- BTC exchange deposits have shrunk to 2016 lows.

- CryptoQuant analyst deem this a signal for a major rally for BTC in the long run.

As a seasoned crypto investor with a decade-long journey through the rollercoaster ride of digital currencies, I have learned to read between the lines and interpret market trends based on my past experiences. The recent drop in BTC exchange deposits to 2016 levels, as suggested by CryptoQuant analyst Axel Adler, is a signal that could potentially herald a major rally for Bitcoin in the long run. This trend has historically indicated a shift in sentiment towards holding Bitcoin rather than selling it.

Remembering the last time we saw similar exchange deposit numbers, I recall the remarkable bull run that followed, and I can’t help but feel a sense of excitement at the prospect of history repeating itself. However, as always, I remain cautious, for the short term may hold bearish pressure that could push Bitcoin down to $90K or even $85K before we see any significant upward momentum.

Investing in crypto has taught me the importance of patience and resilience, so I’ll continue holding onto my BTC, secure in the knowledge that a bullish breakout could see us retesting the $100K mark or even surpassing it. As they say, the longer you can hold on to your Bitcoin, the more profitable it becomes – just ask those who bought at $10 back in 2010!

On a lighter note, I always remember that old saying: “The best time to invest in cryptocurrency was yesterday; the second-best time is today.” So, while we wait for this potential rally to materialize, let’s keep our eyes on the charts and our minds open to opportunity – after all, Bitcoin has a history of surprising us!

Beginning from December 19th, Bitcoin [BTC] has faced difficulties staying above $100K, yet its long-term perspective within the crypto market continues to look optimistic.

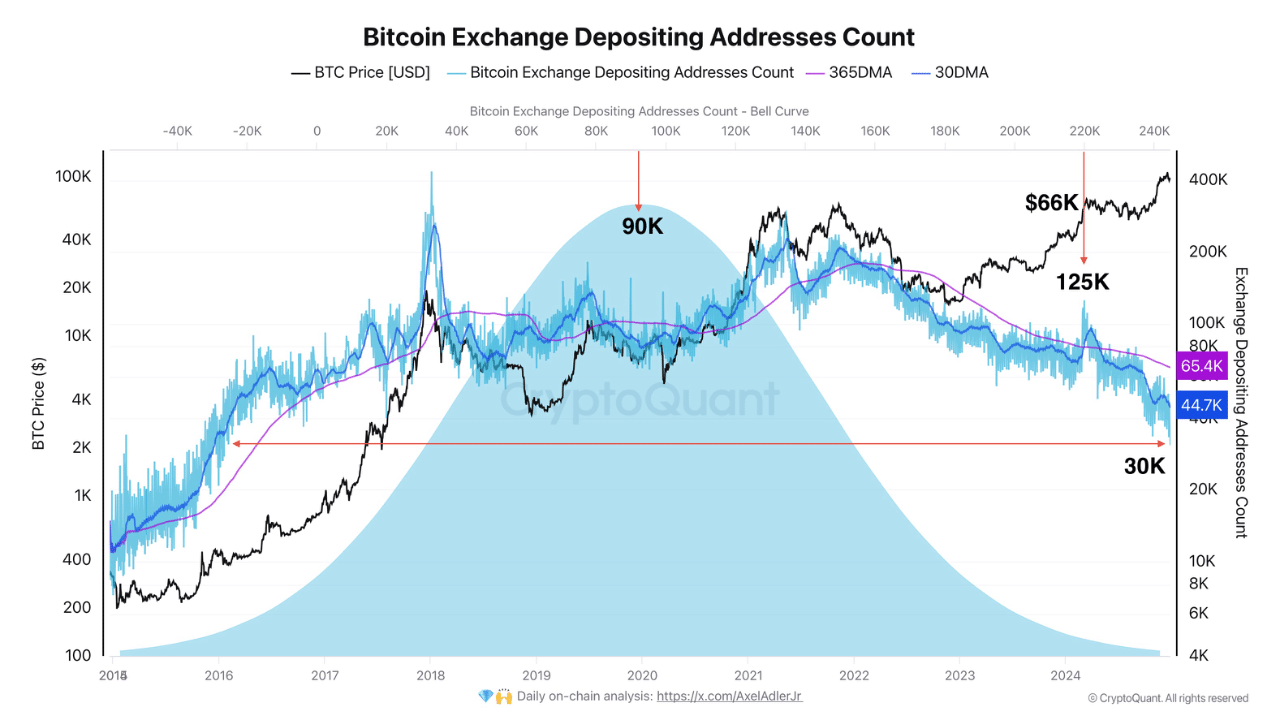

Based on findings by CryptoQuant analyst Axel Adler, the rate at which Bitcoin (BTC) is being transferred to exchanges has fallen to levels not seen since 2016. Remarkably, Axel mentioned that when BTC deposits on exchanges reached such lows in the past, a significant surge or rally typically followed.

