s interpretation of Glassnode’s statistics, there has been a significant decrease in the amount of top cryptocurrencies like Bitcoin (BTC) and Ethereum (ETH) held on exchanges over the past few weeks. This reduction suggests that investors are accumulating these coins.

On the other hand, there was a significant rise in the availability of Polygon (MATIC) and Aave (AAVE) L2 coins – potentially indicating upcoming sell-offs.

Read More

- LDO PREDICTION. LDO cryptocurrency

- JASMY PREDICTION. JASMY cryptocurrency

- Can Ethereum ETFs outperform Bitcoin ETFs – Yes or No?

- Chainlink to $20, when? Why analysts are positive about LINK’s future

- Citi analysts upgrade Coinbase stock to ‘BUY’ after +30% rally projection

- Why iShares’ Bitcoin Trust stock surged 13% in 5 days, and what’s ahead

- Spot Solana ETF approvals – Closer than you think?

- Orca crypto price prediction: Buying opportunity ahead, or bull trap?

- Top 10 Stocks and Crypto Robinhood Alternatives & Competitors

- ‘China’s going to have it’ – Donald Trump crypto stance, finally explained

2024-04-11 08:07