Usually, it indicates that they tend to hold their Bitcoins in private wallets instead of preparing to make a sale.

In contrast to the peak in early 2024 when more than 125,000 Bitcoins were deposited daily, the current rate has fallen under 45,000 BTC, resembling deposit figures from 2016.

The amount of Bitcoin being deposited daily in [current context] is much less than it was at its peak in early 2024 (over 125,000 coins), and this current rate is similar to what was seen in 2016 (around 45,000 coins).

More BTC leaving exchanges

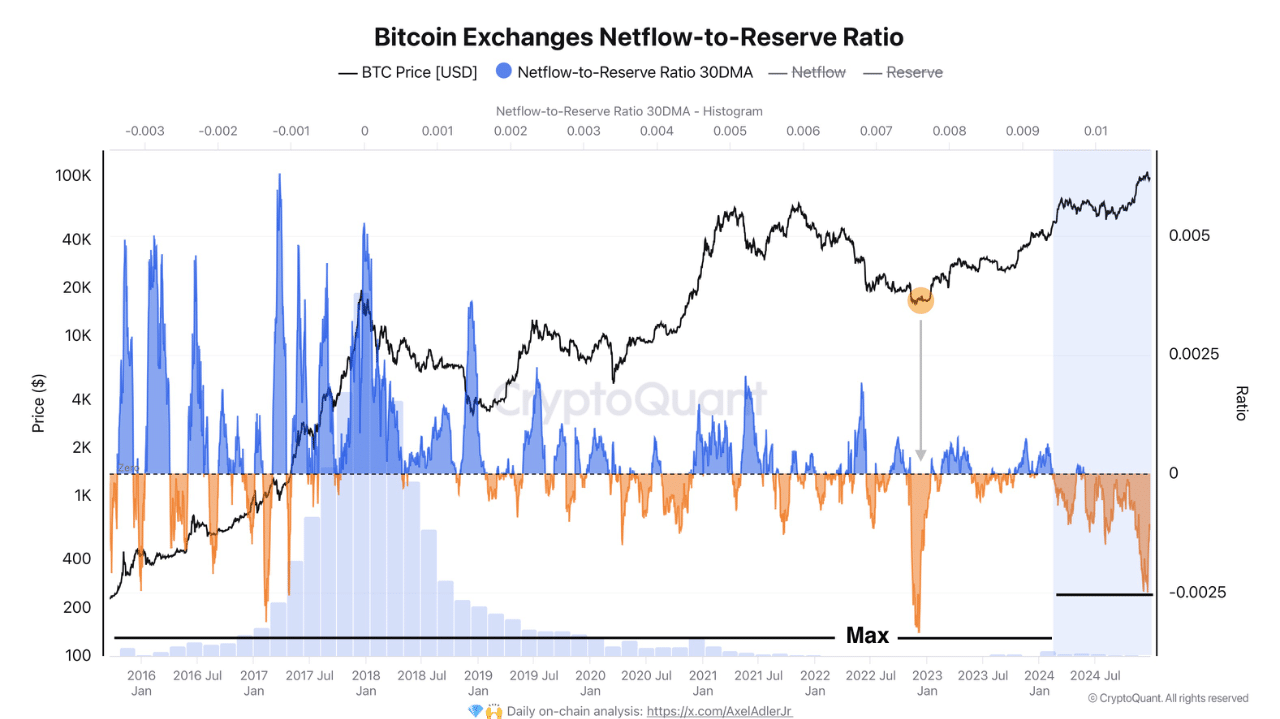

It’s worth noting that this optimistic view was further supported as more Bitcoin was transferred off exchanges.

According to Addler’s analysis, the Bitcoin network’s flow-to-reserve ratio showed a negative value, suggesting a significant influence of exchange withdrawals over inflows.

The ratio gauges the correlation between net inflows/outflows relative to exchange BTC reserves.

As an analyst, I’ve observed an intriguing trend: On average, there seems to be a greater withdrawal of Bitcoin from exchanges compared to the number of deposits being made. This pattern often indicates a bullish sentiment in the market, as it suggests that investors are holding onto their BTC with confidence, expecting its value to rise further.

To summarize, Bitcoin’s future outlook remains optimistic, even though a surge in selling activity has temporarily kept its value under $100K.

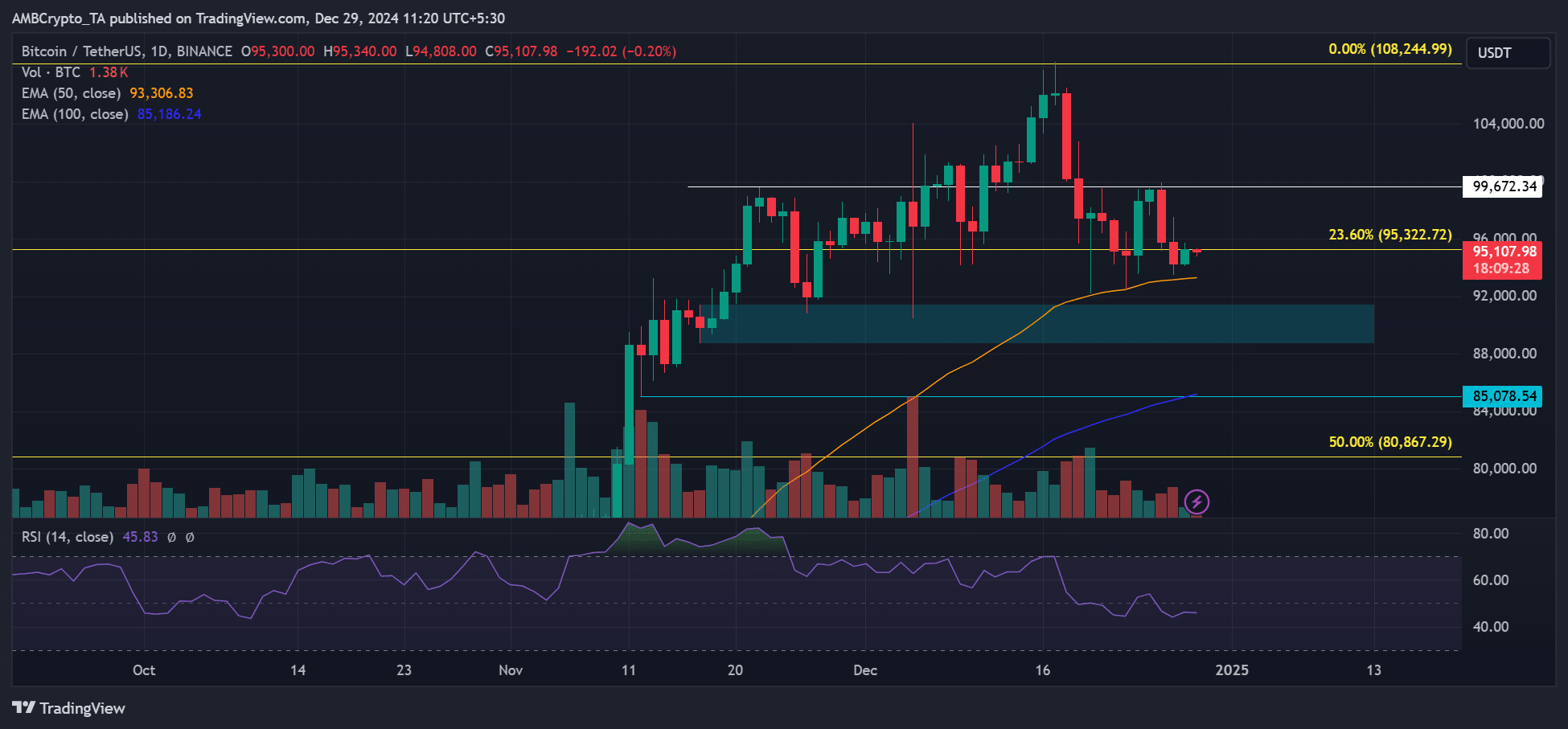

Over the holidays, the Bitcoin price stayed within a specific range rather than making significant movements. It hovered around the $100K mark while also maintaining an equilibrium with its 50-day Exponential Moving Average.

Additionally, the daily RSI slipped below 50, indicating a short-term weakening in demand.

Read Bitcoin [BTC] Price Prediction 2025-2026

Should bearish pressure persist in the short term, a drop to $90K or $85K could be on the cards.

On the other hand, if Bitcoin continues to hover above its 50-day Exponential Moving Average (EMA), it might boost the likelihood of another attempt at reaching $100K, or even trigger a bullish surge.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Despite Bitcoin’s $64K surprise, some major concerns persist

- Solo Leveling Arise Tawata Kanae Guide

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- Planet Coaster 2 Interview – Water Parks, Coaster Customization, PS5 Pro Enhancements, and More

- New Mickey 17 Trailer Highlights Robert Pattinson in the Sci-Fi “Masterpiece”

2024-12-29 16:08